Hidden Champions – The Vanguard of Germany in Globalia

I. Introduction

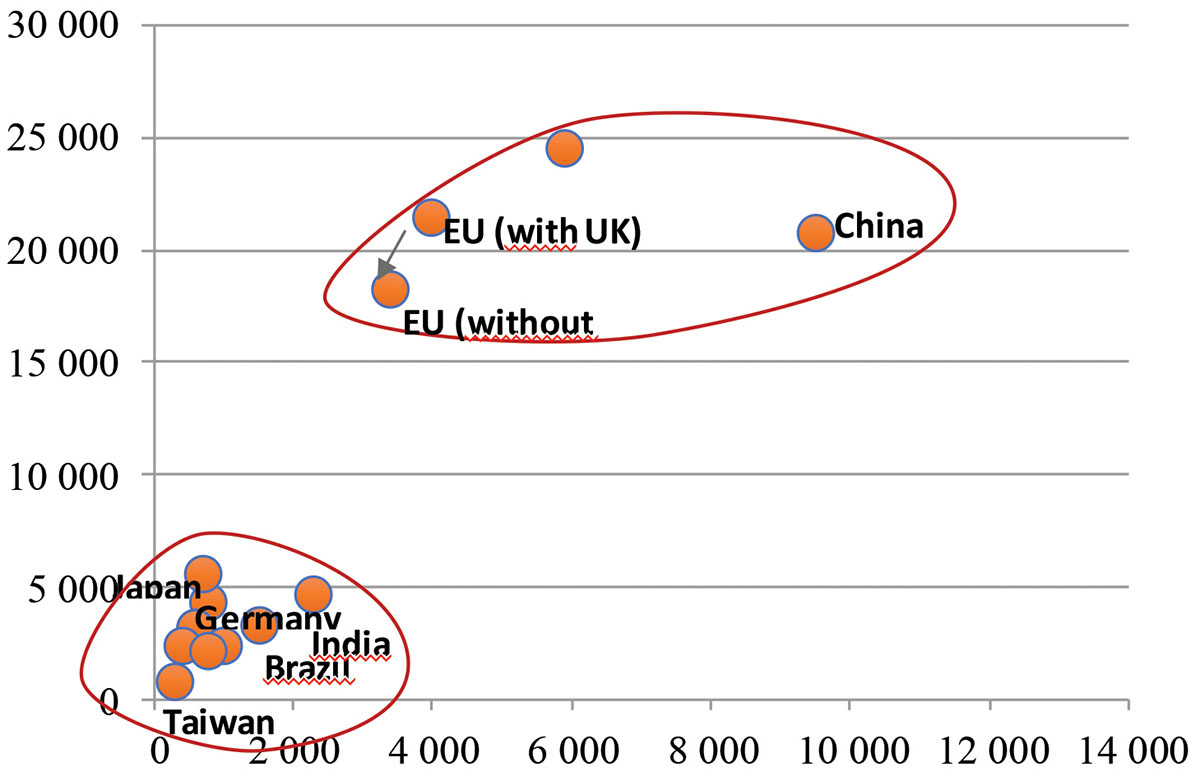

Globalia is what I call the globalized world of the future. (Simon 2009, 2012). What will Globalia look like in the year 2030? As Figure 1 illustrates we will see a two-split world. In terms of gross domestic product, the US will still be number one, closely followed by the European Union and China. However, China will contribute the biggest growth in the years to come. All other individual countries will have considerably smaller economies and less GDP growth. A company aiming to compete on a global scale should be strong in the US, the European Union and in China.

