Excerpts on the New Ways of the State’s Involvement in the Economy – Hungary’s Example

In the decade following the 2007/2008 crisis, economic policies apploed in the world have changed. In Hungary, since the change of government in 2010, a new type of model, built on the state’s active role in influencing and regulating the economy, has been pursued, which places market players, tax and public financial auditing authorities, as well as the economic policy of the government and the Central Bank in a new context. The favourable changes in public financial indicators demonstrate the historical experience that a state assuming an active, powerful role – particularly during a crisis – is able to improve the operations of the state and market players.

Keywords: economic policy, financial crisis, neoliberal economic model, active operation of the state, consolidation, stabilization, Hungary

JEL: A11, E02, E5, E62, G20

1. Excerpts on the changes in the state’s role in economic management

In the context of Hungarian history, Lajos Lôrincz1 concluded that when royal power was strong or a strong government was in operation, the security of the country, its network of international relations as well as its economic situation were acceptable, while at times of chaos, economic crises and the isolation of the foreign policy and the foreign economy the governing power lost its strength. Thus, strong state authority causes a beneficial effect on the economy, while a weak state operation (usually) causes a weakening effect on the operation of the state economy and market players. The dilemma of administration and governance in a strong, active and a weak, “nodding”2 state is a long-standing issue. Antal Mátyás3 explained that neo-Keynesian economists (representing a neo-classical synthesis) take an ambiguous position in connection with the automatisms of the capitalist economy. In the short term, they question the stability of the capitalist private sector. According to Tobin and his co-author, Buitner4, the underemployment of labour and capital is rather frequent and lasting enough to replace (justify) the necessity of state intervention in the economic policy. Modigliani5 takes a similar position: monetarists are wrong when they believe the economy is already so well protected against any shocks that there is no need for a stabilisation policy any more; that is, Modigliani refutes the monetarists’ (the Chicago School’s) claim. Their view that stabilisation policies have failed to eliminate the problems, and, on the contrary, they have caused more trouble is not supported. The 1929-1933 crisis and the 2007-2008 crisis broken out from Anglo-Saxon mortgage markets comprehensively confirm that market players left without sate controls and regulations are not able to continually make rational decisions, to insert independent checks either on the level of the real economy (1929-1933 crisis) or on loan markets (2007 crisis, and the processes taking place before) because there are information asymmetries on the market, the institutional side of the state’s regulating role is in an incomplete, or more precisely, “consciously” eroded state. Through the production of capital goods and the volumes of issued loans, the profit interest of companies and banks prevails, during which they either do not know exact market needs or are unable to follow these after a while, or, due to their abnormal carelessness, they forget about them, bringing about collapses of the market after a while. On a systemic level, market regulators, state authorities regulating the operation of companies and banks, and credit rating agencies were also unable to keep reproducing and lending processes within reasonable boundaries either in the 1920s-1930s or in the early 21th century and the previous world order of four decades determined (and implemented) by the system of the Washington Consensus, as a result of which unacceptable masses of goods, and mountains of loans, becoming unsecured, then unrepaid. If crises are imputed as the fulfilment of Schumpeter’s6 creative destruction, that is, as a consequence of seeking innovative opportunities created (forced out) continuously by capitalism, and the inherent aggressive destruction of the equilibrium, and the hot bed of new situations and higher-level reproduction processes7, it should also be noted at the same time that the capitalist system based on autonomous market players is unable to consolidate. That is, if market players become dysfunctional, in addition to shaking (or even disproving) (the belief in) their self-regulating ability, they are – obviously – not able to take themselves out of the crisis either on the level of their companies or in relation to the market economy as a whole – it would be actually nonsense to expect the latter one because of the insufficiency of the former one. Thus, it is obvious that Adam Smith’s invisible hand should be visible, even perceivable again, that is, the state should use its fiscal8 and monetary9 mechanisms to tackle the crisis. In this changed operational environment controlling10 mechanisms become more robust, and so does the behaviour of market players (investors)11; their operation is saturated by enhanced compliance with new state rules.

