Conscious consumer behavior in the world of cryptocurrency II part

Data analysis continue

similarly, we asked respondents, if cryptocurrency is advantageous for economic sustainability since it is comparatively protected from continuous changes of inherent value, which protects the economy from the financial crisis and economic regressions. Nearly 38.5% of the respondents asserted that cryptocurrency is advantageous for economic sustainability, 10.1% of the respondents strongly agreed, 11% of the respondents disagreed, 3.7% of respondents strongly disagreed, and 36.7% of the respondents were neutral.

The agreement of nearly 48.6% of the respondents in favor of cryptocurrency, fostering economic sustainability, shows that consumers have a positive insight the cryptocurrency, showing an increased inclination of the consumers toward cryptocurrency. The system of cryptocurrency eliminates the possibility of a single point of failure, which is very common in banks and a leading cause of disruption of financial systems, leading to economic regression. Therefore, the use of cryptocurrency is comparatively safer, as it eliminates the possibility of financial breakdown and fosters the process of economic sustainability. Hence, we can hypothesize that.

Cryptocurrency is highly beneficial for stabilizing the financial structure, and for fostering economic sustainability since it protects the economy from both financial crises and economic regressions by keeping the inherent value intact.

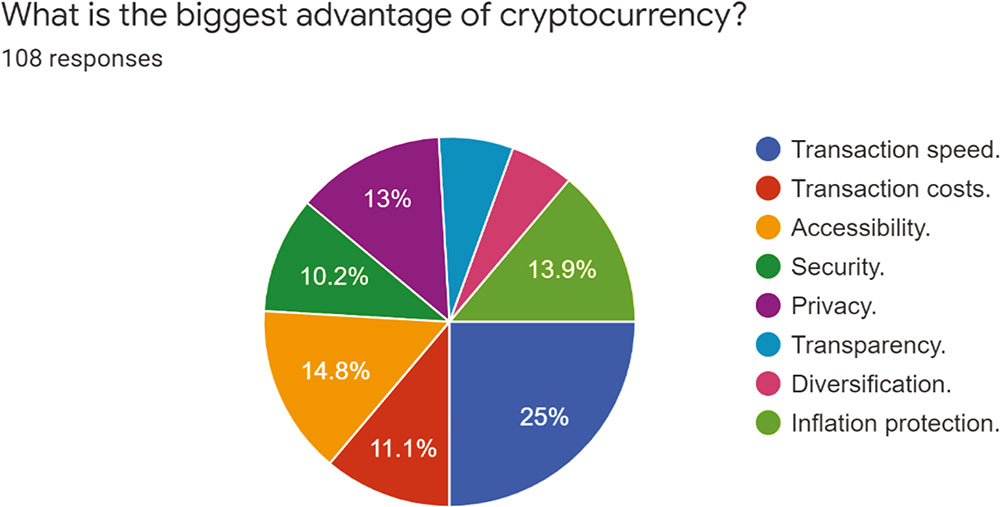

Evaluating the conscious consumer behavior in the world of cryptocurrency, we further asked respondents, that what is the biggest advantage of cryptocurrency according to them. 25% of the respondents, which incorporated 25 people asserted transaction speed, 13.9% of the respondents who incorporated 15 people asserted inflation protection, 14.8% of the respondents who incorporated 16 people asserted accessibility, 13% of the respondents who incorporated 14 people asserted privacy, 10.2% of the respondents who incorporated 11 people asserted security, 6.5% of the respondents incorporated 7 people asserted transparency, 5.6% of the respondents, incorporated 6 people asserted diversification, and 11.1% of the people asserted transaction costs.

Hence, this data obtained is quite multidimensional and shows that cryptocurrency offers more than one advantage, which collectively makes it a very intact currency. Reviewing the literature, the significance of cryptocurrency primarily lies in the independence of the mechanism that it uses for the transaction of money, primarily independent of the centralized intermediaries including financial institutions, independent of these institutions to implement regulations that somehow impede the autonomy and sovereignty of the users. This results in increased confidence and trust of users, which operate the entire system with the assistance of developers, and algorithmic combinations using the system to execute the operation by themselves, through increased automation leading to increased privacy, security, and transparency.

Furthermore, cryptocurrency facilitates the process of sending and receiving funds between two various parties, by using algorithms, and blockchain, without the need for physical presence or any meeting, but all the matters can be resolved virtually, without the assistance of third parties and banks. Hence, this has largely increased the efficacy and effectiveness of online transactions, which are not only highly effective but also highly secured, through the use of public keys and private keys, and various other forms of incentives including proof of work which is also typically known as proof of stake resulting in accessibility. And since cryptocurrency explicitly operates between two parties, therefore it is much faster compared to the transfer of fiat currency, which primarily incorporates three parties, and hence takes more time. resulting in increased transaction speed. Similarly, cryptocurrency can be integrated into the fiat currency as an intermediary currency, streamlining money transactions across borders. In this process, the fiat currency is transformed into a cryptocurrency, principally a bitcoin, and then is later transacted across borders, and then is again converted into the fiat currency of the place of arrival.

This method has been very significant since it allows the users to receive and send money effectively, with increased reliability, security, transparency, and convenience, streamlining the entire process of money transfer, and achieving the whole process economically resulting in the stabilization of the financial structure. Moreover, reviewing the literature, cryptocurrency can be highly useful for generating profits, and large sums of revenue since cryptocurrency markets have been flourishing over the last two decades, rising constantly over the past years, and consequently is attracting the attention of investors. Hence, cryptocurrency withholds numerous opportunities for both stakeholders, businesspersons, and investors, which can lead to an administered control of inflation (Nelson, 2018).

Hence, based on data obtained, and the literature review, we can assert that cryptocurrency offers numerous advantages, which all collectively contribute to economic sustainability. Hence, based on our assertion, we can hypothesize that,

Cryptocurrency offers a set of benefits to the users, which primarily include increased transaction speed, accessibility, protection from inflation, privacy, decreased transaction cost, security, transparency, and diversification, all contributing optimally to the stabilization of the financial structure, and the attainment of economic sustainability.

