Business valuation by the Mckinsey model, comparison of two different accounting systems

Abstract: Business and asset valuation are gaining ground these days. Determining the value of a business is crucial for the management to make the right decision, and it is an essential step for individuals and investors who intend to invest. Several models carry out business valuation by different methods. In this study, we present the main features of the McKinsey model, the model structure, which includes the most important steps to carry out the valuation. The McKinsey model is a discounted cash flow model where the value of a company is determined as the present value of future cash flows from the difference between the accounting systems mentioned above.

Keywords: business valuation, US GAAP, McKinsey model, discounted cash flow model, accounting systems

Introduction

Due to the globalization of the financial and capital market, several opportunities are available for an investor to invest his capital. By the 21st century, national and continental borders had already ceased to exist to the extent that investments in the United States are easily available for a European investor, or even an Australian businessperson can easily buy shares at the Tokyo Stock Exchange any time. Also, it allows the investor to choose from a variety of investment possibilities and to choose the best investment for his preference. (Dékán Tné Orbán I. et.al. (2016)

In order that an investor can decide about the share investments he should know which are the most beneficial ones for him, he should be fully aware of the value of the shares. The value of the shares is closely related to the value of the company issuing them. Therefore, from an investment point of view, the knowledge of the company value may be crucial. The Information-Connection between the Strategic Management-Accounting and the Company Valuation (Zéman et.al. 2011)

From the shareholders’ point of view, one of the main goals is to increase the share values and maximize the company value. To determine the extent to which the shareholder value increased, there is necessary to know the company value. Consequently, valuation is indispensable both from the investors’ and the owners’ point of view.

The knowledge of the value of the business is also crucial in the case of acquisitions because the vendor has to determine the minimum value of the selling price, and the buyer has to determine the maximum value of the buying price. A rational investor does not pay more for a share or an asset than its worth.

In addition to the previous, more aspects could be listed that require corporate valuation (e.g. inheritance, a new owner involvement, the sale of ownership, etc.).

1. The topic of the study

There are several corporate valuation models, which means that the evaluator can choose from several methods. The question is defined as follows: Is it possible to compare the results? Can different accounting systems of countries affect results, so the items used for corporate valuation have different content?

In the research, there was evaluated companies operating under two accounting systems, thus presenting the similarity and difference of the results obtained. Also, the structure of the McKinsey model used for corporate valuation and the corrections needed for the evaluation. The paper presents the essential steps of model building and the differences between the two accounting systems, which should be taken into account in the compilation of the valuation model highlighting the significant differences.

1.2. The comparison of the US GAAP and the Hungarian accounting system, presenting their basic differences

US GAAP (the United States Generally Accepted Accounting Principles) is the US Accounting System of Accounting; it is an accounting system that includes accounting principles, accounts, methods, and procedures. (Beke J. 2014)

For US-listed companies, the SEC (Securities and Exchange Commission, starting now referred to as SEC) requires US GAAP, (Almássy et.al. 2006) requiring mandatory disclosure of audited information. (Beke J. 2014) In the beginning, the SEC was responsible for protecting investors and creating a rigorous system of public disclosure of data, which is also the core purpose of US GAAP, but now defines the form, content, and structure of financial statements, which basically do not include the regulation of accounting issues. (Madarasiné Sz. A. et.al. 2016) To establish accounting rules, the SEC implemented the Financial Accounting Standard Board (FASB). (Madarasiné Sz. A. et.al. 2016)

The Hungarian accounting is regulated by Act C of 2000, which came into existence as an improved version of the regulation introduced on January 1, 1992, and as a result of the convergence to the EU directives and entered into force as a new law as of January 1, 2001. (Harangozóné Tóth J. et.al. 2003)

The main purpose of the accounting law is to define the reporting and accounting obligations of the entities covered by the law, the compilation of the accounts, the principles to be followed in managing the books, the rules built on them, the requirements for disclosure and auditing rules. (Róth J. et.al. 2008)

1.3 Financial Statements in US GAAP

The primary purpose of the financial statement is to provide useful information about the performance of an entity to current or potential investors, creditors, and other stakeholders making financial decisions. (Bragg, S. (2011)

The financial statements include the balance sheet, the income statement, the cash flow statement, other financial statements, and the equity statement of the shareholders. (Beke J. 2014)

The balance sheet is a statement that provides information about the assets, liabilities and equity of an entity for a specific date. (Bragg, S. 2010) With the help of the information in the balance sheet, we can determine the company’s solvency, compare the size of current assets and liabilities, and examine the company’s ability to pay dividends and interests. (Bragg, S. 2010)

Balance function of US GAAP:

Assets = Liabilities + Equity [9].

