Re-Positioning Public Utility Companies in Hungarian Public Finances after 2010

Introduction

In Hungary, public utility companies have had an outstanding role since the second half or the 19th century, when the capitalist method of production was established. These economic participants attend to public duty functions. After the 1867 Compromise, the political leadership of the time established a developed system of state railways by obtaining shares in privately owned railway companies, and the powerful economy influencing activity of the state was also manifest in the market sector and other public services. As a result of the nationalisations performed after World War II, collective ownership became the norm all over the Hungarian economy, and although after the adoption of a New Economic Mechanism in 1968, market features also appeared, although moderately, in public utility companies (performance incentive relations and the rental of production equipment), the method applied by the socialist planned economy prevented the evolution of a genuine market structure (Lentner, 2020). The leadership in charge of the policy that led to a change of regime at the end of the 20th century aimed at the adoption of a modern system for attending to local government duties. Municipalities were in charge of public duties and provided public services, assisted by locally operating public utility companies, for the most part in their ownership. The systems of larger, nationwide public service providers were owned by the state up to the early 1990’s, and then they were gradually privatised.

The end of the 1970’s saw the emergence of the essential elements of the trend called New Public Management in western European countries. This meant that market hegemony came to the foreground, and consequently, the management kit of the business sector were applied in public organisations, decentralised structures were set up in the public sector and efficiency and efficacy were given priority in the public sector (Pollitt, van Thiel & Homburg, 2007; Drechsler, 2005; Drechsler & Kattel, 2008). Upon the appearance of the New Public Management approach in Hungary after the change of regime, public utility companies went into private, mainly foreign hands, and the new managements’ primary target was profit-making. This had an adverse impact on the population, as in order to make the highest possible profit, public service prices rose continuously. One of the main endeavours of the public finance reform launched after 2010 was therefore to improve the standard of living for the population. Thus New Public Management (NPM) and its economic philosophy was replaced by a public utility service provision practice aimed at the centralisation of public utility assets and procedures, the repurchase of public utility companies rather than their continued privatisation, the provision of public benefit in the widest possible circle, instead of profit made on public services (which is the objective generally set by the management, see the CNPG concept in Lentner, 2017).

Public utility business organisations are subject to both the regulation applicable to the central budget and public funds, and business management regulation. As these companies (irrespective of ownership, i.e. whether they are in state or local government ownership) are responsible for providing public services, they have a massive impact on the life and operation of companies, while they must also keep efficient and cost-conscious financial management in mind (Hegedûs & Zéman, 2016). Thus, in Hungarian public finances, reorganised after 2010, public utility companies are subject to tighter government regulation and closer proprietary control, and moreover, the government repurchased of the majority of public utility companies. In ten years, the worth of public assets rose by 50 per cent.

The re-regulated macro-economic background to the operation of public utility companies

Article 38 of the Fundamental Law, which entered into force on 1 January 2012, regulates assets in national ownership. The statutes stress that national assets must be managed efficiently, operation must be sustainable and the needs of future generations must be taken into account. In addition to Hungary’s Fundamental Law, Act CXCVI of 2011 on National Assets (hereinafter: National Assets Act) laid the foundations for a new structure of national property and regulated asset management. National assets may only be used for the specified tasks, i.e. for public duties. The Fundamental Law also emphasises that business organisations owned by the state or local governments must perform their duties autonomously and according to the requirements of lawfulness, expediency and efficiency. Public utility companies related to state assets are regulated in the National Assets Act, while those in local government ownership are also subject to Act CLXXXIX of 2011 on Local Governments (Local Government Act(. Local governments may attend to their duties through a budgetary organisation or through a business organisation in local government ownership. In Hungary the number of companies in local government ownership has increased significantly since 2006. In order to attend to their public duties, municipalities established businesses in especially large numbers between 2006 and 2008, but after 2011 this momentum subsided. This may be traced back to the fact that previously, the regulation of business organisations was more lenient than the rules governing public funds, and labour regulations were also less stringent than those applicable to employment in the public sector. Concerning regulation, in 2015 Act CXCIV of 2011 (on Stability) was completed to require approval for borrowing by business organisations in local government ownership. Local governments and their public utility companies were brought under tighter legislative control. After 2011, the State Audit Office was given powers to supervise local governments’ public utility companies in order to enhance the transparency of their business management. The new system of finances includes higher centralisation and tighter control over the business management of public utility companies.

