Security in modern theory of the firm and the concept of the company’s financial architecture

Abstract

The article deals with the theoretical aspects of determining the place and role of the corporate security category in modern concepts of the firm’s theory. The interrelation of concepts “firm” and “corporation” is grounded, the general classification of existing theories of the firm is presented, the essence of the firm from a position of the different theories is considered. A system-integration approach is proposed in the study of this category. The importance of considering security as a component of the financial architecture of the company is emphasized.

Key words: security, corporation, theory of the firm, corporate theory, financial architecture, system integration theory of the firm.

Introduction

The importance of considering the security problem in the concept of the company’s financial architecture in modern conditions is derived from the change in approaches to understanding the nature of corporate finance and an increasing role of the system integration approach in scientific research of the firm’s theory. The concept of financial architecture, first proposed in 1999 by S. Myers [1], is based on the system integration approach to assessing the company’s performance. Myers defines the financial architecture of the company as a combination of its financial characteristics, such as the form of ownership, the legal form of business organization, incentives, sources of financing and risk allocation mechanisms.

In modern conditions, the study of the difficulties and problems, threats and risks that accompany the activities of enterprises, is one of the general lines of development of the firm’s theory. In this regard, the security problem gradually takes an adequate place in the theory of the firm, but it requires the modernization of the methodological basis for its study in line with modern advances in the institutional and evolutionary economy.

Material and Methods

A considerable number of publications have been devoted to the problems of the theory of the firm, but they have not paid enough attention to corporate security problems. Terminological diversity in corporation concept as a subject of modern economics has been reflected through the prism of the evolution of approaches to the firm’s theory in different interpretation of the corporation, the firm, the organization and the enterprise in the works of G.Kleiner [12,13], D.Pletnev [6,7], L.Saakova [9], R.Gibadulin, I.Mardanova [10], S.Polonsky [16,17]. Questions concerning the terminology of the corporate financial architecture proposed by S. Myers [1] found their reflection in the publications I.Ivashkovskaya, A.Stepanova, M.Kokoreva [2], N.Gortseva [3]. The works of these authors are devoted to determining the essence and components of the financial architecture, its impact on the efficiency of the company’s activities, as well as the features of the formation of a financial architecture for groups of companies with cross financing within the group. The problem of security in the theories of the firm is investigated in the works of M. Korolyov, V. Tambovtsev. The analysis of the literature studied allows us to conclude that there is insufficient research into the problems of corporate security as an organic component of the theory of the firm.

The purpose of this publication is to outline the empirical reasoning of the need and role of researching security problem as an organic component of the company’s financial architecture. The main methods that are used for reaching the goal were synthesis, detailing, logical generalization, comparison, analogy and structural-logical method.

Results and Discussion

An important milestone in the development of the entire problem field of corporate finance was the concept of the company’s financial architecture. For the first time, the term “corporate financial architecture” and the problems associated with it were voiced in the opening speech of S. Myers at the conference of the European Association of Financial Management and Marketing (EFMA) in Lisbon in June 1998. Financial architecture, according to C. Myers, means the entire “financial design of the business, covering the property (concentrated or dispersed), the organizational and legal form, incentives, ways of financing and distributing risks between investors” [Myers, 1999]. Whereas risk is a necessary and indispensable attribute of entrepreneurship, security is also an organic part of the corporate finance theory. However, the development of theoretical ideas about the security of a firm directly depends on progress in understanding the nature, functions, structure and evolution of this economic institution [4, p.54]. The main problem is that “disputes about the structure and functions of the firm have been going on for many years and it is hardly possible to talk about the formation of any single theory” [5, p.85].

When considering the nature of the firm, it is necessary to investigate the relationship between the concepts of “firm” and “corporation”. The most relevant in this case is the research of those areas of the firm’s theory, which are applicable namely to the corporation. Everyone knows corporate scandals with such companies as Enron, WorldCom, Arthur Andersen, etc., which have exposed the existing gaps both in the theory, corporate legislation and the whole system of corporate relations.

It should be noted that the present stage of development of economic science is characterized by a partial merger of the concepts “firm”, “enterprise”, “organization” and “corporation”. The use of this or that term is largely depends not to differences in the object of research, but to the author’s belonging to one or another scientific school. Thus, the “political economists” use the term “firm”, representatives of the economic and mathematical direction use “enterprise”, researchers of the management theory – “organization”, and those who study problems of corporate governance and corporate finance – “ corporation “[6, p.98].