Assets are a set of resources owned by a business entity that can be tangibles, such as fixed assets or inventories, or intangibles, such as patents. (Short, D –Welsch, G 1990) Accordingly, the US GAAP does not have a prescribed structure. This is a significant difference compared to Hungarian accounting since they were laid down by the provisions of Act C of 2000, assets are grouped according to the mandatory parts of the balance sheet. Thus, the asset group consists of current assets, non-current assets and accrued expenses. (Siklósi Á. et.al. 2018) Liabilities include loans and borrowings of the enterprise and other liabilities. Equity shows the extent to which the owners have a company stake. (Short, D. – Welsch, G. 1990)

In the Hungarian accounting system, the balance sheet is prepared in the structure defined by the Act of Accounting, (Róth J. et.al. 2015) which presents the assets and liabilities of the enterprise in a balance sheet layout, and where the assets are in reverse liquidity order and the funds are in reverse maturity order. (Siklósi Á. et.al. 2018)

Income Statement is a statement that presents incomes, expenses and net income over a specified period. (Short, D.-Welsch, G 1990) It provides information on net income and its components that can be used to measure business performance. Although it provides information on past performance, at the same time the investors, creditors, and other stakeholders may make forecasts of future business performance using this information. (Bragg, S. (2011)

In US GAAP, the company earnings can be calculated in two ways: natural expense classification and functional expense classification. (Beke J. 2014) The two methods are identical to the methods used in Hungarian accounting. The difference between these methods is in determining the operating profit, but the results of the financial operations, the pre-tax profit and the after-tax profit are the same. (Harangozóné Tóth J. 2003) In Hungarian accounting, the categories and rows of the income statement are laid down by the Act of Accounting, no derogations are possible. For a long time there was a similarity between the two accounting systems for the extraordinary profit category, but since 1 January 2016, this category of results is no longer included in Hungarian accounting, so this is another difference.

2. Business valuation by McKinsey model

’Cynical man is the one who knows the price of everything but knows nothing of its value’. (Damodaran, A 2015) This statement suggests that whatever we buy, we should try to evaluate it, to find out whether it is worth as much as its price, and to make the decision accordingly. (Damodaran, A 2006) When we deal with valuation, there are some factors to consider, and then choose the most appropriate model for corporate valuation. In our research, we used the corporate free cash flow model to do the valuation, which is also referred to as the McKinsey model.

Free Cash Flow (FCF) is the money amount that is available to the company’s owners or creditors, without risking the continuity of its business operations . (Allman, K (2010)

Free cash flow is determined as follows:

FCF = Gross cash flow – Gross investments

Gross cash flow = NOPLAT + depreciation

Gross investment = Net investment + depreciation

NOPLAT = It is a financial measure including the firm’s operating profits adjusted taxes relevant for EBIT . (Copeland, T. et.al. 1999)

Gross cash flow corresponds to the total cash flow generated by the company that can be reinvested for company growth . (Tarnóczi T. et.al. 2010a) When calculating the gross cash flow, if it is necessary we adjust the operating profit reducing with the adjusted tax and depreciation, which diminishes the profit but does not result in an effective cash outflow . (Tarnóczi T. et.al.2010b)

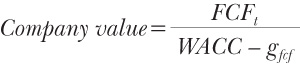

The company value calculation using the simple annuity formula (without growing):

where:

FCF: free cash flow

WACC: Weighted Average Cost of Capital

In this case, the company assumes the same cash flows in the long run and does not assume any change in the capital structure. It is very rare to exist such a company, if it exists at all, that can operate under the same conditions without growth in the long term, and obtains the same results because the results and performance of the company are not only influenced by internal factors.

A constant growth model for company valuation

3. The process of the McKinsey model calculation

In this research, two companies were evaluated by the McKinsey model. The two companies include Kartonpack Plc., which is listed on the Budapest Stock Exchange and Flowserve Corporation, which is listed on the New York Stock Exchange. Kartonpack Plc. makes its financial statements based on the Hungarian accounting system while Flowserve Corporation compiles its financial statements based on US GAAP.