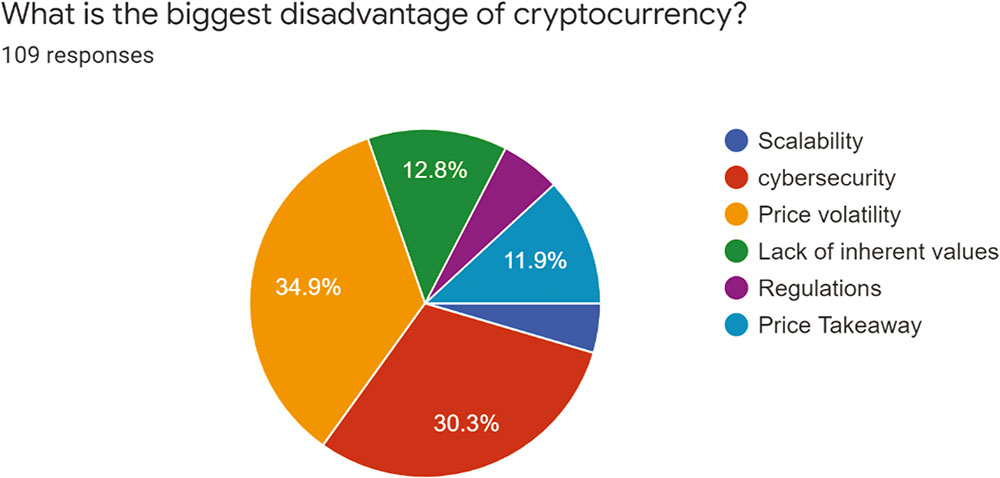

Similarly, we asked respondents about the disadvantages of cryptocurrency, since cryptocurrency is not regulated and monitored by any federal institution or bank, therefore, several strategic problems can arise with it. Nearly 34.9% of the respondents who incorporated 38 people asserted price volatility, 30.3% of the respondents who incorporated 33 people asserted cybersecurity, 12.8% of the respondents who incorporated 14 people asserted lack of inherent value, 11.9% of the respondents who incorporated 13 people asserted price takeaway, 5.5% of the respondents who incorporated 6 people asserted regulation and 4.6% of the respondents who incorporated 5 people asserted scalability.

Hence, this demonstrates that cryptocurrency has predominantly been associated with numerous disadvantages, which are either because of the unregulated structure of cryptocurrency. First of all, scalability, which is probably a very significant disadvantage of cryptocurrency, is a result of the scaling that is posed. And as cryptocurrency is adopted throughout the world, the tokens are allocated at an increased rate, and problems of scale are posed. Furthermore, cybersecurity through leads to increased security, by using blockchain and algorithmic combinations, but still are volatile to cybersecurity breaches, leading to security attacks, and hence stealing of the data, and important information. This is evident from numerous attacks and scams, which have resulted in the loss of millions of dollars. For instance, one of the cryptocurrency attacks led to the stealing of 473 million USD. Furthermore, it has been asserted by economists that cryptocurrency is quite secured, which is because of the cryptographic combinations and blockchain technology, but some crypto repositories are not secured such as mechanisms of wallets and exchanges, which can be hacked through a sustained effort, resulting in the stealing of some specified coins, which can be millions of dollar’s worth.

Similarly, cryptocurrency has also become a significant tool for criminals, which is used by them for illegal activities, primarily associated with black money, such as money laundering, corruption, and terrorism. Cryptocurrency is also widely used by drug sellers on the dark web, for selling drugs, and other illicit products, and services. Furthermore, cryptocurrency is an unspecified form of transaction, which is executed anonymously, by pseudonymous people. However, the digital datasets incorporated in these transactions are evaluated by intelligence institutions, which leads to the possibility of the tracking of financial transfers of money by the common people, as investigated by federal institutions. Similarly, cryptocurrency is also widely used by hackers for stealing private data and important data, using it for performing ransomware activities. Likewise, cryptocurrency has been found to centralize money, though it is a decentralized form of currency, it still, prompts the accumulation of money to a specified class of people, making it a concentrated form of currency. Another significant disadvantage of cryptocurrency is that it can be operated by anyone using simply a computer and internet connection.

However, this mining of the cryptocurrency requires a large amount of energy which in turn requires large costs as well as unpredictability, resulting in the concentration of mining primarily among multinational companies, which leads to the increasing revenue of these companies, with the accumulation of money. Another significant disadvantage of cryptocurrency is that it largely suffers from volatility, and consequently, its value changes constantly, surging immediately at times and then falling after sometimes, which can disturb the economic cycle, leading to the disturbance of the economic structure of the complete world. This is evident from the fact that the market of cryptocurrency fluctuated, rising to more than 17,738 USD in late 2017 and then falling to 7575 USD in early 2018, showing a rapid change in the world of cryptocurrency. Hence, cryptocurrency is also referred to be a transient currency, which is rather short-lived or a speculative bubble as asserted by economists.

Hence, based on the data obtained and the literature, it is indicated that cryptocurrency is associated with various disadvantages that somehow impede the attainment of economic sustainability. Hence, based on the data, we can hypothesize that,

Cryptocurrency has some major disadvantages which largely hinder the strategic process of attaining economic sustainability, and include scalability, cybersecurity, price volatility, lack of inherent values, regulations, and price takeaway.

Furthermore, we asked respondents if cryptocurrency is more secure and transparent as compared to fiat currency, nearly 33.3% of the respondents who incorporated 36 people agreed, 13% of the respondents who incorporated 14 people strongly agreed, 38.9% of the respondents who incorporated 42 people were neutral, 11.1% of the respondents who incorporated 12 people disagreed, and 3.7% of the respondents who incorporated 4 people strongly disagreed.

