Blockchain as an alternative financing for SMEs: Italy as a concrete example

Abstract

This study’s purpose is to focus on alternative financing methods for SMEs since there may be more than one alternative financing method that can be highlighted. The focus of my research will be on blockchain and how it impacts Italy based on information from the OECD. We chose Italy from a technological point of view, they aren’t super advanced in any way, since they prefer a more traditional approach towards different situations. To start things off, we’d like to acknowledge a few misconceptions and point out a couple of important definitions before moving on to the concrete data collected by the OECD about Italy. Having said that, blockchain is not the same as bitcoin. Although bitcoin does use blockchain technology, this is not a technology that is purely limited to bitcoin but can be used in many other places and products as well.

Introduction

It can be said that bitcoin is in a sense a byproduct of the Blockchain technology. Additionally, from a financial point of view within a traditional financing ecosystem, the SME who requires financing will approach a bank and ask for financing from the bank and, on the other hand, the bank will also potentially access other banks or SMEs for funding in order to be able to grant the initial financing request.

By leveraging blockchain, on the other hand, it would be possible for the SME who requested the initial financing to bypass the bank and talk directly to the lander. The blockchain technology is also mischaracterized as being completely decentralised, which is simply not true. Despite the fact that traditional banks are based on centralised ledgers, in the case of blockchain, we can distinguish between three different stages within the decentralised area, which are: private blockchains, consortium blockchains and public blockchains. The only ones that can be considered 100% decentralised are the ones that are public.

Moreover, in order to add to the success of blockchain technologies, they are based on three very important elements, namely, transparency, trust, and traceability. Because of these key elements, the blockchain technology industry is experiencing a rapid growth in many industries such as healthcare, pharmaceuticals, law, cybersecurity, and also in sectors such as digital identity, voting systems, and international trade. Furthermore, startups have been heavily engaged in developing proof of concepts, alpha and beta versions of software which are integrating blockchain technologies (FATF, 2022). These DLT applications are deployed and tested in multiple places and are especially used to create a connection within the international community amongst the SMEs (Casino, 2019).

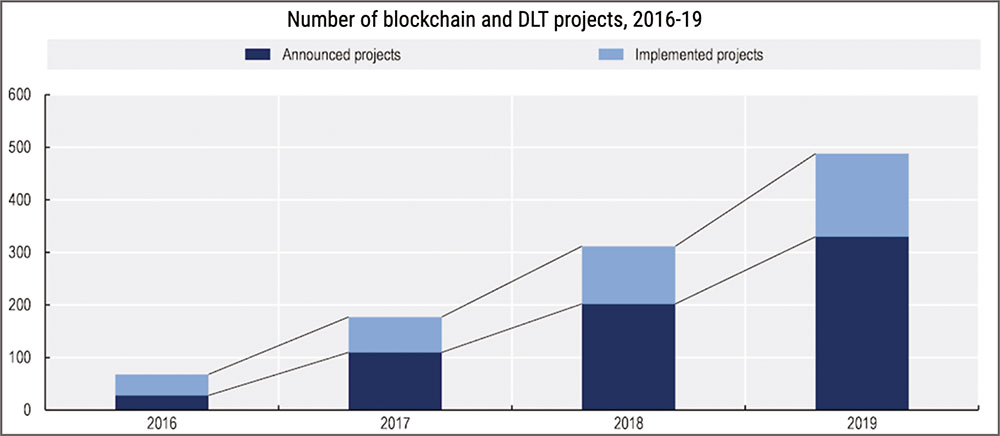

According to a study conducted by Delotte in 2019, there are three main adaptation barriers to blockchain technology: the necessity to replace existing legacy systems (30%), regulatory issues (30%), and the potential security risks associated with partially decentralised systems (Delotte, 2019). Interestingly, the trust in the technology has increased as compared to the same study that was done in 2018 since the numbers were higher at the beginning. A similar trend within Italy was noticed as well in a research conducted by the Polytechnic University of Milan – see diagram 1 (Polytechnic University of Milan, 2020), which emphasises that even in countries that are generally more traditional the blockchain technology is becoming a more organic part of it. Overall the number of projects that use blockchain has grown from 2016 to 2019, furthermore this growth is not only linked with potential pilot projects we can clearly see that the number of actual implemented projects that use this technology has grown as well.

