How to improve your ERP system – A 3.M theory

Abstract

Research problem:

Every enterprise (regardless of whether it is industrial, agricultural, or is in services) has at least a few unique features in its own accounting information system, as well as in its management support system. On the other hand, general ERP systems are not designed to support these unique accounting features of firms.. These features are mainly found the in decision-support part of information system, and are reflected in data model of information system.

Furthermore, managers continuously have to develop their decision-support information systems.

Methods:

AIT-1, -2 and -3:

AIT-1: General IT solutions that are used in all companies.

AIT-2: Tested solutions applied in various firms/economic entities.

AIT-3: IT systems and solutions that are only needed at the given firm/economic entity, and are therefore unique and completely specific to that entity.

Contribution to the literature:

There are always three data-models present when designing application development schemes for accounting information systems:

1.M: The data model for a decision support information system defined by long-term strategic goals

2.M: The data processing model used so far

3.M: The data model of the bought or adopted information system.

As such, one must be very careful when changing the decision-support information system of one’s firm. These statements are supported by 28 years of research and experience at 24 different firms.

1. Introduction: subject of the research

What are the challenges that managers of industrial, agricultural, and service companies have to face when developing their information systems? Having researched management information systems (MIS) for 29 years, and knowing the accounting information system of 24 firms, I can say that it is always the specialties of their information systems that are the most important from a management viewpoint.

