Traditional and innovative approaches to the implementation of the internet marketing functions in insurance

Abstract

The article deals with the essence of Internet marketing and its importance in providing the stable functioning of the insurance company. The characteristic advantages of Internet marketing inclusion into the insurer’s marketing policy are indicated. The possible drawbacks that insurance Internet marketing can pose in comparison with traditional marketing in insurance are determined. The main and specific moments and steps for the integral realization of Internet marketing functions in insurance activities are highlighted. The new opportunities for Internet marketing insurance by means of implementing augmented and virtual reality technology in the process of insurance services fulfilment are described. Internet marketing is singled out as an underlying reason for ensuring a stable future and increasing the profitability of an insurance company.

Keywords: insurance internet marketing, insurance product, insurer, insurant, augmented reality, virtual reality.

Introduction

The need to review approaches to the implementation of the insurance marketing functions lies in the emergence of new, advanced opportunities to promote insurance products, particularly via the Internet. The World Wide Web has now permeated almost all spheres of human activity. It no longer exists only as a source of information or entertainment, but also as a highly developed business environment. Its use in the daily activities of business entities allows expediting the implementation of products and simplifying the conclusion of agreements between contractors, entering the global economic market, searching for potential customers and establishing communication with the existing customer base. That is, the World Wide Web has become an effective tool for doing business, which has significantly curtailed expenditure and expanded the field of activity beyond national boundaries. That is why the use of Internet technologies should necessarily be incorporated into the marketing policies of any insurance company. As a result, the revision of the existing possibilities of insurance Internet marketing as well as the identification of new ways to modernize and improve it to meet the future needs of the insurance market are becoming increasingly important.

Material and methods

The theoretical and methodological basis for describing the essence of Internet marketing and the discrimination of specific features of its use has been provided in the works of leading scientists engaged in the research on this topic. The interpretation of the meaning of the term internet marketing has been offered in the works of such scholars as M.V. Makarova [5], I.V. Uspensky [8], V. Kholmogorov [9]. The study of the specific features of its realization in the present day has been undertaken by such scholars as I.V. Boychuk [1], N.V. Evdokimov [3], F.Yu. Virin [2], M.A. Oklander [7]. However, the determination of the possibilities to combine traditional and innovative approaches in insurance internet marketing remains unresolved in accordance with the current conditions, namely those requirements that are imposed by new generations of potential insurants on insurers.

The aim of the article is to determine the essence of Internet marketing in the sphere of insurance, to distinguish existing advantages and possible risks of its implementation, the characteristics of its main tools and to single out new effective means of marketing activities in the World Wide Web.

The main methods used in the research process to achieve the stated aim include structural and logical analysis (in concept clarification), synthesis (in the accumulated knowledge integration), induction and deduction, detalization, classification (singling out existing advantages and possible risks), grouping (identifying and studying new effective Internet marketing tools).

Results and discussion

Year by year, the number of players is increasing in the global insurance market which leads to increased competition. Insurers who want to remain profitable suppliers of insurance services face the pressing need to use all possible means to fight for the target audience. Marketing activity in the process of distributing insurance products has long been an objective necessity in this struggle. Special emphasis should be placed on the growing role of such a trend as Internet marketing, since it is the digital market, in the present conditions, is undergoing increasing development and remarkable transformations.

There are different approaches to understanding the theoretical and practical essence of Internet marketing. I.V. Uspensky interprets Internet marketing as a new direction in marketing – hyper-marketing, where it acts as a theory and methodology for organizing marketing in the hypermedia environment of the Internet [8, p. 3–4]. However, M.V. Makarova sees internet marketing as part of the company’s overall marketing strategy defining it as a marketing technology by means of computer systems and networks, which helps to solve only those tasks of the company that will be effective in terms of revenue and expenditure [5, p. 172–173]. According to V. Kholmohorov [9, p. 14], Internet marketing is a complex of special methods that enable web resource owners to foster their website on the Internet and to promote their company’s brand and raise extra revenue.

However, in our opinion, all the given definitions do not reveal the essence of Internet marketing in insurance. According to our opinion, insurance Internet marketing is a contemporary system of the insurer’s actions and measures which consists in the formation, calculation of the cost and realization of insurance products to the potential insurant at a convenient time, in a convenient place and in the desired amount with the help of the Internet possibilities.