Since 2013 price regulation has been applied Hungary to optimise solvent demand and the provision of public utility services. As a first step, the government reduced the consumer prices of electricity, natural gas and district heating, then went on to moderate the prices of water supply, waste disposal and chimney sweep public services. As a result of price regulation (termed as “reduction in overhead costs”), at the moment Hungarian families purchase the cheapest natural gas and electricity supply in Europe. The economic impact of mandatory reductions in utility bills is non-negligible, as the number of consumers in arrears with payment and the amounts outstanding have both declined considerably. Quantified data prove that in the wake of these actions, about HUF 85,000 (approx. EUR 300) less was paid for energy supply per household already back in 2014 than in 2012, prior to price regulation. The regulation of water supply, sewage, waste disposal, chimney sweeping and PB gas prices started on 1 July 2013 saves about HUF 100,000 per household annually. Energy suppliers’ total accounts outstanding by more than 30 days has dropped by 21 per cent, and the number of electricity, natural gas and district heating consumers in arrears with payment is 35, 38 and 22 per cent less, respectively. It can be said that these actions had a favourable impact on the population’s income position, and simultaneously, public utility companies’ overdue and unpaid claims also dropped, but the impacts of missed income on public utility service providers’ future operability and profitability is also worth assessing (Lentner, 2015). To offset missed revenues, the emphasis was shifted to more disciplined and cost-saving business management under the tighter control of the State Audit Office.

Operation of public utility companies in the new system of public finances

After the global economic crisis, public utility companies in Hungary also faced factors preventing efficient operation, operating risks and excessive debt. Price regulation, which was adopted in 2013, also had a considerable impact on the operability of public utility companies, as the net price revenue and other additional financing methods became more limited for these companies. As a result of the crisis, and especially the government reform of 2010, the accounting principle of going concern considerably appreciated both in business entities traditionally operating on market bases and in public sector organisations (Zéman and Lentner, 2018). In the case of public utility companies this may be of outstanding significance because they provide public services and also manage public funds, and most importantly, they constitute national assets. The eventual termination of business activity would affect the entire society and the standard of living. Thus, in addition to market relations, political decisions, economic policy interventions and legislative changes also have an impact on the enforcement of the accounting principle in the case of public utility companies (Lentner, 2013), and there is also a standard social demand for the uninterrupted and predictable provision of public services.

The statutory regulations enabling good governance and the efficient use of public funds are explained above. In addition to the establishment of a complex regulatory environment, the supervisory powers of the State Audit Office (hereinafter: SAO) were also enhanced. Act LXVI of 2011 (on SAO), which entered into force in 2011, added to the powers of the financial supervisory authority. Since this act entered into force, SAO can efficiently audit the operation of public utility service providers and judge whether their business management is sustainable and cost-efficient and they perform their public duties at a high standard. The reports of the State Audit Office published between 2011 and 2015 in relation to the renewal of the state management shed light on the deficiencies of public utility companies and on the inadequacy of asset registration (Domokos, 2016; Domokos et al., 2016). Zéman et al. (2018) analysed the creditability of local governments, and found that the information contained in the accounting reports compiled between 2013 and 2016 did not evidence deterioration in creditworthiness. However, research into the operability of local government-owned companies called the attention to the deficiencies in the profitability of these companies (Sisa et al., 2018; Molnár & Hegedûs, 2018; Molnár, 2019). In his study Boros (2019) examined the gaps in Hungarian regulation in the case of state-owned companies, and recommended the adoption of an independent statute on the system of internal control at state-owned companies. Legislation may only require the attitude to achieve financial results but not the financial output itself, this is exactly why the powers of regulatory bodies need to be reinforced (Kecskés, 2018).

Material and methodology

In the course of the research the 2013 and 2017 data of state and local government-owned public utility companies registered in Budapest were analysed. Thirty-two companies were analysed in each of the two periods. One of the selection criteria was the company’s being operative in both years. The key financial indicators of the 32 analysed companies were analysed in the aggregate, and interviews were made with the management of these 32 companies. They were requested to answer 6 questions, evaluating the optional responses on a Likert Scale of 5. It is important to note that the number of state and local government-owned companies registered in Budapest is 143, and 22.32 per cent of them were selected by the application of the following filters. In summary, the filter criteria were the following:

- operation in both 2013 and 2017,

- having a registered office in Budapest,

- complex information suitable for evaluation should be available, and

- the companies should qualify as public utility companies under the National Assets Act and the act on Hungary’s local governments.