At the same time, D.Pletnev in his publications [6, 7] delimits the investigated concepts. The scientist believes that it is appropriate to talk about a firm where it is a subject of market interaction, decision-making about prices, volumes of sales, assortment. The term “enterprise” should be used in relation to the business unit that produces goods and services. The term “organization” is most accurately describing the interaction of individuals in a hierarchical controlled system. When we consider an institutionally independent business unit, consisting of a multitude of interacting individuals and making independent decisions capable of evolutionary development, it will be more proper to use the term “corporation” [6, p. 100].

Simultaneously the phrase “theory of the firm” is widely used, mainly in relation to the corporation. In fact, the problematics of the studies of most theories concern precisely the firm as a corporation: the “principal agent”, the distribution of property rights, the structure of capital, dividend policy, and so on. A key feature of a corporation as a firm is the delineation of the functions of the owner (shareholder) and the manager. Shareholders, unlike the traditionally understood owner of a company (in the tradition of classical economic theory) are separated from the management of their property. Therefore, there is a contradiction between the managing corporation (top management) and its owners (shareholders). Therefore, most economic theories, especially institutional ones, are applicable namely to the corporation, and not to the firm as a system for converting the initial resources into finished products.

The beginning of the formation of the firm’s security theory rightfully belongs to the period of the monograph publication “Risk, Uncertainty and Profit” published by the American economist F. Nayt in 1921. In his work, the author had distinguished the main categories of security – the concepts “risk” and “uncertainty “. The system connection of the firm and risk was further justified by J. Schumpeter. Risk in Schumpeter’s interpretation is an indispensable attribute of entrepreneurship and a key condition for making a profit, although he rightfully didn’t associate the profit with a kind of peculiar risk premium [4, p.54]. The fruitful ideas of F. Knight and J. Schumpeter remained on the periphery of microeconomic research for a long time due to the dominance of the neoclassical paradigm.

Gradually, with the evolution of economic theory, a look on the firm as a participant in market relations had been also changing. Theories of the firm were replenished and updated along with the development of economic science and economic theory as a whole. A diverse spectrum of company theories had appeared, each of them had been trying to explain the nature of the firm from its position.

Many scientists attempted to classify clearly the company’s theories in modern economic literature. It is pertinent to single out the studies of E.Popov [8], L.Saakova [9], R.Gibadulin, I.Mardanova [10], who summarized the theoretical approaches and compared them. I. Blank [11] also considers models of the target function of the enterprise through the prism of modern concepts of the theory of the firm. Kleiner carried out a profound and valid criticism of the existing concepts of the theory of the firm in his papers [12, 13].

In general, theories explaining the nature of the firm are usually divided into two groups: fundamental and applied. Fundamental theories in turn are also divided into two groups – institutional and alternative. Applied theories consider separate functional directions of the company’s development (marketing, finance, manufacturing, organization of management and entrepreneurship).

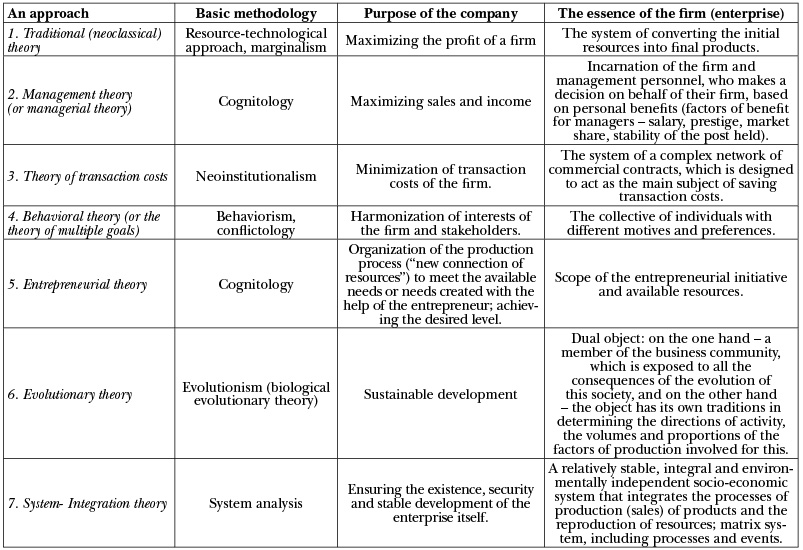

Existing classification allowed distinguishing certain weighty theories from the point of view of formation of the target indicator of the firm’s activity. Herewith for each chosen theory is characteristic of its own vision of essence of the enterprise. The results of the author’s study are given in Table 1.

