Microfinance and financial performance on SMEs in Manado – Indonesia

Abstract

North Sulawesi is the suburban area with the potential for natural wealth is quite abundant: the sea is rich, the land is fertile, and nature is beautiful. Soil fertility is very clearly seen in the fertility of coconut, clove, and nutmeg plants as traditional commodities of this region. Rice and pulses also grow easily and fertile. The government together with the cooperative service and SMEs are trying to facilitate SMEs to get microfinance credit funds. This research aimed to see the significant difference in financial performance of nine Small Medium manufacturing Enterprises in coastal coast area before and after using funds microfinance credit in Manado. Based on the results shows that the financial performance of SMEs in Manado City from the year before using microfinance credit and after using microfinance credit is changing, which is the average value of the financial ratio analysis experienced good changes. SMEs should be more effective in utilizing existing resources to generate sales, and SMEs should know the condition of the company’s financial performance in their business from time to time so that the future can anticipate and quickly taking decisions for possibilities that could happen in the future, and further improve the company’s performance in the future.

Keywords: microfinance credit, financial performance, small and medium enterprises.

Introduction

Most of the land in North Sulawesi is the suburban area with the potential for natural wealth is quite abundant: the sea is rich, the land is fertile, and nature is beautiful. Soil fertility is very clearly seen in the fertility of coconut, clove, and nutmeg plants as traditional commodities of this region. Rice and pulses also grow easily and fertile. Abundant natural wealth has not been utilized well enough. We can easily see the number and extent of land that is not cultivated. Old coconut gardens were not rejuvenated, many clove gardens were left unattended – especially since the clove prices plummeted in 1998. Agricultural potential, including livestock and fisheries potential in this area, is far from optimal utilization, even though the need for agricultural products remains high or even higher because of the increasing population.

SMEs development is not free from the problem of managing finances. The common finances problem address by the SMEs are insufficient capital due to the massive start-up cost and expensive raw material. Other finances problem is about the operational production activity, although high subsidies by the government on gasoline and electricity. The solution to this problem is to access external finance by the bank, but on the other hands, generally, SMEs in Manado is lack of a historical financial report for a couple of years and lack of collateral assets as requirements to the bank. To solve this problem and to avoid SMEs from getting finance by other illegal or informal microfinance business, the Indonesian government issue a program called: “Kredit Usaha Rakyat (KUR)” – microfinance for small business. This finance is fewer requirements but has a credit limit until 500,000,000 (IDR) or equals to 31,275.25 Euro (1 EUR = 15987.08 IDR).

Based on the explanation above, this research tries to explore and investigate the significant difference of the SMEs financial performance before and after microfinance. This research is also understanding how vital contribution and role of bank microfinance bank pointed by the government to the Small medium enterprise in Manado as a strategic area of the eastern part of Indonesia not only for the abundant natural resources and tourism destination. Meanwhile identifying problems and challenges are essential, yet it will come to some possible solution to be offered and presented as a recommendation.

Theoretical review

Finance Management

Financial management according to Dobbins (1993) explains that financial management is activity related to the task of being a financial manager in a business company. Financial managers actively manage financial affairs from various types of businesses, which are related to finance or non-financial, personal or public, large or small, proceeds of profit or non-profit, and carry out various activities, such as budgeting, financial planning, cash management, credit administration, analysis of investment and business to obtain funds (Dobbins, 1993). Further, also act as a restrain in financial performance, since it does not contribute to return on equity (Rafuse, 1996).

Financial Performance

Financial performance for the general company can be divided into five financial ratios as follows: Liquidity, Asset management, Debt management, Profitability, and Market value (Brigham & Houston, 2015). This five financial ratio is almost cannot be found in a small business. Financial performance for small business can be generalized by adjusting the financial ratio into Production, Sales Turnover, and Profit (Wijewrdena et al., 2009; MacMahon, 2007; Gibson et al., 2014).

