Dividend pay-out and financial performance of energy & petroleum listed companies in Kenya

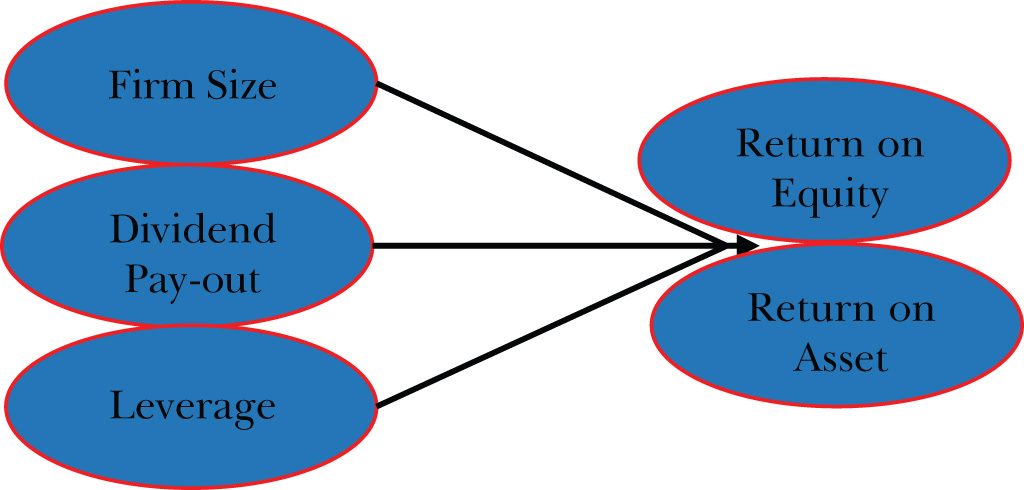

Abstract: One of the objectives of a firm is to maximize shareholders return and the same time minimize costs. It is argued that companies pay dividends not because they are financially stable, but they do so because of the shock waves that are sent out there to customers. We have had cases where companies give out dividends even in cases where the companies have a serious financial crisis. Most investors would want to invest their money in viable projects or organizations. Therefore, the issue of using dividend payout as a measure of financial performance for a company may not be adequate tool for measuring the financial performance of a company. Several studies done in different countries and the findings revealed an association between dividend payout ratio and firm’s financial performance. None of the studies conducted have been focused on the listed companies in the energy and petroleum industry. General conclusions have been made but none of the scholars has tried to validate the results using companies in the energy and petroleum industry. Therefore, the main aim of this study is to evaluate the financial implication of dividend payout on performance of listed companies in the energy and petroleum industries. The energy and petroleum industry of Kenya has five listed companies in the Nairobi and securities exchange. The study will use secondary sources of data from the financial statements of the listed companies. Panel data for the last 10 years from 2007 to 2017. A descriptive research design will be used for this study. Dividend payout ratio will be the independent variable of the study. Return on Equity (ROE) and Return on Assets (ROA) will be used as the dependent variable for this study. To test the relationship between the variables the inferential tests including the regression analysis was used to determine the effect of dividend payout ratio on financial performance.

Key words: Dividend Pay-out, Financial Performance, Leverage, Firm Size, ROA, ROE.

Introduction

Customarily, the core goal of firms is to maximize the returns of investors through growing the value of shares of savings. Payment of dividends by companies is the motivation behind all firms and they do so using two different ways by paying dividend to its shareholders and secondly by re-investing through dividend reinvestment plan (Hamid, Khurram, & Ghaffar, 2017).

