The Main Challenges and Constraints of the Economic Development of Taiwan

Abstract

Beyond a comprehensive review on Taiwan’s economy, the main objective of the present study was to find answer to two questions. The first issue is whether Taiwan followed a classical model of the Asian Newly Industrializing Economies (ANIEs), or in spite of similarities at first sight, it rather had its own, individual way of development. To examine this question the author made a comparison between Taiwan and the Republic of Korea (South Korea) and beside the obvious similarities, a number of significant differences were found.

The other main question this study was focused on is the present and future economic and social challenges which influence Taiwan’s future development as well. From among these characteristics the author pointed out the issue of the high exposition (especially in terms of FDI) and growing dependence on mainland China (the People’s Republic of China), the need for a shift in terms of the main drivers of the future economic development to preserve Taiwan’s competitiveness and mitigate the risks of brain drain and social unrest. It looks evident that Taiwan has to give up insisting to the principle of low labour costs, and this may give impetus to the two-decades long salary stagnation and to the domestic consumption. Taiwan may only be competitive in the future if it gave an increasing focus to the domestic R&D and innovation in the new industries and also puts more emphasis on sustainability.

Key words: Taiwan, ANIEs, Korea, economic development, competitiveness

JEL Classification: R11, F14, F54, F59, N45, O53, O57

Introduction

The island of Taiwan (formerly called Formosa) is located off the south-eastern coast of the continental China, at the western edge of the Pacific Ocean, between Japan and the Philippines. The Central Mountain Range divides the east and west coasts and stretches from north to south. With Japan to the north, mainland China (the People’s Republic of China, PRC, hereinafter: mainland China) to the west, and the Philippines to the south, Taiwan has always been a location of strategic maritime importance since ancient times. It has played an important role in the development of Asia as well as in world history, politics and trade. As a result, Taiwan (named as Republic of China, ROC, hereinafter: Taiwan, which comprise several smaller archipelagos in the South China Sea as well) now enjoys a high level of openness and cultural diversity. Taiwan’s geographical and historical uniqueness has given rise to a diversity of ethnic groups, cultures, and languages. There are 380,000 people who belong to twelve officially recognized indigenous tribes, each with their own social structure, language, and cultural traditions. Taiwan has a population of 23 million people who still observe their culture and still speak regional Chinese dialects in addition to Mandarin (MOE Taiwan, 2017).

Taiwan (is relatively poor in mineral resources however it has small deposits of coal, natural gas, limestone, marble, asbestos and arable land. The majority of the island is covered by a mountain range, with more than 300 peaks over 3,000 m above sea level. Its highest point is Yu Shan (3,952 m). Therefore, Taiwan has very limited possibilities for agriculture. According to the figures of CIA Factbook (2017), based on estimation, the ratio of agricultural land is 22.7% only. The population of Taiwan was 23,464,787 (July 2016), while life expectancy at birth: total population: 80.1 years (male: 77 years, female: 83.5 years (2016) (CIA, 2017).

After the 1960s, Taiwan underwent a rapid economic and industrial reform, also experienced remarkable social development. The economic achievements of the 1970s and 1980s allowed Taiwan to rank among the Asian Tigers and, in the 1990s, among developed countries. Since the 1980s, the economic structure of Taiwan gradually shifted from labour-intensive industries to high-tech industries, wherein the electronics industry was particularly vital to the world’s economy. Taiwan has excelled in the semiconductor, optoelectronics, information technology, communications, and electronics fields. At present, the economy is shifting toward nanotechnology, biotechnology, optoelectronics, and the tourism service industry. Moreover, international trade is the economic lifeline of Taiwan. Japan and the United States were Taiwan’s top two trading partners until 2005, when mainland China took over as Taiwan’s main import/export trading region, with Japan and the United States coming in second and third. In recent years, the unfavourable financial situations of the USA and European economies and the economic slowdown in mainland China had a joint impact on the economic performance of Taiwan (MEET-Taiwan, 2017).

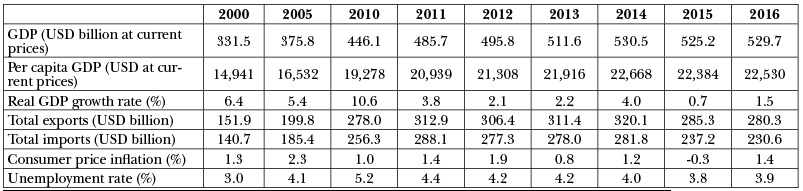

Taiwan has a dynamic capitalist economy with gradually decreasing government guidance on investment and foreign trade. Exports, led by electronics, machinery, and petrochemicals have provided the primary impetus on its economic development. This heavy dependence on exports exposes the economy to fluctuations in world demand. Taiwan’s diplomatic isolation, low birth rate, and rapidly ageing population are other major long-term challenges. According to estimated figures of CIA World Factbook (2017) Taiwan’s PPP-based GDP (purchasing power parity) was 1.125 trillion USD, GDP (official exchange rate) was 519.1 billion USD (2015), while the GDP real growth rate was 1% (2016). The per capita GDP (PPP) was 47,800 USD (2016), while the ratio of gross national saving was 35.7% of GDP (2016).

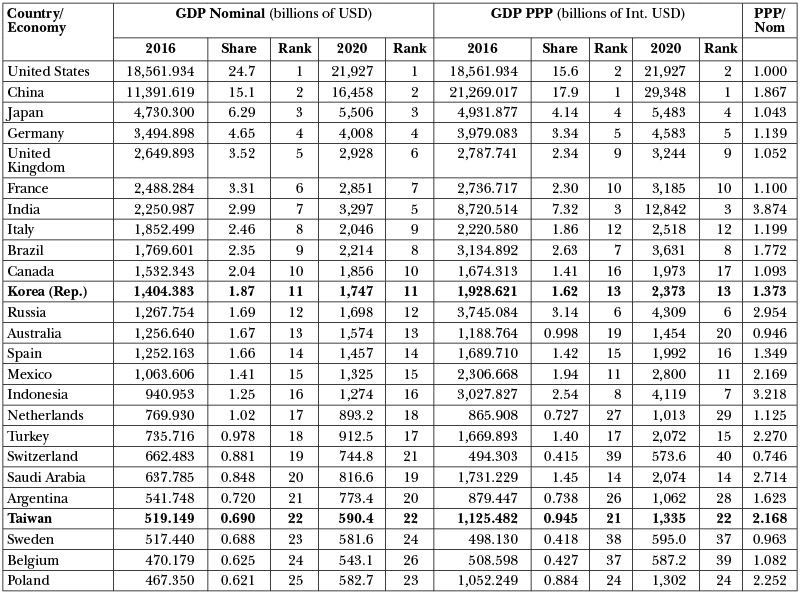

Table 1: List of Countries by Projected GDP – the Top 25

Source: Own edition on the basis of Statistic Times (IMF data), 2016

In 2016, the composition of GDP by sector of origin was as follows: agriculture (1.8%), industry (36.1%) and services (62.1%). The main agricultural products and commodities are rice, vegetables, fruit, tea, flowers; pigs, poultry and fish. The main industries are: electronics, communications and information technology products, petroleum refining, chemicals, textiles, iron and steel, machinery, cement, food processing, vehicles, consumer products, pharmaceuticals. In 2015, the labour force was estimated 11.68 million, the division of which by sectors were as follows: agriculture (5%), industry (36%), services (59%). The unemployment rate was 3.9% in 2016, 0.1% higher than a year before. In 2016, the Taiwanese public debt was 32.7% of GDP (the same like a year before), while in 2016 the budget had a 0.6 percent deficit. In 2016, the inflation rate (consumer prices) was 1.6 %, a year before it was -0.3%. In 2016, the total exports of Taiwan amounted 314.8 billion USD (in 2015: 335.5 billion USD), while the total amount of imports was 248.7 billion USD in 2016, (262.9 billion USD in 2015). The main export commodities are: semiconductors, petrochemicals, automobile/auto parts, ships, wireless communication equipment, flat displays, steel, electronics, plastics, computers, while the main items of imports: oil/petroleum, semiconductors, natural gas, coal, steel, computers, wireless communication equipment, automobiles, fine chemicals, textiles. Taiwan has the sixth biggest reserves of foreign exchange and gold the total amount of which was estimated 456.9 billion USD (on December 31, 2016), one year before it was 430.7 billion USD. Taiwan’s total amount of external debts was estimated 155.4 billion USD (on 31th December, 2016) while one year before it was 159 billion USD (CIA World Factbook, 2017).

Taiwan has its own currency, the New Taiwan Dollar (TWD), the exchange rate of which is determined by market forces. However, when seasonal or irregular factors disrupt the market, the bank of issue (the Central Bank of the Republic of China/Taiwan/, CBC) may intervene to maintain an orderly foreign exchange market. Otherwise CBC promotes financial liberalization and internationalization. The management of capital movements is market based. In general, capital can flow freely in and out of Taiwan. The CBC’s management philosophy of its foreign exchange reserves centres around liquidity, security, and profitability. The foreign exchange reserves have also been used to promote economic development and industrial upgrading According to CBC the actual exchange rate of TWD against USD (Interbank Spot Market Closing Rates) was 30.218 on 28th April, 2017 (CBC, 2017).