Microfinance for SMEs

According to Otero and Rhyne (1999) microfinance is the provision of financial services to low-income poor and very poor self-employed people. Financing a small business does not have many choices like a big company. The owner of the small business needs to use a lot of information to access good financing (Halabi et al.., 2010; Collis and Jarvis, 2002). In the rural area, small business relatively does own more land and depreciable assets and have lower inventory and other current assets when compared to metro firms. Small business in the rural area have relatively similar access to financial services, although utilization varies and rely on a wide variety of sources for financing; however, rural small businesses have significantly more mortgages, loans from shareholders, and other types of loans, but fewer credit cards (Gustafson, 2004). Based on the literature study, the government need to provides conceptualizing solution for the small business to access the financing where public policy is currently usefully employed in addressing such financing problems (Tucker and Lean, 2003). The determinants of MSE owners’ financing references to access good financing factors are ownership type, acquisition type, level of education of the owner/s and a reason for business startups are found to be major (Gebru, 2009). Small business relies heavily on their own funds and would not raise new equity from sources outside the family; thus, there is a reluctance to use new outside equity such as venture capital, business angels, etc (Daskalakis et al., 2013). After the 2008 financial crisis, most of the small business financing their operation using owner equity as a primary source but try to obtaining less capital (Wille et al., 2017).

Previous Research

Kibet et al. (2015) In the final analysis, the research clearly found that MFC has a positive effect on the performance of SMEs with a level of significance of less than 5%. In order to enhance a sustained and accelerated growth in the operations of SMEs credits should be client-oriented and not product-oriented. It’s concluded that MFIs are concerned with the provision of financial services to people who are economically poor and who therefore experience financial exclusion in that they do not have ready access to mainstream, commercial financial services. It is concerned with the provision of financial services to poor people using means which are just, fair and sustainable for example they accept social collateral rather than financial collateral, access to larger amounts of the loan if repayment is performance is positive, easy way to access finance is not much paperwork and easy and short procedures.

Olowe, Moradeyo and Babola (2013) , the study was restricted to Ibadan metropolis Olowe, Moradeyo and Babola (2013) study investigated the impact of microfinance on SMEs growth in Nigeria. The population of the study consists of the entire SMEs in Oyo State. The results also showed that high-interest rate, collateral security, and frequency of loan repayment can cripple the expansion of SMEs in Nigeria. The paper recommended that MFBs should lighten the condition for borrowing and increase the duration of their customers’ loan and also spread the repayment over a long period of time.

Kalui and Omwansa (2015) the Microfinance products offered (micro savings, microcredit, microinsurance, and training) have effects on the financial performance of SMEs. The study recommended that MFIs have a great responsibility of ensuring the proper use of credit which is an important facility in the financial performance of businesses. To achieve this, credits should be SMEs-oriented and not a product- oriented. Microfinance can research into very profitable business lines and offer credit to SMEs who have the capacity to exploit such business lines, microinsurance is paramount to SMEs in cushioning them in the event of unfavourable occurrence, and should be enhanced properly to the SMEs, and that business and financial training should be provided by Microfinance on a regular basis and most cases should be tailored toward the training needs of the SMEs.

Oleka, Maduagwu, and Igwenagu (2014) the study is aimed at evaluating the extent to which Microfinance banks have helped in financing small and medium enterprises (SMEs) in Nigeria, how they access funds from the microfinance banks to finance their productions and how these accessed funds affect their performances. The results show that the operation of microfinance banks is an impetus for the performance and growth of small and medium enterprises. However, other firm-level variables such as business size, business age, business location, loan size, loan maturity etc. are found to have a positive effect on enterprises’ growth.

Hyphothesis

H0: There is no significant different between before and after microfinance apply on small business financial performance.

Ha: There is significant different between before and after microfinance apply on small business financial performance.