3.1. The structure and characteristics of the McKinsey model

The evaluation was done by a method described by (Jennergren L.P. 2005) in the ’The Tutorial of the McKinsey Model for Valuation Companies’, which is also known as the McKinsey valuation model and is a discounted free cash flow model.

The main steps of the McKinsey model calculations:

- Calculation of past free cash flows based on past income statements and balance sheets;

- Creating financial ratios using historical data, and calculating forecasting conditions;

- Establishment of future profit and loss accounts and balance sheets based on financial ratios and forecast conditions;

- Derive the forecasted free cash flows from the forecasted income statements and balance sheets;

- Discounted future free cash flows.

The essential features of the McKinsey model:

- The model uses already published and public data as input data.

- The purpose of the McKinsey model is to evaluate the company’s equity. As a first step, the asset side of the balance sheet is evaluated. The value of the interest-bearing debt is then deducted, and the value of equity is obtained. Interest-bearing debt does not include suppliers and other current liabilities. It may seem that the calculation of equity and the deduction of interest-bearing debt are an indirect approach to the calculation of equity (i.e. it would seem more direct to estimate equity by discounted future dividends directly). However, this indirect approach is used by the model as it is more transparent and results in fewer errors in the evaluation process.

- The value of the company, i.e. the value of the total asset side, is determined by WACC discounting.

- The asset side is evaluated in two parts: free cash flow is forecast for the individual years in the explicit forecast period . (Frykman, D – Tolleryd J 2003) Then, using the last explicitly determined free cash flow value, the so-called residual value, which represents the corporate value beyond the explicit period, must be determined. The explicit forecasting period should be at least 7-10 years. The explicit forecast period can be considered as a transitional phase. However, the interval after the period is characterized by continuous growth.

- Free cash flow for future years is calculated from forecasted income statements and balance sheets.

- Financial statements are forecasted in nominal terms. Thus, the nominal free cash flow is, of course, discounted at the nominal discount rate . (Koller T. et. al. 2005)

- The value after the explicit forecast period is calculated using the formula used in the annuity calculation. Free cash flow increases over the period with a constant percentage year on year.

4. Results and their evaluation

The valuation of Flowserve Corporation and Kartonpack Plc. was based on the McKinsey model presented above. The model itself is not too complicated, but still uses a lot of data during the valuation, which is complicated by the length of the forecasting interval, which is twelve years.

4.1. Past free cash flows

In order to determine the free cash flow, EBIT was calculated, which requires a separate calculation for Katronpack Plc. As past statements included extraordinary results forming an individual output category, unlike the income statement of Flowserve Corporation. Based on this, we determine the net operating profit (NOPLAT) reduced by the adjusted tax, which shows the company’s after-tax operating profit. To calculate NOPLAT, the tax on EBIT should be determined. That is, it would be a tax liability for the company if there were no interest expenses or income.

It is important to mention that the tax payable on EBIT includes the tax paid and deferred, therefore, in order to determine the net operating profit reduced by the adjusted tax, the change in the deferred tax liability should also be taken into account. Since there is no deferred tax in the Hungarian accounting system, it is only in the case of Flowserve Corporation that the deferred tax liability may be charged.

To calculate free cash flows, the gross cash flow was first determined, which is the sum of net operating profit (NOPLAT) and depreciation reduced by the adjusted tax. The reason for the depreciation is that it appears as an expense in the income statement but does not involve an effective outflow of money. Since different accounting systems are activated in different accounting systems when acquiring a tangible asset, the basis of depreciation may differ. Subsequently, gross investments are determined, which is the sum of the change in working capital and capital investments.

In calculating working capital, supplier’s liabilities and other current liabilities are deducted from current assets that are not interest-bearing liabilities. The increase or decrease in working capital affects the amount of cash available to owners and creditors, so a lower value results in higher free cash flow in a given year, while a lower working capital change reduces the available cash flow. A negative value generates a free cash flow, which can be valued as a positive one, while a continuous negative working capital change means that the company sells its current assets at a higher rate than it can replace. Accruals in US GAAP are recognized in current assets and are recognized in the balance sheet as accrued expenses and other receivables and should be treated as receivables and, on the same basis, accruals. In the Hungarian accounting system, these items appear in the balance sheet as a separate category, so these items had to be adjusted to calculate the free cash flow as the model used for corporate valuation is aligned with the US GAAP system. Deferred tax asset is a non-existent concept in the Hungarian accounting system, but in US GAAP it is included in current assets, treated as any tax receivable, so it is included in receivables. Corrections were also required in the case of repurchased treasury shares, as the Hungarian accounting system categorized as securities, a reduction in equity in US GAAP.

