Fintech companies and banks – encounter of two different market structures in Hungary

Abstract

The backbone of financial services is the banking sector. However, nowadays it is getting more and more visible that new challengers are coming and targeting the changing of long established basic rules. Fintech is a term getting well known. Even though it is still questionable how to exactly define, its importance is out of question. Fintech companies’ solutions differ many times strongly from the traditional banking solutions, introducing new methods, cost saving possibilities and many times higher customer satisfaction.

The European Union recognised both the importance of fintech companies to develop financial services through digitalization and the lack of European fintech companies competing their rivals from the United States and the Far East. Thus, Revised Payment Services Directive (PSD2) was introduced to let European banking sector open its gates in front of the fintech companies regarding payment services.

The banking sector was facing challenges in the past many times and those were supporting natural evolution as well. However, they mainly left the structure of the banking sector and the composition of the market players untouched. The high barriers to entry secured a relative stability. PSD2 starts a new episode by causing changes in this structure as well.

Banks are strongly working on the IT developments to meet the legal and technical requirements, however, preparations need to cover strategic questions as well. This paper intends to support this latter issue by reviewing the effects of the encounter of banking and fintech markets. Microeconomics is modelling the real economy thereby helping to understand it. Even though we do not know exactly how the merge of the above markets will go, we know, it will happen. Present paper utilizes the basic market structure theories to classify banking and fintech markets based on the known conditions and then it tries to classify the merged market as well. The goal is to reveal, whether the basic structure itself will be changed in the future or remains. A change in the structure may mean important long term effects and shall be a signal for the present participants to prepare in advance.

14th September, 2019. The date when the Hungarian banking sector has to open towards the fintech companies following the introduction of the PSD2 in Hungary. Thus, the market of payment services confronts significant changes.

Keywords: Fintech, banking, PSD2, market structures, oligopoly, monopolistic competition, payment services.

Introduction

During its long history banking sector was facing many challenges. Let us mention the early examples, like the fall of the financial institution of the Medici family in the XV. century, the financial crisis starting from Europe in 1873, several ‘modern age’ financial crises, like the ’29-’33 world economic crisis, the 1997 Asian financial crisis, the latest 2007-2008 financial crisis, or even the crises spreading over from other industries to the banking sector, like the burst of the dot-com bubble. These episodes contributed always strongly to the development of the banking industry, amending the decision making, the risk handling, communication, etc. (Brealey-Myers 2005)

These challenges were manifold and supported the natural evolution of the banking sector, however, the structure of the sector remained characteristically untouched. Due to the huge capital requirement, the serious expectations of the regulator (which are of course differing country-by-country), the difficulties of entering to the market or the long time needed to win the trust of the customers, the number of sellers was always limited. Seller side of the banking sectors consists of a few (not many) large players. (Henri &Fischer 2019) Even if we are talking about small banks, since those are also companies with large capital, are strictly regulated and are significantly bigger than average companies. (Kiszely 2017)

However, the ongoing introduction of the PSD2 (Revised Payment Services Directives) may open a new chapter in the history of the banking sector. The opening of the financial market for the Fintech companies may change the structure of the market or the composition of the participants significantly. Moreover, the new participants may strongly differ from the existing ones in size (much smaller or even much bigger), capital volume, organization structure, regulations. (Henri &Fischer 2019)

Present paper intends to review whether the market structure of the banking sector (from microeconomic point of view) will be changed during the encounter with the Fintech market, and if yes, what type of market structure will be established.

Thus the paper will introduce the upcoming change affecting the Hungarian banking market, which is the basis of the research. Then the market forms of the microeconomics will be introduced. Based on that the bank market and the Fintech market shall be categorized to the forms. Than the paper will endeavor to analyze how the attributes of the bank sector are expected to change if the new players start their operation under the new PSD2 rules. However, it is important to mention that, the intensity of the spreading of Fintech companies in Hungary is difficult to foretell in the present stage. Finally the amended market shall be categorized to the basic market forms again, and if there is a change, consequences shall be drawn down.

Digitalization, or the invasion of the Fintech companies to the banking market

When discussion is about innovation, favorite topics are the intellectual-property intensive areas, like telecommunication, pharmaceuticals, car industry, software development or game production. If banks or financial systems are mentioned, mainly traditional working, safes with thick walls and money counting people in suits comes to our minds. However, digitalization is at least fifty years old in the sector, even though, that time, it was not called like that. (Nasomov, 2016) Computers became available in the sixties and financial institutions were among the first heavy users. Banks recognized the possibilities provided by the computers quite early, and established the basics of today’s modern banking. In spite of this and in spite of the fact that, digitalization became one of the most highlighted concepts, the banking sector remained a basically conservative industry.(Vissi 1995)

In the mean time digital technology reached a fantastic ‘career’. Almost thirty years ago appeared the publicly available World Wide Web opening a brand new world, repainting many traditional industries, like advertising, commerce or telecommunication. Of course, this process was also not trouble free, for example the dot-com bubble taught to many people that, a good IT solution is not necessarily enough for happiness. But development could not be broken, and from the very beginning of the twenty-first century technology-intensive start-ups were arising in high numbers. From that point it was only a question of time, when those start-ups start to arise, who are specialized on financial services. These companies are called FinTech (Financial Technology) companies. (Henri &Fischer 2019)