Research method

This research used comparative and descriptive research with the quantitative approach (Cooper and Schindler, 2003), and conducted an interview in separate places according to the location of every respondents in Manado – Indonesia in coastal coast area. The population of this research is nine informants who use microfinance credit on their manufacturing business in Manado – Indonesia coastal coast area. In this research is using saturated sampling method (Sekaran and Bougie, 2009; 262). This research used descriptive statistics and paired sample t-test to help researchers detect sample characteristics that may influence their conclusions.

Result and discussion

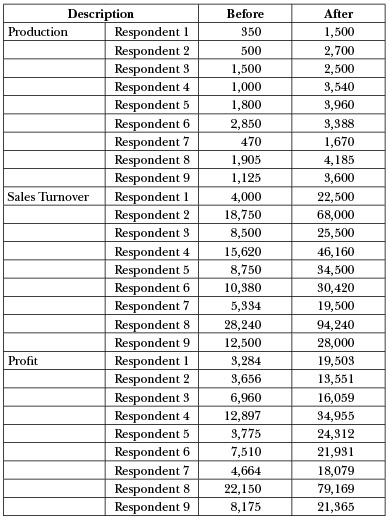

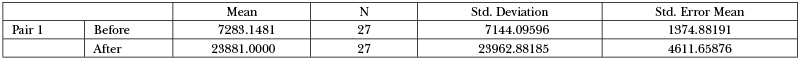

Tables above are to find out the amount of contribution of Microfinance Credit to performance by sector is to calculate the average value of increase of performance indicator that is production, sales turnover, and profit between before and after using Microfinance Credit. The tables above show the significant different before and after microfinance credit apply to small business financial performance. Sig. value shows the .000 indicates that there is a significant different before and after microfinance apply on small business financial performance. From result of calculation of average of performance indicator can be known that the contribution of Microfinance Credit in influencing the improvement of Financial Performance is in Respondent 1 respondents with income stamping after using Microfinance Credit increased by 30%.

Table 1. Production Amount, Sales Turnover, and Profit of SMEs Before And After Microfinance Credit (In Million IDR)

Source: Data processes, 2018.

Descriptive variable of monthly production cost before using loan of Microfinance Credit and after getting loan of Microfinance Credit at 9 SMEs in Manado have average monthly production cost before using loan of Microfinance Credit as much as Rp 1,272,200 and after get loan of Microfinance Credit as much Rp 4,498,100, so on average the cost of production increases after obtaining a loan of Microfinance Credit.

Descriptive characteristics based on monthly sales level before getting Microfinance Credit has average monthly sales turnover of Rp 12,452,600 and after using loan of Microfinance Credit has average monthly sales turnover of Rp 41,535,000 so on average the sales turnover increases after using Microfinance Credit.

Descriptive variable profit / monthly profit before getting loan of Microfinance Credit and after getting loan of Microfinance Credit at 9 SMEs in Manado have average monthly profit as much as Rp 7,785,700 and after using Microfinance Credit have average monthly profit as much as Rp 27,658,200 so on average monthly profit after earning a loan of Microfinance Credit.

Current Ratio and Quick Ratio is good if the ideal value is 200% (Bringham and Houston, 2015). Based on the comparison of financial performance among SMEs stated that the average current ratio and the rapid ratio to the company’s liquidity ratio still stands below 200%, meaning that financial management is must be able to attract consumers, and they must control the business and find a strategic place to run the business to make profit.