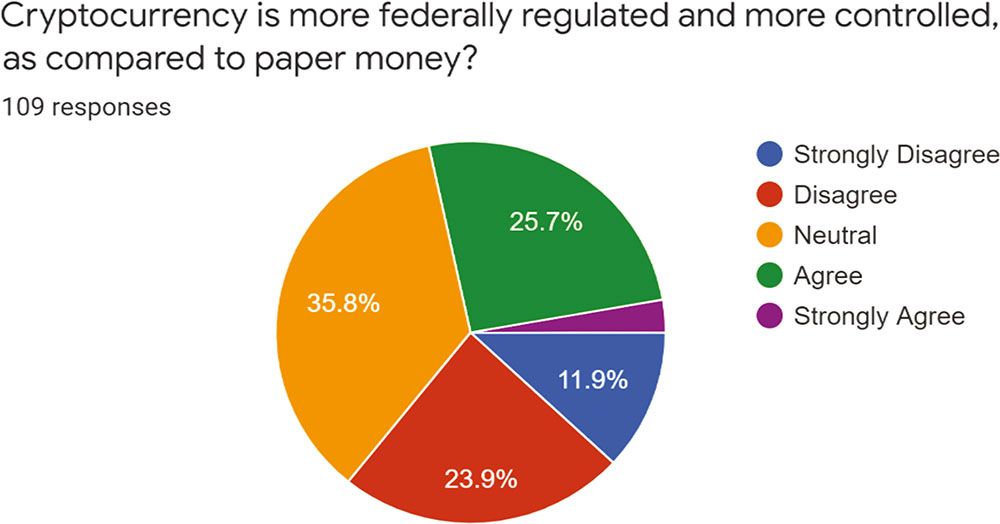

Cryptocurrency, on the other hand, is a bank-free method, that does not depend on any bank or any intermediary to transfer goods and services, and since it is used in the virtual markets, and is not regulated by the federal banks, since these currencies are not coherent with the financial regulations as implemented by the government. And though cryptocurrency is more beneficial for the parties involved in the exchange of goods and services, it allows for increased transparency and increased security among them, leading to increased confidence. However, the lack of financial inclusion poses a threat to the economic structure of a country, which results from the lack of administrative control over decentralized currency, allowing it to be used for illegal purposes, and corruption. Hence, decentralized digital currency can disrupt the financial structure, leading to the imbalance between economic growth and monetary regulations, as imposed by the federal banks. Hence, based on the data obtained, 28.5% of the respondents agreed that cryptocurrency is more regulated compared to fiat currency, however, 35.8% of the respondents disagreed. Hence, both literature and the data obtained, demonstrate that cryptocurrency is less regulated compared to fiat currency. Hence, we can hypothesize that,

Cryptocurrency is comparatively less regulated or unregulated than fiat currency, as no third party or intermediary is involved in the exchange of cryptocurrency, which is primarily a federally-authorized financial institution or a bank.

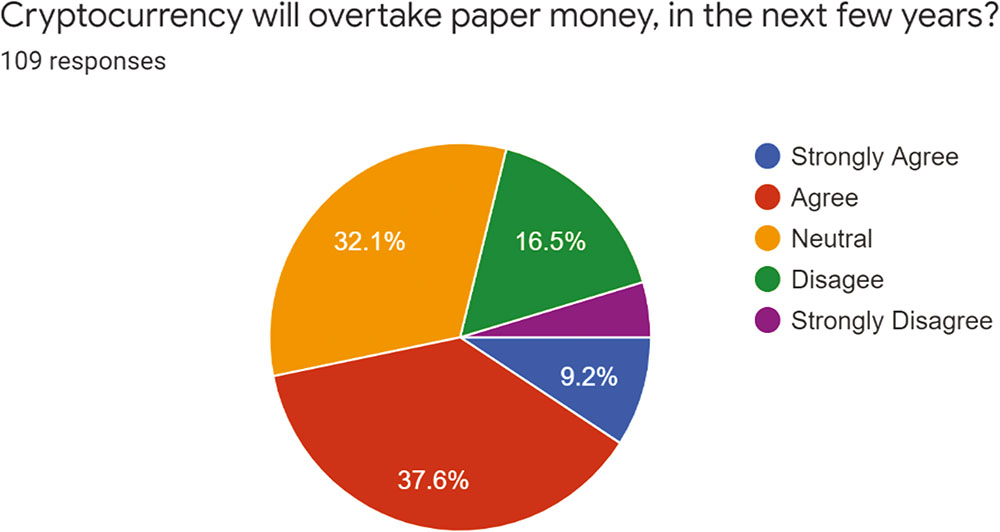

Similarly, we asked respondents if cryptocurrency will overtake paper money in the next few years, nearly 37.6% of the respondents who incorporated 41 people agreed, 9.2% of the respondents who incorporated 10 people strongly agreed, 32.1% of the respondents who incorporated 35 people were neutral, 16.5% of the respondents who incorporated 18 people disagreed, and 4.6% of the respondents who incorporated 5 people strongly disagreed.

Hence, the agreement of 46.8% of the respondents, and the disagreement of 21.1% of the respondents, demonstrate that the consumers believe that cryptocurrency has the potential to become an accepted medium of payment in the next few years, which shows that cryptocurrency is more powerful and more incorporated, compared to paper money. Hence, we can hypothesize that,

In the next few years, cryptocurrency will overtake paper money, becoming the most prevalent medium of payment, since consumers are more inclined toward cryptocurrency.

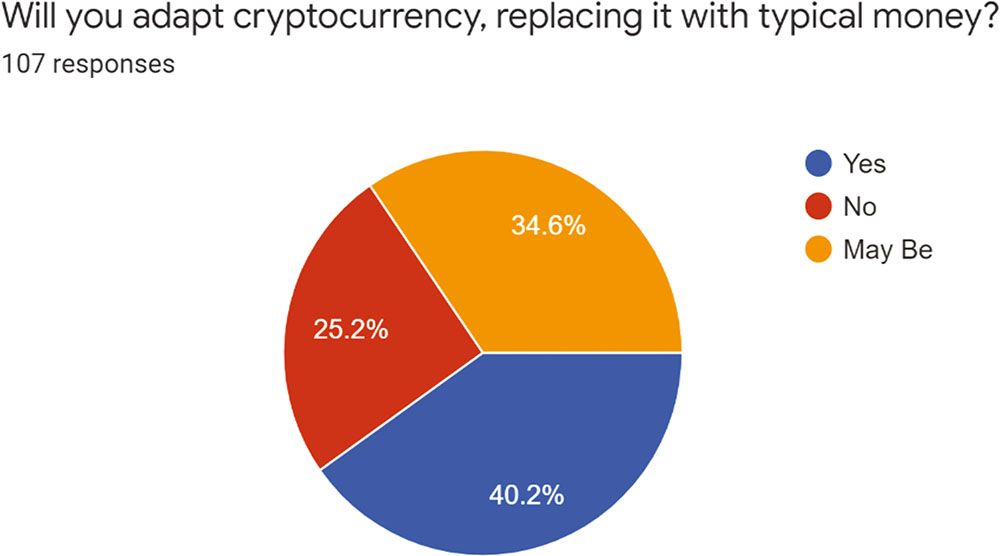

Furthermore, we asked respondents, if they will adopt cryptocurrency, replacing it with typical money, nearly 40.2% of the respondents asserted that they will replace it with typical money, 25.2% of the respondents asserted that they will not replace it, while 34.6% of the people were neutral.