As can be seen from the data in the table, the target security indicator of the firm is not separately identified in any theory. In fact, in economic theory, issues of security, survival, and profit maximization are considered together. This is justified by the fact that in business there is no profit without risk and there is no point in considering them separately from each other. It is considered that it would be foolish to call someone’s decision “profit-maximizing” if it increases the risk and uncertainty so much that the chances for survival become slim to none. The idea of long-term profit assumes taking into consideration of all risks and losses.

Nevertheless, there is an urgent need to study security as a separate economic category. The evidence to it is the huge number of publications devoted to this topic.

In general, the analysis of economic literature allows us to conclude that, despite a deep empirical study of certain aspects of the theory of the firm, there is a multiplicity of ambiguous approaches in this issue. At the same time, there is an objective need to create a systematic vision of a company development strategy, which develops in conditions of high level of uncertainty and risks of economic activity.

Investigating the essence of the security of a corporation cannot be based only on one of the considered approaches of the firm’s theory and their symbiosis is required. In fact, the development of scientific ideas about the security of a firm can be viewed as an evolutionary superposition of various research directions, partially overlapping, mutually adaptive, having comparative advantages in the field of methodology, but not providing a systematic understanding of this most complex phenomenon.

Table 1. The objective function and the essence of an enterprise in the theories of the firm

Note: * – data is formed based on materials of author’s research.

In recent years, the system-integration theory of the firm (the founders – J. Kornai [21], G. Kleiner [12]) has received a special development (Table 1). The main aim for the development of this direction is to solve the problem of integrating various approaches in the theory of the firm. Simultaneously they are viewed not as opposing, but as complementary, allowing a multidimensional disclosure of the essence of the theory of the firm and its content within the framework of ensuring the safety of business processes. Therefore, it is advisable to carry out further research into the problem of corporate security precisely from the point of view of the system-integration theory of the firm.

In this regard, as the basis for an integrated approach to assessing the effectiveness of the company, the concept of financial architecture, first proposed in 1999 by S. Myers [1], was developed. The company’s architecture covers three key structures – capital, property and corporate governance. They exert a significant influence on investment risks, forming both unique risks of the company and its susceptibility to systematic (market) risks. The last two characteristics – the ownership structure and corporate governance – predetermine methods for reconciling the interests of various types of owners, the regulation of conflicts of interests between owners and management. Apart from that, the risk of non-payment and increasing costs of financial instability directly depends on the structure of capital [2, p.14].

The application of the concept of financial architecture implies focusing on the “design of the company”, or on the dynamic nature of the processes taking place in the modern company. According to S. Myers [1], the study of the financial organization of the company, the methods used in it for adapting to changing conditions in a competitive environment and in the capital market acquires exceptional importance. Therefore, a special role is assigned to financial architecture as a system design, based on which it is possible to build an adequate balance of financial and intellectual capital. The construction of the financial architecture of the company should correspond to the task of creating value for all its strategic stakeholders (stakeholder value added, STVA) and avoidance of the stakeholder risk leading to the loss of intellectual capital components [2].

Conclusion

Understanding the characteristics of the company’s financial architecture is important for the further planning of its operations. One of the elements of such planning, for example, may be forecasting the amount of cross financing between business units of a group of companies. The scheme of organization of financial flows based on cross financing and subsidization takes place in groups of companies with a sufficiently high level of integration of subsidiaries and is typical for groups with a typical financial architecture.

The most important perspective areas for the development of security issues and financial architecture of companies can be directed to the research of companies operating in developed markets, where types of financial architecture are more diverse and interesting from the point of view of strategic effectiveness. Including security into the components of firm’s financial architecture will enable to include into consideration such important and rash issues as cybersecurity, protection from raiding, reliability of the counterparty and other issues that somehow affect the financial stability of a company.