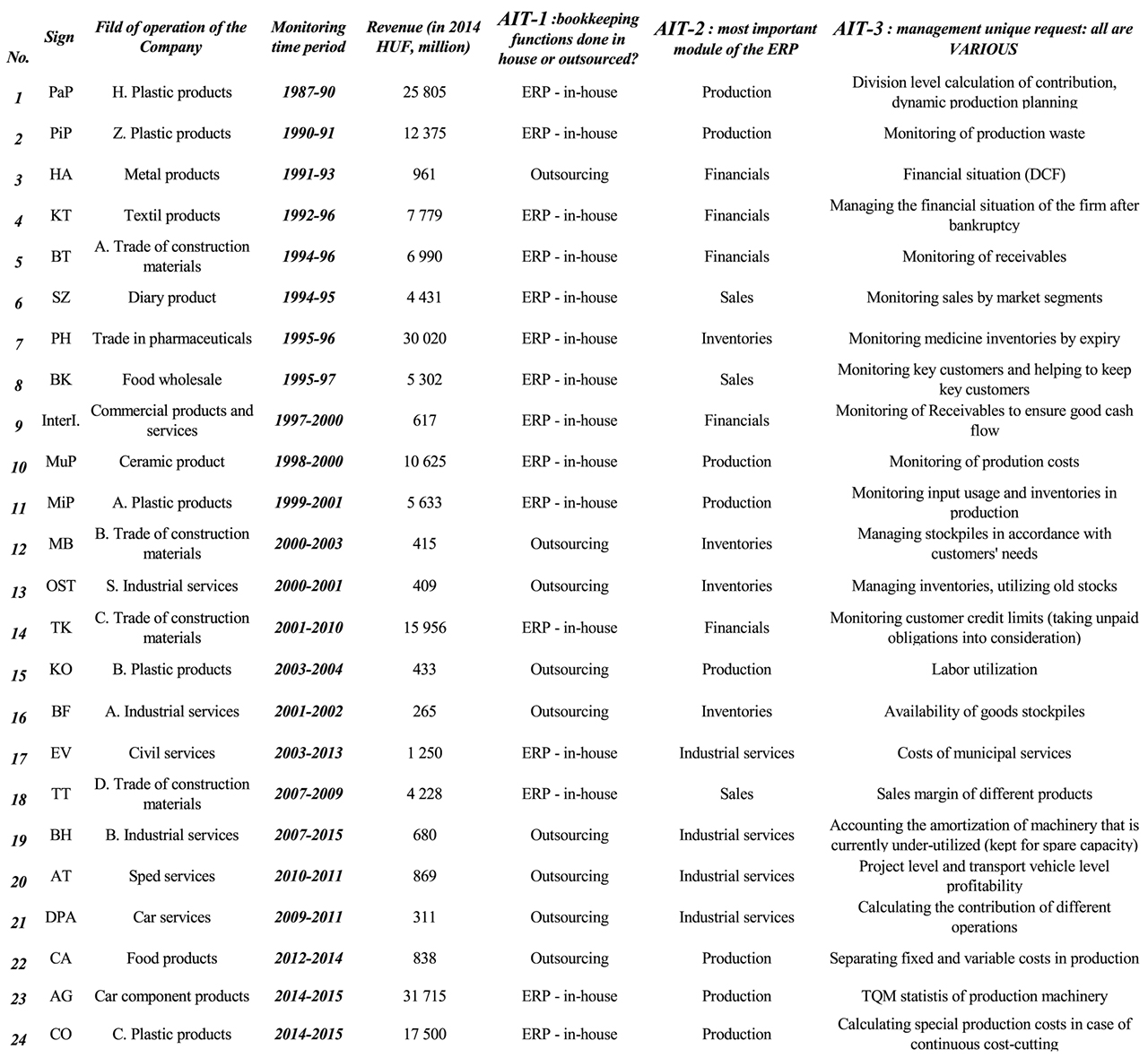

To carry out their management tasks, managers need a lot of information, for example about the company’s assets, capital, resource utilization, financial situation, and so on (Fabricius, 2011; Körmendi-Tóth, 2002; Sinkovics, 2010). The following table presents some details from the research that are useful for understanding the similar and different information needs of the management in case of different business entities, Table 1. (Ceginfo, 2015; KSH 2015; TRIUN 2015):

The colours of the 1st table have meaning as follows:

1.1 In the 4th column, AIT-1: this is the basic method of bookkeeping and preparing annual reports. You can only see 2 cases in this column: bookkeeping by outsourcing or by an in-house ERP system.

1.2 In the 5th column, AIT-2: this column shows the most important parts of the companies’ ERP systems (which are related the areas that determine the firms’ success). The 24 companies can be put into 5 categories.

1.3 The 6th column is AIT-3, which contains the most important information requests of the management (at the moment). This information request is the unique and special demand of the management. There are 3 general cases when AIT-3 solutions are needed:

1.3.1 The ERP system cannot answer the management’s unique (data) requests. In this case it is necessary to design a new subsystem.

1.3.2 A new system is introduced, but it cannot provide the appropriate data, or that data is wrong. In this case it is necessary to modify the system.

1.3.3 The management’s information needs change faster than the how the ERP system can be updated (McGrow, 1993).

The following examples can help understand the three cases above:

“BH” – Industrial services in the 19th row of table 1:

(An example to 1.3.1) This firm has about a dozen special machines that are used for the maintenance of oil industry equipment. These machines are used intermittently, and therefore careful accounting of their operation is required to adequately track amortisation costs.

“InterI” – Commercial product and services in the 9th row of table 1:

(An example to 1.3.2) This firm got a new ERP system which provided information on the firm’s receivables once a week. This had to be modified immediately, because the management needed daily information about the receivables.

“KT” – Textile products in the 4th row of table 1:

(An example to 1.3.3) During the bankruptcy procedure, the firm needed a new subsystem to track its obligations that were due in 14 days.

The examples above show some special Accounting Information Technology requirements of different firms. Below, we will summarize what one can generally know about AIT (Accounting Information Technology).

Table 1: These are some real life examples of management information requests. Out of the 24 companies

2. Material and Methodology

2.1 Different enterprises (industrial, agricultural, service) have unique characteristics, which also make their accounting information systems needs special, meaning that in the end, every company uses a unique accounting information system (Fabricius, 2011; Körmendi-Tóth, 2002; Sinkovics, 2010; Rappaport, 1986).

2.2 There are 3 basic ways to develop an accounting information system in its entirety, or an essential part of it: in-house development, purchase, and modifying a purchased application to suit the given enterprise’s needs. This last case is the most frequently used way of developing AIT systems (Fabricius, 2011; McGrow, 1993).

2.3 Lastly, The data structure of accounting information systems, in particular the structure (or network) of variables (the columns in the record database, e.g. product code, partner code, etc…) make it so that if an AIT software is used in data registry functions and accounting, then the software must be shaped to the company’s accounting policy itself. Logically, this means if we purchase an ERP system, we also purchase a data model. More precisely we purchase the accounting policy defined by the AIT included in ERP. This is the basic rule of data models: if we purchase an ERP software, we also purchase a specific accounting policy (Fabricius, 2011).