Table 2: Taiwan’s main economic indicators between 2000 and 2016

Source: Directorate-General of Budget, Accounting and Statistics, Executive Yuan, Taiwan (cited by DBIT update, 2017)

According to Statistics Times (using database of IMF (2016 October) Taiwan was at No 21 place in terms of the amount of GDP on current price basis and No. 21 in purchasing parity basis (PPP), while foreseeably it would keep its present position in 2020 in PPP basis. On current price basis, it would likely slip one grade back to the 22nd position as it can be seen on Table 1.

The objectives of the research

With the completion of the present study the author aimed give an insight to the most important social and economic challenges of Taiwan nowadays. In the author attempted to find an answer to the question whether Taiwan just followed the successful model of Japan and implemented the same economic policy instruments like other newly industrializing economies in Asia, or it had a special Taiwanese way. For this reason, the author made a comparison between Taiwan and the Republic of Korea (hereinafter: South Korea) in terms of several economic and non-economic factors.

In addition, the author tried answer another question: which are the main economic and social challenges which influence Taiwan’s development at present and in the foreseeable future.

Material and methods

This study is based on secondary and partially primary research information. Most of the secondary information derived from the bibliography in this field which was available in Taiwanese sources, principally in the libraries of National University of Taiwan (NTU), Shih Chien University, Academia Sinica. For statistical data, the author used several international sources of database (CIA World Factbook, IMF) and also of the Directorate General of Customs, Ministry of Finance of Taiwan.

Further to all this, mention must be made about the fact that the author had the privilege to spend two months in Taipei at Shih Chien University in 2017 (March – May) with the fellowship of the Oriental Business and Innovation Centre of BBS. During his stay in Taiwan, the author had personal meetings and made interviews with a number of leading academic professionals of the relevant fields (economy, sociology, international studies, etc.) at Taiwanese institutes and universities (National Taiwan University, National Chengchi University, Academia Sinica. Moreover, experts form the fields of business and administration were also interviewed, like the Investment and Trade Director of the Hungarian Trade Office in Taipei, and also Taiwanese businessmen in farming and food-processing industry. The outcomes of all these meetings and interviews – as valuable primary information – are reflected in this paper as well.

The Taiwanese economic miracle – the export-oriented economic development

According to Chen (2016) the economic development is a complicated phenomenon. Many factors may affect the speed, quality, and direction of economic development. But the major factors affecting Taiwan’s economic development in the past 120 years are mostly international ones – especially the mechanism called international factor price equalization. He believed Taiwan’s economic development was not a miracle, as some people claimed, but rather an achievable outcome for all developing countries facing the same international opportunities. Moreover, he recalled Samuelson (1948) who had proved a theorem of international factor price equalization almost 70 years ago. This theorem stated that, under certain assumptions, the price of production factors, such as the wage rate, will become equal between two countries when the countries have free trade with each other. Chen also referred to Mundell (1957), who demonstrated that even with no trade, the international movement of even only one production factor can also equalize the factor prices of two countries. Since these theories have some assumptions that may not be true in the real world, the wage rate of different countries may remain unequal. Nonetheless, as the theoretical analyses predict, even if some of the assumptions do not hold, the wage rate of two countries, once they are open to international trade, will become closer to each other in most cases (Chen, P 2016).

Taiwan began to experience significant trade with richer countries when the Qing imperial government was forced to open several ports in China to international trade, including two ports in Taiwan in 1860. After Taiwan was ceded to Japan in 1895, it began to engage in large-scale trade with Japan. In addition, investment, modern technology, and educated people moved to Taiwan from Japan. Before 1945, the economic relationship between Taiwan and Japan resembled a modern common market. Taiwan could export a variety of products in which Taiwan had comparative advantage to Japan without paying tariffs. Factor flows between Taiwan and Japan were also cost free. Consequently, income and wage rates in Taiwan grew closer to those of Japan (which were higher). The factor price equalization mechanism began to contribute to the economic development of Taiwan. In 1937, four decades after Japan occupied Taiwan, per capita income in Taiwan reached roughly 75 percent of Japan’s (Chen, P. 2016).

The development model of Taiwan comparing to South Korea – similarities and differences

The peculiar and successful economic development of the Asian New Industrialising Economies (ANIEs), especially the cases of South Korea and Taiwan have received considerable attention from economists. Many studies and analyses have already been prepared and published to find out what was the secret of their successful models. It is also evident that from historical, political, social, cultural aspects there were many similarities between the two entities. Both of them were in severe economic and social situation before their take-off and prosperity came about. South Korea, once one of the poorest economies in the world and devastated by the Korean War (1950-53), is now the world’s No. 12 largest economy in terms of the amount of GDP, while Taiwan has turned itself from a small island with a history of colonization into No. 21-22 largest economy in the world (see Table 1).

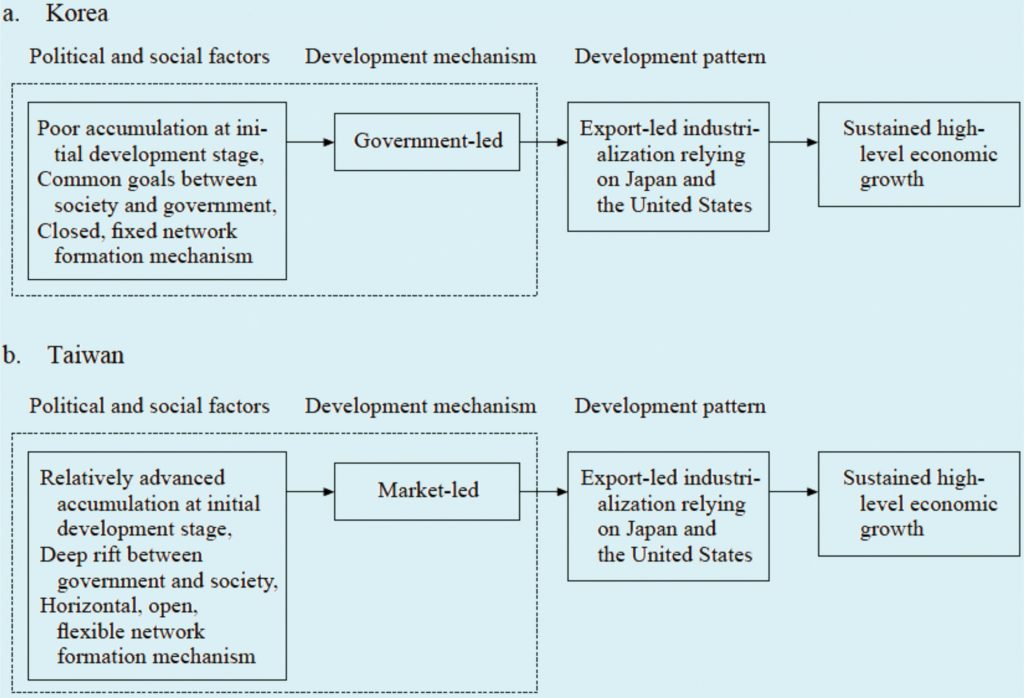

South Korea and Taiwan experienced colonization but developed their economies very rapidly under a government-led development paradigm. Due to limited natural resources, both governments employed an export-oriented industrialization policy. Both economies also were favoured by high rates of domestic savings and human capital characterized by high levels of education and a good work ethic (Kim, H.– Heo, U. 2017).

With economic development, both governments also went through the transition to democracy, which ended authoritarian rule in Taiwan in 1987, in South Korea in 1988.

However, besides the similarities, there were also noticeable differences between those economic development models which were applied in South Korea and Taiwan. The South Korean government monopolized credit allocation, providing preferential credit to big export-oriented corporations to promote economic development. By contrast, small and medium-size enterprises that were mostly family-owned led economic development in Taiwan (Kim, H.– Heo, U. 2017).