Nowadays the institutionalized meeting of these two worlds is in progress in Europe, due to the introduction of the PSD2 EU directive, (Pávlicz 2016) which gives the legal background for the possibility to provide financial services not only by financial institutions, thus, helping the introduction of the new digital services. (Alexey Nasonov 2016)

This topic is of outstanding importance for the bank industry. Many are working on its execution in several areas from IT through product development to strategy planning areas. It is clear for everybody that, many changes are ahead of us, however, nobody knows exactly the real scale of the upcoming changes. How it will amend the life of the banks? Who will be the new players and with what strategy or products they will appear? Banks themselves are moving to different directions as well. Some are accepting the new regulations as a mandatory burden and would like to suit the minimum legal requirements. Others regard it as a possibly, to compete in a new market segment. One is for sure, financial innovations are in front of a revolution. (Pávlicz 2016)

The relevancy of the topic is also shown by the fact that, the PSD2 act establishing the legal environment was approved by the Hungarian Parliament on the 31st of October, 2017. Actual coming alive is expected in the third quarter of 2019, 18 months after the publishing of the Regulatory Technical Standards (RTS). In line with that, actually the whole banking sector is working (has to work) on the preparations to comply with the regulation and to have the best possible start position. (Kiszely 2017)

Introduction of the market models

Since the concept of exchage exists markets are existing as well, since markets are the institutions where parties engage in exchange. Even though in ancient times people maybe did not gather together in one place to exchange their fruits to meat, still it was food market, where the demand and supply curves of the “products” could be prescribed similarly to the markets of the modern ages. (Farkasné-Molnár 2007) While in those days exchange was basically barter, nowadays sellers are offering their goods for money and of course markets were changing in terms of size, form and other conditions as well during their development history.

However, in general market is the institution establishing the price of goods and services through the market processes. Markets enable trade and the reallocation of resources in the society. Markets can emerge by themselves or through human interaction.(Vissi 1995)

Markets are diverse. Differing based on sold goods: products, services, labor, capital, information, etc. Location of the markets is varying as well, of course not only geographically, but they can be real or electronic markets, centralized or decentralized, etc. But there can be differences in length of time, sales process, regulations, taxation, legality, market size, etc. (Marshall 1890)

Geographical size can strongly vary as well. It can be for example a flower market in one room, real estate market in a city, soil market of a country or the uniformly regulated money market of a whole continent. Or we could even mention the diamond market, which can be analyzed on whole world level with its one dominant market player (De Beers Group) and the many surrounding competitive players.

Economics call markets operating based on the Laissez-faire principle free markets. It is “free”, because it is not regulated, there are no taxes, subsidies, price rules, no governmental control. Well working markets are called perfect competition. In reality well working markets are, of course, seldom perfect, however, the theory can be well utilized if there are many small buyers and sellers on the market, if the products are similar and if the market players have the same access to the market information. If on the markets equilibrium is given, but it is not efficient, we are talking about market failures or imperfect competition. Market failures have a lot of forms. Such as information asymmetry, principal-agent problems, externalities, etc. (Joshua , et al, 2003)

The perfect competition

Microeconomics and especially the general equilibrium theory defines perfect market under several idealistic conditions, which are called perfect competition. Theoretically, under the conditions of the perfect competition market equilibrium will be given when the supplied quantity equals to the demanded quantity at a given price.(Friedman 1962)

Perfect competition theories are going back until the years of the late XIX. century. Perfect competition and its working mechanism was first prescribed by Léon Walras. This theory was in the 1950’s further developed by Kenneth Arrow and Gérard Debreu.(Quandt 1971)

To realize perfect competition several major conditions shall be met.

- The given product is sold by many sellers and many consumers are willing and are able to buy it at a certain price. ‘Many’ may mean thousands, ten-thousands, or even millions, important is that, market effect of the individual players.(Friedman 1962)

- One of the most important condition is the lack of barriers to enter or leave the market. Its importance is given by the fact that, most products or services need some kind of investment, let it be the purchase of means of production (or even its sales as barrier of leaving), minimum capital requirement, required education, etc.

- The market players are perfectly informed, regarding the prices of the goods and their utilities.

- Market participants are rational (‘Homo Economicus’), i.e. they are trying to maximize utility. They are executing every transaction increasing utility and nothing which would decrease.

- Sellers are maximizing profit, thus, they sell where marginal cost meet marginal revenue.

- Market participants are price takers. None of the participants has enough power to set price. For example a housewife shall not be afraid that, price of the turnip would change because she is buying more or less and also the turnip producer cannot push the price up with decreasing his own production.

- Products are homogenous, thus, replacing each other perfectly. Differing product characteristics (quality, functionality, etc.) would effect consumers’ behaviour.(Quandt 1971)

- No externalities, thus third parties are not affected by the transactions.

- Production factors are perfectly mobile, not only on local, but on international level as well.

- No transaction costs, which would mean additional burden during the market exchange.