Two objectives were set for the research: on the one hand, the evaluation of the financial procedures of the analysed companies, and on the other, the analysis of the impacts of public finance reforms performed within national competence.

Findings

Sample composition

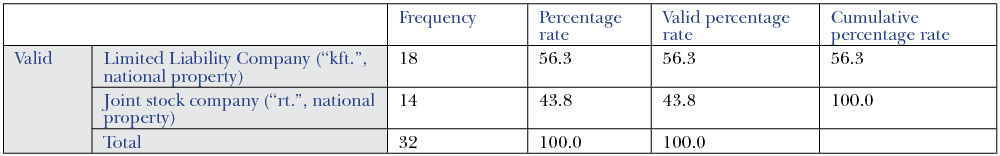

The first table suggests that the companies in local government ownership typically operate as limited liability companies, while state-owned ones are typically joint stock companies. Twenty-two per cent of limited liability companies are non-profit organisations. Company types are selected partly for legislative reasons, as the National Assets Act prohibits local governments from undertaking unlimited responsibility, and this also applies to state-owned business organisations. In addition, operation in a non-profit form is a requirement for certain special tasks.

Table 2 shows the sectors of the national economy where the companies selected for the sample are operative. Most public utility companies operate in communication and transport, followed by companies active in state and local government asset management. Others include water utility companies and businesses engaged in electricity and natural gas supply.

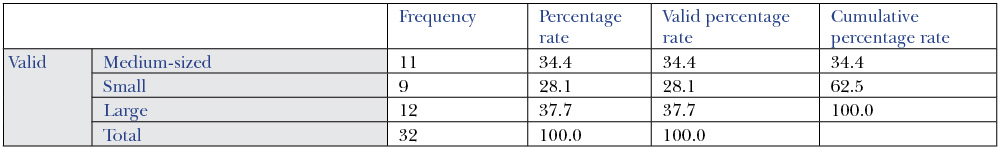

Although the size categories used to characterise SME’s are usually not applied in the case of companies in local government and state ownership, a breakdown by size nevertheless provides interesting information. In a size grouping it can be established that the companies predominating this sector are large corporations and give approx. 37.7 per cent of this sample, while small and medium-sized companies represent 62.5 per cent, considerably below the corresponding ratio in the national economy, as SME’s share 99 per cent of all companies in Hungary.

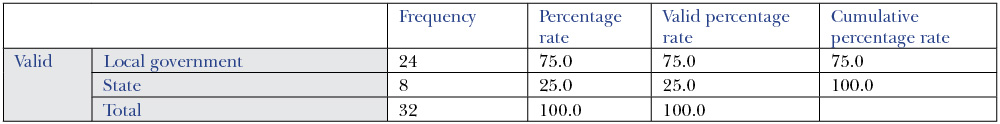

Based on Table 4, most of the companies in the sample were in local government ownership, representing 75 per cent, and only 25 per cent of the reviewed companies are in state ownership.

Table 1: Breakdown by the legal status of the company

Source: Author’s own research, 2020

Table 2: Breakdown by industry

Source: Author’s own research, 2020

Table 3: Breakdown by industry

Source: Author’s own research, 2020

Table 4: Ownership structure of the sample

Source: Author’s own research, 2020

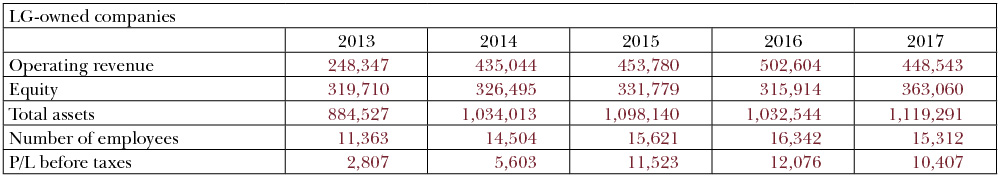

Table 5: Financial data of local government-owned companies (HUF million)

Source: Author’s own research, 2020

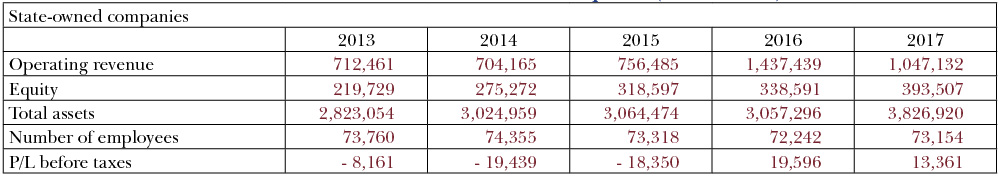

Table 6: Financial data of state-owned companies (HUF million)