Hattori and Sato (1997) in their study also assumed and claimed that the development mechanisms in South Korea and Taiwan were different and came up explanatory hypotheses based on historical and economic facts. According to them there were different levels of capital accumulation at the starting points of post-war economic development, or industrialization, in the two states. In South Korea hopes were very high for accelerated development, but the economy itself was still at a very low level. This situation most likely forced policymakers and the people to believe that development should be carried out through a strong government-led mechanism. The fact that South Korean level of economic development was lower than that of Taiwan looks evident in the figures of per capita GNP. In 1961, per capita GNP in South Korea was only 55 percent of the figure recorded by Taiwan. Taiwan was already producing sugar as a powerful agricultural exporter, enabling a certain level of foreign currency acquisition. South Korea fell behind in this aspect. Industrialization in South Korea also lagged behind. Looking back on the period during which both countries were colonies of Japan, industrialization was progressing during the 1930s and the Korean Peninsula was developing ahead of Taiwan. However, most of the factories were located in the north, and with the division of the peninsula after World War II, South Korea was cut off from the major industrial regions. Also, most of the manufacturing enterprises including SMEs in pre-war Korea were owned and managed by Japanese. In the other hand, in Taiwan, although many large corporations were also owned and managed by Japanese, the SMEs were owned and managed by Taiwanese. Therefore, after the war South Korea experienced setbacks both in terms of manufacturing facilities and human resources, even before the destruction inflicted on the economy by the Korean War. As a result, the resources, especially capital, necessary for economic development was seriously lacking in South Korea. In order to utilize effectively the scarce resources that were available, it was hoped that the government would step in and ration them in a centralized manner. For this purpose, the Park Chung-hee administration nationalized the country’s financial institutions and took control of loans from overseas. In the other hand, Taiwan’s economic level was relatively higher, and although capital was scarce too, the situation was by no means as critical as in South Korea, allowing Taiwan to take a more relaxed approach to economic development (Hattori, T. – Sato, Y. 1997). According to their findings they described a general scheme of the Taiwanese and South Korean developmental model, see Figure 1.

Figure 1: Development Patterns and Development Mechanisms in South Korea and Taiwan

Source: Hattori, T. – Sato, Y. (1997)

Chau (2001a) in his study pointed out that from the beginning, the South Korean government took on an active and direct role in guiding and promoting economic growth, much more so than the governments of Japan and Taiwan. The main objective was growth maximization. This was considered essential to survival, to counter the threat of North Korea, which was stronger in terms of military capacity and economic potentials in early 1960s. The strategy was clear-cut and simple: outward-, industry- and growth-oriented (or “OIG-oriented”). To do well in export was considered of paramount importance. The phrase “export first” was written into the second five-year plan of South Korea (1967-71), and “Nation building through exports” was President Park Chung-hee’s favourite slogan (Chau, L-C. 2001a).

Abe and Kawakami (1997), in their study examined the reliability of that belief – based on a broad consensus – that the backbone of industrialization of South Korea was the sphere of chaebols (conglomerate business groups) rather than small and medium-size enterprises (SMEs), while in Taiwan’s economic development, the SMEs played been the driving force for growth.

According to this general consensus South Korea was considered as „big business economy” while Taiwan an „SME economy.” Their conclusion was that the statistical data to the end of the 1980s confirmed this generally held perception contrasting enterprise size in the two economies. However, later on, between 1986 and 1991 the position of enterprises employing more than 500 workers in the Taiwanese economy increased in importance, if only slightly. In other words, the dichotomy in the position of big business in the two economies seemed to have lessened since the mid-1980s (Abe, M. – Kawakami, M. 1997).

Chau et al. (2001b) also underlined that there were differences in the method of industrial targeting too. Taiwan was most specific in identifying and promoting ‘strategic’ industries, with explicit criteria (technology intensity, market potential, high value added and large linkage). Eight strategic industries were chosen in 1983, and 33 targeted leading products were identified in 1992. By contrast, in its technology upgrading effort, South Korea shifted from industry-specific promotion of the 1970s to functional policies of the 1980s. Policy became more favourable to individual projects rather than sectoral development (Chau et al. 2001b).

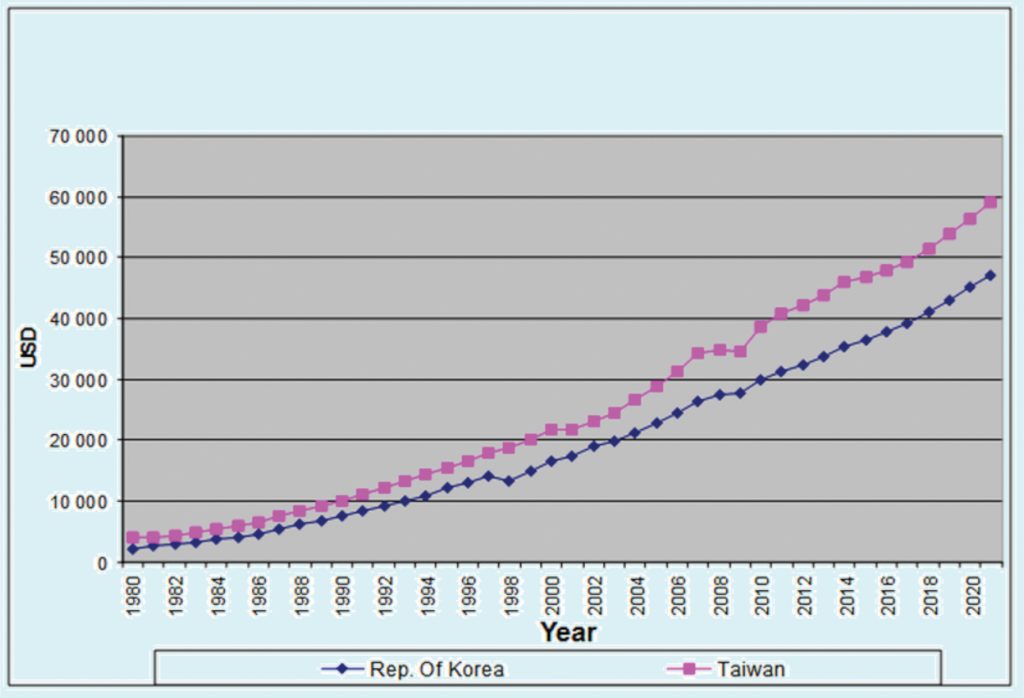

South Korea and Taiwan have enjoyed rapid economic development since the early 1960s. Gross domestic product (GDP) per capita in South Korea and Taiwan has continuously increased over the past decades. However, it is also visible that since 1980 the value of per capita GDP (PPP) has always been higher in Taiwan than in South Korea and the gap between them has also been continuously widening. Taiwan’s per capita GDP (PPP) will closely approach 60,000 USD by 2021, while in case of South Korea it will only be slightly above 47,000 USD (see Figure 2).

Figure 2: Per Capita GDP (PPP) of Taiwan and of the Republic of Korea from 1980 till 2021 (forecast) in USD

Source: own compilation on the basis of Economy Watch (data gained from the International Monetary Fund, http://www.economywatch.com)

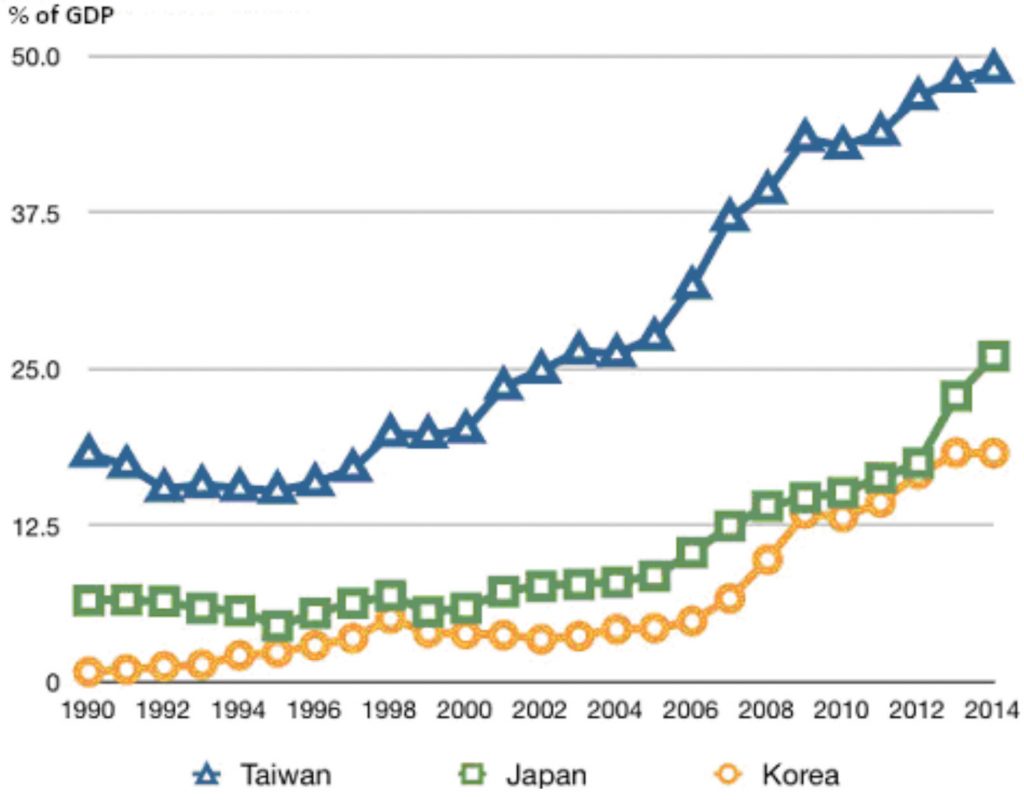

Figure 3: The stock of outward FDI as percentage of GDP in Japan, South Korea and Taiwan, 1990-2014