András Tamás–s12 position is that all liberal ambitions – which would, with various arguments, limit the state’s opportunities to act to develop their economic policy and financial or social system – cling to its legal expression, a regulation allowing for the globalisation of markets, the deregulation of effective legislation, pushing global financial market conditions in the public sector, completely new “legal” underpinnings; a public administration, which is mainly management (that is, profit-oriented), its acceptability is marketing, and its truth is utility and profitability (for someone). The New Public Management, established in the neoliberal regime, and its economic approach, which saw its fulfilment in service and regulation decentralisation, privatisation of service providers and giving priority to being interested in profits, both in public administration and the companies providing public services. The crisis, however, has proven in the public sector and public services that the state cannot let specific parts of its public administration system and state-owned or formerly state-owned public service provider companies (in the Hungarian practice, for example, transferred to capitalised companies) be operated according to the rhythm of the primate of profit interests because therethrough it did not serve the interests of citizens using public services. In the public services market there are corporate and regional monopolies, therefore electricity, sanitation services, district heating, for example, can be purchased from a given company operating in the region, thus the application of profit aspects does not generate a market competition among these companies, and the population cannot do anything else but use the service of this one provider, in a price-monopoly environment, and through this vulnerability private public service providers can realise profit (almost unimpededly). Public Good (PG), replacing the management (profit) principle will be that higher-level guiding principle through the prevalence of which the state can treat its citizens using public utility and public administration services more equitably. As market-based public service provider units “made autonomous” in the field of public services are unable to make optimal decisions due to the “general lack of transparency” of the system and their immeasurable “hunger for profit”, their crisis may inevitably arise, and even a public services deficit may occur, therefore it is rather obvious that it is “more appropriate” if the state takes over (takes back) the regulatory function, which is its entitlement, and going even one step further, takes control or ownership of the public utility company.13 In the Hungarian practice, the NPM was replaced by a new, Weberian model of state organisation and its peculiar Hungarian economic “formation”, the principle and operational mechanism of CNPG (Centralization, Nationalization, Public Good; a notion I have defined).

The crisis of the neoliberal system, however, has extended the role and significance of the state and the science of the state and public administration “designed” to cultivate and “scientifically care for” the state. The sound and transparent public finance conditions of a strong and active state resting upon a good theory provide the basis for a well-functioning state. According to Mária Bordás14, forced and tendentious post-crisis state intervention have brought the fundamental characteristic features of the science of public governance and administration to the fore, raising it to the level of independent scientific disciplines. In the inactive, neoliberal model of the state, the role of the science of public governance was partial as the operation of the state was limited. Neoliberal theory regarded the state’s role as an owner as minimizable, and considered a sound system of state interventions and regulations to be detrimental to market players, restricting their market operations. The processes of the crises unfolding from 2007-2008, however, brought about activity in the practical operation of the state, and added value to the study of public governance in its science system.

2. On the pre-crisis period of the operation of the state in Hungary: system-level issues of the neoliberal market economy transition

The Hungarian economy opening to the production method of the market economy from a planned economy was suffering from weak growth potential and worrisome macroeconomic imbalance due to the further increase of originally high government debt and its vulnerable financing, which became worrying by the 2007-2008 crisis because of its external financing, which had become particularly uncertain; even the risk of state bankruptcy arose. It is important to emphasise that from the early 2000s such macroeconomic processes were taking place in Hungary that made the country a tailender15 from a forerunner in the Visegrad region (V4 countries), as a result of which the Hungarian economy had “chronically” weakened already before the 2007-2008 crisis.16 There was evidence that the deterioration of the balance pushes the entire economy onto an unsustainable trajectory. The state spent a lot on social transfers and little on productive purposes (pension expenditure accounted for more then one-fifth of budgetary spending), and its debt structure shifted unfavourably due to high foreign currency exposure and foreign debt. From one year to the other, the Hungarian state spent more than its income by 6-10 per cent of its economic performance. In 2002, Hungarian government debt was 55 per cent of the GDP; by 2007, this rate increased over 65 per cent, and it exceeded 80 per cent of the GDP in 2010. The main problem was, however, the shortfall of revenues insufficient for the state’s estimate expenditures, the main reason of which was that international companies and firms, constituting the backbone of the economy, were not taxed according to their power to tax, while domestic residents (population, Hungarian small- and medium-sized enterprises) with weaker abilities to asserts their interests were involved in taxation and were burdened to an extent over their power to tax, which led to the deterioration of their operations, difficulties in a tax enforcement, increasing tax evasion and, ultimately, the insufficiency of state revenues, as a result of which the system was characterised by a dysfunctional operation.

The deterioration of balance affected also other areas of the economy, of which the labour market and therefore the activity rate were of outstanding importance. In Hungary, hardly more than 60 per cent of the age group of 15-64 year-olds were present in the labour market, while the average of the EU 15 exceeded 70 per cent. The responsibility of the state is obvious since the high level of taxes on labour and their unfavourable structure had also contributed to a low level of employment. The fact that the total loans of households as a proportion of their disposable income approximated the 80-per cent level, while the figures of partner countries in the region were 20 per cent points lower, represented a serious threat. To make things worse, borrowing had shifted into the direction of foreign currency loans

Unsustainable fiscal and monetary processes resulted in stability and competitiveness deficits, preventing Hungary from harnessing the opportunities offered by its EU accession in 2004: the duality of the economy – the productivity of SMEs was substantially lower than that of large companies – became a fundamental barrier to catch-up. Consumption-focussed growth, financed through increasing indebtedness, hid structural problems beneath the surface. The Hungarian Constitution in force before 2011 did not contain a chapter on finances, that is, there were no constitutional laws or legal empowerment to limit the excessive indebtedness of the state, which contributed to the emergence of a debt spiral. Due to high expenditures tax rates were high; of OECD countries, Hungary had the second highest average tax wedge.