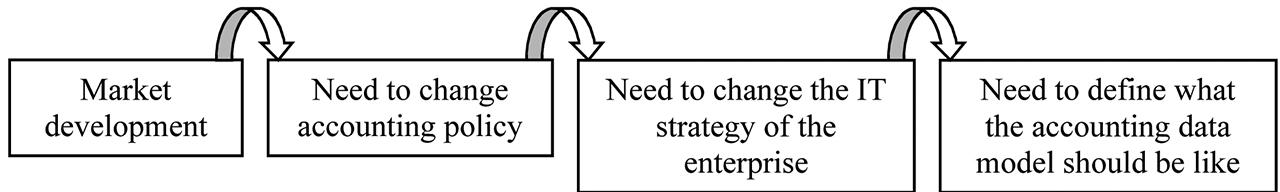

The need to upgrade an accounting system is always brought on by the company adapting to market developments, or by the changing business situation of company. Therefore, there is always a new optimal structure for our AIT system, and there must be an IT strategy to develop the data model of that new AIT system (Fig 1.) (Fabricius, 2011; McGrow, 1993).

Fig 1 A logical way of data model development for AIT

2.4 Different enterprises (industrial, agricultural, service) have unique characteristics (as shown above in the table 1), which also make their accounting information systems unique. Our research confirms the contents of the cited sources in that the specification of the optimal accounting system for firm depends on the following:

2.4.1 The field of operation of the economic entity or firm in question (industrial, agricultural, services, foundations, budgetary organizations, etc…)

2.4.2 Its size (turnover) and number of employees

2.4.3 Ownership (private, public, budgetary)

2.4.4 Organizational culture

2.4.5 Managerial skills.

2.5 For studying the issues related to developing accounting information systems, and based on the table 1, it is useful to divide accounting information technology (AIT) functions into 3 separate groups:

2.5.1 AIT-1: General AIT functions that are used in all companies. These functions are usually included in ERP systems as standard/well known solutions, or templates. Some examples include: creating invoices, online transaction processing, financial accounting, preparation of the accounts, etc…

2.5.2 AIT-2: Tested functions applied in a given group of firms/economic entities (the function being specifically needed by that group), for example: inventory management, FIFO or other stock value calculation, tracking the momentary financial situation of the firm, etc…

2.5.3 AIT-3: AIT functions and methods that are only needed at the given firm/economic entity, and are therefore unique and completely specific to that entity. Examples include: solutions for tracking clients’ credit limit, calculating the cost of municipal services, and solutions for calculating the amortization of assets that are held for security and reserve purposes only, etc….

It is apparent that the economic entities can use the same software solution to cover their AIT-1 needs, while the required AIT-2 solutions vary between a few well-defined categories. All AIT-3 functions are unique, and therefore the solutions used by the companies have to be unique. AIT-3 covers the management accounting and controlling solutions that are related to tracking the MIS/OLAP manager reports, the most important strategic goals and KPI-s (Key Performance Indicator as defined by the management) of the entity (Fabricius, 2011).

The term management accounting usually refers to monitoring and analysis of costs (Fabricius, 2011; Körmendi-Tóth, 2002; Sinkovics, 2010; Horngren, 2008). Table 1 shows that the AIT-3 solutions were related to cost-sensitivity in case of 13 companies out of the 24.

At the same time the management accounting and controlling solutions have to be parcel central part of the whole accounting policy of every firm and economic entity. The accounting structures and connections that fulfil the information need of managerial accounting are called “internal accounting” in the Hungarian accounting context.

Based on all the above, we can state that if market conditions or the company’s business situation change, the accounting policy of the company have to be changed in accordance. However, the information system used to exercise the accounting policy is composed of different parts with different characteristics (AIT-1, -2 -3). Therefore, when developing the ERP system to match the changed accounting policy, the different parts of the information system have to be handled differently.

3. Discussion

In figure 1, we showed the general logic of firms’ IT development. The result of this development is a data model definition that is adequate for the new accounting policy – that is, adequate in light of market changes or a new business strategy (1.M). In case of a regular accounting information system upgrade, the above listed components mean that while we are working on the customization of the purchased software, we have to consider which IT solution fits which accounting policy, and (allowing for possible compromises), which is the exact data model – accounting policy – that should be implemented? Is it the data model used for reaching the firm’s business goals (according the business strategy, 1.M), or the data model and accounting policy used so far (2.M)? Are we using it with the data model of the purchased ERP (3.M)? In the optimal case we are using the data model that matches our new business goals and accounting-information strategy (1.M).