Source: Chow, P.C.Y. (2016) (on the basis of UNCTAD)

The most obvious difference between the South Korean and Taiwanese economies is the size of firms and business groups. Kim (2017) on the basis of previous studies (Amsden, 1989, Wade 1990, Kim 1996, Heo and Tan 2003, Heo and Roehrig 2010,) pointed out the issue of big corporations versus small and medium-sized enterprises. The economic concentration is one of the main characteristics of late industrialization as a small number of firms tend to lead economic development. South Korea is a good example: a small number of gigantic family-owned business conglomerates, called chaebols, account for a major portion of the economy’s production. The South Korean government concentrated resources on a small number of firms for two reasons. First, South Korea had limited resources. Second, the government believed that the size of firms was important to compete in the world market. Scarce resources meant that only a small number of firms received government support, which in turn led to the dominating size of chaebol. For instance, the Hyundai group, the largest chaebol in these early years, expanded at an average rate of about 32 percent from 1972 to 1983, and the five biggest chaebols accounted for 17.4 percent of the total value of the manufacturing sector in 1982 (Kim 1996). By 1999, the top fifty firms in South Korea accounted for 93.8 percent of the country’s GDP (Kim, H. – Heo, U. 2017).

Lin (2017) underlined that Taiwan started her peculiar way of export-oriented industrial development almost at the same time when South Korea did – around the late sixties to the early seventies. But it was a major difference that unlike in case of South Korea, Taiwanese government did not select directly those companies which were designated to be the backbone of the national economy. There were no chaebols or Japanese style Keiretsu-model. The development went through under the guidance of the government, but the most successful industrial manufacturers – especially in the electronic industry – were self-made men. Another typical trend was that bigger companies with textile or other profiles – recognising the prosperity of the electronic industry – also entered the business. Even though, that by now some of the Taiwanese companies grew big, like Asus, Acer, D-Link and many others, – contrary to South Korea and Japan – it happened only in the course of the recent one or two decades. He pointed out that similarly to South Korea, Taiwan also received significant and regular financial assistance from the United States during the 1950s and in the early sixties – until 1965 (South Korea received the US assistance until 1972). All this gave additional impetus and help the impressive economic growth of Taiwan and South Korea that started just a couple of years later. After 1965, still huge amounts of American financial assets remained in Taiwanese banks that were – and still being – used like a joint fund for development purposes, and the Taiwanese and the US administration decide together about the projects to which support should be rendered (Lin, M-J. 2017).

Chou (2017) pointed out that comparing to South Korea the labour unions have always been much weaker and played less active role. Even though that since 1987 the democratization process has been going on in Taiwan, the peoples’ voice, the activation of civil movements can only be seen during the recent 3-4 years (Chou, C-C., 2017). This must be one reason why the level of salaries has been stagnating in Taiwan for two decades.

Comparing the Taiwanese and South Korean R & D sectors, Sanchez-Rubalcava (2014), in his thesis pointed out that there were key differences between South Korea and Taiwan in terms of research and development. He claimed that in contrast to the remarkable similarities in many ways, they differ from each other greatly when looking at the industry data in terms of which the biggest differences could be found. The main difference was in the concentration of research and development, which in South Korea was managed by the largest companies, while in Taiwan the research and development was more uniform and spread out (Sanchez-Rubalcava, D. 2014).

According to Chow (2016) until the 1990s, Taiwan was able to overcome its diplomatic isolation by expanding its trade and investment flows to all of her trading partners with or without official government recognition. Its economy could maintain decent growth rates with an average of 7.49 percent in the years 1991-1995, a record comparable to other newly industrializing countries (NICs) in the early years of the 1990s. However, the proliferation of the free trade agreements (FTAs) in the Asia Pacific since that time has reduced Taiwan’s international economic participation. Unlike South Korea which has signed FTAs with most of its major trading partners, Taiwan has not been able to benefit from a “freer trade” regime through bilateral/plurilateral trade accords. This is because mainland China has prevented those countries with which Taiwan has no diplomatic ties from signing trade accords with Taiwan (Chow, P. C.Y. 2016).

Chow (2016) in his study pointed out another important difference between the two economies: the extent of the outward FDI which is considerably higher in case of Taiwan than in South Korea or even Japan. The stock of outward FDI as percentage of total GDP is shown in Figure 3. By the end of 2012, the stock of outward FDI in total GDP accounted for nearly 50 percent in Taiwan whereas the levels in South Korea and Japan are only 25 percent and below. After Teng Hsiao ping’s southern visit in 1992, which reaffirmed mainland China’s commitment to reform and openness, more Taiwanese capital flowed to mainland China than to any other country. This rose concerns about overdependence on mainland China (Chow, P. C.Y. 2016).

The present state and challenges of the Taiwanese economy and society

Taiwan’s economy has been experiencing a downturn since the breakout of the global economic crisis since 2008. This is due to the overdependence to the exportation. Both investment and consumption are growing at a slow pace. There are three main factors contributing to Taiwan’s economic growth: investment, export and consumption. Regarding the investment sector, the government has faced the sovereign debt ceiling, which restricts its capacity for raising public debt. The private investment sector shows limited growth potential. Furthermore, there is little progress in negotiations for FTA (Free Trade Agreement) as well as EFCA (Cross-Straits Economic Cooperation Framework Agreement) follow-up agreements. Negotiations, however, have been started for a cross-strait trade in goods agreement under the ECFA framework (Wang, J-C. 2015).

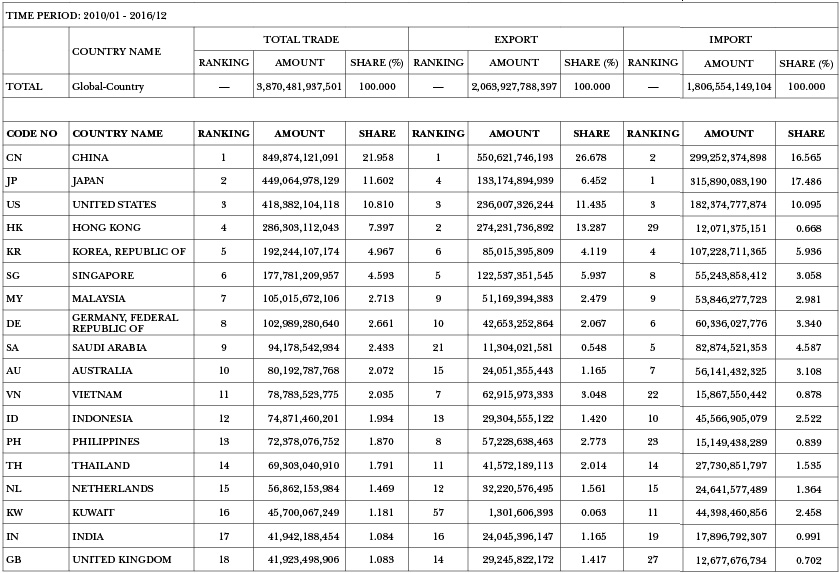

Table 3: The main trading partners of Taiwan between January 2010 and December 2016 (in USD)

Source: Directorate General of Customs, Ministry of Finance, (Taiwan)

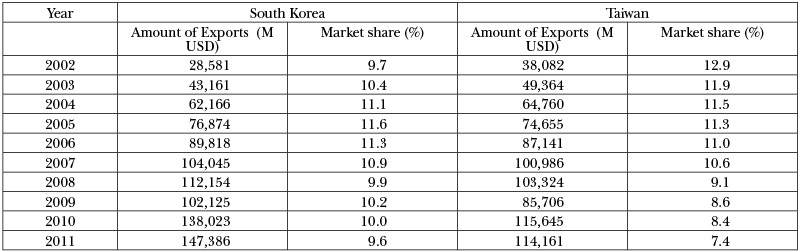

Table 4: Taiwan’s and South Korean Exports to and Market Share in China (2002-2011)

Source: Chang, C-C (2015) on the basis of “The Impact of Taiwan President Ma’s Re-election on South Korea’s export to China”.

Qingdao Newsletter (KOTRA Chingtao Weekly Newsletter) (March, 2012)

In order to maintain the technical and business issues between Taiwan and mainland China, the Straits Exchange Foundation (SEF) was established by the Taiwanese government. It is technically a private foundation, but in fact it is funded by the government and controlled by the Mainland Affairs Council of the Executive Yuan (the executive branch of the Taiwanese political leadership). Its role is in fact, a kind of de facto embassy to mainland China, to not officially acknowledge the latter’s sovereignty over Taiwan. The SEF is headed by a former Taiwanese foreign minister, Tien, Hung-mao (SEF, 2017).