4.2. Creating past ratios

Creating past ratios is essential in evaluating, as these ratios are used to create future forecast values that are needed to produce future results. First, the ratios for the increase in net sales are determined to calculate future results. Namely, the income statement and certain elements of the balance sheet are forecast as a percentage of net sales

4.3. Future forecast

As mentioned earlier, the model splits the future period into two parts. The first phase is the explicit forecasting period, which in this case is 11 years (from 2016 to 2026). The second phase is the period after the explicit forecast period, which runs from 2027 to infinity. Accordingly, future forecasts should be made.

4.3.1. Forecasts for growth and working capital

At this step, future inflation and real growth in net sales should be determined.

For the first year of the explicit forecast period (2016), the ratios between the different categories of working capital and the net sales and operating costs are based on the same ratios over the past seven years. Since there are different valuation procedures in the two accounting systems, so the contents of the ratios are not the same, the items of the Kartonpack Plc. required continuous transfer to comply with the steps and requirements of the McKinsey model. As the Hungarian accounting system classifies the funds as securities, the equivalents cannot be decided without internal information, which can be reclassified as equivalents, so the calculation of this current asset must be applied in the Hungarian accounting system by way of derogation from the model.

After recording the different categories of working capital and the ratios between net sales and operating costs for the first year of the explicit forecast period, we assumed that nearly all ratios for the last year of the explicit forecast period (2026) are the explicit forecast period compared to its first year. For intermediate periods, the ratios were calculated by linear interpolation. In the year following the explicit forecasting period (2027), the same ratio was used in the last year of the explicit forecast period (2026).

4.3.3. Forecasted income statements and balance sheets

The results are based on forecast assumptions. The items in the forecasted balance sheets were mostly determined directly through net sales, so we multiplied the value of the appropriate forecasting condition with net sales. Then, the value of free cash flows, as we did in previous years, was calculated.

4.4. Company valuation and determination of equity

Company valuation was done by discounted free cash flow model. The free cash flows available are discounted. The discount rate used for this purpose was determined using the weighted average cost of the capital model (WACC).

We first calculated the value of the assets of these companies for the beginning of the year after the explicit forecast period (2027); this value was determined by the Gordon model. The value of the interest-bearing debt was deducted from the value of the assets of the companies and thus we received the value of the equity of the company for the year 2027.

We then made a similar calculation for the previous year, i.e. the last year of the explicit forecast period. The value of assets at the beginning of 2026 is equal to the value of assets at the end of 2027 and the discounted value of free cash flow at the end of 2026. We then discounted year after year until we reached the first year of the explicit forecast period (2016). Calculations are done annually. It is not difficult to notice that this one-off retraction gives the same result as directly discounting each year’s free cash flow to present value, early 2016. \ t However, this method makes it possible to calculate the value of equity at the beginning of each year of the explicit forecasting period, and not only at the beginning of the first year of the explicit forecast period . (Jennergren, L.P. 2005)

5. Conclusions and recommendations

Our study suggests that an American company based on the Anglo-Saxon accounting system is easier to evaluate with the model used and more accurate results can be expected. Most of the literature dealing with company and asset valuation is based on the Anglo-Saxon accounting system, so there is more literature available to the analyst, which does not need to be transferred to the Hungarian accounting system during its assessment.

During the evaluation of Kartonpack Plc., Several simplifications had to be applied which distorted the result. In the case of Flowserve Corporation, we did not feel the need for simplification, so we determined almost all values based on the model, which helped to make the exact assessment.

There are many concepts in the model that are not applied in the Hungarian accounting system, such as the concept of deferred tax and surplus marketable securities. Thus, it is clear that the application of the model is more suitable for the assessment of a US GAAP financial reporting company than for a public limited company compiled according to the rules of the Hungarian Accounting Act.

At the beginning of the analysis, it is worth examining the external environment of the company you want to evaluate, in which you carry out your economic activity. Because external factors have an impact on the results, value, performance and future development potential of the company. Examples of such external factors include the market activity of competitors, the size of the economy in which the company operates, the market entry barriers present in the economy, the market share of competitors and the tax rules in force in that country.