3. The Hungarian starting points of an active operation of the state

The lesson learned from the two decades after the planned economy was that economy could have worked with better efficiency if market players had been managed with an approach encouraging cooperation. For a state model implementing a transition to a more dynamic, sustainable trajectory, the consolidation and strengthening of public finances, and the creation of stable macroeconomic fundamentals are essential. The state must become able to encourage economic operators to cooperate, thereby creating the foundation of a cooperative state model of state and market. For the implementation of good governance, new fundamentals can be created through gradual reforms and by building partnerships that are reliable and effective for the national economy. Both state- and privately-owned companies can gain strength through a cooperative activity of the state. The task of the state is to enhance its abilities to satisfy social needs as comprehensively as possible and to renew state institutions in order for a more cost-effective operation. Stability and predictability are mutual interests of a budget providing state services from tax revenues and the circle of owners of primary income giving up a part of their incomes for operation on the basis of the tax policy, which can be achieved if an identity of interests in the success of state measures and the accomplishment of goals is created and among the primary, original owners of incomes. An active operation of the state is a mutual system of relationships, that is including both the state and taxpayers, in which the parties become committed to achieving common success, and the cooperation platform between economic operators is diversified.

The Fundamental Law was adopted by the Parliament in April, 2011, together with a chapter on public finances including Articles 36-44, marking the beginning of a new era in the management of public finances. To reduce the government debt-to-GDP ratio, the reform of the tax system, an increase in labour market activity, an efficient and orderly use of public finances, a public financial controlling system guaranteeing the use of public assets, low inflation, a monetary policy promoting growth as well as a shift towards balance are required, for which the support of an independent central bank is essential. As a result of coordinated fiscal and monetary mechanisms, the stability of Hungary’s public finances, its budgetary and government debt position have improved considerably.

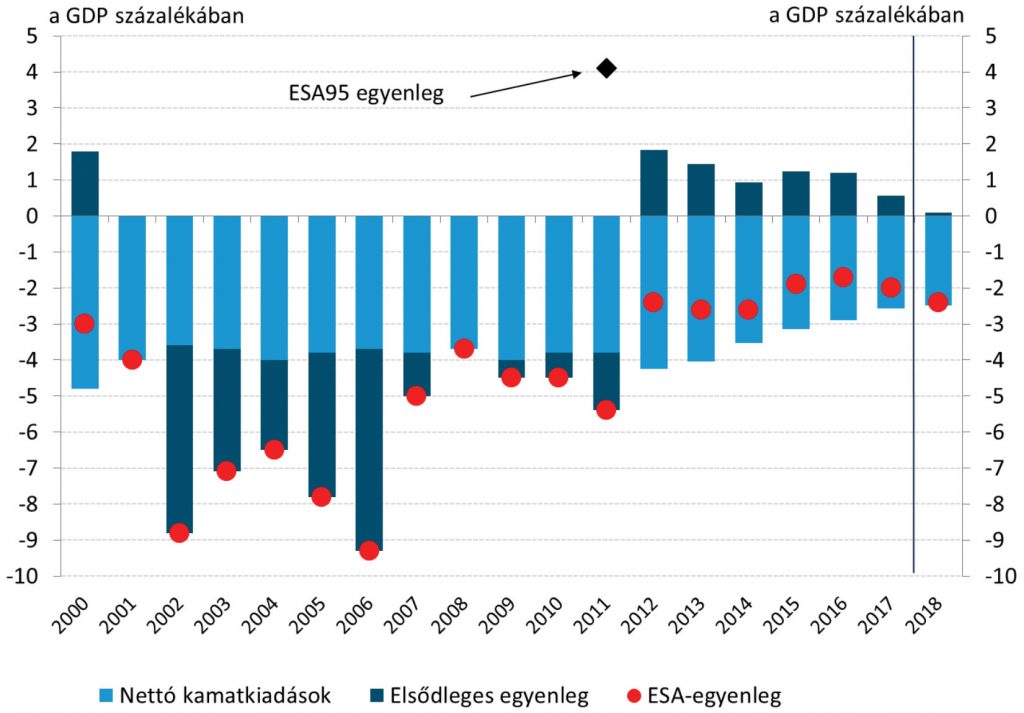

1. Figure No. Trend of Hungarian Government Deficit, 2000-2018 (provisional data in 2018)

Source: The Central Bank of Hungary, 2018

4. Main elements of the turnaround in fiscal and monetary policy – the period after 2010

The improvement of the fiscal balance was outstanding also in an international comparison, the balance of the Hungarian budget demonstrated the biggest improvement among EU Member Countries after the crisis. Between 2003 and 2007, fiscal deficit was around 7 per cent of the GDP; a similar deficit could be seen only in Greece, but in 2014-2015 the Hungarian deficit dropped to around 2 per cent, which was an improvement of 5 percentage points. This favourable trend continued also in 2018.