Gordon theory on dividend policy Advocates for payment of dividends as he says that it increases the value of the firm (Press & Review, 2010).Contrary, Miller and Scholes belief that it is irrelevant. In any business the concept of whether to pay dividend or not remains a very controversial issue. Inourdays the concept of dividend policy remains a vital issue that has received attention by many organizations. When companies make profits, they must make two important decisions on how the profit will be shared. One of the ways is whereby the company decides to retain the profit generated to expand the business through investments in new projects. The other decision is that they must decide on the amount they should pay as dividends to the shareholders. The dividend policy is always viewed as a financial policy that cannot be ignored by the company or as this is one of the strategy, most companies or rather organizations use to lure investors into the company. In addition to that, there are other interested parties including the government, workers, buyer and other domineering bodies who are also interested with the dividend policy. None of the researchers has been able to bring out clearly the concept of dividend pay-out and its influence on the financial performance. There is no clear distinction that can be made in the capital markets on dividend policy even in developing or developed countries. Companies decide on the amount of money to retain for investment based on the dividend policy of their company as they cannot give out all the profits that they have generated in a financial period (Whitehurst, n.d.)

According to Baker, Veit, & Powell (2001) the dividend policy can be used to influence the value of the firm as well as maximizing the shareholders wealth. The signalling theory is commended in dividend policy as it is deemed a source of communiqué that deliver information to financiers about the firm performance. Shareholders always monitor steps of organization and would be interested mostly in matters that can affect the firm value as this has a direct sway on the performance and profitability of the firm.

Therefore, Dividend involves spreading a percentage of the firm’s earnings to the shareholder to maximize their wealth. This being one of the main objectives that encourage investment by the shareholders. The proportion to investors is paid after tax has been paid. Dividend pay-out reduces the amount of retained earnings of a company. The main internal sources of funding for a firm is the retained earnings since that is the proportion of the profit that is put aside for investment. Therefore, there is a conflict between the mangers of organizational and the shareholders. This is since managers would want to reduce the amount of dividend paid so that they can increase the retained earnings. On the other hand, shareholders would wish to be have a greater share of the profit through dividends. In a book written by Firer et al in Yee (2017) dividend policy of any organization are guidelines used by a company in deciding the proportion of the profit that will go to the shareholders. The decision to pay dividend cannot be annulled once the organization declares, as this becomes a debt to the business organization.

Several renowned institutions in Kenya have gone under even in circumstances where they have declared dividends to shareholders. This being because they would like to send positive shocks to investors to prevent any cause of alarm. Therefore, this study is concerned in establishing the connexion between dividend payment and financial performance of listed companies in the Nairobi securities and exchange market.

Literature review

This study used two approaches to literature review. The first one being a theoretical orientation or approach dealing with theories related to the topic under study. The second part consists of the empirical examination of literature. On the theories on dividend policy, the study adopted two schools of thought, as discussed below,

Gordon theory

The main proponent of the theory was Myron Gordon in 1959. This theory also known as the bird in hand theory. Myron said that a bird in the hand is worth more in the push. He argued that most shareholders prefer dividends in form of cash to capital gains. He advocated for companies to pay dividends. Companies paying dividend were as the best perform while those that did not pay were non-performing. He added that shareholders should only invest their monies only in companies or organizations that declare dividends as it is a good sign of financial performance (Press & Review, 2010). Investor who prefer retained earnings face price risk decline as the dividend is increased. Gordon said that any return to shareholders in form of dividend pay-out is a good and sure thing compared to capital gains which is risky and therefore, organizations should pay large dividend to shareholders to maximize the share price of the firm (Turki & Al-khadhiri, 2013).

Miller and Modigliani Theory

The main proponent of this theory was Miller and Modigliani (MM) in 1961. According to him, he said that dividend to the shareholders were irrelevant and that they did not have any influence on determination of the value of the firm. In other words, according to MM financial performance of an organization is affected by other factors non-other than dividend pay-out. They said that payment of dividend has no effect on owners’ wealth in an efficient market. Basic earning power and business risk of a firm were the main determinants of the net worth of any firm. Many scholars however did not agree with this theory since it was viewed that Miller and Modigliani based their assumption on a perfect market assumption which doesn’t exist in the real world (Gugler & Yurtoglu, 2003).

Empirical literature

The concept of dividend payout is a topic of concern for many businesses nowadays. Dividend policy is an important financial policy not only to business stakeholders but also in the firms’ point of view (Ajanthan, 2013). Fundamentally, the liquidity evaluation in a company is gauging the domino consequence of firm’s strategies and set-ups in financial matters. These results are simulated in the firm’s value added, return on investment, and return on assets (Zriba, 2015).