It is evident that the adoption of this new digital technology continues to grow. This is primarily due to the fact that it’s similar to other digital technologies that are leveraged inside of a firm. Therefore, it brings value to the SME that uses it. The right conditions, the extra capabilities and incentives that a technology can offer could bring this concept closer to reality (Brynjolfsson and McAfee, 2014; Draca et al, 2009; Sorbe at al, 2019).

Figure 1. number of blockchain and DLT projects

Source: Polytechnic University of Milan, 2020

The financing side of the blockchain

With regards to the financing sector, we have seen that blockchain technology is able to reduce costs dramatically, especially when compared to traditional financing where money isn’t directly received from the source as proxies are used. In case of blockchain financing, we have seen a significant reduction in costs (Sun et al., 2020). For the majority of the SMEs this cost reduction fact is the major influencer of actually using this technology compared to the more traditional one. The cost of maintaining records and reconciling can be reduced in such a manner by removing intermediaries as well as reducing the administrative burden (Carson et al, 2018). Furthermore, other cost-saving factors have been identified as well, such as reducing the verification costs in case of each transaction, for example, verifying the state of the transaction, the data and also the digital assets. Another interesting price reduction comes from networking, or in this case the lack of it, since blockchain provides a direct connection between the landowner and the one who receives the loan, thus reducing a lot of the costs that come from the used intermediaries such as data verification (Catalini and Gans, 2019).

There has been a steady increase in digitalization among small and medium sized enterprises (SMEs) in the last couple of years, however this process was heavily accelerated by the COVID-19 pandemic. As a result of this increase in digitalisation, asset security, financial security, and other factors, has become more and more relevant over time (Taylor et al, 2020). With its architecture and extra layer of security, blockchain technology offers a security layer over the above-mentioned issues, and the fact that it is decentralised along with its trustless and peer-to-peer structure makes it very resilient to almost any type of attack.

SMEs and the blockchain

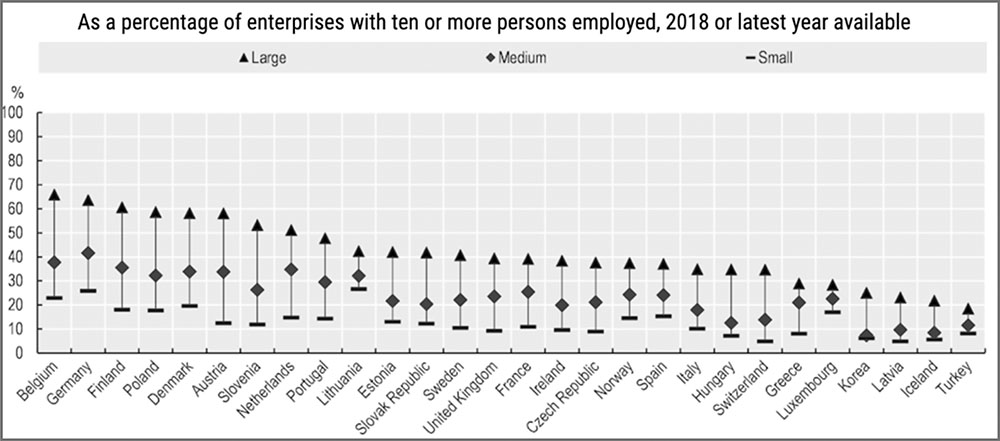

Data from the OECD indicates that more and more SMEs are actively connected to the internet, which essentially allows the connection of distributed ledgers for distributed ledger technology as the integrity of the DLT is dependent on it (see diagram 2).