- No scale of economy, since its presence would prevent the existence of the large number of producers. This condition is in line with the lack of barriers to entry. (Joshua , et al, 2003)

If the above conditions are met on the perfect markets, on the long run participants are operating at zero economic surplus (no buyer or seller surplus), sellers are realizing only normal profits after their investments. Even though on the short run extra profit can be realized, it will motivate new market players to enter and the increased production will push market price down to normal profit level. Thus, with the ceasing of extra profit and the lack of further motivated new participants, the long term equilibrium will be set. (Not going into details, such as the too many new participants first pushing the price below the equilibrium level, pushing the profitability to loss making as well, etc.) (Marshall 1890) (Farkasné-Molnár 2007)

Perfect competition is nevertheless only an economic model, in reality no markets are meeting all the above conditions. Of course, there are markets close to perfection, if there is a high enough number of sellers and buyers. In reality there are some examples close to this model, such as the stock exchange, but even there are big enough players to modify the prices alone (e.g. investment funds or pension funds).(Friedman 1962)

Thus, this model faces many critics as well. Such as the irrationality of price taking behaviour, since sellers would like to increase their personal utility, thus they will execute their own price strategy, product design, advertisements, etc. Also the ‘Homo Economicus’ concept is criticised, since it does not really exist in reality. (Joshua , et al, 2003)

The imperfect competition

Development of the market models is natural if the introduction of the perfect competition – and especially its relationship with reality – is taken into consideration. Even though the perfect competition theory is based on the supply-demand model introduced by Alfred Marshall in 1890 (Principle of Economics), even Marshall himself was sceptic with its general usability on every markets. Those competitive markets where some characteristics of the perfect competition are not met are called imperfect competition. Based on which characteristics are not met are the varying market forms differentiated. .(Quandt 1971)

The monopoly

The monopoly is the typical form of the imperfect markets, can be said, it is the opposite of the perfect competition. A market is a monopoly if the given product or service has on the market several buyers but only one seller. Its ‘opposite’ is the monopsony, if there are several sellers, but only one buyer. Thus, on these markets the main element of the perfect competition is damaged, there is no competition. (Joshua , et al, 2003)

Main characteristics of the monopoly are as follows:

- Only one seller on the market. Thus, the company equals to the industry (supposing the same size of course, while there is only one electricity service provider in a city – in monopoly position – on country level the electricity service industry may have several suppliers.)

- Serious barriers to enter, to a level, where no other (second) seller can enter the market. This is the main condition to the first characteristic.

- Seller is profit maximiser.

- Seller is price maker, which is decided by the determination of the produced quantity.

- The seller has market power, which means that, the seller can influence the market price and the profit level without losing all of their consumers.

- Seller may execute price discrimination, selling high quantity on low price in an elastic market, while selling low quantity on high price in an inflexible one. (Bork & Robert 1993)

Based on the above, main difference between monopoly and perfect competition is that, while a company of the perfect market faces a perfectly elastic demand curve, the monopoly faces a downward-sloping one. Thanks to this downward-sloping demand curve, connection between total revenue and the output is very different. While in case of a perfectly elastic demand curve total revenue is directly proportional with the output, a monopoly can choose the price where the difference between total revenue and total cost is the largest. (Friedman 1962)

To keep the stability of this situation major factor is the barrier to enter for every other company. Such barriers can be:

- Scale of economy, when the minimal effective scale is large comparing to the size of demand. If production requires high fix costs, unit price will be significantly lowered with the increase of the produced volume. Thus, if the market is served by one supplier with high investment costs and with low unit price because of the high volume, a possible new supplier could only enter planning a much lower volume, which would not reach the effective scale. Thus, it could not be competitive due to the high average cost.

- High equity requirement. It can be in connection with the scale of economy, like the expensive starting investments. But such can be for example the high equity need of research and development or the concession rights to be purchased. (Stiglitz 1976)

- Technological superiority, when the monopoly is in a better situation comparing to other companies regarding modern technologies and processes. Also realized monopole profit may enable for them to keep the advantage and thus the security on the long run.

- Control of resources may be the primary source of monopoly if the company is solely in control of a resource needed for production. Such are mainly natural resources, like owning the sites of natural resources. An example can be the extractive of the high moving cost fossil fuel and the nearby power plant, since purchasing the raw material from a farther supplier would be too expensive.

- Legal barriers. Legal rights may create monopolies as well. Similar can be the ownership of intellectual property (like patents or copyrights) providing exclusive sales rights or mining concessions.

- Finally the barriers to leave shall be mentioned as well, which mainly means the difficulty to sell the high investment need assets. The selling of a serious production line is not easy, especially if it is only for one product, and it turned out just now that production next to the monopoly cannot be fulfilled profitability. (Joshua , et al, 2003)

Like perfect competition, absolute monopoly is also rare in reality. However, their examination is very important to model transitional market forms and to understand real markets. (Stiglitz 1976)

The oligopoly

However, monopoly profits are promising, thus, on the long run, rarely remains without challenge. Companies with outstanding profit, in reality, sooner or later will induce some form of competition. This is one reason why clean monopolies are so rare. Thus, in industries operating with scale of economy oligopolies are more usual. Main characteristic of the oligopoly is that, there are more large sellers on the market, all of them are strong enough to influence market price, but none of them is in an unassailable monopoly position. The oligopoly with two sellers is called duopoly.(Heuss 1960)

Main characteristics of oligopoly:

- Sellers are maximizing profits.

- Sellers are mainly setting and not taking prices.

- High barriers to entry and exit. Similarly to monopoly, barriers can be governmental rights, scale of economy, high investment needs, access to expensive technologies, etc. Barriers to exit may be important as well. For example nowadays in case of a financial institution sales of a significant mortgage loan portfolio may mean long time and significant loss. Thus, when planning entering, it shall be considered, if operation will be loss making, leaving will be neither quick nor cheap.

- There are “few” sellers on the market. Even though it is difficult to define how much is cheap, mainly the concept is that, market players know each other and the behaviour of one participant has effect on the behaviour of the others.