References

Allman, K. (2010): Corporate Valuation Modeling. John Wiley & Sons, New Jersey, 275 p. ISBN: 978-0-470-48179-0

Almássy D. – Kántor B. – Musinszki Z. – Pál T. – Várkonyiné Juhász M. – Verebélyi L. (2006): Számviteli rendszerek. ECONOMIX Egyetemi Business Centrum Tanácsadó és Kereskedelmi Kft., Miskolc, 287 p.

Beke J. (2014): Nemzetközi számvitel. Akadémiai Kiadó, Budapest, 271 p. ISBN 9789630595728

Bragg, S. (2010): The Ultimate Accountants’ Reference. John Wiley & Sons Inc., New Jersey, 783 p.

Bragg, S. (2011): Interpretation and Application of Generally Accepted Accounting Principles. John Wiley & Sons Inc., New Jersey, 1351 p.

Copeland, T. – Koller, T. – Murrin, J. (1999): Vállalatértékelés – Értékmérés és értékmaximáló vállalatvezetés. Panem könyvkiadó Kft., Budapest, 552 p. ISBN 963545192X

Damodaran, A. (2006): Befektetések értékelése. Panem könyvkiadó Kft., Budapest, 1065 p. ISBN 963 5454 55 4

Damodaran, A. (2015): A vállalatértékelés kézikönyve. Alinea Kiadó, Budapest, 240 p.

Dékán Tamásné Dr. Orbán Ildikó – Kiss Ágota: Az egyéb átfogó eredmény (OCI) kimutatásának értelmezése vezetõi szemszögbõl. TAYLOR Gazdálkodás- és szervezéstudományi folyóirat. A Virtuális Intézet Közép-Európa Kutatására Közleményei. Szeged 2016. 2016/1. szám VIII. évf./1. szám No 22. 46.oldal

Frykman, D. – Tolleryd, J. (2003): Corporate Valuation. Prentice Hall, Glasgow, 191 p. ISBN 0 273 66161 2

Harangozóné Tóth J. – Bíró T. – Fridrich P. – Kresalek P. – Mitró M. (2003): Számviteli kézikönyv. UNIÓ Lap- és Könyvkiadó Kereskedelmi Kft, Budapest, 750 p.

Jennergren, L.P. (2005): A Tutorial of the McKinsey Model for Valuation Companies. SSE/EFI Working Paper Series in Business Administration. No. 1998:1

Koller, T. – Goedhart, M. – Wessels, D. (2005): Valuation: Measuring and Managing the Value of Companies, John Wiley & Sons, New Jersey, p. 742

Madarasiné Szirmai A. – Bartha Á. (2016): Nemzetközi számviteli ismeretek. Perfekt Gazdasági Tanácsadó Oktató és Kiadó Zártkörûen Mûködõ Részvénytársaság, Debrecen, 469 p. ISBN: 9789633948460

Róth J. – Adorján Cs. – Lukács J. – Veit J. (2008): Pénzügyi számvitel. Lap és könyvkiadó Kft , Budapest, 366 p.

Róth J. – Adorján CS. – Lukács J. – Veit J. (2015): Számviteli esettanulmányok. MKVK OK Kft., Budapest, 573 p.

Short, D. – Welsch, G. (1990): Fundamentals of financial accounting. R.R. Donnelley & Sons Company, Boston, 841 p.

Siklósi Ágnes – Veress Attila (2018): Könyvvezetés és beszámolókészítés. Saldo Pénzügyi Tanácsadó és Informatikai Zrt., Budapest, 559 p. ISBN 978-963-638-543-9

Tarnóczi T. – Fenyves V. – Tóth, R. (2010b): Corporate valuation using two-dimensional Monte Carlo simulation. Annals of the University of Oradea, Economic Science 19 : 2 pp. 788-794.

Tarnóczi T. – Fenyves, V. (2010a): A vállalatértékelés komplex szimulációs modellje. ACTA SCIENTIARUM SOCIALIUM 31 pp. 95-106. , 12 p.

Zéman Z. – Bárczi J. – Grószné Sz. M. (2011): The Information-Connection between the Strategic Management-Accounting and the Company Valuation pp.1-20 Social Science Research Network

Mirjam Hamad, PhD Student

University of Debrecen,

Faculty of Economics and Business

Alexandra Szekeres, PhD Student

University of Debrecen,

Faculty of Economics and Business

@ WCTC LTD --- ISSN 2398-9491 | Established in 2009 | Economics & Working Capital