According to the figures of Table 3 – comprising seven years from 1st January, 2010 to 31st December, 2016 it is very much visible, that Taiwan’s No. 1 and No. 2 foreign economic partners are located in East Asia, namely the mainland China and Japan. In terms of the entire bilateral turnover, and in case of Taiwanese exports, mainland China is the biggest partner (even without Hong Kong nearly 850 billion USD turnovers, from which 550 billion USD was the export), while in terms of imports to Taiwan, Japan was the biggest in this period (with nearly 316 billion USD). The United States was at No 3. place both in terms of exports and imports. Hong Kong, South Korea and Singapore are also very important partners, while from Europe only one country, Germany had a place among the Top Ten (with nearly 103 billion USD turnover).

Mention has to be made about the Economic Cooperation Framework Agreement (ECFA), a preferential trade agreement between the governments of mainland China and Taiwan, which aimed to reduce tariffs and commercial barriers between the two sides. The pact, signed on June 29, 2010, in Chongqing, was seen as the most significant agreement since the two sides split after the Chinese Civil War in 1949 (BBC News, 2010).

Chang (2015) pointed out that whilst legislative ratification of the latest Cross-strait Trade in Services Agreement has been held in abeyance since the Sunflower Movement took place in March 2014. in Taiwan attended a WTO (World Trade Organization) Trade Policy Review meeting in Geneva on September 16, 2014. During this meeting from the end of mainland China concerns were expressed over Taiwan’s restrictive measures that substantially limit its direct/portfolio investments in Taiwan. In addition to reiterate its expectation towards the removal of Taiwan’s unilateral import bans on basic products from mainland China in compliance with the MFN (Most Favoured Nation)-level obligations of WTO. Beijing has also signalled that, by failing to open Taiwan’s domestic economy to China, it will lobby against Taiwan’s participation in multilateral pacts such as the Trans-Pacific Partnership (TPP). Also, according to Chang (2015), South Korea and Taiwan both significantly increased their exports to mainland China between 2002 and 2011, however the figures show that South Korea’s export expansion was more successful in absolute values. However, South Korea’s share within the Chinese market did not change significantly (from 9.7% to 9.6%), while the same in Taiwan’s case decreased from 12.9 % to 7,4% (Chang, C-C. 2015), see the comparison in Table 4.

According to Chang (2015) in the long run, keeping restrictive stance towards reciprocal flows from mainland China is definitely not an option for Taiwan. Making prudent policies of cross-strait opening, with appropriate safeguards in place, may not be the panacea for Taiwan’s competitiveness, but it is a necessary step to maintain and further enhance its strength in global trade. Taiwan should take a more positive perspective and consider forming a strategic alliance with mainland China, rather than viewing it as an adversary, in order to maximize its relative advantage under this ever-changing global business environment (Chang, C-C. 2015).

According to Wang (2015), the domestic consumption, the average growth of Taiwan’s disposable income was approximately one percent in the past ten years. It causes the sluggish growth of Taiwan’s economy. Lastly the export trade is also largely affected by the up-and-down fluctuations of the global economy, which imply that Taiwan has lost much of its control over its economic growth. However, on the bright side, Taiwan’s export and consumption are better off following the recovery of the global economy. Foreign tourist arrivals were expected to exceed ten million in 2016 to significantly increase domestic demand. Moreover, with the establishment of Free Economic Pilot Zones (FEPZs) and the shift in investment from China to Taiwan, by Taiwanese businessmen, the economic growth of 2015 shows signs of recovery. But with the rise of China’s high-tech industry, the cross-strait business relationship has shifted from cooperation to competition. However, there are still some doubts about the global economic recovery, Taiwan still has a lot of work to do, though its economic growth in the next two or three years shows promise and has an optimistic forecast. It has to speed up not only in industrial transformation but also sign FTAs to stand a chance in this fierce competition and break through existing trade barriers to get back on the right track of economic growth, at faster pace too. Taiwan has been too much dependent on mainland China. Taiwan is pressured to speed up industrial upgrading and transformation. Moreover, Taiwan has to plan FEPZs (free economic pilot zones) and sign FTAs at faster rate in order to make industrial advancements and maintain competitive advantages over mainland China. Upon accomplishment Taiwan will be able to pursue sustainable economic growth. Besides the aforementioned challenges, there are still some other pressing complications. Such one is the rise of mainland China’s supply chain and the fierce industrial competition between the two sides of the Taiwan Strait. In recent years, Taiwanese and foreign companies all face the pressure of localization or joining with the China supply chain. This means the original Taiwanese and foreign suppliers of semi-conductor and other component manufacturers are being replaced. The negative effect can be seen by the recent decrease in the ratio of intermediate goods Taiwan imports from mainland China. It may have resulted from mainland China’s import substitution and localized production policy. In 2013, the manufacturing of ICT (information and communication technology) products and optical instruments, which constitute a large part of imported goods, has been hit the hardest, weakening Taiwan’s export performance. Therefore, Taiwan has to shift focus to the American reindustrialization process to maintain competitive advantages over mainland China.

The conclusion of Wang (2015) is that industrial transition must speed up and new industries must be introduced in order to attract investment. In addition, service industries should take full advantage on FTAs and ECFA. In doing so, Taiwan can take advantage of China’s and ASEAN countries’ vast hinterland to secure benefits of economies of scale and create demand for skilled manpower (Wang, J-C. 2015).

Füle (2017) pointed out that during the recent, 8-year period of the KMT-government, (2008-2016), Taiwan made many gestures to improve relations with mainland China. When Taiwan and mainland China concluded the ECFA in 2010, as a part of this framework agreement, a so-called Early-harvest List was agreed in 2011, which comprised altogether tariffs concessions of 806 product items. He pointed out that the unhindered trade of at least two third of these products was really beneficial for Taiwanese exporters to mainland China, which is interested in the imports of modern technologies from Taiwan. On the other hand, it is a noticeable fact that nowadays around 23 million people are employed by Taiwanese firms in mainland China – which number is comparable to the entire population of Taiwan.

Following ECFA, within few years altogether 22 additional agreements were concluded between Taiwan and mainland China, which covered the field of liberalization of the movement of persons as well. At the beginning only tourist groups, but later on individual travellers were also allowed to travel to the other side of Taiwan Strait. Finally, ECFA became highly debated and the last agreement within its framework on the liberalizing trade in services was not ratified by the Taiwanese legislature.

It even raised public dissatisfaction and created an intense situation in Taiwan, which resulted in the significant occupation of the Taiwanese Legislative Yuan as many people had fears of the fast pace of signing and ratifying so many agreements between the two sides of the Taiwan Strait. It was considered too risky both from political and economic point of view. Finally, it contributed to the victory of the previous opposition, the liberal, Democratic Progressive Party (DPP) in 2016.

He added that Taiwan struggles for any kind of additional possibility to participate in the international arena, however it is very much limited in the shade of mainland China, as the latter prevented most of these efforts. The Free Trade Agreement (FTA) between Taiwan and the European Union is widely promoted by various feasibility studies and would highly benefit both the EU and Taiwan. However, it is stalemated and not likely to be signed unless a similar agreement had already been concluded between the EU and mainland China. He underlined that it is very unlikely that such an agreement would be concluded between the EU and China in the near future, therefore the case of FTA between Taiwan and the EU cannot be on the agenda. He said it can be considered as a breakthrough-sound achievement that mainland China did not prevent the conclusion of the FTA between Taiwan and New Zealand in 2013, as well as the earlier conclusion of an investment protection accord between Taiwan and Japan in 2011 (Füle, J. 2017).

Wang (2015) emphasized another problem facing Taiwan is its unsolved salary stagnation. Real salary has stagnated for almost 20 years because of the imbalance of income distribution, not from the lack of economic growth. Salary stagnation serves as an obstacle hindering Taiwan’s economic recovery. Although the speed of inflation in Taiwan is relatively low, the increase in salary is even lower. Under such circumstances, Taiwan is struggling to maintain talent in the country, further reinforcing the vicious cycle of low salary (Wang, J-C. 2015).

Cheng (2017) also mentioned the dilemma of salary stagnation. She pointed out that the young generation in Taiwan faces elementary problems establishing families because of the increasing gap between the growing real estate prices and the stagnating salaries. She mentioned that in the course of the recent two decades even cuts in salaries happened (Cheng, C. 2017).

Chou (2017) pointed out that 60% of college graduates in Taiwan are engineers, many of whom establish ventures and most of them become successful in a course of a couple of years (Chou, C-C., 2017). However, Hsu (2015) in his study pointed out that the young generation (20-24 years old people) face nowadays even bigger difficulties at the labour market than before. He claimed that Taiwan’s labour market had gone through a major change over the past decade. In fact, unemployment among people aged 35 or above had declined since 2003, but joblessness of the age 20-24 age group hit a new high in 2013. He suggested that Taiwan should learn from the US and other OECD countries which use the so-called Active Labour Market Policy (ALMP) to structurally connect the youth to the labour market and also urged for more innovative strategies that systematically could bring back this underrepresented generation, whose members possess with high educational attainment (Hsu, Y-H. 2015)

Lin (2017) outlined the main traps jeopardizing Taiwan’s competitiveness “behind the shade” of mainland China:

- Many Taiwanese businessmen went to China to manufacture and enjoy the advantages of the cheap labour. But, it has several risk factors for Taiwan as follows:

- If Taiwanese manufacturers focus too much on the advantages deriving from the low labour costs, in longer run these manufacturers will lose their competitiveness, as the labour costs, even in China are growing. The Taiwanese government has been trying to encourage entrepreneurs to rather do more intensively innovations and increase the value-added content in their products and services.