Firm market value and dividend policy has been of interest to many researchers in the recent past. Scholars and researchers have tried to demonstrate the liaison between dividend policy and its influence on the stock price of company and firm value as well. Decisions on dividend pay-out are important because they help in making individuals understand the proportion of profit that is vested into investment and how much is given to the investors (Primis & Whitehurst, n.d.). In some circumstances, decisions on dividend payout are not important and that they have no influence on the value of the firm. Traditionally, payment of dividend is advocated for the argument being that they have a direct influence on the price of shares as well as the owner’s worth when properly managed. In their assumption Kanwal & Hameed (2017) argued that investors who are paid cash dividends have no tax exemption and that the frim can raise finances through the capital markets without bearing significant issuance costs.

Yusuf (2015) conducted a study on the impact of paying dividend on performance of some selected deposit taking banks in Nigeria for the period between 2004 and 2013. The study adopted an exploratory research design selecting four deposit taking. The variables of concern by the researcher included leverage, profitability and dividend payout ratio were gathered. Correlation analysis and multiple regressions were conducted. The findings revealed that dividend payout ratio was negatively related to banks’ leverage and profitability. Dividend payout was found to have an inversely relationship with performance.

A similar study sought to scrutinize the association between dividend philosophy and stock price volatility. Cross-sectional regression analysis conducted with earning volatility, payout ratio, debt, firm size and growth in assets as control variables. The results from the paper revealed a positive, but non-significant association between stock value volatility and dividend yield. A domineering assertion of this study was that, the share price reaction to the earnings declaration was not like that of other developed countries. Therefore, managers may not adopt the dividend policy to influence their stock’s risk. The influence of stock price risk through dividend may be also ambiguous due to the ineffective capital market in Bangladesh (Rashid & Rahman, 2008).

Nishat & Irfan, 2008 conducted a research to determine the influence of dividend payment philosophy on risk associated with share price in Karachi Stock Exchange, Pakistan. The study involved 160 listed companies from 1981 to 2000. Cross-sectional regression analysis was used to find the relationship between share price fluctuations and dividend payment holding constant the firm size, earning volatility, total debt to total capital (Leverage) and asset growth. The findings revealed that both measures of dividend policy had a significant influence on the volatility of the stock price. The responsiveness of dividend yield to stock price volatility increased during reform period (1991-2000). Payout ratio had a significant effect only at lower level. In overall period, the size and leverage had a positive and significant impact on stock price volatility. The firm size effect was found to be negative during pre-reform period (1981-1990) but positive during reform period. The results were in tandem with the behavior of emerging markets although not strong enough as in the case of established markets.

A recent study was conducted by Yee (2017) on dividend pay-out policy and firm performance. The researcher wanted to evaluate if dividends are the key indicator of share price and that share price was the key indicator of firm value. The study was supporting the notion that to maximize the wealth of shareholders, they should be awarded the highest combination of dividend and increase in share price. The objective of the study was to help in understanding the concept of dividend payment policy by reviewing existing literatures. Whereas, this study was very imperative to establish the key pillars in support of dividend payment, the researcher did not explain the methodology used and sample size involved for this study. The key findings from the study are also missing from his study.

Turki & Al-khadhiri (2013) conducted a research on factors determining dividend payment in the Saudi Arabia stock exchanges (TASI). Regression analysis model was conducted from panel data from non- financial firms listed in the stock market from 2004 to 2010. The study involved 105 companies. The independent variables of the study included Earnings Per Share (EPS), Dividend Per Share for previous year, Debt to Equity and Capital Size on Dividends per Share. The results established that current Earnings Per Share and past Dividend Per Share were key determining factors for dividend payments.