So, it can be concluded through this descriptive analysis, we are able know the growth of financial performance of SMEs in Manado city before and after using KUR, It can be seen that after using KUR, the average growth of SMEs Manado is good. According to Oleka, Maduagwu, and Igwenagu (2014) that microfinance credit and advances to the small and medium scale entrepreneurs have a significant positive impact on the SMEs enterprises component of GDP. This is influenced by the increasing amount of production and account receivable of the company’s. the Liquidity Ratio, Activity, and Profitability of SME has increased, while one variable Leverage Ratio on the average the number of SMEs is decreased. According to Kibet, et al. (2015) these results suggest that most SMEs are able to effectively and efficiently allocate the initially borrowed loans and thus with knowledge gained through training by MFIs, they are able to register positive results and also make savings. The low percentage of using loans only shows that business financial performance is sound thus SMEs are able to plow back profits to expand their business. According to Oleka, Maduagwu, and Igwenagu (2014) the regression results imply that microfinance credit contribute more to the financial performance of SMEs and hence higher return on assets. less able to allocate more productive funds. Activity Ratio of SMEs after using the average KUR experienced an increase in Inventory Turnover and Receivable Turnover. This is due to increased receivables and inventory on the company after using KUR. This has good impact for the company because it means that sales have increased and in Total Assets Turnover and Fixed Assets Turnover. The average value of SMEs after using KUR has decreased due to the increasing turnover of net sales. this is influenced by the business climate faced by SMEs in the market which causes the net sales amount obtained by each SME unstable.

Leverage Ratio of SMEs after receiving KUR funds experienced an average decline, although the company used KUR funds as additional capital of their business but they still maintain the existence of their assets. Despite having to meet short-term obligations and long-term obligations, this does not affect the value of production and sales because they use both personal mixed capital and borrowing through credit with portions that are not much different from before. Leverage ratio is considered fair if it has the highest average value above 50%, the average amount of own capital. Despite the difference between before and after using KUR funds, the yield of leverage ratio on total debt to assets and long-term debt to fixed assets is below 50%. Profitability Ratio SME after using KUR on average value is increased compared to before using KUR. They must have a strategy to maintain their business in both capital and loan capital. Business owners must be able to attract consumers, and they must control the business and find a strategic place to run the business to make profit.

Table2. Paired Samples Statistics

Source: Data processes, 2019.

Table 3. Paired Samples Test

![]()

Source: Data processes, 2019.

So, it can be concluded through this descriptive analysis, we are able know the growth of financial performance of SMEs in Manado city before and after using KUR, It can be seen that after using KUR, the average growth of SMEs Manado is good. According to Oleka, Maduagwu, and Igwenagu (2014) that microfinance credit and advances to the small and medium scale entrepreneurs have a significant positive impact on the SMEs enterprises component of GDP. This is influenced by the increasing amount of production and account receivable of the company’s. the Liquidity Ratio, Activity, and Profitability of SME has increased, while one variable Leverage Ratio on the average the number of SMEs is decreased. According to Kibet, et al. (2015) these results suggest that most SMEs are able to effectively and efficiently allocate the initially borrowed loans and thus with knowledge gained through training by MFIs, they are able to register positive results and also make savings. The low percentage of using loans only shows that business financial performance is sound thus SMEs are able to plow back profits to expand their business. According to Oleka, Maduagwu, and Igwenagu (2014) the regression results imply that microfinance credit contribute more to the financial performance of SMEs and hence higher return on assets.

Conclusion and recommendation

Conclusion

Results from this study show that financial services obtained from Microfinance Credit have highly benefited SMEs in Manado and have facilitated the sharing of business skills and innovative ideas, as well as alleviated the acute shortage of finance to an extent. The policy implication of this study is that microfinance contributes significantly to an enhanced entrepreneurial environment by making the business environment more conducive and narrows the resource gap for small businesses.

When properly harnessed and supported, microfinance can scale-up beyond the micro-level as a sustainable part of the process of economic empowerment by which the poor improve their situation. Based on findings from this study, the use of Microfinance Credit has potentials for enhancing the performance of small businesses in three major ways- regular participation in microfinance credit, an offering of non – financial services, and as a means to enhance entrepreneur’s productivity.

If we consider the variation in the impact of these factors on the intensity of MSE growth and survival within any one sub-sector, it is possible to define a common series of critical factors for sub-sets of firms. This suggests that policies aimed at promoting the performance of micro and small enterprises should adopt a sectoral approach. Thus, approaches and resources should address the most critical determinants of performance in focal sub-sectors, aiming to augment access to critical resources and, perhaps, overcome the disadvantages that cannot be easily varied.