Hence, based on the data, it can be hypothesized, Consumers are inclined towards cryptocurrency, and will adapt and execute it as a medium of payment, in the future, ruling out the typical money.

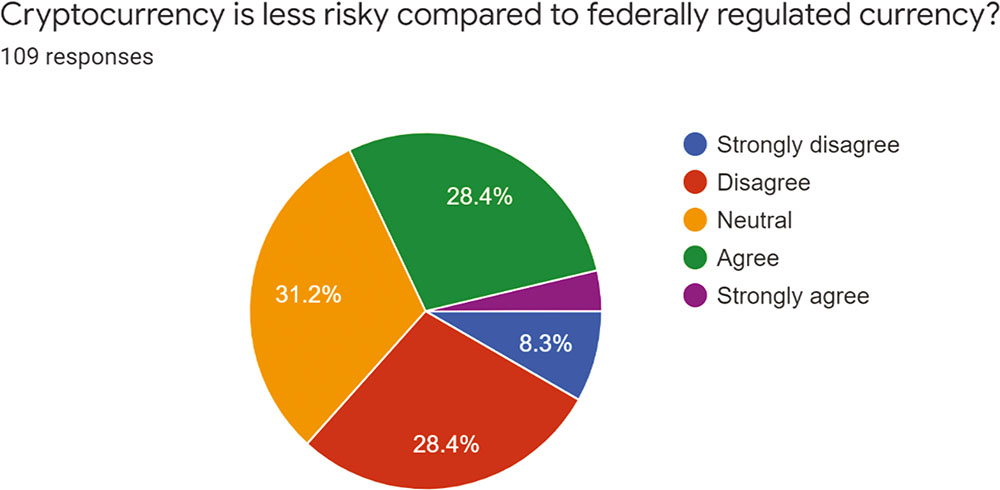

Similarly, we asked respondents if cryptocurrency is less risky compared to the fiat currency or federally generated currency, nearly 28.4% of the respondents who incorporated 31 people agreed, 3.7% of the respondents who incorporated 4 people strongly agreed, 31.2% of the respondents who incorporated 34 people were neutral, 28.4% of the respondents who incorporated 31 people disagreed, and 8.3% of the respondents who incorporated 9 people strongly disagreed.

The disagreement of 36.7% of the respondents and agreement of 32% respondents somehow points towards the increased risk of cryptocurrency compared to the federally generated currency. This is also demonstrated by literature. Cryptocurrency, as asserted by researchers, is a significant tool for criminals, which is used by them for illegal activities, and by drug sellers on the dark web, for selling drugs, and other illicit products, and services. Cryptocurrency is also widely used by hackers for stealing private data and important data, using it for performing ransomware activities. Furthermore, cryptocurrency somehow disrupts the balance in the economic system, leading to a specified concentration of money as it can be operated by anyone using simply a computer and internet connection. Moreover, cryptocurrency largely suffers from volatility, and consequently, its value changes constantly, surging immediately at times and then falling after sometimes, which can disturb the economic cycle, leading to the disturbance of the economic structure of the complete world. Cryptocurrency, as asserted by researchers, is a significant tool for criminals, which is used by them for illegal activities, and by drug sellers on the dark web, for selling drugs, and other illicit products, and services. Cryptocurrency is also widely used by hackers for stealing private data and important data, using it for performing ransomware activities. Furthermore, cryptocurrency is an unspecified form of transaction, which is executed anonymously, by pseudonymous people. Hence, based on the data obtained and literature reviewed, it can be implied that cryptocurrency is somehow riskier compared to fiat currency. Hence, we can hypothesize that,

Cryptocurrency, as a result of price volatility, security breaches, lack of inherent value, and cyber crime is riskier than fiat currency or federally regulated currency.

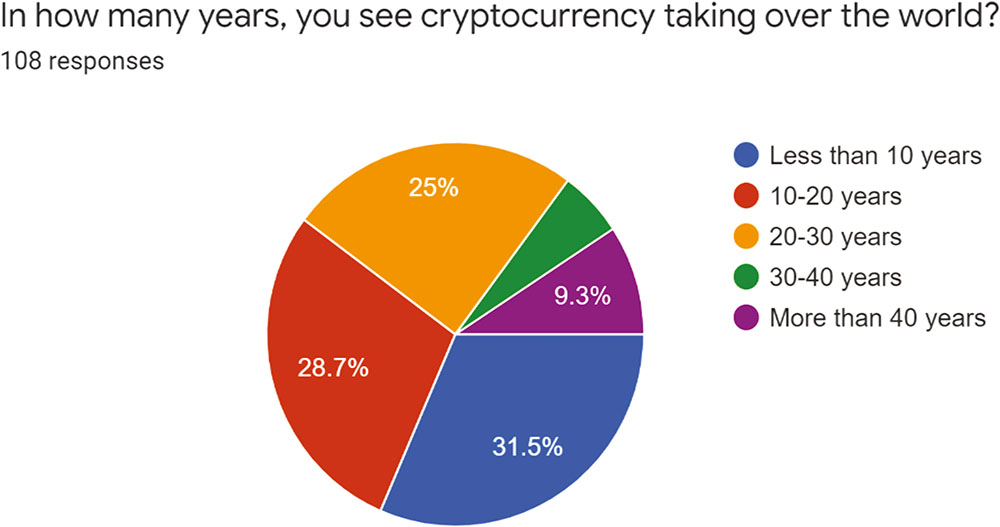

Similarly, we asked respondents in how many years they see cryptocurrency taking over the world, nearly 31.25% asserted that in less than 10 years, 28.7% asserted 10-20 years, 25% asserted 20-30 years, 9.3% asserted more than 40 years, and 6.5% asserted 30-40 years.