Figure 1. Globalia in 2030 – GDP and growth of GDP

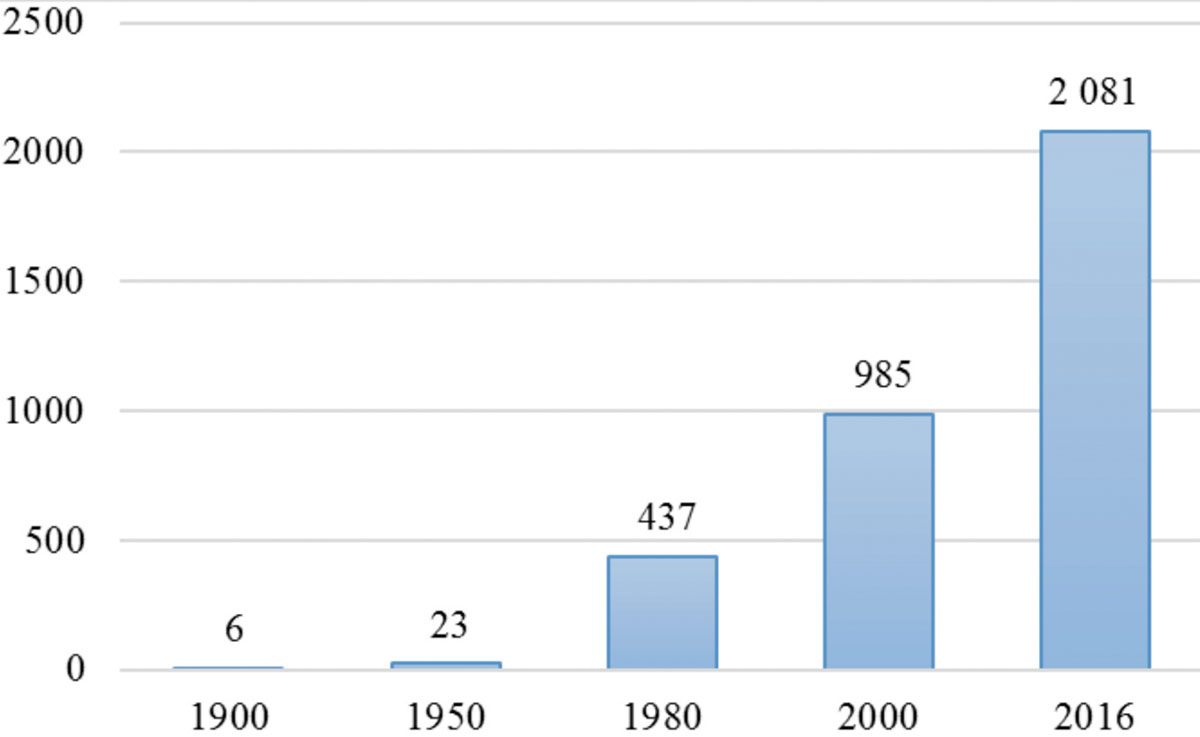

On a global scale there are few saturated markets. Globalia holds practically unlimited growth potentials for companies from all over the world. This is especially true for international trade. Figure 2 shows the development of global per capita exports since 1900, when they were close to zero. It took 80 years to bring them to 437 dollars. In the following 20 years global per capita exports more than doubled and since 2000 they again almost tripled to 2634 dollars in 2013.