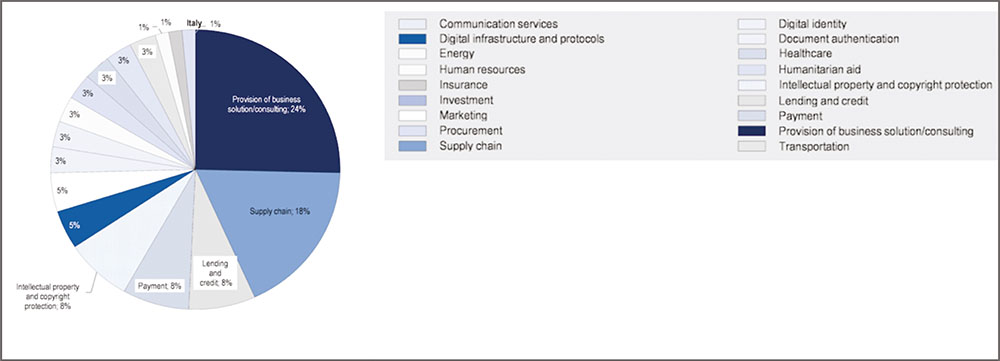

Data from the OECD indicates that in Italy, 67 SMEs were directly using blockchain technologies for financing in 2019. Overall, it may not seem like a large number, but compared to previous years, the number has been steadily rising and continues to do so. Companies that only use crypto currencies as assets were excluded from this list, and the focus was on SME’s that are actually using blockchain technology, such as a payment gateway for retail products, or a mechanism for directly connecting the company with its clients without paying transaction fees. It should be noted that as most of the SME’s that use blockchain as a technology to reduce transaction costs are startup companies, their business demographic is rather volatile. Due to this fact, we are not able to identify the right business area for the blockchain technology just yet (see diagram 3).

Additionally, 24% of the above mentioned companies are utilizing blockchain technology because the technology is integral to the success of their business. The rest, which is quite a big number, use it simply because it is a more cost efficient option from a financing standpoint. An interesting fact is that 18% of the companies were offering solutions related to supply chains, and an even more interesting fact is that seven out of the 12 companies were targeting the agro-food sector, and aimed to connect farmers directly with food processors and consumers (Start-up Nation, 2019). A further application of the technology is in the area of copyrights and payment services, which are used within SME sectors. It is worth noting that in terms of copyrights, Italy is the third most targeted country in the world after the United States and France (EUIPO, 2019). Based on an estimate made by the OECD (OECD, 2018), Italian businesses were stripped of about 24 billion Euros just in 2016. In terms of affected industries, the apparel and footwear industry, along with the food and beverage industry are the most heavily affected. I think it is important to point out that not only the business financing sector is affected, but their brand image is also affected in some way by these thieves.

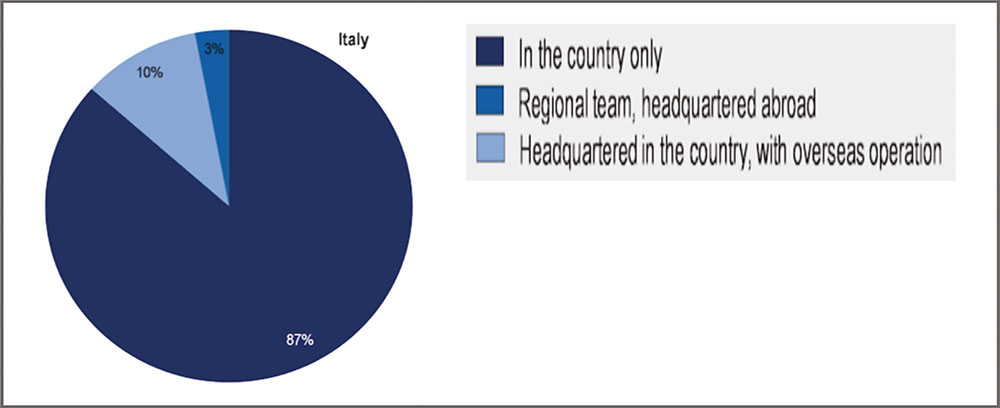

In terms of the company’s presence within the country, 87% of the ones using blockchain technology actively have their headquarters based in Italy. Only 10% of the companies with offices in Italy have an international presence as well. It is also noteworthy that a very small portion of companies, just 3% of them, have just regional teams operating within the country (see diagram 4). From the point of view of financing, this is of utmost importance because companies that have a local headquarters strive to keep their money within their primary business. It is obvious that money is meant to stay within the country as well. With the use of blockchain technology, not only are they experiencing cost savings, but they are also gradually converting people in the direction of this more efficient technology.

It seems that the picture from a regional point of view is a more traditional one, since the majority of the companies are based around Lombardy and Lazio which are regions where the financial standing of the companies is already well established (Audretch et al, 2005).