Recommendation

Based on the discussions and conclusions above, the author tries to provide suggestions with the hope that it can be useful for the management of the company in connection with the financial condition of SMEs in the city of Manado. Microfinance Credit should increase the duration of their clients’ asset loans, or spread the repayment over a longer period of time, or increase the moratorium. Also, the Microfinance Credit should employ collective group-based loan disbursement strategy; this will reduce the default rate and the volume of the portfolio at risk.

In terms of policy on support services, Microfinance Credit should assist their clients by providing training on credit utilization and provide information on government programs to Microfinance Credit operators in the country. Such Microfinance Credit support and training institutions should be strengthened and properly funded while the services should be properly delivered too. Microfinance Credit can partner with relevant technology enterprise development organizations/skills training institutions to provide client-focused skills training to their clients. Microfinance Credit should seek long-term capital from the Pension and Insurance Companies in the country. This will help to reduce their lending rates and enable them to spread their interest payments over a longer period to encourage the acquisition of capital assets and technology. The Microfinance Credit should attend to loan proposals of Microfinance Credit through their business associations and other self –help organizations. This will reduce the adverse effect of information asymmetry. Social capital can be employed to obviate the need for tangible collateral.

References

Brigham, E. F., and Houston, J. F. (2015). Fundamentals of Financial Management 14th Edition. Boston, USA: Cengage Learning.

Collis, J. and Jarvis, R. (2002) “Financial information and the management of small private companies”, Journal of Small Business and Enterprise Development, Vol. 9 Issue: 2, pp.100-110. Emerald Group Publishing Limited 1462-6004. https://doi.org/10.1108/14626000210427357

Cooper, D. and Schindler, P. 2003. Business Research Methods. Boston: McGraw-Hill/Irwin.

Daskalakis, N., Jarvis, R., and Schizas, E. 2013. Financing practices and preferences for micro and small firms. Journal of Small Business and Enterprise Development Vol. 20 No. 1, 2013. pp. 80-101. Emerald Group Publishing Limited 1462-6004. DOI 10.1108/14626001311298420

Dobbins, R. (1993) “An Introduction to Financial Management”, Management Decision, Vol. 31 Issue: 2, . Emerald Group Publishing Limited 1462-6004. https://doi.org/10.1108/00251749310031851

Gebru, G., H. 2009. Financing preferences of micro and small enterprise owners in Tigray: does POH hold? Journal of Small Business and Enterprise Development Vol. 16 No. 2, 2009 pp. 322-334. Emerald Group Publishing Limited 1462-6004. DOI 10.1108/14626000910956083

Gibson, S., G., McDowell, W., C., and Harris, M., L. (2014) “Small business owner satisfaction with financial performance: A longitudinal study”, New England Journal of Entrepreneurship, Vol. 17 Issue: 1, pp.15-20. Emerald Group Publishing Limited 1462-6004. https:// doi.org/10.1108/NEJE-17-01-2014-B002

Gustafson, C., R. (2004),”Rural small business finance: evidence from the 1998 survey of small business finances”, Agricultural Finance Review, Vol. 64 Iss 1 pp. 33 – 43. Emerald Group Publishing Limited 1462-6004.

Halabi, A., K., Barrett, R., Robyn Dyt, (2010) “Understanding financial information used to assess small firm performance: An Australian qualitative study”, Qualitative Research in Accounting & Management, Vol. 7 Issue: 2, pp.163-179. Emerald Group Publishing Limited 1462-6004. https://doi.org/10.1108/11766091011050840

Kalui, F. M., and Omwansa, D. M. 2015. Effects Of Microfinance Institutions’ Products On Financial Performance Of Small And Medium Enterprises. Journal of Business and Management (IOSR-JBM) Volume 17, pp 50-57. Machakos Town, Kenya. http://iosrjournals.org/iosr-jbm/papers/Vol17-issue4/Version-5/G017455057.pdf. Accessed: 9 Aug 2017

Kibet, K., Dennis., Kenneth., and Omwono, G. 2015. Effects of Microfinance Credit on the Performance of Small and Medium Enterprises. Journal of Small Business and Entrepreneurship Research Vol.3, No.7, pp.57-78. Kenya. in Uasin Gishu County.