Of the above, tax reform must be highlighted in particular, which was followed by a reform of tax administration in 2016, along the new opportunities offered by digitalisation. The transformation of the personal income tax system reduced tax burdens to an extent amounting to 2.5 per cent of the GDP in total. The centre of gravity of tax centralisation has shifted from taxes on labour onto consumer taxes, the average PIT rate of the average wage decreased from over 20 per cent in 2009 to 15 per cent in 2016, with which Hungary ended up below the average EU rate. In parallel with tax reductions, the active operation of the state placed has great emphasis on the enhancement of labour incomes, constituting the basis for increasing solvent demand. Between 2010 and 2020, the gross minimum wage is increasing from HUF 70 thousand to 161 thousand, giving cumulative impetus to other market wages. New foundations have been laid for the Hungarian tax system: taxes on labour and capital have decreased, and revenues deriving from taxes on consumption and surtaxes have increased. The tax system has become consumption-based and performance-centric at once. Surtaxes have contributed to the budget substantially: in 2013, these revenues accounted for 2 per cent of the GDP, and almost 1.5 per cent in 2016.

In the early 2000s, Hungary moved to an unsustainable trajectory despite having a well-built and institutionalised public finance controlling system; consequently, the role of Hungarian public financial controls, including the State Audit Office, had to be renewed. After the adoption of the Fundamental Law, the new regulatory framework, effective from 1st July, 2011 (SAO Act), has been serving the purpose that the Audit Office could act more effectively with a strengthened legal background to use taxpayers’ money and protect national assets, thereby improving the efficiency of public services and the spending of public funds. Based on the new act, the SAO is one of the most significant elements of the system of economic checks and balances ensuring a democratic operation of the Hungarian state, also emphasising that the period of auditing without consequences has come to an end in Hungary.17

In 2013, the Central Bank of Hungary – by renewing and widely applying the monetary policy toolkit – joined the line of central banks intending to mitigate the consequences of the crisis by an active monetary policy, where several good practices of innovative measures emerged in addition to traditional solutions18. In accordance with its statutory task, the Central Bank of Hungary supported the stabilisation of the economy and the economic policy efforts of the government with several programmes19.

The reduction of the interest rate, implemented through gradual and careful steps, and a permanently low interest rate environment have contributed to economic growth and the medium-term achievement of the inflation target. The innovative programmes have mitigated the fall in lending to the Hungarian small- and medium-sized enterprises sector, thus the Funding for Growth Scheme as well as the Growth Promoting Scheme and the Market-Based Lending Scheme, encouraging market lending with a healthy structure, have been decisive. The Central Bank has launched a Self-Financing Programme to reduce the external vulnerability of the country. By converting households’ foreign currency mortgage loans into forints, system-level exchange risks to households have been eliminated, the burdens of households have been considerably eased, while it has become possible to plan family budgets. Debt cap regulations introduced in 2015 within the frameworks of a macroprudential policy – in addition to maintaining a consistent structure of lending in the long term – protect borrowers through risk-taking limits by considering aspects of financial stability and consumer protection. It should be noted that these regulations would have also prevented the increase of excessive (unsecured) borrowing before 2008. Certified Consumer-Friendly Housing Loans render the repayment of borrowers’ debt service burden predictable with a longer interest rate fixation period. By recognising and managing risks in a timely manner, macroprudential regulations prevent them from compromising the stability of the financial system and the confidence in the financial intermediary system.

In this economic policy context, supported by an active operation of the Central Bank and the State Audit Office, the need for renewing the Hungarian capital market, which had failed to fulfil its role for years, was arisen, therefore the goal to broaden enterprises’ room for manoeuvre in terms of financing and raising capital was set. As Hungary obtained majority ownership in the Budapest Stock Exchange in December 2015, it became possible to design a comprehensive capital market development strategy, as a result of which the role of equity-based fundraising may increase in financing successful and competitive Hungarian companies, effectively supplementing the current predominance of bank lending.20

The combined impact of a decrease in debt, as well as fiscal stabilisation and a turnaround in the monetary policy enabled Hungary to start to catch up in 2013. This process is comprehensively characterised by a renewed, active operation of state institutions, and on the basis of this positive turnaround in fiscal and monetary policy a good foundation is created for a transition onto a competitiveness-based (innovation-based, human capital-intensive) growth trajectory, to avoid the middle income trap.