- As China needs semiconductors in growing quantities, but still not able to meet her own demand from domestic resources. He mentioned that China spent nearly as much on importing semiconductors as on the annual oil imports. Hence, in the recent years China started to intensively develop her own semiconductor industry, which is followed by a special kind of brain-drain process: Chinese firms offer good job opportunities for Taiwanese specialists working in this field. He underlined: this was not prevalent in case of the assembly- manufacturers, just the cutting-edge segment of the industry: the semiconductor design and production. If this process went on, Taiwan would surely face serious difficulties with her competitiveness in this field (Lin, M-J. 2017).

Chow (2016) summarized the tasks of the present administration of Taiwan – under presidency of Tsai Ing-wen (she assumed her office on May 20, 2016) – in order to revitalize Taiwan’s economy amid an unfavourable global environment. For Taiwan to benefit economically from its interactions with the rest of the world, in turn, and to enhance its international visibility politically, the Taiwanese government has at least six significant challenges as follows:

- Building on the economic statecraft that has brought participation in the WTO, plurilateral and multilateral trade arrangements;

- Expanding its limited successes in bilateral FTAs negotiations, especially with those countries which have multiple memberships in the emerging trade blocs;

- Continuing economic gains that Taiwan has made through its functional approach to deepen further the de facto economic integration it has achieved through outward investment and its participation in the global value chains (GVCs);

- Maintaining peace and stability in the cross-Strait relations by taking a non-provocative attitude toward China;

- Pursuing membership in the new mega-regional trade blocs to diversify its trade and investment flows so as to mitigate its asymmetric dependency on China’s market;

- Engaging a “New Southward Policy” to integrate further with the economies in Southeast and South Asia.

Figure 4: Taiwan’s Corruption Rank

Source: Trading and Economics (Transparency International)

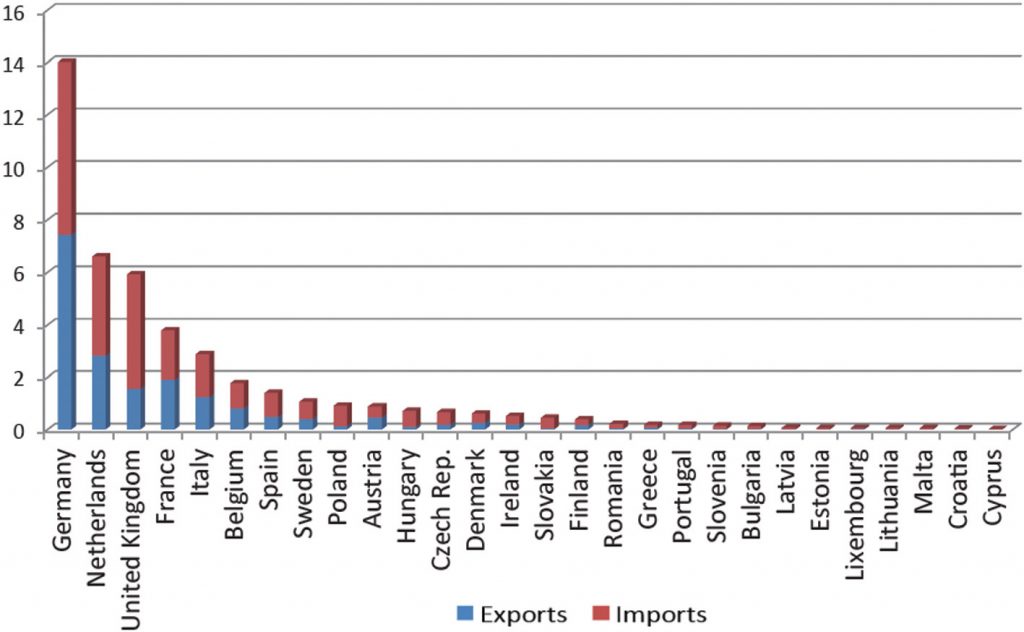

Figure 5: Bilateral trade between the 28 EU Member States and Taiwan in 2015 (EUR, billion)

Source: EU–Taiwan Factfile, 2016 (on the basis of EUROSTAT data)

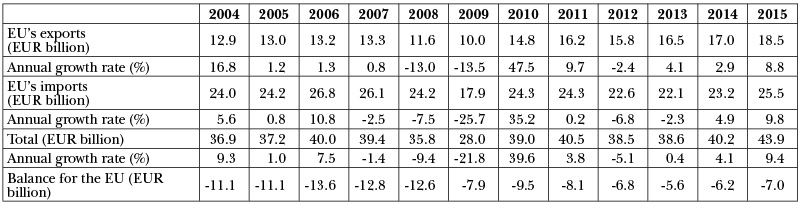

Table 5: EU’s trade in goods with Taiwan

Source: EU–Taiwan Factfile, 2016 (on the basis of EUROSTAT data)

Chow claimed that this might be a grand strategy for the Tsai-administration to globalize Taiwan’s economy with substantial political dividends in the international community (Chow, P. C.Y. (2016).

Another challenge the Taiwanese government and society has to face is the corruption. According to GAN (2016) corruption does not represent a major obstacle for business operating or planning to invest in Taiwan, but, there are several reports of official corruption. These can be traced back to the close ties between politics and business which have raised the risks of corruption particularly in public procurement. Petty corruption, however, is very uncommon in most sectors. Taiwanese anti-corruption law is primarily contained in the Anti-Corruption Act, the Criminal Code and the Organic Statute for Anti-Corruption Administration and the government generally implemented these laws effectively. Taiwan’s Agency Against Corruption defines low-level gratuities; therefore, any facilitation payment could be viewed as a bribe by the courts (Taiwan Corruption Report, GAN 2016).

According to Transparency International, in 2016 Taiwan ranked at No 31 in the world list, which is slightly worse than in 2015, but an improvement comparing to the preceding several years can still be seen on Figure 4.

In close relationship with all this, in Taiwan a new idea and well-functioning solution was found out to combat against tax evasion, at least in retail trade. In an effort to get merchants to keep things on the books, the Taiwanese government introduced a sweepstake, called Receipt Lottery. The theory being, with millions in winnings on the line, customers would start demanding receipts with every purchase and merchants would wind up with all their income on the books. Each receipt gets a unique eight-digit number stamped on it. On the 25th of every odd month they announce six winning numbers. People who collect their receipts, check their receipt numbers from the preceding two months (Receipt Lottery).

This author believes that this is a classic win-win situation. The customers, who have a real chance to win, are strongly interested to claim receipts even after their small shopping, as the highest prize is 10 million TWD (around 330,000 USD), but even minor prizes are still attractive. In the other hand both the government and the community wins, as the total sum of prizes remains far below the surplus the budget receives from taxes like this, even though the VAT ratio is much lower in Taiwan (5%) than in most European countries. This system works well, with bimonthly draw, and people follow the results with keen attention while VAT and all additional payments arrive to the budget.

Economic relations between Taiwan and the European Union

Bilateral trade relations between the EU and Taiwan are in general good and expanding. According to statistical figures of 2015 Taiwan is the EU’s 18th trading partner and the 7th in Asia in value of goods 44 billion EUR traded in 2015 (9.4% increase comparing to 2014). The EU is Taiwan’s 5th trading partner, after China, the ASEAN block, US and Japan. The EU-Taiwan bilateral trade accounted for 1.3% of EU’s world trade 2015. The EU’s exports to Taiwan (18.5 billion EUR) grew in 2015 by 9%. Total trade in services between the EU and Taiwan was 7 billion EUR in 2014, with a shrinking surplus for the EU (1.3 billion EUR). ICT products dominate Taiwanese exports to the EU (35%), followed by machinery (17%) and transport equipment (11%). The share of Taiwan in integrated circuits and electronic components in EU’s imports worldwide is more than 15%. Machinery is the main export of the EU to Taiwan (23%); transport equipment takes also a significant part of EU’s exports to Taiwan (18%), followed by ICT products (9%), pharmaceuticals (8%) and agri-food (7%). With a stock of FDI of 10 billion EUR, the EU is the largest investor in Taiwan. The EU’s FDI accounts for 25% of all foreign investment in the island. At the same time, Taiwanese investment in the EU remains at a very low level (stock of 1 billion EUR). The EU as a whole only accounts for 2% of the stock of Taiwanese FDI. The inclusion of Taiwan in the European Commission’s “Trade for All” trade communication, adopted in October 2015 is a major development. The prospect of a bilateral investment agreement (BIA) is an opportunity to create an overall better business environment in Taiwan for EU investment (EU – Taiwan Factfile, 2016).