Nina Poyda-Nosyk

PhD, professor of Finance and Banking Department, Uzhhorod National University

References

1. Myers S. Financial Architecture // European Financial Management. 1999. Vol. 5. P. 133 – 141.

2. Ивашковская И.В. (2013) Финансовая архитектура компаний. Cравнительные исследования на развитых и развивающихся рынках: Монография. / И.В. Ивашковская, А.Н.Степанова, М.С.Кокорева — М.: ИНФРА-М, 238 с.

3. Gortseva N. V. (2015) THE FINANCIAL ARCHITECTURE OF RUSSIAN BUSINESS GROUPS /N.V.Gortseva // Kemerovo State University Bulletin . Vol. 1 Issue 2, p.221-225.

4. Королев М.И. (2012) Проблема безопасности в теории фирмы: развитие и противоречия / М.И. Королев// Вестн. Волгогр. гос. ун-та. Сер. 3 «Экономика. Экология», № 1(20), с.53-58.

5. Лукша П.О. (2009) Самовоспроизводство в эволюционной экономике / П.О.Лукша. – СПб. : Алетейя, 208 с.

6. Плетнев Д.А. (2009) Определение понятия «корпорация»: терминологический дискурс в контексте/ Д.А.Плетнев // Вестник Челябинского государственного университета. Экономика. Вып. 18, №2 (140), с.89–100.

7. Плетнев Д.А. (2010) Определение корпорации: энтропия научного знания/ Д.А.Плетнев // Вестник Челябинского государственного университета. Экономика. Вып. 26, № 6 (187), с.20–27.

8. Попов Е.В. (2002) Классификация миниэкономических теорий /Е.В.Попов // Труды всероссийского симпозиума по миниэкономике. Пленарные доклады. – Екатеринбург, Институт экономики УрО РАН, с.145-159.

9. Саакова Л.В. (2010) Сравнительный анализ теорий фирмы и сущность современной корпорации [Электронный ресурс] / Л.В.Саакова // Проблемы современной экономики, №4(36). – Режим доступа: http://www.m-economy.ru/art.php?nArtId=3342

10. Гибадулин Р.Х. (2009) Экономическая теория фирмы предпринимательского типа: генезис и тезаурус/ Р. Х. Гибадулин, И. М. Марданова // Вестник Челябинского государственного университета. Серия «Экономика». Вып. 20, №9 (147), с. 96–100.

11. Бланк И.А. (2004) Управление финансовой безопасностью предприятия / И.А.Бланк – К.: Эльга, Ника-Центр, 784 с.

12. Клейнер Г. Системная парадигма и теория предприятия [Электронный ресурс] /Георгий Клейнер – Режим доступа: http://www.kleiner.ru/arpab/sistemparad.html

13. Клейнер Г.Б. Новая теория экономических систем и ее приложения. [Электронный ресурс] / Г.Б.Клейнер. – Режим доступа: http://www.kleiner.ru/arpab/novteor.html

14. Экономическая стратегия фирмы (1995) / под ред. проф. А. П. Градова. – 4-е изд., перераб. – СПб.: Спец. лит., 959 с.

15. Градов А.П. (2005) Национальная экономика: Уч.пособ./ А.П. Градов /2-е изд. – СПб.: Питер, 240 с.

16. Полонский С.Ю.(2007) Теория корпорации и развитие корпоративной архитектуры: институциональный подход / Под науч. ред. д.э.н., проф. Панибратова Ю.П. – СПб.: Инфо-да.

17. Полонский С.Ю. (2007) Институциональный подход к теории современной корпорации [Электронный ресурс] / С.Ю. Полонский // Проблемы современной экономики, №2(22). – Режим доступа:http://www.m-economy.ru/art.php?nArtId=1356

18. Тамбовцев В.Л. (2008) Стейкхолдерская теория фирмы в свете концепции режимов собственности /В.Л.Тамбовцев //Российский журнал менеджмента, Т.6, №3, с.3-26

19. Акофф Р. (1985) Планирование будущего корпорации /Р.Акофф – М.:Прогресс, 327 с.

20. Freeman R. (1984) Edward Strategic Management: A stakeholder approach. — Boston: Pitman. — ISBN 0273019139

21. Корнаи Я. (2002) Системная парадигма. /Я.Корнаи // Вопросы экономики, №4, с.4-22.

@ WCTC LTD --- ISSN 2398-9491 | Established in 2009 | Economics & Working Capital