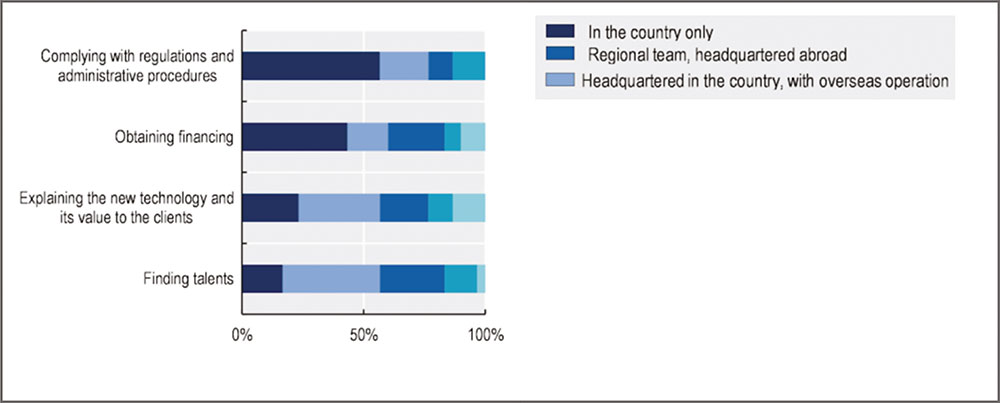

According to the OECD, there are four major obstacles that blockchain technology could help and improve a company’s day-to-day activities, these include finding talent, explaining the client value, obtaining financing and complying with the regulations. It is clear that blockchain has a significant impact on how easy it will be for a company to obtain funding from an external source without incurring additional costs that would normally be required when using a more traditional type of business funding (see diagram 5).

Blockchain technology can also be used by the Small Business Administration to streamline the application and loan process. Due to the fact that all data on a blockchain platform is visible, the SBA lenders can determine a borrower’s credit worthiness without an application process. In Italy, we can see that businesses and entrepreneurs are already turning to blockchain to solve the capital access problem. Several private companies, including Crypto and Finclusive, offer financial services based on blockchain and cryptocurrencies.