Regarding the issue of the EU – Taiwan BIA, in spite of the recently mentioned optimistic consideration of the EU-Taiwan Factfile (2016), the state of this agreement does not look bright. The author need to recall Füle (2017) who pointed out that it has no reality until such an agreement between the EU and mainland China has been concluded (which is very unlikely). From the European Union’s side, such an agreement with Taiwan would collide with the One-China Policy (Füle, J. 2017).

In 2015, the European Union continued its intense and well-structured dialogue on economic and trade matters with Taiwan. Four technical expert-level working-groups, that meet twice a year, deal with questions related to sanitary and phyto-sanitary rules (including food safety), technical barriers to trade, automotive (including standards, certification and testing requirements), intellectual property rights, pharmaceuticals, cosmetics and medical devices. Ad hoc regulatory dialogues are held on government procurement, customs, telecom, complemented by seminars and workshops on issues of mutual interest, organised jointly by the European Economic and Trade Office (EETO) and Taiwanese stakeholders aimed at strengthening our cooperation. At the joint events, European experts from European Commission, EU Member States, industry and academia share best practices and advocate international and EU regulatory principles. The first Industrial Policy Dialogue took place in June 2015, which focused on innovation through digitalisation, standardisation and SMEs internationalisation and clusters cooperation, notably in the framework of the Enterprise Europe Network, of which Taiwan became a member on 28th May, 2015. The aggregated figures of trade between the European Union and Taiwan can be seen in Table 5, while the bilateral trade between the 28 EU member-states and Taiwan (in 2015) can be seen in Figure 5. In the latter, it can be clearly seen that Germany is the biggest economic partner for Taiwan from among the 28 member states, covering 31.9% of the total EU-Taiwan trade turnover. The second biggest partner is the Netherlands (15.0%), the third one is the United Kingdom (13.5%), France (8.6 %), Italy (6.5%), Belgium (4.1%) and Spain (3.2%) are still significant (EU – Taiwan Factfile, 2016).

Conclusion

Following the objectives of the study, on the basis of bibliographic sources and databases, furthermore incorporating all relevant information the author gained by personal interviews in Taiwan, as primary research results during his fellowship in 2017, the main findings and conclusions can be summarized as follows.

1) The Taiwanese model – similarities and differences between the development of South Korea

To answer the question – whether Taiwan just followed the successful model of Japan and implemented the same economic policy instruments like other newly industrializing economies in Asia, or it had a special Taiwanese way – the author made a comparison between Taiwan and South Korea in terms of several economic and non-economic factors.

In this respect there are many similarities, the most prominent ones are as follows:

- relatively small land, with significant population,

- scarcity of natural resources, especially energy carriers,

- colonial past,

- underdeveloped economy after the colonial period which was further devastated by the war(s) – WWII, and in case of South Korea, the Korean War (1950-53),

- strong (dictatorial) political leadership until the late 1980’s,

- export-oriented economic development policy,

- American economic assistance helped the recovery and the take-off,

- Following Japanese and American patterns,

- Conflicts and continuous tensions in the direct geographic neighbourhood,

- High savings ratio, especially during the take-off period (1970’s),

- Democratization process from the late 1980’s

In the other hand, there were significant differences in the way of South Korea and Taiwan as follows:

- The role of state (government) in guiding the economic development was strong in both cases while in South Korea the government monopolized the credit allocations giving preference to the selected big export-oriented companies (which became the chaebols), while in Taiwan the interfering role of state was not that strong, mostly family-owned SMEs led the economic development.

- We may say, South Korea followed the chaebol-model, while Taiwan the successful SME model. However, what is more important difference, that in South Korea the success of the selected companies was pre-decided by the government, while in Taiwan self-made companies became successful. (Even though some of these SMEs grew big, they are still not giants like most of the well-known South Korean firms).

- The post-colonial heritage was quite different after Japan surrendered in 1945. Even though Japan had invested a lot both to Korea and Taiwan (as they both used to be provinces of Japan), in case of Korea the relatively modern Japanese investments and production capacities were in the North, they remained at North Korea. Those few capacities existed in the South were mostly devastated by the Korean War while in Taiwan production- and export-oriented capacities were not that much damaged, so Taiwan still had a stronger basis to start again from. Hence, even though the post-colonial and post-war situation devastated both economies, at the beginning the situation in South Korea was much worse (even in 1960 South Korea was one of the poorest country in the world), than in Taiwan where the situation was not so critical.

- Due to the previous factors Taiwan had higher per capita GDP (PPP) from the beginning than South Korea and this trend has still been continuing.

- The role and activity of the labour unions (In South Korea labour unions are strong, while in Taiwan they are still in a weak position).

- The R&D activity is concentrated to big corporations in South Korea while in Taiwan it is more spread. While in both economies the R&D activity used to be industry-specific from the take-off period, from the 1980’s in South Korea it was shifted to the promotion of functional policies, while Taiwan went on selecting and promoting industries of strategic importance with more explicit criteria.

- The outbound FDI in case of Taiwan is much higher (in ration of GDP), it is around 50%, while in South Korea it is considerably lower.

- The role and activity in the international community. While South Korea is a widely accepted and recognized, independent member of the international community, Taiwan remains in the shade of mainland China in diplomatic isolation. Therefore, South Korea could join all those international agreements which it found beneficial (like FTAs), while Taiwan’s possibilities are strongly limited.

After all the author considers that besides the obvious similarities, there were too many differences between the Taiwanese and the South Korean model that it can be claimed that Taiwan had its peculiar way of development, it did not copy or follow strictly any other patterns.

2) Economic and social challenges of Taiwan nowadays

- According to the author’s experiences, and also the widely available, up-to-date bibliographic sources it seems that one of the main dilemmas is for Taiwan how to manage its economic relationship and the ‘political contacts’ with mainland China, in order to preserve its competitiveness and relative freedom (the de facto independence) while from some points it looks that mainland China and Taiwan seem to merger into a peculiar free trade zone.

- Taiwan invested much, one may say too much FDI into mainland China, which makes her economy and de facto independence even more vulnerable. Moreover, it contributes to mainland China’s competitiveness only if Taiwanese companies went to the mainland to benefit from the lower labour costs there. It will not help to generate more jobs and it would not give any impetus to increase the salary level in Taiwan which is one of the main obstacles that hinders the growth of the domestic consumption and the economic growth.

- The author found that in spite of the geographic and cultural distance there are some points and phenomena, in which Taiwan and Hungary have similar experiences and challenges. One of these ones is the already mentioned salary stagnation, which hit Taiwan and also Hungary, where the salary level has still been retarded, comparing to other European countries, even most of the neighbouring states. Taiwan’s (and other ANIEs’) example clearly shows the fact that the low salary level cannot be a helpful competitive advantage for too long time. Definitely it helped the economic growth during the “take-off” period, but after a time it will be a constraint to catch up. (There must be different factors, like innovation, more R&D-intensive industries to generate more value added). Otherwise, there will always be more competitive economies which invest more to the domestic R&D and innovation and in longer run such countries will be able to pay higher salaries. Taiwan should follow this way. In the other hand, there will always be another place in the world – like mainland China – where the salary levels are lower, but to deploy manufacturing industries in a bigger extent to such places, it too risky. It has a reason why, for example, the new president of the United States campaigned and strived for bringing back the production capacities of American companies which went long ago abroad to benefit from lower wages, furthermore – due to such considerations – he withdrew the United States from the Trans-Pacific Partnership (Bradner, E. 2017).

- The author believes that – very similarly to Hungary, – the salary stagnation has been a very timely issue in Taiwan for the recent decade as well. In this respect, another similarity has to be pointed out between Taiwan and Hungary: the weak role and activity of labour unions. This is also one reason why the salary level could not catch up, even though Taiwanese or even the Hungarian economic performance would enable significantly higher salaries by now.

- In case of Hungary – thanks to the free movement of labour within the European Union, – several hundred thousand Hungarians have migrated to other European and overseas countries with the view of finding better livelihood. As a result of this process there is a massive shortage in various professions from medical doctors to skilled workers. This finally gave an impetus to the government to start tackling on the salary issue, while labour unions still not too active in this matter.

- The case of Taiwan is different a bit, young Taiwanese people who study abroad, remain there for a better job, and do not return. In some specific professions (like the mentioned semiconductor industry), brain-drain strongly exists and can even be accelerated if the government does not make sufficient efforts in this field. Till Taiwanese companies prefer keeping their manufacturing units in mainland China, the Taiwanese wages will not grow. If this stagnation continues, it will have adverse impact to the economy and will be a hard constraint of the future development.

- As a successful solution, the adaption and implementation of the mentioned Receipt Lottery system can be highly recommended in Hungary or any other European country where governments combatting with VAT evasion.