Francis, Samuel, & Wu (2017) investigated the impact of the stock-price formation process on payout. Secondary data for the period 2001 to 2003 (inclusive) and 2005 to 2010 (inclusive was used for the study. 2004 was omitted since the pilot firms were not announced during that year. The findings revealed that pilot firms were more likely to increase dividends payment during this program. After the ending of the program, these firms were less likely to increase dividends but continue to pay dividends and the propensity to repurchase shares increases too. The findings were consistent with signaling and agency-based models. The results were more pronounced for firms with higher information asymmetry and weaker governance. In general, the study showed that stock price dynamics within the secondary financial market had a significant and long-lasting impact on firms’ payout policy.

A similar study was conducted by Kanwal & Hameed (2017) on the association between the dividend payout ratio and financial performance of the firm in Karachi stock exchange. A study period of five years (2008 to 2012) was used. Correlations and linear regression analysis were used in this study as forms of inferential statistics in the study to find out relationships among variables. The result of this study showed a positive association between dividend payout on financial performance. Dividend payout has an influence on financial performance of firms.

Hamid et al., (2017) in his study for the period 2006-2014 on the dynamics of dividend policy and macroeconomic variables and their effect on stock price volatility in the financial sector of Pakistan used panel data to identify the common, fixed, random and GMM effect. The study resolved that dividend payout ratio, market value, interest volatility and inflation volatility have positive significant correlation with price volatility. Common impact model showed that dividend payout and interest volatility had a major positive impact on share costs. Whereas fixed effect model is more suitable and good fit than random effect model, it was indicated that dividend payout ratio had a significant positive impact and market volatility had significant negative impact on stock prices. In addition to that, GMM results also supported the fixed and random effect outcome. It was therefore, concluded that the study considerably contributed to the dogma of dividend policy choices and appreciated the role of small and macro variables on stock value volatility within the financial sector of the country.

Additionally, (Kanwal & Hameed, 2017) a connected study on the association between the dividend disbursement ratio and monetarist performance of the firm exhibited that dividend payout positively influenced financial wellbeing of firm. Conferring to the scholars basically, the dividend disbursement is portion payment to shareholder by the organization from its net earning while the financial performance comprises the net profit after tax, return on equity, return on asset etc.

In another study the researcher scrutinized determining factors of performance in non-financial firms listed on Nairobi Securities Exchange (Musiega, Alala, Douglas, Christopher, & Robert, 2013). The study involved 50 listed non-financial companies according to the NSE report (2012). Purposive sampling technique was used and a sample of 30 non-financial companies were selected for the duration of five years from 2007 to 2011. Secondary data from audited financial reports were used. Dividend payout ratio was the dependent variable while independent variables of the study included profitability, growth, current earnings, and liquidity. Size of the business and business risk as moderating variables. The discoveries exposed that return on equity, current earnings and firms ‘growth activities remained positively associated to dividend payout, business risk and size. Introduction of business risk and firm size as moderating variables amplified the exactitude of significant variables from 95% to 99%, which meant that they were among the major determinants of dividend payout.

De Cesari & Ozkan, (2015) in their study examined how corporate payout policy was influenced by managerial enticements for 1,650 publicly listed firms from United Kingdom, Germany, France, Italy, the Netherlands and Spain, for the period from 2002 to 2009. The findings of the study revealed that executive stock option holdings and stock option deltas are connected with lower dividend payments in the sampled countries in European where dividend protection for executive stock options was not observed. It was found out that the relationship was mainly driven by exercisable stock options and by options that are in the money. Furthermore, it was observed that executive stock option holdings and stock option deltas had a negative impact on total payout, suggesting that executives were not allowed to substitute share repurchases for dividends. Additionally, the portion of share repurchases in total payout surges as executive stock option holdings and stock option deltas rise.

Baker & Smith (2006) sampled 309 firms exhibiting behavior consistent with a residual dividend policy and their matched counterparts to learn how they set their dividend policies. The findings revealed that the sample firms were more likely than their counterparts to maintain a long-term dividend payout ratio, use long-run earnings forecasts in setting the dividend, and be unconcerned about the cost of raising external funds. Yet, firms behaving as though they follow a residual dividend policy generally do not profess to follow the policy. At best, the sample firms follow a „modified” residual policy in which they carefully manage their payout ratio and dividend trend. Although it may not be an explicit goal of such a dividend policy, consistently low free cash flow typically results.