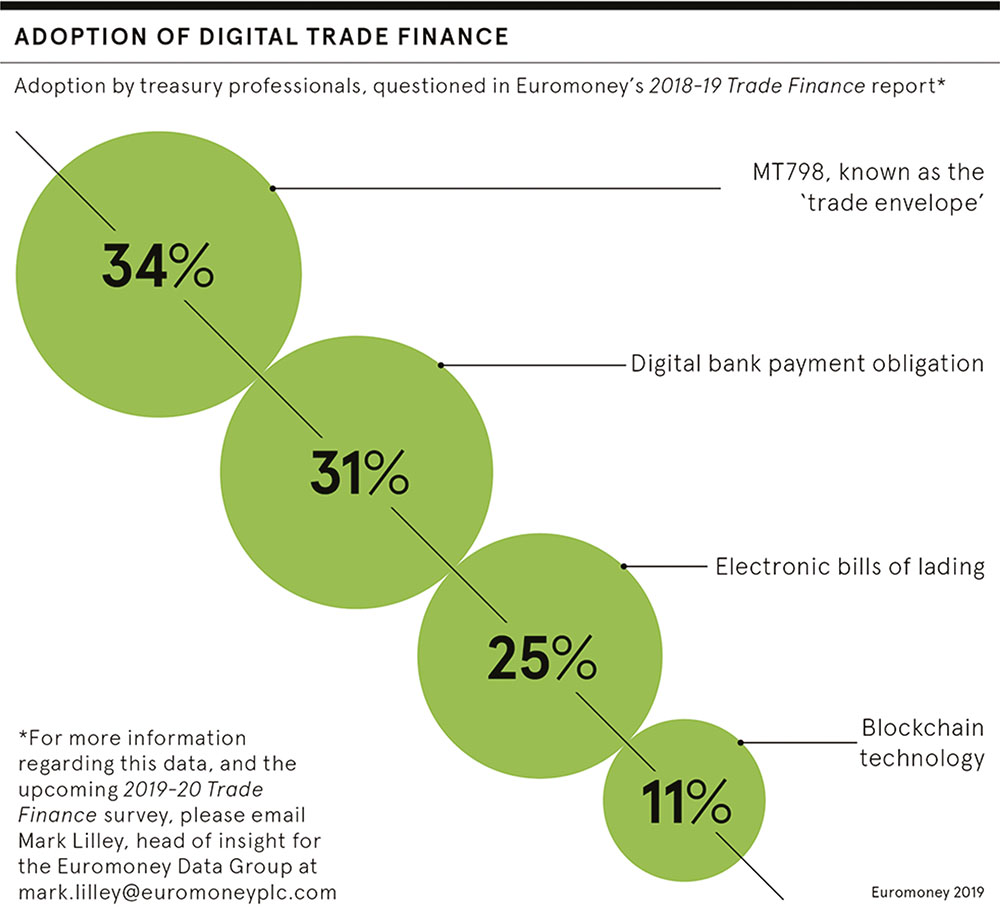

When it comes to business financing for SMEs, getting a loan from a financial institution can be challenging, especially for those just starting out. Due to a lack of funding, many SMEs have limited chances of survival; almost 30 percent of them shut down in their first three years. Obtaining trade finance is another challenge for SMEs operating internationally. A key component of SMEs’ success is the ability to obtain trade financing, but it is not always easy for them to do so. Access to traditional trade finance products is difficult for SMEs, especially when it comes to getting funding (McIntyre, 2020). Small businesses are greatly harmed by the inability to access capital, stifling growth and affecting cash flow. In order to purchase materials, start the production process, pay employees, or cover other business expenses, businesses need cash flow. Late payments can make the difference between success and failure for smaller companies (Moris, 2022). In order to obtain funding and ease their cash flow issues, today’s SMEs are turning to alternative sources of financing. P2P lending and crowdfunding, the latter focusing primarily on technology-based start-ups, have been popular alternative lending vehicles in recent years, with mixed fortunes, but overall there is a lack of alternative financing amongst SMEs (SCF, 2022). A really nice cost reduction in the case of SMEs is summarised in diagram 6 when financing that uses blockchain technology is compared to the more traditional one.

Figure 2: As a percantage of enterprises with ten or more persons employed

Source: OECD (2020[32]), OECD ICT Access and Usage by Businesses Database, http://stats.oecd.org/Index.aspx?DataSetCode=ICT_BUS (accessed 2 May 2022).

Figure 3: Blockchain companies by type of service offered

Source: OECD (2021)

Figure 4: Blockchain companies by type of business operation within country

Source: OECD (2021)

Figure 5: Blockchain entrepreneurs’ survey: Business barriers

Source: OECD (2021)

Figure 6: Adaption of digital trade finance

Source: Easen, 2020

Summary

The blockchain technology holds a lot of potential for ensuring the integrity and security of data, as well as enhancing accountability and trust among parties involved in a given project. SMEs and start-ups are able to overcome size-related challenges through blockchain-based applications. OECD country case studies on “Blockchain for SMEs and Entrepreneurs”, carried out in Italy, provide in-depth insights into both the opportunities and challenges faced by businesses interested in exploring blockchain innovation, and also provide insights into the development of blockchain ecosystems in general. Initially, blockchain policies were aimed at understanding crypto-asset exchanges and regulating them, but in recent years, governments have increasingly utilised nuanced approaches to encourage the use of blockchain across industries.

References

Audretsch, D. – E. Lehmann – S. Warning (2005): “University spillovers and new firm location”, Research Policy, Vol. 34/7, pp. 1113-1122, http://dx.doi.org/10.1016/j.respol.2005.05.009.

Brynjolfsson, E. – A. McAfee (2014): The second machine age: Work, progress, and prosperity in a time of brilliant technologies.

Carson, B. – Romanelli, G. – Walsh, P. – Zhumaev, A. (2018): Blockchain beyond the hype: what is the strategic business value, McKinsey&Company Digital, https://cybersolace.co.uk/CySol/wp-content/uploads/2018/06/McKinsey-paper-about-Blockchain-Myths.pdf (accessed on 2 May 2022).

Casino, F. – T. Dasaklis – C. Patsakis (2019): A systematic literature review of blockchain-based applications: Current status, classification and open issues, Elsevier Ltd, http://dx.doi.org/10.1016/j.tele.2018.11.006.

Catalini, C. – J. Gans (2019): “Some simple economics of the blockchain”, NBER Working Paper Series, http://www.nber.org/papers/w22952 (accessed on 2 May 2020).

Delotte (2019): Deloitte’s 2019 Global Blockchain Survey, https://www2.deloitte.com/content/dam/Deloitte/se/Documents/risk/DI_2019-global-blockchain-survey.pdf (accessed on 2 May 2022).