György Iván Neszmélyi PhD

Associate Professor, Budapest Business School – University of Applied Sciences

References

BIBLIOGRAPHY

Abe, M. – Kawakami, M. (1997): A Distributive Comparison of Enterprise Size in Korea And Taiwan The Developing Economies, XXXV-4 (December 1997): pp. 382–400.

Amsden, A. H. (1989): 1989. Asia’s Next Giant: South Korea and Late Industrialization. New York: Oxford University Press. ISBN 0-19-505852-6, 379 p.

Bradner, E. (2017): Trump’s TPP withdrawal: 5 things to know CNN Politics, January 23, 2017 http://edition.cnn.com/2017/01/23/politics/trump-tpp-things-to-know/ – Accessed: 11-04-2017

Chang, C-C. (2015): Restrictive Stance on Reciprocal Flows from China Hinders Taiwan’s Global Trade Participation In: Taiwan Development Perspectives 2015, National Policy Foundation, Taipei, 251 p. ISBN: 978-986-7745-62-0 pp. 143-153

Chau, L-C. (2001a): South Korea: Government-Led Development and The Dominance of Giant Corporations In (eds.): Chau, L-C., Lui, F. T. – Qiu, L. D. (2001): Industrial Development in Singapore, Taiwan and South Korea. World Scientific, Singapore, pp. 118-200.

Chau, L-C. – Lui, F. T. – Qiu, L. D. (2001b): Comparison Among Singapore, Taiwan and South Korea. In (eds.): Chau, L-C., Lui, F. T. – Qiu, L. D. (2001): Industrial Development in Singapore, Taiwan and South Korea. World Scientific, Singapore, pp. 201-232.

Chen, P. (2016): Lessons from Taiwan’s Economic Development Orbis, FPRI’s Journal of World Affairs Volume 60, Number 4, Fall 2016, pp. 515-530.

Chow, P. C.Y. (2016): Taiwan in International Economic Relations Orbis, FPRI’s Journal of World Affairs Volume 60, Number 4, Fall 2016, pp. 531-549.

Hattori, T. – Sato, Y. (1997): A Comparative Study of Development Mechanisms in Korea And Taiwan: Introductory Analysis The Developing Economies, XXXV-4 (December 1997), pp. 341–357.

Heo, U. – Tan, A. C. (2003): Political Choices and Economic Outcomes: A Perspective on the Differential Impact of the Financial Crisis on South Korea and Taiwan. Comparative Political Studies, vol. 36, no. 6 (August), pp. 679–698.

Heo, U. – Roehrig, T (2010): South Korea Since 1980. Cambridge, UK: Cambridge University Press, 2010, (The World Since 1980 Series), ISBN 978-0521743532, 226 p.

Hsu, Y-H. (2015): Revisiting „Who Steal our Jobs” – Youth Employment and Its Policy Response in Taiwan In: Taiwan Development Perspectives 2015 National Policy Foundation, Taipei, 251 p. ISBN: 978-986-7745-62-0. pp.243-251. Journal of Development Economics 49 (1996) pp. 392-394.

Kim, E-M (1996): The Industrial Organization and Growth of the Korean Chaebol: Integrating Development and Organizational Theories. In Hamilton, G.G. (ed.): Asian Business Networks. Berlin: Walter de Gruyter, pp. 231–252.

Kim, H.– Heo, U. (2017): Comparative Analysis of Economic Development in South Korea and Taiwan: Lessons for Other Developing Countries Asian Perspective 41 (2017), 17–41 pp.

Mundell, R. A. (1957): International Trade and Factor Mobility, American Economic Review, 1957, pp. 321-335.

Samuelson, P. A. (1948): International Trade and the Equalization of Factor Prices. Economic Journal, 1948, pp. 163-184.

Sanchez-Rubalcava, D. (2014): Understanding the Differences of Research and Development Between Korea and Taiwan (Thesis) National Taiwan University, College of Management, 2014, 38 p.

Wade, R. (1990): Governing the Market: Economic Theory and the Role of Government in East Asian Industrialization. Princeton, N.J., Princeton, University Press. pp. xiv + 438.

Wang, J-C (2015): Prospects and Challenges for Taiwan’s Economy in 2005 In: Taiwan Development Perspectives 2015 National Policy Foundation, Taipei, 251 p. ISBN: 978-986-7745-62-0, pp. 137-142.

THE AUTHOR’S PERSONAL INTERVIEWS

Cheng, C. (2017): The author’s personal discussion and interview with Dr. Claire Cheng, sociologist, founder and director of Cloud Global Education, Taipei, 1st April 2017

Chou, C-C. C. (2017): The author’s personal discussion and interview with Dr. Chelsea Chia-Chen Chou Ph.D., sociologist, Assistant Professor of the Graduate Institute of National Development of National University of Taiwan, Taipei, 31th March, 2017.

Füle, J. (2017): The author’s personal discussion and interview with Mr. János Füle, Vice President of Chi Fu European Trading Co. Ltd, former Investment and Trade Director of the Hungarian Trade Office in Taipei, 10th May, 2017

Lin, M-J. (2017): The author’s personal discussion and interview with Prof. Lin, Ming-Jen Ph.D., Professor & Chairman of Economics of National University of Taiwan, Taipei, 31th March, 2017.

OTHER REFERENCES:

CBC (2017) – Central Bank of the Republic of China (Taiwan) http://www.cbc.gov.tw/lp.asp?CtNode=700&CtUnit=308&BaseDSD=32&mp=2 http://www.cbc.gov.tw/mp2.html Accessed: 02-05-2017

CIA (2017) – The World Factbook (Information and database on Taiwan and South Korea) Central Intelligence Agency (CIA), USA https://www.cia.gov/library/publications/the-world-factbook/geos/tw.html https://www.cia.gov/library/publications/the-world-factbook/geos/ks.html https://www.cia.gov/library/publications/the-world-factbook/geos/print_tw.html Accessed: 12-04-2017

Cross-Straits Economic Cooperation Framework Agreement http://www.ecfa.org.tw/EcfaAttachment/ECFADoc/ECFA.pdf Accessed on 01-04-2017

DBIT (Doing Business in Taiwan) post-publication update (16 March 2017) PWC (Price Waterhouse Coopers), Taiwan http://www.pwc.tw/en/publications/assets/pwc-doing-business-in-taiwan-post-publication-update.pdf 7 p.- Accessed: 18-04-2017

DBIT (Doing Business in Taiwan) PWC (Price Waterhouse Coopers), Taiwan. 2016, 90 p. http://www.pwc.tw/en/publications/assets/doing-business-in-taiwan.pdf

DGBAS (Treasury Department of the Ministry of Finance, Bureau of Trade, Statistical Office http://cus93.trade.gov.tw/FSCE010F/FSCE010F?menuURL=FSCE010F 01-04-2017

Economy Watch (on the basis of data gained from the International Monetary Fund) http://www.economywatch.com/economic-statistics/Taiwan/GDP_Per_Capita_PPP_US_Dollars/ Accessed: 02-04-2017 http://www.economywatch.com/economic-statistics/Korea/GDP_Per_Capita_PPP_US_Dollars/ Accessed: 02-04-2017

EU–Taiwan Factfile, 2016 European Economic and Trade Office, 2016, 60 p. BBC News, 2010 – Taiwan and China sign landmark trade agreement 29 June 2010 http://www.bbc.com/news/10442557 Accessed on 01-04-2017

MEET-Taiwan (2017) – Ministry of Economic Affairs, Bureau of Foreign Trade (BOFT) Implemented by: Taiwan External Trade Development Council https://www.meettaiwan.com/en_US/menu/M0000752/Introduction%20of%20Taiwan.html?function=2B360BA863747824D0636733C6861689 Accessed: 06-04-2017

MOE Taiwan, (2017) – Ministry of Education, Republic of China (Taiwan) http://english.moe.gov.tw/ct.asp?xItem=8008&CtNode=3891&mp=1 Accessed: 06-04-2017

Statistic Times – List of Countries by Projected GDP, (on the basis of International Monetary Fund World Economic Outlook, October-2016) Date 21 Oct 2016 http://statisticstimes.com/economy/countries-by-projected-gdp.php Accessed: 02-04-2017

SAF (2017) Strait Affairs Foundation http://www.sef.org.tw/mp.asp?mp=300

Taiwan Corruption Report GAN Business Anti-Corruption Portal, September, 2016, 8 p. http://www.business-anti-corruption.com/country-profiles/taiwan# Accessed: 08-05-2017

Trading & Economy (Taiwan Corruption Rank) http://www.tradingeconomics.com/taiwan/corruption-rank Accessed: 08-05-2017

Taiwan Receipt Lottery http://www.tealit.com/article_categories.php?section=living&article=lottery Accessed: 08-05-2017

@ WCTC LTD --- ISSN 2398-9491 | Established in 2009 | Economics & Working Capital