Internet marketing as a bright representative of modern marketing has absorbed almost all the main features of traditional marketing while significantly expanding them through the use of innovative technologies and Internet resources.

This type of activity as part of the marketing policy of the insurance company can offer several advantages for both the insurer and the insurant. Particularly, it is possible to single out the following advantages:

1. Analytical provision of the insurance company and its clients. The Internet network provides quick and almost free access to the information the user needs. The insurer can use it for marketing research, namely, to analyze information about competitors and their weak and strong points, to substantiate the reliability of partners, to study the preferences of the target audience through active customer base surveys, the characteristics of the number of daily visitors of the insurance company’s pages and the reasons that have led them there, to determine the offers that have been viewed and chosen most often, to identify factors that have increased the demand for an insurance product and to eliminate the factors that reduced the demand for it, to synthesize the information gathered in the process of marketing strategy formation and its usage in advertising campaigns. The insurant receives constant sources of information about the insurance company and the services it provides, the possibility of comparing the benefits of its insurance products with the similar offers, studying its financial status to confirm its reliability, as well as the ability to conveniently contact the insurer and ask questions at any time.

2. The convenient way of purchasing insurance policies by the client. The insurant can quickly and easily obtain an insurance product through the site and software applications of the insurance company presented in advertisements. Moreover, the insurer can increase the profitability of such advertisements by automating the process of interaction with a potential client on the landing page and providing a quality personalized service to the insurant at a convenient time and in a convenient way.

3. Minimization of the insurance company’s marketing expenses. Electronic insurance policies can significantly reduce the cost of distribution and delivery. The expenses on the communication with the target audience and its service are reduced. The price of insurance products can also be significantly lower for potential customers due to the lower cost of organizing a virtual office than the cost of their motivation to visit the real office directly, which facilitates to make the company’s insurance services considerably attractive.

4. New opportunities for promoting the insurer’s services. Internet marketing empowers the insurer to be almost completely independent of territorial or time boundaries. It is possible to simply and effectively conduct advertising campaigns for foreign citizens at any time and in almost any state, which allows capturing new markets, reaching out to new audiences. In addition, Internet marketing enables choosing contemporary promotion methods using innovative methods of digital advertising.

5. Formation of partnership relations with the insurant in the process of construction of the Internet brand of the insurance company. Internet marketing allows directly interacting with the insurer’s client. In particular, the following aspects should be highlighted: the possibility of conducting online broadcasting, organizing forums or dialogues by means of the content, where insurants would be able to post questions, express opinions or share feedback, and consecutively get answers to those issues that concern customers on behalf of the company. In prospect, the insurance company will be able to flexibly adapt the approach based on the received data as well as to personally target a part of future advertising campaigns.

With all the benefits of the insurer’s implementation of the marketing activity on the Internet, one should bear in mind the possible shortcomings of Internet marketing:

1. Increase in the competition for the target audience due to the reduction of the role of state borders, which greatly expands the choice of alternative insurance products not only among national insurers but also among foreign insurance companies.

2. The insurer’s effective entry on the Internet requires significant costs for expert services and initial marketing campaigns to form a strong internet brand.

3. A significant part of the target audience may be inclined to buy insurance products only in the office and not on the Internet.

4. There is a problem of the absence of a common legal framework for all countries on the standards of electronic insurance which is an obstacle to the sale of an insurance product to any target client.

5. Technical problems in the process of marketing activity or delivery of insurance products through the Internet due to the failure of websites.

6. The absence of full protection of the content copyright while filling the site of the insurance company, its pages in social networks or the implementation of Internet advertising with its usage. Indeed, due to the digital nature of the content, it is easy to copy and use it to pursue the competitors’ or other interested persons’ own objectives. Therefore, in order to maximally use its benefits and minimize the impact of possible disadvantages, it is necessary to understand what basic points and steps should be primarily implemented. And effective fulfilment of the main functions of Internet marketing involves the implementation of specific actions to promote the product and brand of the company.