There is clear evidence that since 2010, but especially since 2013, the Hungarian state has gained strength, the structural problems of the pre-crisis period have been resolved, which allows for the “institutionalisation” of a change in the model affecting the entire operation of the state. Now the state has scope to adopt measures which require adequate room for manoeuvre and the power of the state that are necessary for receiving a cooperative response to state cooperation also from the partners concerned, thereby the economy is characterised by a significantly stronger ability to cooperate, a method coordinated between the state/population and based on mutual interests. Decreasing tax rates, and the accompanying decline in tax evasion processes can be regarded both as a step to improve the fiscal position (a strengthening budget of the state) and as a state measure affecting masses of people, representing the cooperation between the state and taxpayers, similar to the renewal and modernisation of tax collection. Constructive cooperation between the monetary and the fiscal policy aims at achieving economic policy goals together, in synergy, while also maintaining the independence of the Central Bank. In the Central Bank’s programmes based on voluntary cooperation of banks (Self-Financing Programme, Market-Based Lending Scheme) banks made cooperative steps as a response to the incentive steps made by the Central Bank. The transformation of the public finance supervisory system, in which the empowered State Audit Office introduces and operates “guiding” programmes assisting users of public funds in adopting a compliant practice, such as the Integrity project, sharing good public finance practices, and a transparent operation of the State Audit Office in particular.

The state, as a special economic operator and regulator, due to its peculiar position, can contribute to the improvement of the competitiveness of the national economy. The change of mindset that leads to partnerships even in the case of market players by using cooperative, positive incentives actively is of strategic importance. The transformation of the tax context is a very clear example of that.

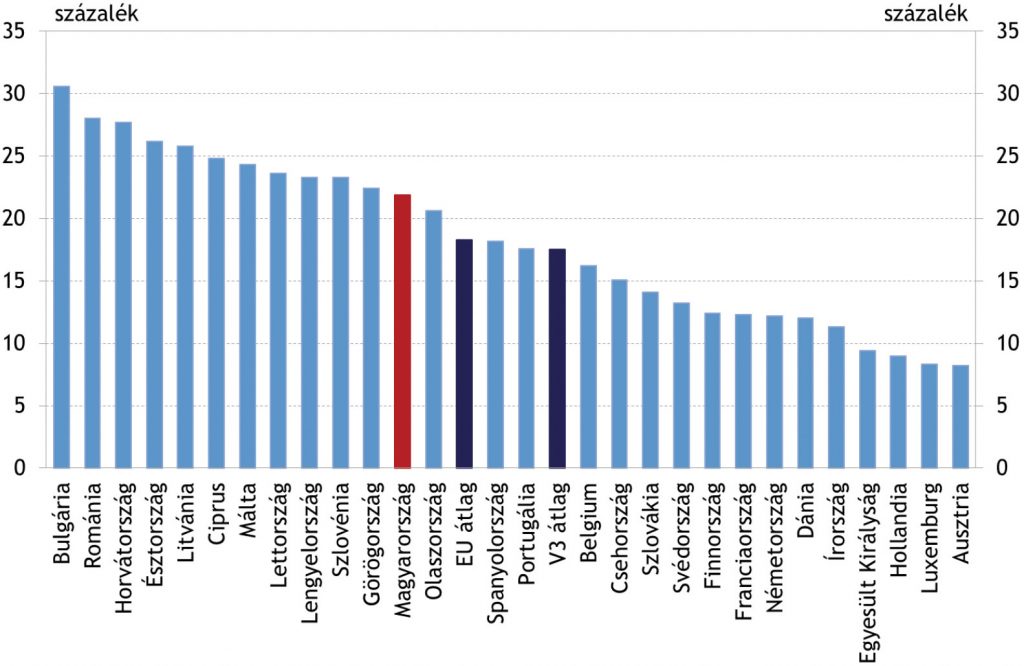

Figure No. 4 Estimated Extent of the Shadow Economy in the EU as a Share

of GDP (2015)

Source: (Lentner, 2017)

New tax policy and tax administration

The tax system existing before 2010 over-taxed domestic residents’ personal and corporate incomes deriving from labour, thus its punitive nature encouraged employees and entrepreneurs to hide some parts of their operations. The deviant practice based on fiscal pressure21, creating a non-compliant taxation culture was not able to promote growth and place the budget onto a trajectory of sustainable balance. The hidden economy was coupled with a low employment level. By contrast, two decades after the regime change raising the employment level and reducing the unemployment rate became priorities of the economic policy, in addition to balance and growth.22 The conditions for a sustainable financial equilibrium have been met since 2013, Hungary has exited the excessive deficit procedures of the European Union, of which a comprehensive tax reform and thereby supporting budgetary revenues with a new tax structure were essential elements.