Adediran & Alade (2013) conducted a study to ascertaining the relationship between dividend policy and corporate profitability, Investment and Earning Per Shares. Annual report and accounts of twenty-five quoted companies in Nigeria were used. Regression analysis was conducted using e-views software and the findings indicated a significant positive relationship between dividend policies of organizations and profitability. Secondly, a significant positive relationship was reported between dividend policy and investments and thirdly, the study established a significant positive relationship between dividend policy and Earnings per Share. It is recommended that Organizations should ensure that they have a good and robust dividend policy in place because it will enhance their profitability and attract investments to the organizations.

Model Summary

Figure 1: Author 2019

Methodology

Secondary data of financial companies of the five listed companies in the energy sector will be used for a period from 2003-2013 for a period of 10 years. Correlational analysis and a multiple regression analysis will be used to establish relationships between variables. The following regression model summary will be used to determine relationships between the dependent and independent variables.

Y1 = α + β1X1 + β2X2 + β3X3 + ɛ

Y2 = α + β1X1 + β2X2 + β3X3 + ɛ

Where;

Y1 = Financial performance measured by ROA–indicator of how profitable a company is relative to its total assets (Net income to total assets).

Y2= Financial performance measured by ROE which is the amount of net income returned as a percentage of shareholders equity. Net Income/Shareholder’s Equity

X1 = Dividend Payout ratio – Dividend per share/ Earnings per share.

X2 = Firm size – The Log of total assets for a firm

X3 = Leverage – ratio of total debt to total capital of a firm

α = the constant term

β1, β2 & β3 = coefficient used to measure the sensitivity of the dependent variable to unit change in the predictor variables.

ɛ = is the error term to capture unexplained variations in the model and which is assumed to be normally distributed with mean zero and constant variance

Correlations

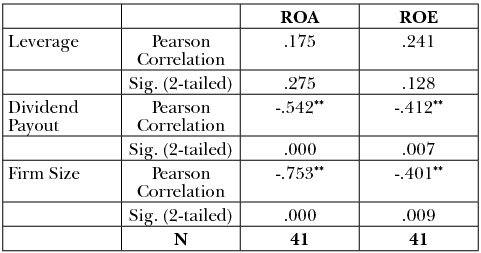

Correlations were used to establish if there was any linear relationship between the predictor variables and the dependent. The findings from the study were as shown below;

Table 1: Correlations

Using both return on equity and return on asset as the key measures of financial performance in listed companies, firm size had a very strong negative correlation (r=-0.753 p-Value 0.000) with return on Assets. Dividend payout on the other hand a strong negative correlation (r=0.542, P-value 0.000) with ROA. Lastly leverage had a very weak positive correlation (r=0.175, p-value 0.275). A similar trend was observed when ROA was replaced with ROE. The results revealed a negative association between Firm size and ROE (r=-0.401, p-value 0.009). Dividend payout ratio had a negative association with ROE (r=-0.412, p-value 0.07) and lastly the results revealed a positive relationship between Leverage and ROE (r=0.241, p-value 0.128). the p-value for dividend payout and firm size was 0.000 (p<0.05) which means that the positive and negative association that occurred was significant. It was not due to chance. The p-value for leverage in both the two instances was above (p> 0.05) threshold which means that the difference in association between leverage ROA and ROE was not significant. The study therefore concluded that firm size and dividend payout were key indicators of financial performance of the companies in the energy and petroleum. The relationship however is inverse. Investors should not therefore invest in companies that declare huge dividends but should consider those ones with higher percentages of retained earnings than dividend.

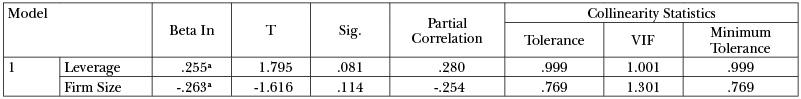

Multiple Regression Model using ROA

Under this model ROA was used as the dependent variable. The findings from the study were as shown below. (Table 2.)