Source: Author’s own research, 2020

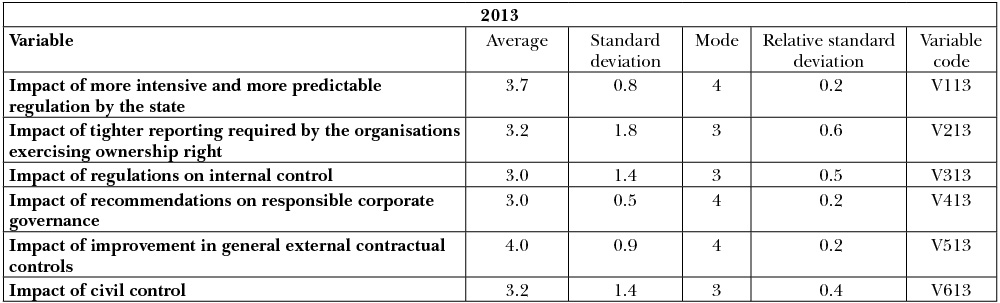

Table 7: Findings of the 2013 survey

Source: Author’s own research, 2020 (n=32)

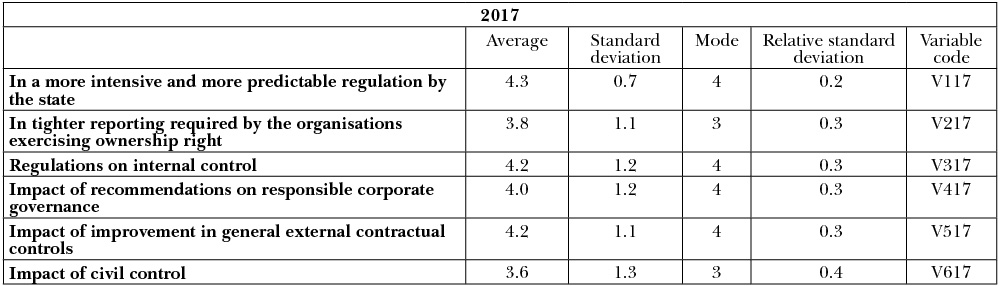

Table 8: Findings of the 2017 survey

Source: Author’s own research, 2020 (n=32)

Financial data analysis

The analysis of the financial data included a time line analysis of the operating income, the equity, the balance sheet total, the employee headcount and the profit before taxes, after aggregation of the financial statements of these companies.

An analysis of the operating revenues reveals that the turnover of public utility companies in local government ownership registered in Budapest grew between 2013 and 2016. A major rise is seen in 2014: turnover had increased by nearly 75 per cent; however, a halt is recorded in 2017, as the income realised by these companies decreased by 11 per cent on the 2016 peak, due to a major extent to a reduction in the service prices (price regulation).

In the period reviewed, with the exception of 2016, the equity rose constantly, and this is a favourable indication of the successful aggregate operation of these companies in the aggregate.

A slight decline of 4.8 per cent can be observed in 2016.Unfortunately, however, the ratio showing capitalisation, i.e. equity to the balance sheet total, is only around the creditability threshold.

The balance sheet total shows developments similar to the equity: between 2013 and 2015 the aggregate asset value of these companies rose, then a slight drop is seen in 2016, but in 2017 the assets held by these companies increased again.

The trend described for operating income is also observable in the headcount of employees: between 2013 and 2016, growth is rapid, and then a considerable decline is recorded in 2017, due to labour outflows.

As a favourable not to profitability, profit before taxes shows profit every year in the aggregate. Profitability was especially impressive between 2013 and 2015, remained unbroken in 2016, but a declined in 2017.

In relation to developments in operating revenues it can be established that between 2013 and 2015 the operating revenues realised by state-owned public utility companies stagnated; and then this was followed by a considerable increase due to funds obtained from project grants. Although the amount of available funds had decreased by 2017, they did not fell to the values recorded in the previous years, and this can be considered as a favourable development.