Creating a single-rate, proportional personal income tax system and the introduction and gradual expansion of a family tax base allowance serving primarily demographic purposes were important elements of the new tax system, channelling more income into households, and in 2015 a family and home subsidy regime was also introduced.23

Bank tax and separate surtaxes have contributed to budgetary consolidation, while in the case of SMEs the reduction of corporate tax to 9 per cent – in two phases – has meant some remaining surplus income, which promotes investment activity and the creation of jobs from the perspective of job creation. It has become generally accepted that income earned through employment forms the basis for the income required to meet subsistence needs. This is a significant change, compared to a way of life based on social re-distribution and benefits.

The tax administration reform, launched in 2016 by transforming the tax authority in a a client-friendly way and adopting a cooperative, supportive approach, aimed at reducing the administrative burdens of taxpayers, which improves taxation morale, and focusses on compliance with rules in addition to encouraging transparent operations in lieu of sanctioning. Institutional operation based on new principles has been accompanied by several new instruments and measures. Good examples in the taxation dimension include the taxpayers’ rating system, mentoring, tax traffipax (spot inspections announced in advance) and the institution of conditional tax penalty, which “guides” taxpayers toward the approach of the state through supportive nd positive incentives.

Measures introduced in administration reduce costs, as the time spent on taxation by economic operators decreases as a result of taking advantage of the digital opportunities offered by technological development. It should be noted that taking a supportive and active role resulting from the change in the state’s approach, and embedding the opportunities of digitalisation into everyday practice also meet the expectations of the society. It is particularly important with view to the fact that time spent on a corporate tax return is rather high, some 270 hours per year, while the EU average is only 170 hours.24

One of the objectified forms of the reduction of tax administration is the completion of E-PIT returns. The National Tax Administration has undertook to prepare personal income tax returns electronically since tax year 2016, and will undertake the preparation of private entrepreneurs’ returns from 2019, which means a considerable reduction of administrative burdens. Furthermore, excise duty returns have been also prepared by the Tax Administration since 2018, and the online invoicing system was launched in July, 2018.

Digitalisation reduces, on the one hand, clients’ administrative burdens and, on the other hand, the costs of the Tax Administration, and may shorten the length of time required for procedures, and it is also a basic condition for automatization in many fields. The digitalisation of public administrative and tax administrative procedures (e-public administration) significantly simplifies the everyday administrative matters of enterprises.25

With the aim of a transparent operation, reducing the extent of the shadow economy represents a priority in economic policy – in line with international practice – in order to whiten the economy.

If tax evasion exists, the society suffers losses, since, on the one hand it loses incomes that paying taxes would have meant, and, on the other hand, the market distorting effect impairs competitiveness, honest entrepreneurs pursuing transparent operations are put into competitive disadvantage against the ones pursuing shadow operations, budgetary revenues decrease, and in this vicious circle, heavier tax burdens are concentrated on legally operating economic operators. If there is a loophole that could be used by tax evaders, it severely distorts competition. In addition, the degree of tax evasion is also influenced by the operational efficiency of the state. Low-quality state services and a high level of corruption deteriorate the expected value in use of taxes paid, increase the willingness to evade taxes,26 and even legislative deficiencies or a weak methodology of tax audits may also lead to the proliferation of harmful behaviours; these undesirable elements are in decline in Hungary.

With the introduction of online cash registers in 2013, compliance with legislation has been enhanced and the effectiveness of the Tax Authority’s operation has been increasing. Auditing is placed in a new dimension, which is also demonstrated by the positive trend of VAT revenues. The aim of the introduction of the electronic road toll system, launched in 2015, was to strengthen the position of law-abiding economic operators, monitor goods traffic, prevent abuse related to food products often harmful to human health and filter out tax evaders. The goal of the electronic invoice data reporting (e-invoicing), launched in the summer of 2018, is – in addition to significantly reducing the administrative burden of enterprises – to allow the NTCA to partly fill their VAT returns and improve traceability of turnover. Summing it up, the Tax Authority’s new, constructive approach, which regards taxpayers as partners, and its strengthened legislative and methodological foundations prevent inconsequential tax evading behaviours.

Conclusion

The active economic policy method adopted by the Hungarian state in the post-crisis period broke with its economic views built on the neoliberal illusion of a self-regulatory market, eroding morality and social confidence, and a prominent role is taken by the state, prevailing in the fiscal and the monetary policy as well. In the new economic space, the state as well as its partners, market players, stakeholders, authorities guaranteeing a predictable operation of the market economy, financial administration, controlling bodies and even their cooperation are becoming more important. Government debt and government deficit are further reduced but not with the introduction of newer austerity packages but through equitable taxation, the suppression of the black economy, a tax system supporting higher economic performance, and the Central Bank of Hungary, the State Audit Office and the National Tax and Customs Administration’s activities supporting good governance, of which market players are becoming increasingly partners as their interests – in maintaining results – are mutual.