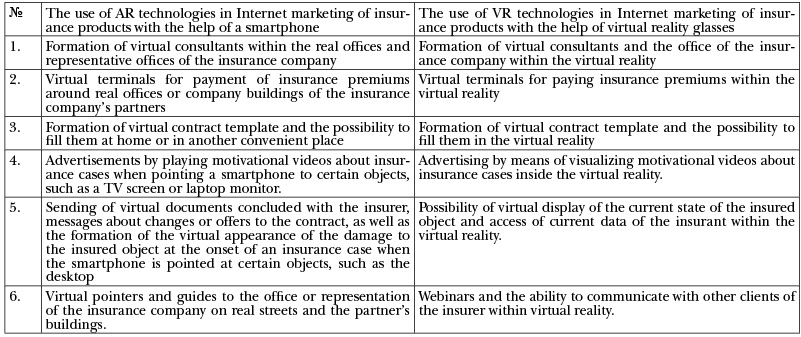

Table 1. Ways of using AR and VR technologies in Internet marketing of insurance products*

* formed by the authors

Firstly, the obligatory step is to develop a company site. As a matter of fact, it will favour the increase in sales and development of the client base. To get the advantageous position of the site on the Internet, it is necessary to do its search engine optimization (SEO) by improving its text content to raise the ranks of the site in the search results according to users’ specific queries in search engines. It will foster an increase in the number of potential customers’ visits to the site. In this case, it is possible to use the e-mail bases of users to send direct invitations to registered users and to place links to the site and landing pages on the sites of business partners. The site itself should be filled with high-quality content to interest its users and add an opportunity for their round-the-clock counselling, for instance, using a chatbot.

Secondly, it is necessary to do a promotion on social networks (SMM/SMO). It is advisable to have professional accounts at least in the most popular social networks, effectively designed and also filled with high-quality content. At the same time, it should not be forgotten to provide the link to the site on the accounts in social networks, and on the contrary, on the site – links to social networks, which will increase the attraction of regular customers and the inflow of new ones.

Thirdly, the activity of the insurance company’s marketing department outside the site and in social networking pages should include the use of various forms of Internet advertising with an exact targeting at the desired target audience. However, advertising campaigns, in addition to the promotion of insurance policies sale, should also be aimed at creating and further enhancing the positive image of the insurance company’s Internet brand. Circumspect Internet-PR insurer’s campaigns can help here.

Fourthly, in order to maximize the effectiveness of any Internet activity, it is necessary to combine all this with the use of web analytics tools to evaluate the results of the insurance company’s Internet marketing and to improve its further activities.

In addition to all the above-mentioned aspects, there are also specific, inherent to insurance, important moments, without which it is impossible to implement quality insurance products on the Internet. Among them, the following should be mentioned:

a) It is obligatory to have access to an effective system of online sales of insurance products on the site, where the insurant is able to fully assess the cost of the insurance policy he/she needs and compare it with similar offers of the insurer.

b) Every user of the company’s services registered on the site should be able to view all necessary information about the purchased insurance product and the possibility of interaction with it. That is, access to the status of the agreement with the possibility of extending, suspending or ordering additional services, the procedure, terms and methods for the implementation of insurance premiums and insurance payments, as well as the presence of a column for reporting an insured event by submitting an online application.

However, all these forms and methods of implementing the functions of Internet marketing have long been used by at least some insurers. Therefore, in order to improve modern Internet marketing in insurance, we have decided to offer our own innovative solutions (Table 1). In particular, it involves the use of augmented reality (AR) and virtual reality (VR) technologies, which have recently been at the peak of popularity and new opportunities for their use.

Augmented reality is the superimposing of image layers generated by the computer onto the existing reality [4]. Its use, including for marketing purposes, is possible with the help of modern smartphones. Virtual reality is an artificial space created by means of technical means that gives the consumer a sense of full presence in another dimension [4]. It can also be used for marketing purposes with the help of virtual reality glasses.

Both technologies now provide ample opportunities for changing current methods and insights into doing business. For instance, with the application that uses augmented reality, the company “IKEA” offers the opportunity to choose furniture from the manufacturer’s catalogue and as if to “try” them in any room, and, in order to make the printed car advert unique, the company “BeaversBrothers” has developed AR -application with an interactive presentation of the car, where customers can see a three-dimensional car model when placing the camera on a banner.