As a favourable development, the equity grew year by year despite the fact that between 2013 and 2015 losses were made before taxes in the aggregate. This is explained by the fact that the losses realised were paid by the owners. The fact that the profit realised before taxation in the last year explains growth in the equity only in part is also due to this factor. The profit realised before taxes in 2016 explains rise in the equity.

The asset values of these companies show a slight rise followed by stagnation between 2013 and 2016, and a considerable increase of 25 per cent in the last year reviewed. The reasons for this included raising funds from resources available for development and the accounting of development projects. Nevertheless it can be established that the capitalisation of the analysed companies is considerably low; they operate with high capital leverage and this has a significant adverse impact on their sustainability.

The headcount fluctuated around the average of 73,366 in the period reviewed, with a merely 1 per cent relative standard deviation, representing 738 persons. In the analysed period, the highest headcount value was recorded in 2014, and the lowest one in 2016, followed by a rise to the average number in 2017.

A comparison of the two circles of owners reveals different characteristics. While local government-owned companies were clearly the most successful in 2016, the performance of state-owned companies is highly influenced by co-funding from the European Union and by additional payments to the capital by the owner. The data reveal that companies in local government ownership have more favourable financial data, in other words, the profitability and capitalisation of state-owned companies is weaker than those of companies owned by local governments.

Findings of the interview survey

One of the objectives of the research was to obtain the opinions of the management of public utility companies about the impact of the public finance reforms on corporate business management. Score 1 represents adverse impact and score 5 stands for the most favourable impact on operation. For convenience, the company managers were asked to rate the impacts of the six most marked changes. The serial numbers of the variables serve as parameters in the comparative chart, and comprise the serial numbers of the questions and the year of the query.

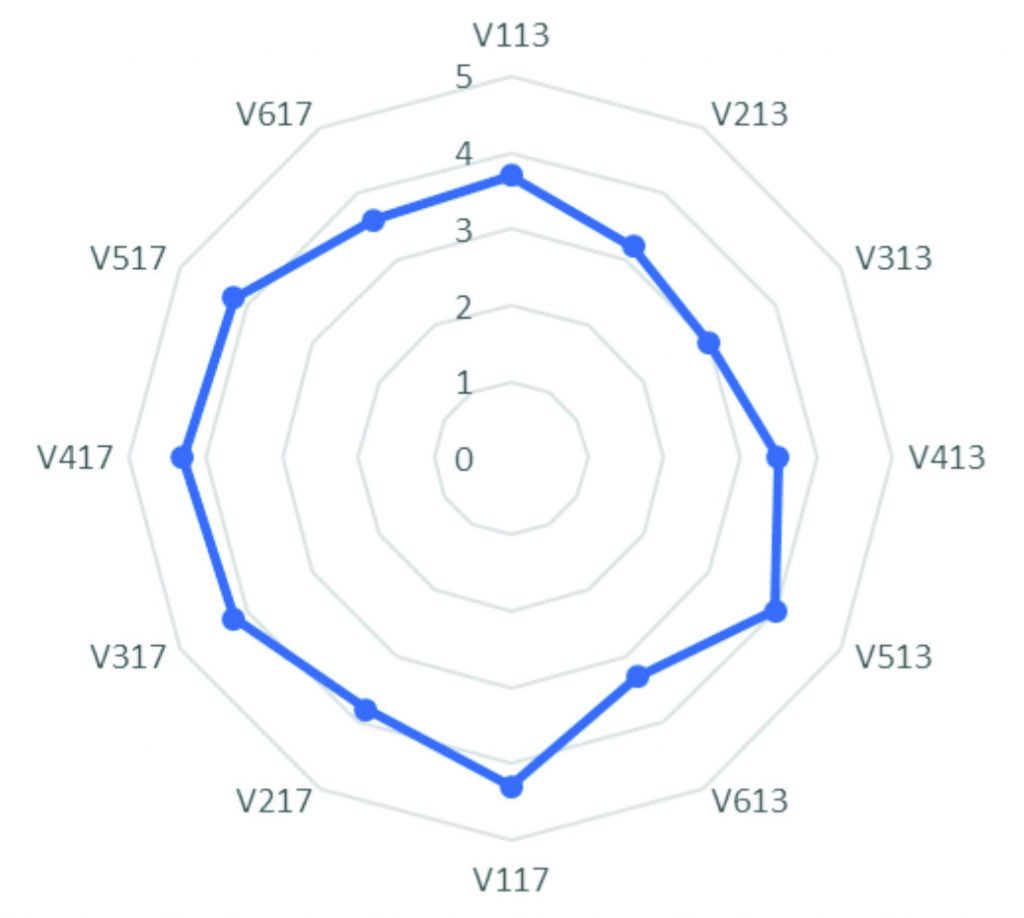

1. Chart: Comparison of two surveys (2013 vs. 2017)

Source: Author’s own research, 2020 (n=32)

Table 7 reveals that the given action had at least medium impact on corporate management in each of the analysed variables.