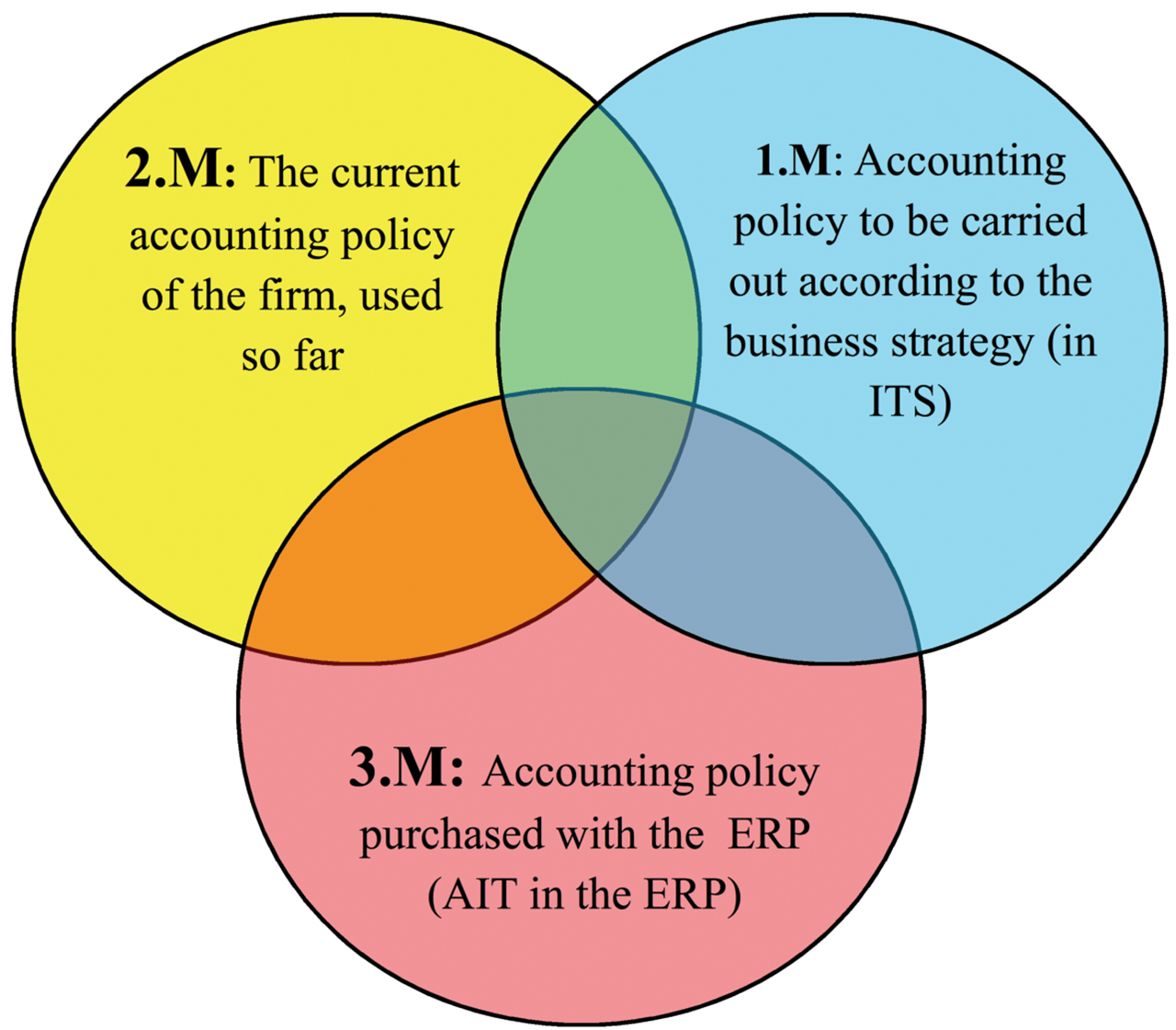

To see clearly, we need a model that approaches systems development from a unique perspective; one that encompasses the 3.M syndrome (Fig. 2):

3.M Syndrome in Information Technology:

There are always 3 data models present during the design and development period of accounting information systems:

1.M: The data model of the accounting policy laid out by the IT Strategy of the company (hereafter: ITS)

2.M: The current data model used so far

3.M: The data model of the purchased or adopted information (sub-)system(s).