- On the long run sellers can realize extra profit. Like in case of monopolies, high barriers of entry may prohibit new players entering to the market and pushing down prices.

- Products may be homogenous (e.g. steel production) or differentiated (e.g. vehicle production)

- Knowledge is imperfect. While oligopolies have perfect knowledge on their own functions and costs, but their knowledge on the competitors is incomplete. Also the buyers’ knowledge is imperfect.

- Sellers mainly do not seek price competition. They are competing with quality, differentiation, marketing tools, etc. but not with prices, if possible. (Joshua , et al, 2003)

- Finally one of the most important characteristic is dependency. Since the sellers on the market are typically a few large corporations, their behaviour influences the market. The competing companies are watching each others’ steps and are reacting. Thus, when players plan their next step, they have to take into consideration how other players will react. Thus, for the companies it is like a game, where they “players” have to plane the possible scenarios before they act. This is one of the main topics of game theories.

Companies of the oligopoly mainly realize that, their profit can be maximized if they act together, coordinated. Even though it mainly hurts competition laws, companies of the oligopoly may reach almost monopolist profit if they make their decision together. In such cases companies together limit their production increasing the market price. Since these companies are mainly working on regulated markets, if they are cooperating, they are doing it in tacit collusion, trying to avoid any incriminating evidences. The common profit maximizing of the oligopolist companies is called cartel. Another issue is that, a participant of the cartel may realize extra profit if deviates from the agreement, thus, stability of the cartels is limited.(Heuss 1960)

The monopolistic competition

In the monopolistic competition model there are two main assumptions. First is that, every single company is able to differentiate their product from the others. Since their customers would like to buy this differentiated product, they will not choose another companies’ product because of a small price difference. Product differentiation allows for every company to have a monopoly on the market of their own product, being slightly separated from the competitors. Second assumption is that, every company takes their competitors’ prices as given, thus, does not care about the effect of their price to the competitors prices. (Friedman 1962) The monopolistic competition model assumes that, sellers are behaving like monopolies even though they have competitors – this is where the model’s name comes from. (Chamberlin 2004)

Main characteristics of the monopolistic competition:

- Products are differentiated. However, these – real or perceived as real – differences are not significant enough, to prevent consumers from taking competitors’ product as substitute products. Differences may be based on quality, appearance, style or the quality of the linked services. Good examples are the restaurants, attracting guests with different services or specialities.

- There are many sellers on the market and there are many potential companies who may enter to the market. However, number of the participants may significantly vary. Producers’ market share is typically larger than in case of the competitive ones.

- Low barriers to entry or exit. Similarly to the perfect competition, new players may enter the market if the existing ones are realizing extra profit. Thus, in case of long term equilibrium, companies will only realize normal profit, extra profit will decrease to zero. (Cournot 1838)

- Sellers are deciding on their price on their own, because of the marginal effect as mentioned above.

- Companies of the monopolistic competition have some market power. It means that, they can raise their prices without loosing all of their customers. This market power is due to the product differentiation. Consequence is that, their demand curve is downward-sloping and while not horizontal, but significantly elastic. (Bork, Robert H. 1993)

- Neither sellers nor buyers are perfectly informed on the market.

- Participating sellers do not feel the need for cooperation to avoid competition.

Monopolistic competition causes welfare loss as well. However, its size comparing to the deadweight loss of monopoly is marginal and customers are even compensated on some level through the wider product selection. (Farkasné-Molnár 2007) For the wider product selection most of the customers are willing to pay a higher price. However, excessive product differentiation and advertisements may increase costs to a level where the welfare effect is really negative. (Friedman 1962)

The Fintech Market and Bank Market

The common feature of the main market forms presented in the previous chapter is that theoretical models are found rarely in practice. (Schueffel 2016) (Arslanian & Fischer 2019) However, in this chapter, two industries are being examined for inclusion in the above models. Although, of course, none of the two industries will fit perfectly into any of the models, the goal is to find out which market form they are closest to after identifying the key criteria. (Henderson et al 2016)

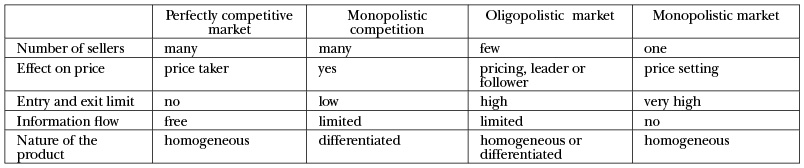

The relationship between the two industries and the market forms discussed above, although having many characteristics, is primarily examined by the criteria in the table below. (Schueffel 2016)

The processed literature is not uniform in the look of the above criteria naturally. For example, that how much the many or less can be differ according to the different interpretations, moreover, when the theories were born even the real markets differed from the today’s markets in many looks, among other things in the undertakings’ cardinality. (Arslanian & Fischer 2019)

Banking Market – Payment services

The banking market – and it means here of course not the banks’ market, but the market of the bank products – shows considerable differences in each country. Even if we do not speak about the Islamic banks of Middle-East for example, still the regions, countries have very different regulations, technological development level, number of participants and structure of products. (Dietz & Lee 2016) Even so, the basic structure, functioning and characteristics of the market are very similar. Thus, while the Hungarian banking market is currently being examined, most bank markets analyses could probably lead to similar results. . (Kerényi&Molnár 2017)