Draca, M. – R. Sadun – J. Van Reenen (2009): Productivity and ICTs: A review of the evidence, Oxford University Press, http://dx.doi.org/10.1093/oxfordhb/9780199548798.003.0005.

Easen, N. (2020): How will blockchain transform trade finance? Racounteur, finance, Fintech. January, 2020. Raconteur Media Ltd., a UK.

EUIPO (2019): Trends in Trade in Counterfeit and Pirated Goods, Illicit Trade, OECD Publishing, Paris/European Union Intellectual Property Office, https://dx.doi.org/10.1787/g2g9f533-en.

FATF (2022): Guidance for a Risk-Based Approach to Virtual Assets and Virtual Asset Service Providers, FATF, https://www.fatf-gafi.org/media/fatf/documents/recommendations/RBA-VA-VASPs.pdf (accessed on 2 May 2022).

Georgia McIntyre, What Percentage of Small Businesses Fail (And Other Need-to-know Stats), 2020: https://www.fundera.com/blog/what-percentage-of-small-businesses-fail (accessed on 2 May 2022).

Nicky Morris, WEF/Bain: Blockchain Trade Finance Could Boost Trade by $1 trillion, Ledger Insights, https://www.ledgerinsights.com/wef-bain-blockchain-trade-finance-trillion/ (accessed on 2 May 2022).

OECD (2018): Trade in Counterfeit Goods and the Italian Economy: Protecting Italy’s intellectual property, Illicit Trade, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264302426-en.

OECD (2021): The Digital Transformation of SMEs, OECD Studies on SMEs and Entrepreneurship, OECD Publishing, Paris, https://doi.org/10.1787/bdb9256a-en.

Polytechnic University of Milan (2020), Blockchain & Distributed Ledger: Unlocking the potential of the Internet of Value, https://www.osservatori.net/it/eventi/on-demand/convegni/convegno-risultati-ricerca-osservatorio-blockchain-distributed-ledger-2020 (accessed on 26 November 2020).

SCF is a term describing a set of technology-based solutions that aim to lower financing costs and improve business efficiency for buyers and sellers linked in a sales transaction; https://www.investopedia.com/terms/s/supply-chain-finance.asp#:~:text=Supply%20chain%20finance%20is%20a,capital%20at%20a%20lower%20cost (accessed on 2 May 2022).

Sorbe Stéphane – Peter Gal – Giuseppe Nicoletti – Christina Timiliotis(2019): “Digital Dividend: Policies to Harness the Productivity Potential of Digital Technologies”, OECD Economic Policy Papers, No. 26, OECD Publishing, Paris, https://dx.doi.org/10.1787/273176bc-en.

Start-up Nation Central (2019): Italy’s Cybersecurity Industry in 2018, http://mlp.startupnationcentral.org/rs/663-SRH-472/images/Start-Up%20Nation%20Central%20Cybersecurity%20Report%202019.pdf (accessed on 2 May 2022).

Sun Ruo-Ting – Aravinda Garimella – Wencui Han – Hsin-Lu Chang – Michael J. Shaw (2020): “Transformation of the Transaction Cost and the Agency Cost in an Organization and the Applicability of Blockchain—A Case Study of Peer-to-Peer Insurance”, Frontiers in Blockchain, Vol. 3, http://dx.doi.org/10.3389/fbloc.2020.00024.

Taylor Paul J. – Tooska Dargahi – Ali Dehghantanha – Reza M.Parizi – Kim-Kwang –Raymond Choo (2020): A „systematic literature review of blockchain cyber security”, Digital Communications and Networks, Vol. 6/2, pp. 147-156, http://dx.doi.org/10.1016/j.dcan.2019.01.005.

Norbert Forman, PhD student,

Budapest Business School, Department of Business Informatics

Dr. Avornicului Mihai, Associate professor,

Babeş-Bolyai University, Cluj-Napoca, Department of Economics and Business Administration Hungarian Institut

Dr. Richárd Kása, Senior researcher,

Budapest Business School, Department of Management

Dr. Róbert Tóth PhD, Senior Lecturer,

Institute of Economics and Management, Faculty of Law of the Károli Gáspár University of the Reformed Church in Hungary

@ WCTC LTD --- ISSN 2398-9491 | Established in 2009 | Economics & Working Capital