As mentioned, that the market of cryptocurrency has been constantly growing since its inception in early 2008. The total revenue generated by the cryptocurrency market in 2010 was less than 1 billion USD, however, in 2015, it increased to more than 4.59 billion USD, which further increased to more than 773 billion USD in 2018, 2555 billion USD in May 2021, which rapidly rose to 3048 billion USD in November 2021, which depicts the continuously and increasingly increasing growth of the cryptocurrency market, demonstrating the large potential that the industry holds in the future. And besides the growth of the collective cryptocurrency market, the individual types of cryptocurrencies are also gaining momentum, receiving attention all across the world. This can be demonstrated by the fact that Bitcoin is valued at more than 862 billion USD in the crypto market, which is considered the beginning of the era of digital currency.

Hence, this shows that soon cryptocurrency will take over the world, probably within next ten years.

Similarly, we asked respondents that if they will accept cryptocurrency and adopt it as a medium of payment, nearly 40.2% of the respondents asserted that they will adopt cryptocurrency and will replace it with typical money. Nearly 25.2% asserted that they won’t adopt cryptocurrency, while 34.6% respondents were unsure.

The world of cryptocurrency has generated considerable attention from the people, constantly fluctuating the perception of consumers towards it as the value of these digital assets has changed substantially. And this whole perception of the consumers is principally changed because new consumers are constantly entering the world of cryptocurrency, while some are leaving it.

This is evident from the fact that within one the year 2021, nearly 969.5 million people visited 60 crypto websites all across the world, which was a nearly 200% increase in the audience as compared to 2020. This increase in the number of people resulted in the increased value of cryptocurrency, which was doubled over the years, Bitcoin, reached a value of more than 1 trillion USD in late 2020, despite the pandemic which had disrupted the complete financial receptacle of the world.

The recent data statistics show that consumers have been primarily interested in cryptocurrency, as the investments being made by people have been constantly increasing during the last decade, with the increasing value of the cryptocurrency. Using these statistics, it was found that by December 2021, the total market capitalization of the crypto market was more than 2.21 trillion USD, showing the potential of the market of cryptocurrency. Furthermore, nearly the average trading volume of cryptocurrency was amounted to be 120 billion USD, which demonstrated the constantly growing and constantly flourishing cryptocurrency on a daily, monthly, and annual basis. Heilman and Rauchs used web trafficking and internet data to acquire information on how many people visited various websites of cryptocurrency, how frequently visited these websites, and how much invested in them, giving them a generalized insight into the total number of people leaving the sphere of digital currency, and entering the digital currency. And though all types of cryptocurrencies have been important, 40% of the consumers investing in cryptocurrency invested in bitcoin, which predominantly dominates in the world of cryptocurrency. This is also evident from the fact that during the pandemic when the value of nearly all things fell, the business world suffered socially, and economically, leading to the disruption of the whole economic receptacle.

Hence based on the data obtained and literature reviewed, it can be asserted that consumers are inclined to the use of cryptocurrency, and will adopt it, thereby replacing it with typical money. Hence, it can be hypothesized,

Cryptocurrency has successfully drawn attention of the consumers, who are inclined to adopt and execute it as a medium of payment.

Conclusion and proposals:

The research has analyzed the conscious consumer behavior in the world of cryptocurrency analyzing various facets and parameters of cryptocurrency. Cryptocurrency, the most significant and supreme type of digital currency, is quite similar to virtual currency and is based on a cryptographic framework, which makes it highly secured, and highly protected. Cryptocurrency is primarily a decentralized digital currency since it does not depend on a third party or an intermediary and does not follow any provisions implied by the federal government. Moreover, cryptocurrency s different from paper money since it can only be accessible through the internet by using a computer, mobile, or laptop since these types of currencies are only available in electronic form. Besides, physical appearance or physical attributes, another predominant distinction between paper money and digital money is that digital money can be used to avail services and purchase goods not only across cities, countries but also continents, which makes it the most seamless invention of technology.

It has been asserted by R Grinberg that cryptocurrency primarily lacks physical attributes, or material existence, which is the principal difference between federally generated currency or paper money and digital currency. Paper money is used nearly everywhere, for the exchange of goods and services at international, national, and provincial markets, whereas digital currency is primarily used for the specified markets, which conventionally use an electronic wallet, which can easily access the internet or other networks related to the internet. In other words, physical currencies such as minted money or banknotes are real and definite, showing their physical presence. Moreover, the transactions involving the exchange of these currencies are only possible as both parties involved in the exchange have physical ownership of this paper money. And though the use of cryptocurrency is the same, since both are used to buy various goods and services, the mechanism of how these currencies operate is entirely different from each other. This demonstrates that most people do not prefer cryptocurrency over federally generated currency, which can be associated with numerous facets, including regulatory problems, price volatility, scalability, lack of inherent value, and others. However, a very significant comparison exists here, between the people not using cryptocurrency, and the people preferring cryptocurrency. And based on research, we have found that consumers are largely inclined toward the use of cryptocurrency, which is primarily associated with the advantages of cryptocurrency.

These advantages are offered by cryptocurrency, Cryptocurrency facilitates the process of sending and receiving funds between two various parties, by using algorithms, and blockchain, without the need for physical presence or any meeting, but all the matters can be resolved virtually, without the assistance of third parties and banks. Hence, this has largely increased the efficacy and effectiveness of online transactions, which are not only highly effective but also highly secured, through the use of public keys and private keys, and various other forms of incentives including proof of work which is also typically known as proof of stake. And since cryptocurrency explicitly operates between two parties, therefore it is much faster compared to the transfer of fiat currency, which primarily incorporates three parties, and hence takes more time.

Furthermore, cryptocurrency can be highly useful for generating profits, and large sums of revenue since cryptocurrency markets have been flourishing over the last two decades, rising constantly over the past years, and consequently is attracting the attention of investors. Moreover, cryptocurrency offers independence to the users for the transaction of money, primarily independent of the centralized intermediaries including financial institutions, independent of these institutions implement regulations that somehow impede the autonomy and sovereignty of the users.