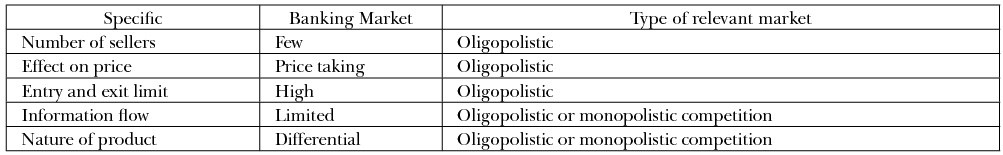

Main market features:

- Number of sellers: According to the Hungarian National Bank’s Golden Book, there were 40 credit institutions in Hungary at the end of 2017. From this, after deduction of KELER Central Depository Ltd., Credit Guarantee Companies, specialized credit institutions and other non-payment credit institutions, there will be 25 banks. Here the question immediately arises, 25 companies are many or few? To decide, it is important that banks know each other. (Golden book 2017) Even if you don’t have the perfect information on each other’s situation, strategy, they are pretty much aware of each other’s market position, strength, product structure, prices, main strategic directions, development focus, etc.. So their competitors’ situation is taken into consideration, when the banks are making their strategy, pricing, and defining development directions, and if they take a more serious step, they can expect competitors to react. True, the reaction is not always fast and most of the steps taken by leading banks are the guiding steps for other players.

- Impact on the price: (Arslanian & Fischer 2019) Banks are typically price-setting, in the sense that there is no ‘single’ price on the market, over which that they cannot sell or under that price they can sell any number. Banks are pricing their products differently depending on product quality, bank reputation, affiliate services, etc. and the costumers accept it. At the same time, the competition is strong enough to prevent them from changing their prices too much. This is also true for payment services. However, it is also important to see that almost everybody uses banking services, especially payment services, but this cost is a negligible part of the consumer basket of most customers, so even a larger difference can be accepted if they find greater utility. For example, a well-managed mobile application can charge serious “convenience” fees to a younger generation who is susceptible to it. (Kerényi&Molnár 2017)

- Entry and exit limits: Although entry is possible, the limits are very serious. Capital requirements are so high that small and medium-sized enterprises and natural persons can rarely get it. Scale of economy is also typical for banks. It is true that not the production lines give high fixed costs, but the cost of IT investments and human resources. An interesting feature of IT systems is that it is practically the same size for one or for one million customers. If the bank wants to manage accounts, it needs an account management system that complies with current regulations, adequate IT security systems, GIRO, SWIFT, etc. for cash flow, contacts and contracts, applications for anti-money laundering, etc. They are already needed for one bank account, but after the opening of additional accounts, further improvements are not required (or only slightly). Human resources are also important. Due to the Chinese walls, the “four-eyes principles”, the conflict of interest questions, the task sharing and substitution rules, the minimal staff number is given. However, this staff number is already suitable for the service of a significant number of costumers. Then we have not even talked about the problem of exit, because the IT systems that are developed or purchased are not or only partially sellable and the transfer of connected portfolios is costly and takes long time. The (Economist 2017)

- Information flow: The information and flow of information is not perfect. Although they have a lot of information about each other, it is far from perfect. For example they know, how a competitor advertises a credit product. But they do not know exactly what kind of costumer will be able to use it, what is the weight of the product in the product range, what factors have been taken in pricing, and so on. (Henderson et al 2016)

- Nature of the product: In the banking market, the products are differentiated. Although a GIRO transfer is basically the same for all banks, however, “packaging” may be different. It is possible to reach it on different ways (coverage by bank branches, call center quality, opening hours, electronic channels, etc.), what are the related applications, how the netbank looks like, what are the behavior of bank employees, what are the advertisements, what pricing technique (not price) was used (e.g. package price with unlimited transfer, pricing per transaction, etc.). (Arslanian & Fischer 2019)

Examining the Hungarian banking market, we can say that it belongs to the microeconomic oligopolistic market model. Although it cannot be said that, based on all the features, it is a pure oligopoly – probably similarly to most of the other markets – but since we are talking about models that do not clearly cover reality, the goal is to find the closest possible variation. (Golden book 2017)

1. Table The summary of the main features of market forms : Own edition, Based Own: (Henri &Fischer 2019)

2. Table Summarizing the findings Own edition, Based On: (Henri &Fischer 2019)

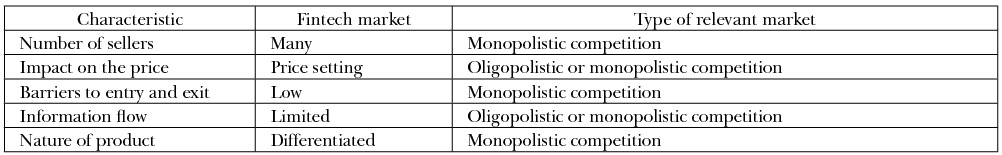

3. Table Summarizing the findings Own edition, Based On (Bownie 2018)

The Fintech market

Analysing fintech market strongly differs from the analysis of the banking market. This has several reasons. Primarily the time factor. While banking market is a ‘grown-up’ area, established long ago (in Hungary even the modern two level banking system is working since 1987, actually more then 30 years), fintech market is still in transition. There are large and well-known companies worldwide, but start-up companies providing financial services are also appearing and disappearing. An interesting example is that in 2017 the best European FinTech Startup was Blueopes in the Central European Startup Awards (their system is optimizing investment portfolios), which was founded in 2016! (Deloitte 2017)