Figure 2: The development of global per capita exports since 1900 in US-$

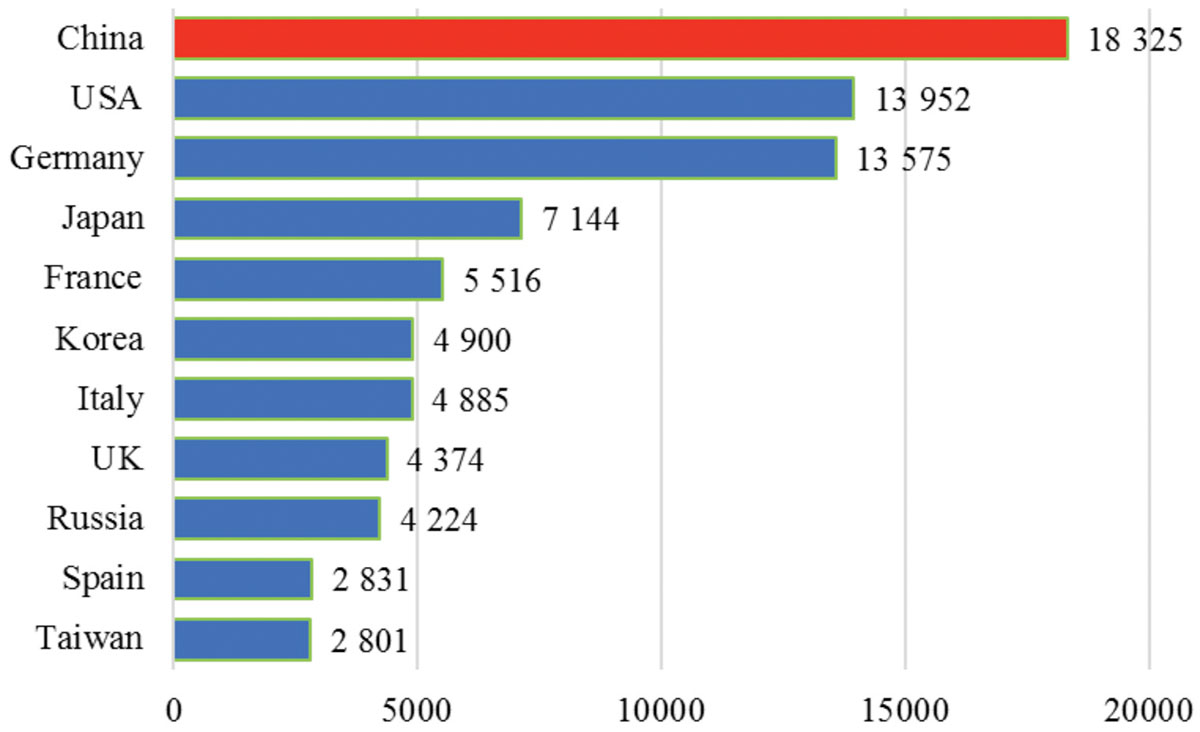

This “explosion” has taken place in spite of a rapidly growing global population. In 1900 the world’s population was 1.6 billion, today we are 7.3 billion. In absolute terms global exports today are about 2000 times larger than in 1900. We can assume that global trade will continue to grow faster than national gross domestic products. Each company and each country which participates in this accelerating globalization can profit enormously. How do individual countries fare in Globalia? Figure 3 shows the exports for a selected group of larger countries for the ten years 2004-2013. Even under this long-term view China is already number one. Germany comes in as number two, slightly ahead of the US.