4. Conclusions

During the management of IT systems innovation and development, we have to be aware that there are 3 models present; and we also have to ask ourselves the following: out of the three directions of 3.M, in which does the chosen IT solution shift the accounting information system under development? If we are not careful with the roll-out of the ERP, only the small intersection of the three sets (1.M, 2.M and 3.M) will be utilizable in the new accounting system.

It is prudent to attach two examples (4.1, 4.2) to the above reasoning. These examples will help understand the 3.M model, and show that the inappropriate handling of systems development affects different accounting functions to differing degrees.

4.1 In case of AIT systems operating with many templates (that is, well known and structured algorithms and/or data model solutions (Fabricius, 2011; McGrow, 1993), we can be sure that the pre-development program used the same models as the current one, and a new IT Strategy will not require new models. These system-parts include those of financial accounting, cash-desk management, and invoicing; these are clearly functions of the accounting system that fall into the AIT-1 or AIT-2 category.

Fig 2 The 3.M Syndrome in introducing software systems is essentially a triple mind-split of accounting policies. If we are not careful, only the small intersection of the three sets will be utilizable in the new ERP system

4.2 It is less clear whether the purchased accounting method will fit (that is, whether data models will match) in case of special functions of our firm’s AIT (AIT-3).

Purchasing an ERP system is the most problematic in case of management accounting and controlling issues; that is AIT-3 functions. Since these are the accounting areas where we can find the most company/institution specific characteristics (that is, special AIT solutions), they are the ones most threatened according to the framework of the 3.M syndrome. This is because the purchased ERP system comes with its own data model, and therefore, it is made for one specific accounting policy. By buying this system we buy the accounting policy, but this received accounting policy will not be suitable for the specific management accounting and controlling needs of our own company.

5. Overview of the 3.M syndrome in case of purchasing and introducing a complete program:

Nowadays, in case of the innovation of a general ERP module based accounting system, the following data models/accounting policies are on the table:

5.1:

1.M: This is the data model of our new, envisioned information system (according to our IT Strategy, hereafter referred to as ITS). If our implementation of the new IT system was done according to the recommendations of systems development methodologies such as SSADM (McGrow, 1993), then it must have been described and defined by our Requirement-Specification (Fabricius, 2011; McGrow, 1993). If this is not so, we are in a difficult situation, as our company’s expectations about the new accounting information system do not even exist on paper, while it already has two other existing data models in place (2.M, 3.M). The first is 2.M, as old system functions are present even though we want to modify them, and secondly the system to be purchased is built on the chosen ERP system (3.M) – see some notes below.

5.2:

2.M: This is the accounting policy that was used up to the present. We assume – and this is true for all accounting policies (data models) – that accounting tasks were partly done manually, and partly electronically. In general we can say that after implementing a new system, the ratio tasks carried out electronically will increase; however, we have to make sure that this actually benefits the management and the accounting staff.

5.3:

3.M: The ERP system to be purchased (which hopefully has not yet been paid in the preparatory period) obviously has its own data model, and with it, the program will define a sort of accounting policy. Also must have been a data model which hopefully have been documented according to SSADM standards (McGrow, 1993). In connection with this, we should remember the following:

5.3.1 If there is no IT Strategy and Requirement-Specification (that is, our concept is not finalized) upon the purchase of the complete ERP system, we simply get the data model that is available, or the one used at former applications. This statement is also true in the form that for those accounting areas where we have concrete, definitive desires for the new accounting policy in the IT Strategy, implementation will be easier. For areas where we do not have these definitive needs, we are “lost”: the accounting policy that will prevail will be the one brought along with the program.

5.3.2 All ERP systems have flexibility: this allows for customization. However, this flexibility is to our benefit if and only we have the Requirement-Specification (which is based on the IT Strategy) to direct the customization. Optimally, this should be done before actually paying for the new ERP system.

5.3.3: The required customization is done by the software companies: if they have a version of the system with similar parameters, they will of course bring that to our company, as it is in their interest also that there only be a minimal amount of modification required. Obviously, this will facilitate customization efforts only if we can compare that particular software version to the needs that are defined by our Requirement-Specification, and they match.