Footnotes

1 Lôrincz, Lajos: The Effective State (A hatékony állam), in Magyar Közigazgatás, issue 2005/8, pp. 449–453; Lôrincz, Lajos: Public Administration Reforms: Myths and Reality (Közigazgatási reformok: mítoszok és realitás), in Közigazgatási Szemle, issue 2007/2, pp. 3–13;

2 The “nodding state” originates in my own set of notions (Nodding John Effect). Nodding John is a well-known character of Hungarian folk tales, who approves everything as he has little strength or skill to influence processes or events. I have coined this notion for Hungary’s transition from a weakened planned economy regime into an even less efficient (especially in terms of public finances) market economy regime. The state sold its property, gave up pursuing an independent economic policy to a significant degree in exchange for further loans from foreign banks to finance government debt and attracting as much working capital as possible into the country to create its functionality. Nodding John, i.e. the Hungarian State in the late 20th century, was not able to organise the production and technical capacities or the economy of the state in accordance with the requirement of sustainability. To a large extent, it asserted the interests of foreign investors so that the political formation “taking shape” behind the state (government, governing parties) could retain its power.

3 Mátyás, Antal: Debates on the neutrality of money in various trends of economics (A pénz semleges voltával kapcsolatos viták a közgazdaságtan különbözô irányzatainál), In Lentner, Csaba (ed.): Monetary Policy Strategies in the Early 20th Century (Pénzügypolitikai stratégiák a XXI. század elején), 2007, Akadémiai Kiadó, Budapest, pp. 29-38

4 Tobin, James – Buitner, Willem: Fiscal and Monetary Policies, Capital Formation and Economic Activity, in Tobin, James: Essays in Economics, Vol. 3, 1982, The MIT Press, p.183

5 4 Modigliani, Franco: Money, Savings, Stabilisation – Collected Essays (Pénz, megtakarítás, stabilizáció), 1988, KJK, Budapest, p. 126

6 Schumpeter, Joseph, Alois: The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest and the Business Cycle, 1911 (new edition: Transaction Publishers, 1983, p. 255

7 The creation of innovations does not always require “creative destruction”, as frequently both the technology and the market exist for development. See in detail: Chikán, Attila: Business Economics (Vállalatgazdaságtan), Aula Kiadó, p. 218

8 The recipe of fiscal stimulus is provided by J. M. Keynes’s economic philosophy; it builds upon raising solvent demand by state instruments and – to a significant extent – the development of the third sector, the military industry. See in more detail: Kenyes, J. Maynard: The General Theory of Employment, Interest and Money, Palgrave Macmillan, 1936, p. 472.

9 The role of monetary institutions (central banks) has become significant after the events of 2007-2008, because of their role in crisis management. See in more detail: Galema, Rients – Lugo, Steafo: When Central Banks Buy Corporate Bonds: Target Selection and Impact of the European Corporate Sector Purchase Program. SSRN Electronis Journal, Utrecth University, DOI: 10.2139/ssm.3091751, pp. 2-31; Matolcsy, György: Economic Balance and Growth, Kairosz Publishing House, 2016, p. 680; Lentner, Csaba: New Concepts in Public Finance After the 2007-2008 Crisis. Economics & Working Capital, 2017/1-4.issue, 2-8. pp.

10 Oláh, Judit – Zéman, Zoltán – Balogh, Imre – Popp, József: Future Challenges and Areas of Development for Supply Chain Management. Logiforum, 2018, Vol. 14, No. 1, pp. 127-138, Zéman, Zoltán: The Emergence of “True and Fair View” Principle in Accounting with Special Regards tot he Provisions of the Hunarian Accounting Act, Faculty of Law, Josip Juraj Strossmayer University of Osijek, 2018, Vol. 34, No. 3–4, pp. 219-232 DOI: 10.25234/pv.5997; In. Corjova, Tatiana, Madlenak, Radovan – Madlonákova, Lucia (eds.): Compani Diagnostics Controlling and Logistics. 9th International Scientific Conference, Zilina, Slovakia, 2018, EDIS, 294-302