McMahon, R., G., P. (2007),”Ownership structure, business growth and financial performance amongst SMEs”, Journal of Small Business and Enterprise Development, Vol. 14 Iss 3 pp. 458 – 477. Emerald Group Publishing Limited 1462-6004

Oleka, C. D. O., Maduagwu, E., N, and Igwenagu C. M. 2014. Analysis Of The Impact Of Micro-Finance Banks On The Performance Of Small And Medium Scale Enterprises In Nigeria. Journal of Management and Social Sciences (IJSAR-JMSS) Volume 1, pp 45-63. Nigeria. http://www.mdcjournals.org/pdf/145229994620160901010639.pdf. Accessed: 31 Jul 2017

Olowe, F.T., Moradeyo, O.A., and Babalola, O. A. 2013. Empirical Study Of The Impact Of Microfinance Bank On Small And Medium Growth In Nigeria. Journal of Academic Research in Economics and Management Sciences Vol. 2, No. 6. Nigeria. http://hrmars.com/hrmars_papers/Empirical_Study_of_the_Impact_of_Microfinance_Bank_on_Small_and_Medium_Growth_in_Nigeria.pdf. Accessed: 1 Aug 2017

Otero, M., and Rhyne, E. 1999. The New World Of Microenterprise Finance. Building Healthy Instittutions For The Poor. P 119-139. West Hartford.

Rafuse, M.E. 1996. Working Capital Management: An Urgent Need To Refocus. Journal of Management Decision Vol. 34(2), pp. 59-63. University in Pakistan. ISSN 2303-1174 http://maxwellsci.com/print/crjss/v3-269-275.pdf. Accessed: 12 Aug 2017

Robert T. Hamilton Mark A. Fox, (1998),”The financing preferences of small firm owners”, International Journal of Entrepreneurial Behavior & Research, Vol. 4 Iss 3 pp. 239 – 248. Emerald Group Publishing Limited 1462-6004

Sekaran, U., and Bougie, R. 2009. Research Methods For Business: A Skill Building Approach. Fourth Edition. UK: John Wiley.

Tucker, J. and Lean, J. (2003) “Small firm finance and public policy”, Journal of Small Business and Enterprise Development, Vol. 10 Issue: 1, pp.50-61. Emerald Group Publishing Limited 1462-6004. https://doi.org/10.1108/14626000310461367

Wijewardena, H., Nanayakkara, G., and Zoysa, A. D, (2008),”The owner/manager’s mentality and the financial performance of SMEs”, Journal of Small Business and Enterprise Development, Vol. 15 Iss 1 pp. 150 – 161. Emerald Group Publishing Limited 1462-6004. http://www.eajournals.org/wp-content/uploads/Effects-of-Microfinance-Credit-On-the-Performance-of-Small-and-Medium-Enteprises-in-Uasin-Gishu-County-Kenya.pdf. Accessed: 12 Aug 2017

Wille, D., Hoffer, A., and Miller, S., M. (2017) “Small-business financing after the financial crisis – lessons from the literature”, Journal of Entrepreneurship and Public Policy, Vol. 6 Issue: 3, pp.315-339. Emerald Group Publishing Limited 1462-6004. https://doi.org/10.1108/JEPP-D-17-00005

Johan Reineer Tumiwa

University of Debrecen, Hungary

Octavia Diana Monica Tuegeh

Manado State University, Indonesia

@ WCTC LTD --- ISSN 2398-9491 | Established in 2009 | Economics & Working Capital