This results in increased confidence and trust of users, which operate the entire system with the assistance of developers, and algorithmic combinations using the system to execute the operation by themselves, through increased automation. Similarly, another significant advantage offered by cryptocurrency is that it is currently integrated into the fiat currency as an intermediary currency, streamlining money transactions across borders. Moreover, the system of cryptocurrency eliminates the possibility of a single point of failure, which is very common in banks and a leading cause of disruption of financial systems, leading to economic regression. Hence use of cryptocurrency is comparatively safer, as it eliminates the possibility of financial breakdown and fosters the process of economic sustainability. Similarly, cryptocurrency can be highly useful for generating profits, and large sums of revenue since cryptocurrency markets have been flourishing over the last two decades, rising constantly over the past years, and consequently is attracting the attention of investors. Hence, cryptocurrency withholds numerous opportunities for both stakeholders, businesspersons, and investors, allowing them to earn huge profits as per the demand of the market. Therefore, because of convenience and time-saving, cryptocurrency has the optimal potential to serve as a very productive form of currency in the trading, and other transfers of funds. Hence, cryptocurrency has entirely revolutionized the complete infrastructure of economics, offering numerous benefits to the financial paradigms, leading to the stabilization of the financial structure of the world. Cryptocurrency offers a very unique, yet sustainable paradigm for the increased transparency and increased security of the economic system, using a decentralized system of economy.

However, there are several disadvantages that hinder the integration of cryptocurrency as a generalized and accepted medium of payment for purchasing various goods and availing services. Primarily, cryptocurrency has also become a significant tool for criminals, which is used by them for illegal activities, primarily associated with black money, such as money laundering, corruption, and terrorism. Cryptocurrency is also widely used by drug sellers on the dark web, for selling drugs, and other illicit products, and services. Furthermore, cryptocurrency is also widely used by hackers for stealing private data and important data, using it for performing ransomware activities.

Similarly, cryptocurrency has been found to centralize money, though it is a decentralized form of currency, it still, prompts the accumulation of money to a specified class of people, making it a concentrated form of currency. Furthermore, the cryptocurrency is an unspecified form of transaction, which is executed anonymously, by pseudonymous people. However, the digital datasets incorporated in these transactions are evaluated by intelligence institutions, which leads to the possibility of the tracking of financial transfers of money by the common people, as investigated by federal institutions. Besides, another significant disadvantage of cryptocurrency is that it can be operated by anyone using simply a computer and internet connection. However, this mining of the cryptocurrency requires a large amount of energy which in turn requires large costs as well as unpredictability, resulting in the concentration of mining primarily among multinational companies, which leads to the increasing revenue of these companies, with the accumulation of money. Besides, another disadvantage of cryptocurrency is that it largely suffers from volatility, and consequently, its value changes constantly, surging immediately at times and then falling after sometimes, which can disturb the economic cycle, leading to the disturbance of the economic structure of the complete world.

Hence in review to this literature and the data obtained, following results are obtained,

1. The market of cryptocurrency is yet to flourish and expand since a large number of consumers prefer cryptocurrency over fiat currency, and they’re not using it currently, indicating that these people might switch to cryptocurrency in the future, based on their personalized preferences.

2. Cryptocurrency is highly beneficial for stabilizing the financial structure, and for fostering economic sustainability since it protects the economy from both financial crises and economic regressions by keeping the inherent value intact.

3. Cryptocurrency offers a set of benefits to the users, which primarily include increased transaction speed, accessibility, protection from inflation, privacy, decreased transaction cost, security, transparency, and diversification, all contributing optimally to the stabilization of the financial structure, and the attainment of economic sustainability.

4. Cryptocurrency has some major disadvantages which largely hinder the strategic process of attaining economic sustainability, and include scalability, cybersecurity, price volatility, lack of inherent values, regulations, and price takeaway.

5. Cryptocurrency is comparatively less regulated or unregulated than fiat currency, as no third party or intermediary is involved in the exchange of cryptocurrency, which is primarily a federally-authorized financial institution or a bank.

6. In the next few years, cryptocurrency will overtake paper money, becoming the most prevalent medium of payment, since consumers are more inclined toward cryptocurrency.

7. Consumers are inclined towards cryptocurrency, and will adapt and execute it as a medium of payment, in the future, ruling out the typical money.

8. Cryptocurrency, as a result of price volatility, security breaches, lack of inherent value, and cybercrime is riskier than fiat currency or federally regulated currency.

9. Cryptocurrency has successfully drawn attention of the consumers, who are inclined to adopt and execute it as a medium of payment.

Summary:

The research evaluates cryptocurrency and the conscious consumer behavior about it, thereby analyzing various advantages and disadvantages of the cryptocurrency, and how they influence the behavior of people. Cryptocurrency is a type of digital currency and has evolved as a result of the integration of technology in finance: FinTech, which is the hodgepodge of new technology such as artificial intelligence, robotics, data-driven databases big data, cloud computing systems, machine learning, data-driven marketing, behavioral analytics, and others which largely facilitates the organizations in performing business operations, and in taking effective financial decisions. Digital currencies are an important part of FinTech. Digital currencies as evaluated by JS Hans are a form of currency that is only available and operated in the electronic or digital form and is also regarded as digital money, electronic currency, electronic money, and cyber-cash. Primarily these currencies can only be accessible through the internet by using a computer, mobile, or laptop since these types of currencies are only available in electronic form.

There are two primary forms of digital currencies, including centralized digital currency and decentralized digital currency. The centralized digital currency as evaluated by MD Brodo and AT Levin is a type of digital token, which is essentially issued by the federal bank, and is pegged to the equivalent value of a federal currency. Furthermore, this type of digital currency is regulated and administered as per the federal monetary policies, which are imposed by the federal bank. However, a decentralized digital currency which is also referred to as peer-to-peer money, on the other hand, is a bank-free method, that does not depend on any bank or any intermediary to transfer goods and services. Primarily, decentralized currency is used in the virtual markets, and is not regulated by the federal banks. Cryptocurrency is a type of decentralized digital currency. Cryptocurrency is primarily a decentralized digital currency since it does not depend on a third party or an intermediary and does not follow any provisions implied by the federal government. The operational system of the cryptocurrency is highly effective, as it stores the datasets of each of the coins, by using cryptographic mechanisms, and computerized databases.