11 Kecskés, András: Recent Trends in Hungarian Investment Law. Jahrbuch für Ostrecht, 2018, Vol. 59, No. 1, pp. 69-78, Mallinghum, Edmund – Zéman, Zoltán – Kecskés, András: Innovative Financial Digital Ecosystem: An Evaluative Study of Kenya. In. Cebeci, Kemal, Pawlicz, Adam, Altaher, Asmahan (eds.): MIDREC – 6th, International Academic Conference on Social Science, Multydisciplinary, Economics Business and Finances Studies, Lisbon, Masters International Consultancy Research and Publishing (MIDREC), pp. 93-112; Kecskés, András: Prospecting the Future: Shaping Prospectus Provisions for the Benefit of SMEs. Hungarian Journal of Legal Studies, 2016, Vol. 57, No. 1, pp. 103-118; Kecskés, András: The Sarbanes-Oxley Act from a Legislative Viewpoint. Theory and Practice of Legislation, 2016, Vol. 4, No. 1, pp. 1-17

12 Tamás, András: The Place and Role of the Science of Public Administration within Sciences (A közigazgatás-tudomány helye és szerepe a tudományokon belül), in Pro Publico Bono Magyar Közigazgatás, No. 2013/2, pp. 28–34

13 Western European market economies still tend to keep a wide range of public utility providers or, in certain cases, even strategic sectors in national ownership, while in Hungary the state and its local governments were “keen” to sell their assets and companies after the regime change.

14 Bordás, Mária: Some thoughts on the Science of Public Administration (Gondolatok a közigazgatás-tudományról), in Polgári Szemle, No. 2012/3–6, pp. 11–31; Bordás, Mária: Economics of Public Administration – the Opportunities and Dilemmas of Economic Governance (A közigazgatás gazdaságtana – a gazdasági kormányzás lehetôségei és dilemmái), 2014, Dialóg Campus Kiadó, p.320

15 2-31, Matolcsy, György: From Forerunner to Taileneder – the Chronicle of Lost Years (Éllovasból sereghajtó – elveszett évek krónikája). Éghajlat Kiadó, 2008, p. 359

16 In 2006, the government at the time adopted a large-scale convergence trajectory adjusting package with the aim of reducing the government deficit fluctuating between 6-10 per cent.

17 On the renewed audtiting practice of the State Audit Office: Domokos, László – Mészáros, Leila – Szakács, Gyula: How the constitutional situation of the State Audit Office has strengthened (Az Állami Számvevôszék alkotmányos helyzetének megerôsödése). In. De Iurisprudentia et iure publico. Vol. IX, No. 2, p. 20

18 See: PARRAGH, Bianka: Monetary Polemics. Results of the Central Bank’s Changed Role Perception (A megváltozott jegybanki szerepfelfogás eredményei). Public Finance Quarterly (Pénzügyi Szemle) 2017/2 (pp. 234-250)

19 On these, see: LEHMANN, Kristóf – PALOTAI, Dániel – VIRÁG, Barnabás ed.: The Hungarian way – targeted central banking policy (A magyar út – célzott jegybanki politika). MNB, 2017; and KOLOZSI, Pál Péter – NOVÁK, Zsuzsanna (2016): Monetary Policy Instruments in the 21st Century – the Example of the. Central Bank of Hungary (A monetáris politika eszközei a XXI. században – az MNB példája). In. State – Crisis – Finances, ed. Kálmán, János; Gondolat Kiadó, 2016, pp. 523-545

20 Parragh, Bianka – Végh, Richárd: Economic Stimulus Effects of Capital Market Developemnt (A tôkepiaci fejlesztés gazdaságösztönzô hatásai). Polgári Szemle, No. 2018/4-6,

21 Fiscal pressure is when the state tries (is forced to try) to adjust collectible taxes to its expenditures and not to taxpayers’ power to tax.

22 See in more detail: Matolcsy, György (2015), op.cit. p. 185.

23 On the Home Purchase Subsidy Scheme for Families in more detail: Sági, Judit – Lentner, Csaba: Certain Aspects of Family Policy Incentives for Childbearing –

A Hungarian Study with az International Outlook, Sustainability, Vol. 10, No. 11. 3976

24 Based on IMF-Doing Business, PWC

25 Parragh, Bianka – Palotai, Dániel: Towards an Incentive Tax System: The Reform of the Tax System and Tax Administration in Hungary (Az adórendszer és adóigazgatás reformja Magyarországon), Pénzügyi Szemle, 2018/2. In these papers, the authors analyse in full detail a higher degree of willingness to cooperate, deriving from the effects of positive incentives.

26 Balog Ádám (2014): Tax Evasion and Hidden Economy in Hungary (Adóelkerülés és rejtett gazdaság Magyarországon). Public Economy (Köz-gazdaság), Special Issue 2014/4

Prof. Dr. Csaba Lentner

Full Professor, Head of Institute

National University of Public Service, Hungary

Public Finance Research Institute

@ WCTC LTD --- ISSN 2398-9491 | Established in 2009 | Economics & Working Capital