Figure 3: Exports for selected countries 2004-2013 in US-$ billion

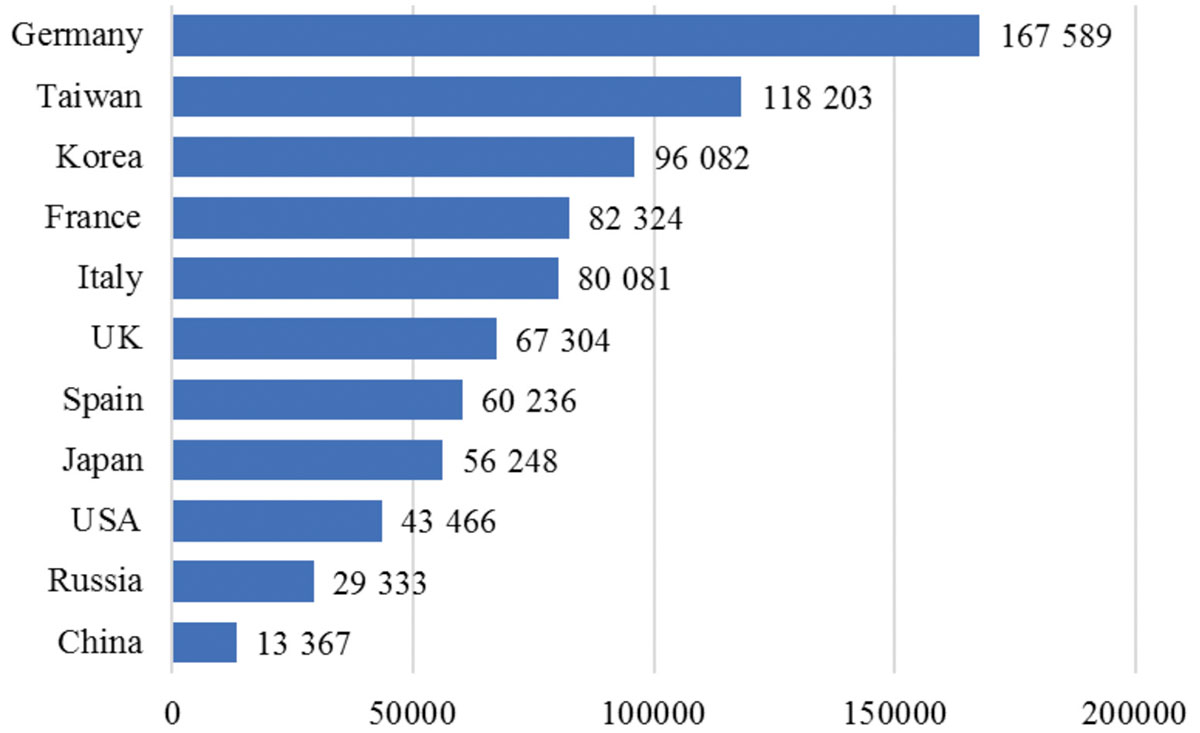

The differences in export performance are striking. This becomes even more evident when we look at the per capita exports in Figure 4, again for the period 2004-2013.

Figure 4: Per capita exports of selected countries 2004-2013 in US-$

Germany is an extreme outlier with almost double the per capita exports of the other large countries. There are some obvious questions. What makes certain countries strong in exports and others weak? Can the current export weakness of a country be interpreted as a potential to increase exports, generate growth and create jobs? Can exports become a growth area for emerging countries with low per capita exports, such as India and Brazil? The case of China certainly suggests this.