Table 2. Model Summary

![]()

a. Predictors: (Constant), Firm Size, Leverage, Dividend Payout

From the model summary R=0.818. this showed that the three-predictor variable; firm size, leverage and dividend payout accounted for 81.8% of the total variance brought about on the dependent variable. The close association also between R and R Square shows that the model of the study was reliable and could be used to make an inference. This shows a great contribution from each of the independent variable. (Table 3.)

Table 3. Coefficientsa

a. Dependent Variable: ROA

The collinearity statistics were important to establish if our research model would be affected by collinearity of variables. The findings from the study revealed tolerance values within the acceptable range of Tolerance >0.2. Therefore, the variables were not affected by collinearity in any way. Leverage was found to have a positive relationship with ROA while dividend pay-out and firm size had inverse relationships with ROA. The findings were similar to those of (Yusuf, 2015) The model summary was stated as; Y1 = 30.636 + 3.401X1 – 0.322X2 – 2.758X3 + ɛ. (Table 4.)

Table 4. Model Summary

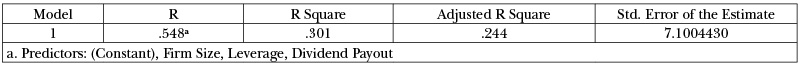

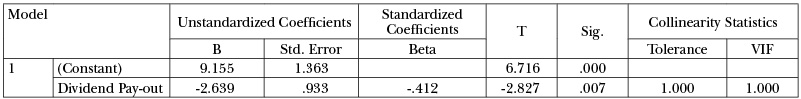

Second Regression Model Using ROE

The model summary of R=0.548, this showed that the three-predictor variable; firm size, leverage and dividend payout accounted for 54.8% of the total variance brought about on the dependent variable. The value of R Square and Adjusted R Square was 0.301 and 0.244. The close range of association also between R and R Square shows that the model of the study was reliable and could be used to make an inference. This shows a great contribution from each of the independent variable. (Table 5.)

Table 5. Coefficientsa

a. Dependent Variable: ROE

Collinearity diagnostic was conducted to ensure that the variables were not affected by highly correlated components. The findings from the study revealed tolerance values of >0.2. Therefore, the variables were not affected by collinearity in any way. Leverage was found to have a positive relationship with ROE with p-value = 0.05. This means that the association was significant and did not happen due to chance. The regression model of the study Y1 = 62.196 + 17.459X1 – 1.791X2 – 5.538X3 + ɛ. Dividend pay-out and firm size had inverse relationships with ROE. Their corresponding p-values were greater than 0.05. This means that the relationship between the variables was not significant therefore concluding that it was due to chance. Having conflicting research findings prompted for more diagnostic analysis. Stepwise regression was therefore, conducted to establish the significant influence of each predictor variable on the dependent’s variable. The finding from the study were as shown below;

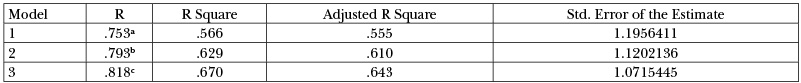

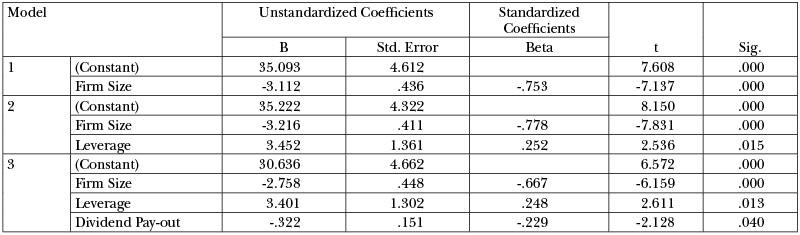

Stepwise Regression (ROA) (Table 6.)