The respondents considered the state’s more predictable regulatory activity as favourable. Improved predictability is manifest in numerous legislative changes based, among others, on the National Assets Act and the Stability Act, but the earlier adopted act on the more cost-efficient management of publicly owned companies can also be included in this group. The respondents consider the impact of the latter as the most favourable; however, the standard deviation and relative standard deviation values attached to it are relatively low. The impact considered as the most favourable by the businesses is the State Audit Office’s control: this parameter is accompanied by low standard deviation and relative standard deviation.

The respondents rated the impacts of the exercise of proprietary rights and civil control below medium. The exercise of rights by the owners had a weaker than medium impact as the activity of the supervisory board was still merely formal in the case of a significant part of the respondents.

Internal control and responsible corporate government were rated the lowest on average because in the period reviewed, they were not widely used in the regulatory practice of public utility businesses, and they were not mandatory for every company. This explains the relatively high standard deviation and relative standard deviation.

Several changes took place during the 2017 data collection, among others, as a result of recommendations on responsible corporate government, issued for business organisations in the ownership of Magyar Nemzeti Vagyonkezelõ Zrt. (MNV, see Kecskés, 2016). In the same period the legislator included local government-owned companies among those subject to the borrowing approval procedure. As clear from Table 8, each variable had a stronger than medium impact on management. Civil control, traceable for the most part in companies engaged in public benefit activities, had the slightest impact. The exercise of proprietary rights also had a higher-than-medium impact on companies, and this suggests a more marked presence of supervisory boards and other bodies exercising ownership rights, as confirmed by a 2018 study complied by the State Audit Office. The predictability of the state’s regulatory activity was rated relatively high, which is explained by the combined effect of the above described statutory changes. As the standard deviation is the lowest in this category, it can be established that the responded had the highest consensus on this matter. The widening of regulation on internal control has a massive impact on corporate business management, with an acceptable standard deviation. Increasing control by the State Audit Office was rated favourably by the respondents. Acting as an external body of legislation, since 2015 SAO has been intensively supervising state and local government-owned companies. Regarding internal control, in 2014 a significant part of the companies in national ownership were included in the group subject to the internal control applicable in public finance, and consequently their significance increased considerably. As a result of the previously described corporate management practices, MNV’s recommendations could have a more powerful impact on subsidiaries, and the relevant Chi2 test showed correlation with the proprietary control mechanisms (p=0,01).

The results of the two surveys were compared in a radial diagram. The findings of the 2013 survey are shown on the right, while those of the 2017 survey on the left side of the diagram. This suggests that each variable has changed for the more favourable, as the respondents had more favourable attitudes to each variable in 2017 than in 2013. A significant rise can be seen in responsible corporate management, in internal control and in the evaluation of the government’s regulatory system.

LENTNER CSABA Prof. Dr.

Full Professor, National University of Public Service, Budapest

Bibliography

Állami Számvevõszék (2018): Az állami tulajdonú gazdasági társaságok mûködése, Budapest, p. 44 (Hungarian State Audit Office about State Owned Companies, 2018, working paper)

Boros, A. (2019): Compliance Audit Issues of State-owned Business Associations, PUBLIC FINANCE QUARTERLY 2019 : 4 pp. 542-558.

Domokos, L. (2016): Culmination of the Powers of the State Audit Office of Hungary within the Scope of New Legiaslation on Public Funds, Public Finance Quarterly 2016/3 pp. 291-311.

Domokos, L. ; Várpalotai, V. ; Jakovác, K. ; Németh, K. ; Makkai, M. ; Horváth, M. (2016): Renewal of Public Management. Contributions of State Audit Office of Hungary to enhance corporate governance of state-owned enterprises, Public Finance Quarterly, 2016, vol. 61, issue 2, 178-198.

Drechsler, W. (2005): The Rise and Demise of the New Public Management. Postautistic, Economics Review, 33(14), pp. 17–28.