On the other hand, the solutions of fintech companies are very different from traditional banking solutions and thus, differentiation should be understood differently. For example in the banking market retail mortgage lending works the same way. The credit assessment process, the requested documents, historical financial information, required income certificates, etc. are essentially the same. (Greg , et al 2018)Differences are in the level of conditions (e.g. how many percent of the loan value is used to finance the purchase of the property), in affiliated services and in marketing (e.g. insurance). The answer from fintech companies was a solution where there is no need for credit risk analysts or the documents listed above. Instead collecting all the information available on the internet about the credit applicant and deciding based on that. Such information may include, for example, data appearing on social networking sites that show the applicant’s financial situation, social relationships, consumption habits, etc. Thus, differentiation is much more important for fintech products. (Deloitte 2016) (Deloitte 2017)

In addition, the difference in size between the players is much larger. Not necessarily in Hungarian Forint, but even a small bank needs to have serious infrastructure, human resources and equity, while the fintech market is great for the small startups next to the giants like Google or Amazon. (Browne 2019) (Kiszely 2017)

Main market features:

- Number of sellers: The number of sellers is high, although it is difficult to determine. Most of the fintech companies can handle their services globally, as online technology crosses borders, even for a small company. However, there are fintech companies whose solutions – even for regulatory reasons – are available in some countries, but not in others. The players are very diverse. (Schueffel 2016)T here are the so-called “GAFA” companies, Google, Amazon, Facebook and Apple. Similarly large companies operate in the Far East on the local mobile and online payment market, such as AliPay, Tencent, Paytm or AntFinancial. In the Far East, there is practically a fintech revolution with a huge market. For example, the Indian Patm was founded in 2010 and has now gathered 300 million customers. Finally, there are the much smaller players who may be startups or existing (e.g. IT) companies that want to bring a good idea to the market. An example of this is the Revolut (pre-paid bank card service, crypto currency exchange, etc.), which almost appeared out of nowhere for only 3 years and is already planning the introduction in Hungary. (KPMG 2017) (Kiszely 2017)

- Impact on the price: These companies are price-determining. Large players can increase their prices by their size and market power without losing their customers, moreover they do not compete with their prices, but with the differentiation of their products, related services, etc. Smaller players can also change their prices. On the one hand, because of their size, they do not significantly affect the market, on the other hand, because a fintech company can be successful in showing something that was not yet, and which (for a while) is unique (whether in function, design, etc.) so it works as a monopoly. (Dietz & Lee 2016)

- Barriers to entry and exit: In our opinion, entry and exit limits can be considered low. Of course, not in case of the position of the fintech giants. It is very difficult to enter to this latter part of the market. Reaching the reputation, recognition and reliability requires a lot of investment, including the use of appropriate technologies, high quality assurance, the acquisition of adequate human resources, or huge marketing costs. However, startups typically require a good idea, behind which even the right capital can be raised with community funding. It is true, having a good idea can be considered a barrier to entry as it is not so easy to obtain. (Arslanian & Fischer 2019)

- Information flow: Information flow is not perfect. Although large companies know each other and count on the responses of others, they do not know exactly the behavior, pricing, plans, etc. of their competitors. It is especially true for small players that information is limited, particularly if we count many participants, in this case, they cannot really learn each other. (Deloitte 2017)

- Nature of the product: The products are differentiated. It is so much true, because this is the essence of the fintech market. There are well-established banks, payment service providers, brokerage firms, etc. to provide normal financial services. (Copeland et al 1999) (Henri &Fischer 2019) A fintech company can kick a ball if it can figure out something new. It can be a new method, for example, a new and highly cost-effective process, new design, easier handling. Simply better customer experience. (Greg , et al 2018)

Summarizing the findings, we can say, the fintech market is a monopolistic competition. Mostly, because of the high number of sellers, the low level of barriers to entry and exit and the monopolistic nature of the products.

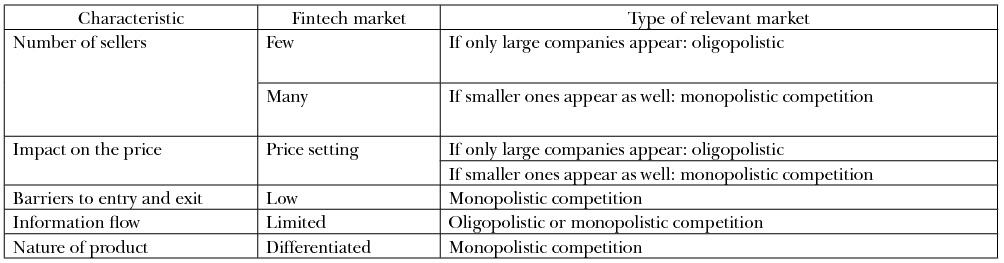

4. Table: Summarizing the findings in case of entry to the Hungarian market of payment services Source: own editing based on (centraleuropeanstartup/season.2019.com)

The collision of the two markets in Hungary

As it was mentioned earlier, introduction of the PSD2 will establish the possibility for fintech companies to enter to the Hungarian banking market, especially to the market of payment services. (Golden Book 2017) According to that, while in the previous chapters two existing, real markets were checked, in this chapter a future market and an expected situation will be analysed. Thus it will contain many assumptions. (Dietz & Lee 2016)