Table 6. Model Summary

a. Predictors: (Constant), Firm Size

b. Predictors: (Constant), Firm Size, Leverage

c. Predictors: (Constant), Firm Size, Leverage, Dividend Pay-out

Firm size accounts for 75.3% of the model summary while, a combination of firm size and leverage contributed 79.3% to the model summary. All the three proctor variables contributed 81.8% to the model summary. The close association in range between R Square and the Adjusted R Square showed that the variables can be relied on in making an inference. (Table 7.)

Table 7. Coefficientsa

a. Dependent Variable: ROA

The findings from the stepwise analysis showed a negative relationship between firm size and firm financial perform using ROA as the dependent variable. A reduction of dividend pay-out showed that form size still maintained a negative relationship whereas leverage had a positive relation on financial performance. Using the three-dependent variable in the stepwise analysis further showed a similar trend in the influence of the variables on the dependent variable. (Table 8.)

Table 8 Excluded Variablesc

a. Predictors in the Model: (Constant), Firm Size

b. Predictors in the Model: (Constant), Firm Size, Leverage

c. Dependent Variable: ROA

The variance Inflation Factors from the findings revealed a value of >2.0 which is the minimum threshold. Multicollinearity was therefore not an issue to affect our regression model. Leverage had a positive correlation with ROA while dividend pay-out has a negative relationship with ROA. The p<0.05 shows that the relationship between the variables was significant and not due to chance. We therefore conclude that dividend pay-out has an inverse relationship with ROA.

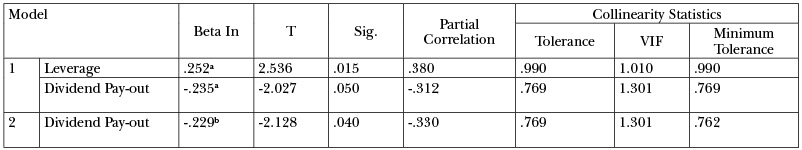

Stepwise Regression (ROE)

A repeated stepwise analysis was conducted further with ROE as the dependent’s variable. The findings were presented as shown below. (Table 9.)

Table 9. Model Summary

![]()

a. Predictors: (Constant), Dividend Pay-out

From the table above 41.2% of the variance is brought about by the dividend pay-out ratio. The closeness in value between R Square and Adjusted R Square shoes that the model can best explain the variance among the variables. (Table 10.)

Table 10 Coefficientsa

a. Dependent Variable: ROE

Table 11. Excluded Variablesb

a. Predictors in the Model: (Constant), Dividend Pay-out

b. Dependent Variable: ROE

Collinearity of the variables was not observed under this model. The findings revealed that dividend had a negative association with ROE r=-2.639 p-value 0.007 = p<0.05. We therefore conclude that there is a significand difference between dividend pay-out and financial performance of listed companies in the energy and petroleum sector in Kenya.

Leverage had a positive correlation with financial performance while firm size has a negative association. The corresponding p-value were above 0.05, which shows that the difference was not significant, and may have been due to chance. The variables were therefore, removed from the regression model.

Conclusion

The foremost objective of this article was to establish any association between dividend payment and financial performance in the Nairobi and Securities and Exchange Markets. To find the association between pay-out ratio and firm financial performance Correlation and regression were used. The findings from the study revealed that Asset and dividend pay-out had an inverse relationship with financial performance while leverage had a positive relationship on financial performance. This showed that the firm’s financial performance is affected by the dividend payment philosophy. Consequently, the results suggest that the dividend pay-out ratio highly influenced the firm financial performance negatively.

References

Adediran, S. A., & Alade, S. O. (2013). Dividend Policy and Corporate Performance in Nigeria. American Journal of Social And Management Sciences. https://doi.org/10.5251/ajsms.2013.4.2.71.77

Ajanthan, A. (2013). Corporate Governance and Dividend Policy: a Study of Listed Hotls and Restaurant Companies in Sri Lanka. International Journal of Scientific & Research Publications, 3(12), 98–114.