Drechsler, W. & Kattel R. (2008): Towards the Neo-Weberian State? Perhaps, but Certainly Adieu, NPM. NISPAcee Journal of Public Administration and Policy 1(2), 95–99.

Hegedûs, Sz.; Zéman, Z. (2016): Tõkeszerkezeti elméletek érvényesülésének vizsgálata a hazai önkormányzati tulajdonú gazdasági társaságok körében (Prevalence of Capital Structure Theories Among Municipal Companies), STATISZTIKAI SZEMLE 94: 10 pp. 1032-1049.

Kecskés, A. (2016): A felelõs társaságirányítás európai rendszere. (Responsible Corporate Governance’s Method in Euorpe) EURÓPAI JOG: AZ EURÓPAI JOGAKADÉMIA FOLYÓIRATA 16: 3 pp. 28-38. , 11 p.

Kecskés, A. (2018): A gazdasági jog optimuma: a jó gazdasági jog kérdésfelvetései a válság elõtti jogalkotás tükrében (Optimum in Business Law – The Questions of Good Business Regulation in Light of the Pre-Crisis Legislation), POLGÁRI SZEMLE: GAZDASÁGI ÉS TÁRSADALMI FOLYÓIRAT 14: 4-6 pp. 88-94.

Lentner, Cs. (2013): Enforcement of the Principle of Going Concern: with Special Regard to Public Service Providers, In: Hyránek, Eduard; Nagy, Ladislav (szerk.) Zborník Vedeckých Statí : Priebežné výsledky riešenia grantovej úlohy VEGA č. 1/0004/13: Aktuálne trendy a metódy vo finančnom riadení podnikov a ich vplyv na finančnú stabilitu podniku, Bratislava, Szlovákia : Vydavatelstvo Ekonóm, pp. 9-17.

Lentner, Cs. (2015): A vállalkozás folytatása számviteli alapelvének érvényesülése közüzemi szolgáltatóknál és költségvetési rend szerint gazdálkodóknál – magyar, európai jogi és eszmetörténeti vonatkozásokkal: 31. fejezet (Enforcement of the Principle of Going Concern: with Special Regard to Public Service Providers – Hungarian, European legal and ideological aspects: Chapter 31.), In: Lentner, Csaba (szerk.) Adózási pénzügytan és államháztartási gazdálkodás : Közpénzügyek és Államháztartástan II. (Taxation Finance and Public Finance: Public Finance and National Budget II.) Budapest, Magyarország: Nemzeti Közszolgálati és Tankönyv Kiadó Zrt., pp. 763-783.

Lentner, Cs. (2017): New Concepts in Public Finance after the 2007-2008 Criris. In. Economics & Working Capital (London, UK) 2017/1-2. issues, pp. 2-8.

Lentner, Cs. (2020): East of Europe, West of Asia. L’Harmattan Publishing, Paris (Chapter II, IV)

Molnár, P. ; Hegedûs, Sz. (2018): The Analysis of the Accounting Principles of Going Concern Through the Hungarian Municipal Companies, MODERN SCIENCE / MODERNI VEDA 2018:1 pp. 37-46.

Molnár, P. (2019): Az önkormányzati vállalatok mûködõképessége megyei összehasonlításban (Operability of Corporations Owned by Local Government in Hungary in County Comparison), TERÜLETI STATISZTIKA 59: 3 pp. 273-299.

Pollitt, C.; van Thiel, S & Homburg, V. (2007): New Public Management in Europe. Adaptation and Alternatives. New York, NY: Palgrave Macmillan.

Sisa, A. K. ; Hegedûs, Sz. ; Molnár, P. (2018): Examination of Capital Structure in the Sector of Local Governemnt Owned Business Organizations: The Role of Controlling in this Sector, In: Zéman, Z; Magda, R (eds..) Controller Info Studies II., Budapest, Magyarország : Copy & Consulting Kft., pp. 167-176.

Zéman, Z. ; Hegedûs, Sz. ; Molnár, P. (2018): Analysis of the Creditworthiness of Local Government-owned Companies with a Credit Scoring Method, PUBLIC FINANCE QUARTERLY 63: 2 pp. 176-195.

Zéman, Z. ; Lentner, Cs. (2018): The Changing Role of Going Concern Assumption Supporting Management Decisions after Financial Crisis. Polish Journal of Management Studies, 18:1pp. 428-441.

@ WCTC LTD --- ISSN 2398-9491 | Established in 2009 | Economics & Working Capital