In addition to storing the record of each coin ownership, it regulates the record of each transaction, to ensure the safe transfer of coin ownership, and the creation of new coins. Cryptocurrency uses cryptographic techniques, which principally include blockchain and distributed ledger technology, making it nearly impossible for hackers to hack the system, or counterfeit or double-spending the system since these technologies incorporate a disparate and extensive network, which makes it immune from external threats. A blockchain is an extended list of datasets, which are referred to as the blocks, and these blocks are linked together by using mathematical algorithms of cryptography. A blockchain is also evaluated as a digital balance sheet containing the transactional data, which is transcribed and translated across the entire network of blockchain across the computer system. Each of these blocks consists of cryptographic data, which is related to the data of the subsequent block. This data is principally transaction data and a record of time. This transactional data demonstrates the record of each of the transactions, whereas the timestamp is used to keep the record of the time, and the date on which each of the blocks was launched.

These blocks are correlated with each other and form a network of data, and this network is resistant to any change, once the data is recorded (I G, 2020). This fact makes cryptography a reliable algorithmic combination, as it is entirely based on this chain of blocks, whose data cannot be altered, replaced, or modified without changing the configurational sequence of the blocks. And this system of blockchain is primarily associated with the security of Bitcoin. However, for altcoins, smart contracts are used. Smart contracts use a strategic method to set out some provisional rules for executing and enacting financial contracts, assuring that the right agreements are made under the right regulations.

There are several advantages of cryptocurrency. Firstly, it facilitates the process of sending and receiving funds between two various parties, by using algorithms, and blockchain, without the need for physical presence or any meeting, but all the matters can be resolved virtually, without the assistance of third parties and banks.

Furthermore, the significance of cryptocurrency primarily lies in the independence of the mechanism that it uses for the transaction of money, primarily independent of the centralized intermediaries including financial institutions, independent of these institutions to implement regulations that somehow impede the autonomy and sovereignty of the users. This results in increased confidence and trust of users, which operate the entire system with the assistance of developers, and algorithmic 9 using the system to execute the operation by themselves, through increased automation.

Moreover, the system of cryptocurrency eliminates the possibility of a single point of failure, which is very common in banks and a leading cause of disruption of financial systems, leading to economic regression. Hence, this has largely increased the efficacy and effectiveness of online transactions, which are not only highly effective but also highly secured, through the use of public keys and private keys, and various other forms of incentives including proof of work which is also typically known as proof of stake. Furthermore, cryptocurrency can be highly useful for generating profits, and large sums of revenue since cryptocurrency markets have been flourishing over the last two decades, rising constantly over the past years, and consequently is attracting the attention of investors. Hence, cryptocurrency withholds numerous opportunities for both stakeholders, businesspersons, and investors, allowing them to earn huge profits as per the demand of the market.

The convenience of the cryptocurrency has been regarded as the biggest advantage, allowing the users to execute and administer their financial transactions on their own, without any intervention or assistance from third-party or federal institutions. Some of the cryptocurrencies including Ethereum, Litecoin, and Bitcoin can be easily purchased with fiat currency or cash, at a Bitcoin ATM, and can be used without having a bank account. Furthermore, increased consensus and reduced cost are other property, which makes cryptocurrency a comparatively preferable medium of payment.

And though some people invest in cryptocurrency for price appreciation, for others it is an acceptable and regulated medium of payment, allowing them to make quick settlements at comparatively lower fees. Similarly, outsized returns are also a significant advantage of cryptocurrency, contributing tremendously to the strengthening of the economic structure of individuals, businesses, and countries. Cryptocurrency specifically bitcoin results in large outsized returns, representing millions of points on the stock exchange market, worth millions of dollars. Hence, cryptocurrency offers numerous advantages for day traders and investors, allowing them to earn large outsized returns through the investment of this digitized currency.

However, cryptocurrency has predominantly been associated with numerous disadvantages, which are either because of the unregulated structure of cryptocurrency. First of all, scalability, which is probably a very significant disadvantage of cryptocurrency, is a result of the scaling that is posed. And as cryptocurrency is adopted throughout the world, the tokens are allocated at an increased rate, and problems of scale are posed. Cryptocurrency is also widely used by drug sellers on the dark web, for selling drugs, and other illicit products, and services. Furthermore, cryptocurrency is an unspecified form of transaction, which is executed anonymously, by pseudonymous people. However, the digital datasets incorporated in these transactions are evaluated by intelligence institutions, which leads to the possibility of the tracking of financial transfers of money by the common people, as investigated by federal institutions.

Similarly, cybersecurity through leads to increased security, by using blockchain and algorithmic combinations, but still are volatile to cybersecurity breaches, leading to security attacks, and hence stealing of the data, and important information. This is evident from numerous attacks and scams, which have resulted in the loss of millions of dollars. Furthermore, cryptocurrency is also widely used by hackers for stealing private data and important data, using it for performing ransomware activities. Similarly, cryptocurrency has been found to centralize money, though it is a decentralized form of currency, it still, prompts the accumulation of money to a specified class of people, making it a concentrated form of currency.

Also, cryptocurrency somehow disrupts the balance in the economic system, leading to a specified concentration of money as it can be operated by anyone using simply a computer and internet connection. And another significant disadvantage is that cryptocurrency largely suffers from volatility, and consequently, its value changes constantly, surging immediately at times and then falling after sometimes, which can disturb the economic cycle, leading to the disturbance of the economic structure of the complete world.

However, despite these disadvantages’ cryptocurrency has been rendered beneficial as per the response given by respondents, showing their inclination towards cryptocurrency, as the majority of them agreed that cryptocurrency is more favorable for economic sustainability, and they’re ready to adopt and integrate it as a medium of payment. This shows that cryptocurrency has the potential to become the largest industry in the future, incorporating itself into all financial institutions.