Additionally, in Hungary the PSD2 is still under introduction, thus factual data are not available yet, which existing foreign companies will appear in Hungary, and how many local companies will try to compete with banks to share the fee incomes on payment services and linked solutions.(Kiszely 2017)

Based on present information it can be stated that, Hungarian money- and capital market regulation is quite strict, even in European relation, not to mention the United States or the Far East (especially Chinese) regulations.( The Economist 2017) In this regard it is a good question whether the fintech companies appearing in Europe and selling their products and services will handle Hungary as target market or will get around us and target only the surrounding countries to avoid regulatory problems. (Kerényi&Molnár 2017)

Expected characteristics of the future Hungarian market:

- Number of sellers: The newly appearing sellers shall be divided (as it was mentioned earlier) to three plus one major groups. On one hand the “GAFA” companies who are big, having serious equity, technology, fame, reputation, etc., and there is a good chance that they will appear in Hungary (and most of the European countries) quite quickly. (Kovács 2017) With their background it is unlikely to be “afraid” of the Hungarian regulations, and leave such a market alone, especially because their reputation is general in Hungary as well, and not to utilize it does not seem to be a good idea. However, in case of the large Far Eastern companies it is a question how quickly they plan to “conquer” Europe. On one hand because their own local market is huge enough with remarkable growth potential, and on the other hand, because for them to comply with the European legislation is a much bigger challenge and thus a big investment as well (it is enough if we mention GDPR, which is not even a financial regulation…). Finally much smaller sellers may appear in large quantities, building up smaller or bigger client groups, or even targeting niche markets with special solution. However, forecasting this tendency is difficult at the moment. And also the already present players should not be forgotten, the banks. At the moment a part of the banks is preparing already to act as fintech service providers themselves (or their daughter companies) as well. Since they are aware that the technological development is unstoppable, they plan to enter the competition for the fee incomes generated by fintech solutions as well. Moreover, they try to utilize their reputation among local customers and their local advantages to precede new competitors.(Kerényi& Molnár 2017) (Pávlicz 2016) (KPMG 2017):

- Effect on the price: Companies will be price setters. Like in case of the bank market and the fintech market, the product differentiation and market power will have high importance here as well. As it was mentioned already, the success of a fintech company may be caused through some unique solution, thus, may act as monopoly.

- Barriers of entry and exit: In my opinion these barriers will be relatively low. If we are examining the market of Hungarian payment services and the possibilities opened by the PSD2, (Pávlicz 2016)

- entry may be quite simple. If a company has appropriate development capacity, with the help of the API an appropriate solution can be established to become a member between the banks and the customers. Of course, in reality it is not that simple, but, as barrier to entry, it should not be considered as high. (It shall not be forgotten that, it is not about establishing a new financial institution, but only for example a nice information or money transfer solutions, where the actual transfer id done by the bank and the fintech is providing only a pretty surface to please the clients.) (Kerényi&Molnár 2017)

- Information flow: The information flow will not be perfect on this market either. Even though large players know each others, but they do not know the competitors’ exact reactions, pricing, plans, etc. In case of the smaller companies the limited information is true as well, especially if we count on many players.

- Product characteristics: Products are differentiated. As it was mentioned as well, main point of the fintech solutions is differentiation. It is important in case of the Hungarian payment service as well that main goal of the players will be – in case of fintech services – to provide something to the clients for what they are willing to pay extra money. A good example is the “Simple by OTP” application, which helps to reach a lot of services (ticket purchase, highway tickets, food order, map service, etc.) in one place, being quick, easy, simple. And for this clients are willing to pay “comfort fee”. But any new idea might be possible. For example if a company develops a special solution for visually impaired people, a niche market’s needs will be satisfied. Also comfort fee could be asked e.g. for a special payment solution based on AZUR, where with touching two mobile devices money can be simply and easily transferred, like cash. These products – temporarily – can work as monopoly. (Kiszely 2017)

Overall it may be stated that, if (or until) only large players enter the market, or the already present banks will act as fintech service provider, the market will work as oligopoly. However, when the smaller fintech companies will appear in larger numbers, the market of payment services and connected solutions will get closer to the monopolistic competition market form than to the oligopoly.

Conclusions

Main market theories aim to model the operation of the economy. Even though there are only a few markets which fit fully into the theoretical market forms, these models help a lot to understand the operation of the real markets even nowadays.

PSD2 provides the possibility to fintech companies across Europe to enter banking markets with products linked to payment services or even replacing them. This way being members of a market where until now banks were almost autocrats. Even though there were a few large fintech players present in the world – especially in the United States and China – until now as well, but those service providers were in Europe less significant. .(Kiszely 2017) (Arslanian & Fischer 2019)

Still, the real effect on the analysed Hungarian market is questionable. It is yet unknown how many companies will enter, how the local banks are preparing or how they will react to the new players’ behaviour. However, it is worth being prepared for the new situation. It may be also helpful if it is known how the market structure may be changed and this is the point where we shall go back the market models for help. Detailed knowledge on the models and their main conditions will provide help to categorize fintech companies and banks to some models. Banks are working mainly as oligopolies, and the operation of fintech companies show the characteristics of the monopolistic competition.

If the inflow of the fintech companies will start, first the large companies are expected to appear. This will not drastically change the market structure. However, on the long run the appearance of further smaller companies and stat-ups is expected as well. With that the structure of the payment services market may be significantly changed as well and may shift toward the monopolistic competition.