II. Export performance and company size

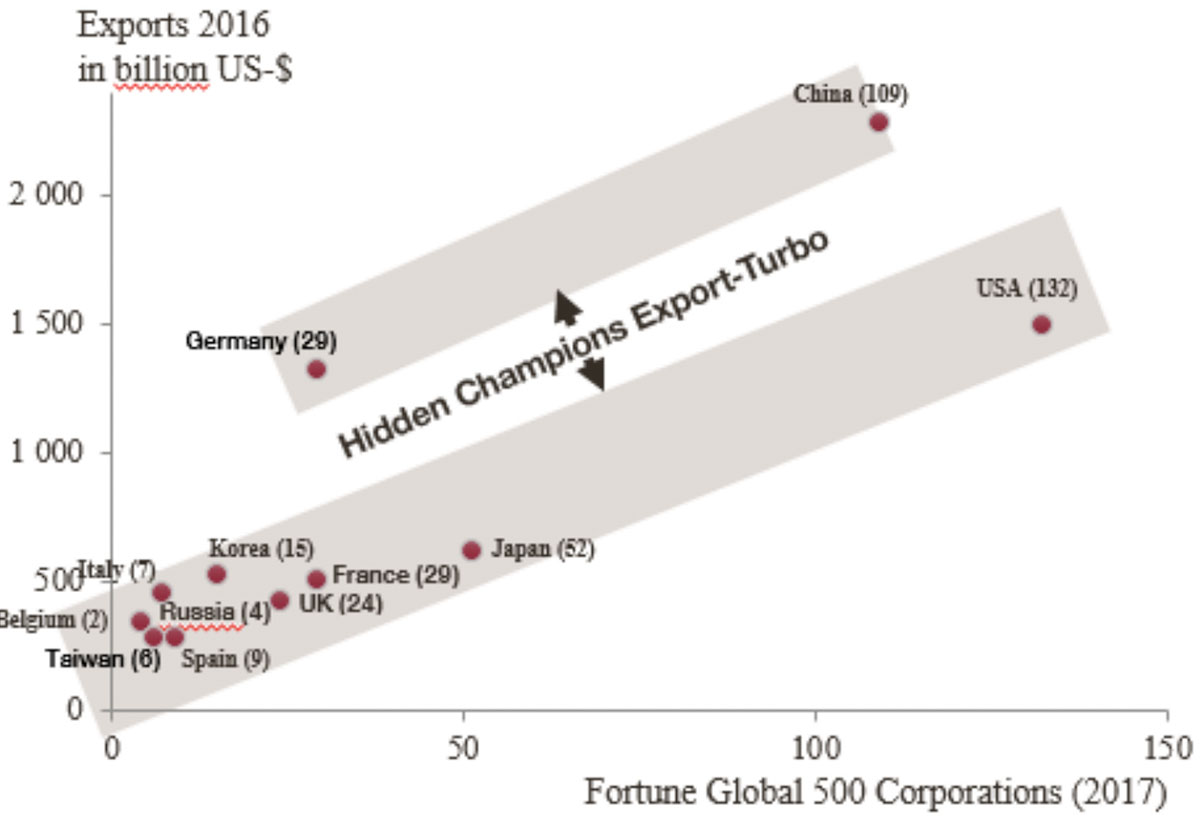

Most people assume that export performance depends on the prevalence of large corporations. Is there also a role of small and mid-sized companies in exports? And what are the implications for emerging countries? Figure 5 reveals the relation between the number of large corporations and exports for selected countries. The horizontal axis shows the number of Fortune Global 500 corporations, the vertical axis the exports.

Figure 5: Large corporations and export performance

For most countries there is indeed a strong correlation between the number of large firms and exports. But there are two exceptions, China and Germany. And exactly these two outliers are the leading export nations in absolute terms. What do they have in common and what distinguishes them from the other countries? It is the share of exports contributed by mid-sized firms. 68 percent of Chinese exports come from companies with less than 2000 employees (“Small Fish,” 2009). In Germany the Mittelstand contributes about 70 percent to exports.

This suggests that in order to achieve truly exceptional export performance a country needs both large corporations which are strong in exports, and a broad foundation of small and mid-sized exporters. Countries should not only build their international competitiveness on large corporations alone. For emerging countries it seems illusory to develop a significant number of Fortune Global 500 firms, though this is the dream of many politicians. In 2014 only 29 of the 206 sovereign states in the world had an entry in the Fortune Global 500 list, of those 12 countries had only one entry (“Global 500,” 2014). For most emerging countries it is and will remain a vain hope to create firms of this size. In the 1980s Malaysia set out to become a force in the global auto market and founded a company called Proton. This auto manufacturer started with high ambitions, but in spite of hiring some of the best British engineers Proton has remained a regional competitor with negligible global weight. On the other hand a Malaysian company, Top Glove, which takes advantage of the countries natural rubber resources, has become the world’s market leader for rubber gloves. Brazil has about a dozen global market leaders of similar stature. Emerging countries seem well advised to build their economic future primarily on strong mid-sized firms. Betting on many of these firms will allow emerging nations to get a fairer share of the rapidly growing global economy, to create high quality jobs and to flourish. Globalia abounds in opportunities. How many separate markets are there in the world? Nobody knows the exact number. Let’s assume the number is 10000. Fortune Global 500 firms only operate in 100 or 200 of these markets while the remaining 98 percent are small or niche markets. Each of them offers the chance for a small or mid-sized firm to become a global market leader. And there is a fundamental difference to the world of the past. With the Internet, modern telecommunications, air transport and seamless global logistics it is possible for small and mid-sized firms to do business on a worldwide scale.