As for the virtual reality, it has allowed the company “Volvo” to collect pre-orders for the prestigious Volvo XC 90 by running a virtual test drive in branded VR glasses; and the company “Oreo” – to show unusually the process of creating a cookie by displaying an animated VR tour on Google Cardboard [6]. Therefore, these trends have significant potential for the use in insurance Internet marketing.

Therefore, Internet marketing of insurance products, which will most effectively use traditional methods in the combination with innovations, will be able to achieve new opportunities for the development of insurance business. At the same time, opportune investments in the realization of all the identified moments give an opportunity to achieve the maximum results in the future.

Conclusion

The development of Internet marketing as an integral part of an insurance company’s marketing policy is a prerequisite for its stable and profitable functioning in the future.

Despite the possibility of such disadvantages arising in the process of implementing the functions of Internet marketing as increased competition for the target audience, significant costs for services and initial marketing campaigns for the formation of a strong Internet brand, the propensity of some insurants to buy insurance products only in the office, the absence of the common legal framework for all countries to the electronic insurance policy standards, technical problems in the process of marketing insurance products or their delivery via the Internet due to failure of the website and the absence of full copyright protection for the content when filling the insurance company website, there exist also significant benefits from its use. Particularly, they include: quick and almost free access to the information required by the insurer and insurant, convenient way to purchase an insurance product through the insurance company’s site and software applications, minimization of the insurance company’s marketing costs in comparison with traditional forms of marketing, the possibility to be independent of territorial or time boundaries and to form partnership relations with the insurant in the process of building the insurance company’s Internet brand.

The fundamental steps for the effective use of Internet marketing include the development and optimization of the insurer’s site, promotion of the page in social networks, the use of Internet advertising and further study of its results with the help of web analytics tools. However, in our opinion, these steps do not provide an absolute advantage. Therefore, it is advisable to resolve to innovative solutions, namely to use the capabilities of augmented reality (AR) and virtual reality (VR) technologies. Their implementation as a necessary constituent of Internet marketing activities, indeed, will offer a significant advantage over competitors and will be an important step for the formation of an image of the innovative and advanced insurer.

References

1. Бойчук I.В. Напрями реалізації маркетингових функцій підприємства через застосування Інтернету / І.В. Бойчук // Вісник Хмельницького національного університету: збірн. наук. праць. Хмельницьк: Вид-во ХНУ, 2009. Вип. 5. С. 34–38.

2. Вирин Ф.Ю. Интернет-маркетинг. Полный сборник практических инструментов / Ф.Ю. Вирин. М. : ЭКСМО, 2010. 126 с.

3. Евдокимов Н. В. Раскрутка Web-сайтов. Эффективная Интернет-коммерция / Н.В. Евдокимов. К.: Вильямс, 2008. 160 с.

4. Королёв И.К. Рынок виртуальной и дополненной реальности: перспективы для стартапов с точки зрения инвестора. URL : https://habrahabr.ru/company/friifond/blog/322230/.

5. Макарова М. В. Електронна комерція: [посіб.] / М. В. Макарова. – К.: Академія, 2002. – 272 с.

6. Новиков М. AR и VR в маркетинге. URL : https://beaversbrothers.ru/blog/ar-i-vr-v-marketinge.html

7. Окландер М.А. Цифровий маркетинг – модель маркетингу ХХІ сторіччя: монографія / авт. кол.: М.А. Окландер, Т.О. Окландер, О.І. Яшкіна [та ін.]; за ред. д.е.н., проф. М.А. Окландера. Одеса: Астропринт, 2017. 292 с.

8. Успенский И. В. Интернет как инструмент маркетинга / И. В. Успенский. – СПб. : БХВ-Санкт-Петербург, 1999. – 254 с.

9. Холмогоров В. Интернет-маркетинг: [краткий курс] / В. Холмогоров. – [2-е изд.]. – СПб., 2002. – 271 с.

Poyda-Nosyk Nina Nykyforivna

Ph.D. in Economic Sciences, Professor,

Professor of the Department of Finance and Banking, the Faculty of Economics, SHEE “Uzhhorod National University”.

Svadeba Viktor Viktorovych

postgraduate student of the 2nd year of training,

the Faculty of Economics, SHEE “Uzhhorod National University”, specialty “Economics”.

@ WCTC LTD --- ISSN 2398-9491 | Established in 2009 | Economics & Working Capital