Even though at first glance this finding may seem very theoretical, it must not be forgotten that market models were created based on the analysis of real markets as well, thus the observed effects may occur in reality as well. It may be enough to mention that, economic profit in monopolistic competition exists only on the sort run. On the long run there is only normal profit. If only this idea is taken into consideration, banks’ strategy creation should already be cautious. They may expect increasing investment costs in payment services to remain competitive and decreasing profit contribution because of the changing market standards. Thus the role of this product group shall be reconsidered as well. Invest a lot to become a client magnet and then harvest on the lending side or make strategic cooperation with fintech companies sparing on the investment and sharing the profit? There can be many ways, but touched financial institutions shall be aware of the need for being prepared for the possible scenarios. Especially because the fulfilment of this kind of strategies take a lot of time and investment.

References

Alexey Nasonov (2016): We are setting up the new standards for successful FinTech companies in the CEE region – The Paypers

Alfred Marshall, Principles of Economics 1890, (London: Macmillan and Co. 8th ed. 1920). 2020. 03. 13

Brealey-Myers (2005): Principle of Corporate Finance, 10. Edition, The Mcgraw-Hill/Irwin Series In finance, Insurance, and real estate

Bork, Robert H. (1993): The Antitrust Paradox (second edition), New York: Free Press

Cournot (1838) – Researches into the mathematical principles of the theory of wealth, The Macmillan Company, New York, (1897)

Deloitte (2017): Fintech by the numbers – Incumbents, startups, investors adapt to maturing ecosystems,

Deloitte (2016): Fintech in CEE – Charting the course for innovation in financial services technology,

Dietz M., Lee G. (2016): Bracing for seven critical changes as fintech matures., Mckinsey-industries studies

Edward Chamberlin (2004) – Monopolistic Competition And Pareto Optimality Journal Of Business & Economics Research, Volume 2, Number 4, pp. 17-26

Ernst Heuss (1960) Das Oligopol, ein determinierter Markt Weltwirtschaftliches Archiv Bd. 84 (1960), pp. 165-190

Farkasné Fekete Mária – Molnár József (2007): KÖZGAZDASÁGTAN I. – MIKROÖKONÓMIA, Szent István Egyetem kiadó

Gans Joshua – King Stephen–Stonecash, Robin–Mankiw N. Gregory (2003). Principles of Economics Cenganged Learning Australia

Greg Buchak, Gregor Mathvos, Tomasz Piskorski Amit Seru (2018) Fintech, regulatory arbitrage, and the rise of shadow banks Volume 130, Issue 3, December 2018, Pages 453-483

Henderson, James M. and Dorfleitner, Gregor and Hornuf, Lars and Schmitt, Matthias and Weber, Martina, The Fintech Market in Germany (October 17, 2016).

Henri Arslanian, Fabrice Fischer (2019)-The Future of Finance: The Impact of FinTech, AI, and Crypto on Financial, Hong-Kong

Hungarian Central Bank Golden Book, 2017,

In fintech, China shows the way. The Economist 2017 februar

IIR Conference: Pénzintézeti Fraud (2016. december 6.) – Pávlicz György: PSD2 – RTS „Globálisan – közelebbrõl”

IIR Conference: Pénzintézeti Fraud (2017. június 29.) – Kiszely Róbert: Paradigmaváltás a fraud kezelés területén a PSD2 és az azonnali fizetés tükrében

Joseph E. Stiglitz Monopoly and the Rate of Extraction of Exhaustible Resources The American Economic ReviewVol. 66, o. (Sep., 1976), pp. 655-661 (Stiglitz 1976)

Kerényi Ádám, Molnár Júlia (2017): A FinTech-jelenség hatása − Radikális változás zajlik a pénzügyi szektorban? Hitelintézeti Szemle, 16. évf. 3. szám

KPMG (2017): The Pulse of Fintech – Q3 2017 – Quarterly analysis of global investment trends in the fintech sector

Kovács, Olivér – Az ipar 4.0 komplexitása – I., Közgazdasági Szemle 2017. július-augusztus

Milton Friedman (1962) Capitalism and Freedom, Universitiy Press of Chicago

Patrick Schueffel Taming the Beast: A Scientific Definition of Fintech Hochschule für Wirtschaft Fribourg Vol. 4 No. 4 (2016) 32-54 pp

Richard E. Quandt. (1971) Microeconomic Theory:

A Mathematical Approach. New York: McGraw-Hill

Ryan Browne (2019) Fintech start-up Revolut grabs 2 million users and plans to launch commission-free trading service CNBC

Tom Copeland – Tim Koller – Jack Murrin (1999) Valuation: Measuring and Managing the Value of Companies, 3rd Edition

Central European Startup Awards, http://centraleuropeanstartupawards.com/

Vissi, Ferenc (1995) – Stratégiai szövetségek, globális monopóliumok, Közgazdasági Szemle, November, 1995

Neményi Máté

PhD Student, Szent István University, Faculty of Economics and Social Sciences, Ph.D. Doctoral School of Management and Business Administration

Czirkus László

PhD Student, Szent István University, Faculty of Economics and Social Sciences, Ph.D. Doctoral School of Management and Business Administration

Gáspár Sándor

PhD Student, Szent István University, Faculty of Economics and Social Sciences, Ph.D. Doctoral School of Management and Business Administration

@ WCTC LTD --- ISSN 2398-9491 | Established in 2009 | Economics & Working Capital