Baker, H. K., & Smith, D. M. (2006). In search of a residual dividend policy. Review of Financial Economics. https://doi.org/10.1016/j.rfe.2004.10.002

Baker, H. K., Veit, E. T., & Powell, G. E. (2001). Factors Influencing Dividend Policy Decisions of Nasdaq Firms. The Financial Review, 36(3), 19–38. https://doi.org/10.1111/j.1540-6288.2001.tb00018.x

De Cesari, A., & Ozkan, N. (2015). Executive incentives and payout policy: Empirical evidence from Europe. Journal of Banking and Finance. https://doi.org/10.1016/j.jbankfin.2014.12.011

Francis, B. B., Samuel, G., & Wu, Q. (2017). The Impact of Financial Markets on Payout Policy: Evidence from Short Selling. Ssrn. https://doi.org/10.2139/ssrn.3038300

Gugler, K., & Yurtoglu, B. B. (2003). Corporate governance and dividend pay-out policy in Germany. European Economic Review, 47(4), 731–758. https://doi.org/10.1016/S0014-2921(02)00291-X

Hamid, K., Khurram, M. U., & Ghaffar, W. (2017). Juxtaposition of Micro and Macro Dynamics of Dividend Policy on Stock Price Volatility in Financial Sector of Pakistan: (Comparative Analysis through Common, Fixed, Random and GMM Effect). Journal of Accounting Finance and Auditing Studies, 3(1).

Kanwal, M., & Hameed, S. (2017). The Relationship between Dividend Payout And Firm Financial Performance. Research in Business and Management, 4(1), 5. https://doi.org/10.5296/rbm.v4i1.10784

Musiega, M. G., Alala, O. B., Douglas, M., Christopher, M. O., & Robert, E. (2013). Determinants Of Dividend Payout Policy Among Non-Financial Firms On Nairobi Securities Exchange, Kenya. International Journal of Scientific & Technology Research.

Nishat, M., & Irfan, C. M. (2008). Dividend Policy and Stock Price Volatility in Pakistan. The Pakistan Development Review, 4(1), 175–188. https://doi.org/10.1080/096031096334402

Onali, E. (2014). Moral Hazard, Dividends, and Risk in Banks. Journal of Business Finance and Accounting. https://doi.org/10.1111/jbfa.12057

Press, T. M. I. T., & Review, T. (2010). Dividends , Earnings , and Stock Prices, 41(2), 99–105.

Primis, H., & Whitehurst, D. (n.d.). Finance Fundamentals of Corporate Finance. Retrieved from http://www.untag-smd.ac.id/files/Perpustakaan_Digital_1/CORPORATE FINANCE Fundamentals of Corporate Finance, 6th Ed – Vol I.%5B2002.ISBN0072553073%5D.pdf

Rashid, A., & Rahman, A. Z. M. A. (2008). Dividend Policy and Stock Price Volatility: Evidence from Bangladesh. The Journal of Applied Business and Economics, 8(4), 71–81. Retrieved from http://search.proquest.com/docview/218717004?accountid=27540

Turki, S. F. A., & Al-khadhiri, A. (2013). Determination of dividend policy : the evidence from Saudi Arabia. International Journal of Business and Social Science, 4(1), 181–192. https://doi.org/10.30845/ijbss

Whitehurst, D. (n.d.). abc.

Yee, T. C. (2017). Dividend Pay-out Policy and Firm Performance. Journal of Arts & Social Sciences, 1(1), 42–52.

Yusuf, B. R. (2015). Dividend payout ratio and performance of deposit money banks in Nigeria. International Journal of Advances in Management and Economic, 4(6), 98–105.

Zriba, H. (2015). Journal of Humanities and Cultural Studies, 2(2).

Daniel Oigo PhD student

Szent Istvan University, Hungary,

Prof. Zoltan Zeman PhD

Szent Istvan University

Dr. Richard Ndege PhD

Kenya

Dr. Peter Gaturu PhD

Kenya

@ WCTC LTD --- ISSN 2398-9491 | Established in 2009 | Economics & Working Capital