5.3.4: We have mentioned that the risk of data models being incompatible is the highest in case of AIT-3, that is, special accounting fields such as Controlling and Managerial Accounting, as these solutions are the most diverse across companies. This problem manifests mostly in case of decision-supporting information systems, as well as in case of special fields as production or resource management.

6. Advices and Notices

We should make four other important notes concerning the 3.M Syndrome (6.1 – 6.6.):

6.1 The worst imaginable scenario is if we or any other parties involved in the implementation of a new system are not aware of the existence of the 3.M phenomenon.

6.2 The roll out of the software, training and customization must not be done at the same time (not even two of them). The reason for this is that if they are done simultaneously, participants will not be able to distinguish between tasks, and the 3 Models will mix. If rolling out, training, and customization happened at the same time, we would have to pay special attention to the separation of the 3 Models at all time. If a user made a query or a developer modified the settings, they would have to be aware of which model they are acting based on: the previous reporting model, the desired (IT Strategy) model, or the one the software company brought. In case of the operating staff, it is hard to imagine that they studied the information strategy, or are well-versed in systems-organization – they will be looking to implement the practices they have established while using the previous system. Similarly, the programmer of the software will focus solely on configuration and issues regarding future maintenance needs.

6.3 The most sensitive and complicated field is AIT-3 solutions in Managerial Accounting systems: without extensive preparation, it is impossible to actually realize the concepts and needs of the management.

6.4 We cannot really blame the software company for not effectuating the concepts laid out in our enterprise’s IT Strategy and Requirement-Specification: they do not know our exact desires or the needs of the management, and neither is it their areas of expertise.

If the Dear Reader has just been part of an information system development project, they can now, having read the risks associated with the “triple personality split” that is the 3-M phenomenon, easily assess whether the issues described here apply to them. If the Dear Reader experiences that after having completed the implementation of a new accounting software system or ERP, tasks take longer, need more labour, are more expensive, or the program does not even do what it is supposed to, than the unfortunate situation is that the new data model does not match the conceptualized accounting policy. The accounting system is suffering from a personality split. Being aware of the 3.M syndrome helps avoid the emergence of such a schizophrenia of IT systems.

References

Book:

0(1) Fabricius-Ferke Gy. (2011): IT for controlling & managerial accounting. CompLex Press Ltd, Budapest.

0 (2) Gábor A. (1997): Információ-menedzsment. Aula Kiadó Kft, Budapest

0 (3) Horngren, C.T – Sundem. G.L – Straton, W. O. (2008). Introduction to Management Accounting. A Pearson Education Company. New York, USA,

0 (4) Horváth & Partner. (2001): Controlling – The way to an efficient controlling system. KJK Judiciary & Business Press Ltd, Budapest.

0 (5) Kaplan, R.S.- Atkinson, A.A. (2003): Vezetôi üzleti gazdaságtan haladó vezetôi számvitel. Panem, Budapest.

0 (6) Kaplan, R.S. – Cooper, R. (2001): Költség & Hatás. Panem-IFUA Horváth & Partner, Budapest

0 (7) Körmendi L, Tóth A. (2002): Scientific approach to controlling and its application. Perfekt Press Ltd, Budapest.

0 (8) Laáb Á. (2010): Vezetôi számvitel – módszertani füzetek. CompLex Press Ltd, Budapest

0 ( 9) McGrow, Hill. (1993): Software System Development. The McGrow-Hill Companies, New York

(10) Rappaport, Alfred. (1986): Creating shareholder value: The new standard for business performance. Free Press, New York

(11) Sinkovics A. (2010): Corporate financial planning. CompLex Press Ltd, Budapest

(12) Tomcsányi P. (2000): Általános kutatásmódszertan. Szent István Egyetem, Gödöllô

(13) Tóth E. (2008): Döntéstámogató rendszerek. Panem, Budapest

(14) Witt, F.J – Witt, K. (1994): Controlling a kis és közép-vállalkozások számára. Springer-Verlag, Budapest

Internet:

0 (8) Ceginfo (2015). www.ceginformacio.creditreform.hu/ 2015.08.28. 16:30.

0 (9) KSH (2015). www.ksh.hu/docs/hun/xstadat/xstadat_eves/i_qsf001.html. 2015.08.17. 16:34.

(10) TRIUN (2015). www.triun.hu/adatlap/ 2015.08.28. 19:03.

@ WCTC LTD --- ISSN 2398-9491 | Established in 2009 | Economics & Working Capital