Figure 1 Cryptocurrency for Economic Sustainability

Figure 2 Biggest Advantage of Cryptocurrency

Figure 3 Disadvantages of Cryptocurrency

Figure 4 Transparency of Cryptocurrency

Figure 5 Federal Regulation of Cryptocurrency

Figure 6 Future of Cryptocurrency

Figure 7 Risk associated with Cryptocurrency

Figure 8 Future Overtaking of Cryptocurrency

Figure 9 Consumer Perception of Cryptocurrency

References

Dwyer, G.P. (2015). The economics of Bitcoin and similar private digital currencies. Journal of Financial Stability, [online] 17, pp.81–91.

Hogan, T.L. (2012). Competition in Currency: The Potential for Private Money. SSRN Electronic Journal.

Kshetri, N. (2021). The Economics of Central Bank Digital Currency [Computing’s Economics]. Computer, 54(6), pp.53–58.

Rolnick, A.J. (2010). Maintaining a Uniform (Electronic) Currency. Journal of Money, Credit and Banking, 31(3), p.674.

Berentsen, A. (2006). On the private provision of fiat currency. European Economic Review, 50(7), pp.1683–1698.

Townsend, R.M. (1989). Currency and Credit in a Private Information Economy. Journal of Political Economy, 97(6), pp.1323–1344.

Andolflatto, D. (2018). Assessing the Impact of Central Bank Digital Currency on Private Banks. Federal Reserve Bank of St. Louis, Working Papers, 2018(025).

Du, W. – Schreger, J. (2021). Sovereign Risk, Currency Risk, and Corporate Balance Sheets. SSRN Electronic Journal.

Sönmez, A. (2020). DIGITAL CURRENCY BITCOIN. TURKISH ONLINE JOURNAL OF DESIGN, ART AND COMMUNICATION, 4(3), pp.1–14.

Perugini, M.L. – Maioli, C. (2014). Bitcoin: Tra Moneta Virtuale E Commodity Finanziaria (Bitcoin: Between Digital Currency and Financial Commodity). SSRN Electronic Journal.

Yao, Q. (2017). Understanding central bank digital currency: a systemic framework. SCIENTIA SINICA Informationis, 47(11), pp.1592–1600.

Goldfarb, A. – Greenstein, S.M. – Tucker, C. (2015). Economic analysis of the digital economy. Chicago; London: The University of Chicago Press, Cop.

Singh, S.R.S. – Satish, D. – Kumar M.V.R. (2018). Survey on Surging Technology: Cryptocurrency. International Journal of Engineering & Technology, 7(3.12), p.296.

Liu, Y. – Tsyvinski, A. (2018). Risks and Returns of Cryptocurrency. SSRN Electronic Journal.

Wu, A. (2018). Non-Stationarity in Stochastic Distributions of Cryptocurrency Returns. IU Journal of Undergraduate Research, 4(1), pp.73–79.

Lee Kuo Chuen, D. – Guo, L. – Wang, Y. (2019). Practical Applications of Cryptocurrency: A New Investment Opportunity? Practical Applications, 6(4), pp.1.11-5.

I G, V. (2020). Survey on Blockchain: Backbone of Cryptocurrency. International Journal for Research in Applied Science and Engineering Technology, 8(6), pp.2011–2027.

Dhotre, S. (2019). A Survey of Blockchain Applications beyond Cryptocurrency. International Journal for Research in Applied Science and Engineering Technology, 7(4), pp.1102–1105.

Peck, M.E. (2017). Blockchain world – Do you need a blockchain? This chart will tell you if the technology can solve your problem. IEEE Spectrum, 54(10), pp.38–60.

Sheth, H. – Dattani, J. (2019). OVERVIEW OF BLOCKCHAIN TECHNOLOGY. ASIAN JOURNAL OF CONVERGENCE IN TECHNOLOGY, 05(01), pp.1–4.

C, K. (2018). An Overview of Blockchain Technology. International Research Journal of Electronics and Computer Engineering, 4(4), p.1.

Xiong, H. – Dalhaus, T. – Wang, P. – Huang, J. (2020). Blockchain Technology for Agriculture: Applications and Rationale. Frontiers in Blockchain, 3.

Fernándet-Villaverde, J. – Sanches, D.R. – Schilling, L. – Uhligh, H. (2020). Central Bank Digital Currency: When Price and Bank Stability Collide. SSRN Electronic Journal.

Nelson, B. (2018). Financial stability and monetary policy issues associated with digital currencies. Journal of Economics and Business, [online] 100, pp.76–78.

Kwon, O. – Lee, S. – Park, J. (2020). Central Bank Digital Currency, Inflation Tax, and Central Bank Independence. SSRN Electronic Journal.

Chohan (2019). Are Stable Coins Stable? SSRN Electronic Journal.

Brown, P.N. (2019). Incentives for Crypto-Collateralized Digital Assets. Proceedings, 28(1), p.2.

Zilioli, C. (2020). Crypto-assets: Legal Characterisation and Challenges under Private Law. SSRN Electronic Journal.

Lyns, R.K. – Viswanath-Natraj, G. (2019). What Keeps Stable Coins Stable? SSRN Electronic Journal.

Reza, T.S. (2018). A STUDY ON DIGITAL CURRENCY: THE SAFETY OF FUTURE MONEY. Transparency Journal Ilima Illum Administration, 1(1), pp.134–139.

Kwon, O. – Lee, S. – Park, J. (2020). Central Bank Digital Currency, Inflation Tax, and Central Bank Independence. SSRN Electronic Journal.

Wu, Y. – Fan, H. – Wang, X. – Zou, G. (2019). A regulated digital currency. Science China Information Sciences, 62(3).

Saito, K. – Iwamura, M. (2019). How to make a digital currency on a blockchain stable. Future Generation Computer Systems, 100, pp.58–69.

Meaning, J. – Dyson, B. – Barker, J. – Clayton, E. (2018). Broadening Narrow Money: Monetary Policy with a Central Bank Digital Currency. SSRN Electronic Journal.

Dr. Attila Szakács Associate Professor,

University of Debrecen, Szolnok Faculty, Economics, Institute of Marketing and Trade,

Dominik Szakács MSc Student,

Budapest Bussiness School – BGE KKK,

Dr. Judit Bárczi Associate Professor,

Hungarian University of Agruculture and Life Sciences,

Adil Saleem, PhD student

Hungarian University of Agruculture and Life Sciences,

@ WCTC LTD --- ISSN 2398-9491 | Established in 2009 | Economics & Working Capital