III. Hidden Champion

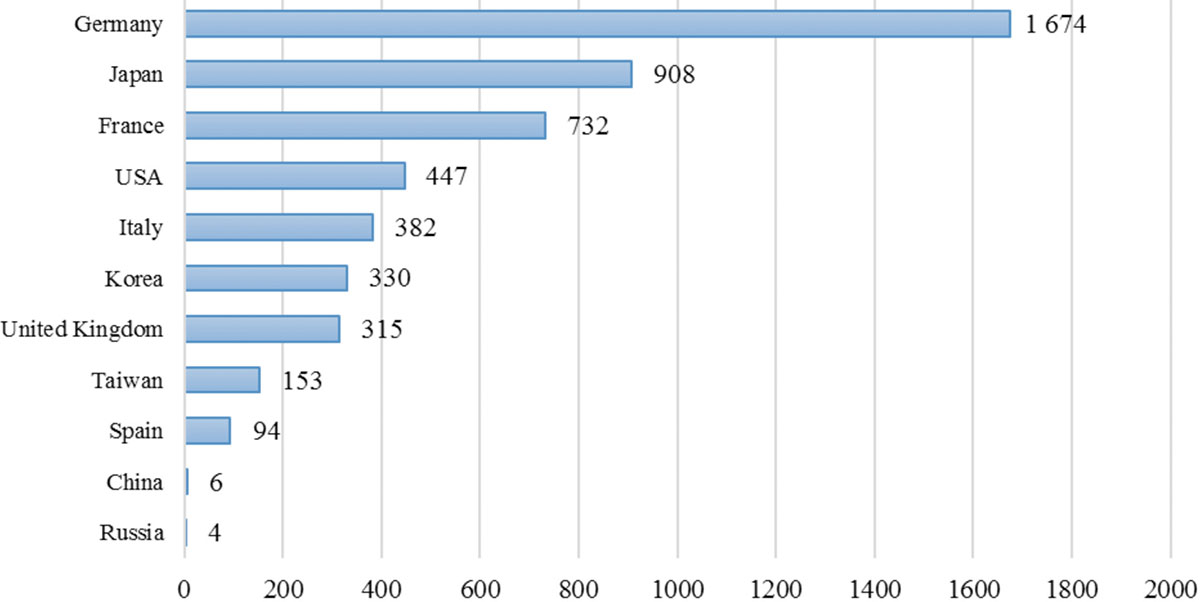

The late Ted Levitt, at the time marketing professor at the Harvard Business School, asked me back in 1986 (and as we see not much has changed since then) why Germany is so successful in exports. I started researching this phenomenon and came to the conclusion that this is due to the Hidden Champions. What is a Hidden Champion? It’s a company which is one of the top three in its global market, has less than $5 billion in revenue, and is little known in the public. A revenue of $5 billion may seem large, but it is less than one quarter of the revenue of the smallest Fortune Global 500 company. Since then I have been collecting names and today my list contains 2734 Hidden Champions from all over the world. Figure 6 shows the number of Hidden Champions by country.

Figure 6: Hidden Champions by country

The explanation of Germany’s continuing export success lies in its Hidden Champions. Germany has more of these mid-sized world market leaders than any other country. On a per capita base Switzerland and Austria are similar, with around 15 Hidden Champions per million population. But we see from figure 6 that there are Hidden Champions all over the world. My experience from visits to hundreds of them is that their cultures and strategies are remarkably similar, independent of the country they are based in. But why are there so many Hidden Champions in Germany and what can other, especially emerging countries learn from them?

IV. Breeding grounds of Hidden Champions

Traditional skills

Countries and companies should select their markets based on the skills, resources and competencies they have access to. This may include natural resources as in the case of Top Glove from Malaysia or Nakhia from Egypt, the global leader in tobacco for water pipes. Germany doesn’t have many natural resources, but there are many traditional skills that businesses still build on today. Clocks have been produced in the Black Forest for centuries, requiring fine mechanical skills. The Black Forest’s clock-making industry has basically disappeared today, but new industries have arisen taking advantage of the fine mechanical skills of the population. Today the Black Forest is home to more than 400 companies that specialize in medical technology, especially the production of surgical instruments – an industry that strongly relies on fine mechanical skills.

In Northern Germany an unusual cluster of 39 companies around Göttingen has its roots in a different skill area, namely measurement technology. The dense concentration of these specialists can be traced back to the University of Göttingen, whose school of mathematics was leading in the world for centuries. Germany has many traditional skill areas whose impact is still felt today. According to former Siemens director Edward Krubasik, “Germany uses its technology base stretching back to medieval times to be successful in the 21st century.” And Peter Renner, Chairman of the Supervisory Board at Dolphin Technology, another measurement technology specialist, states, “Germany is still a huge engineering office.” Some things really don’t change.

Strong manufacturing base

Before the financial crisis took hold, Germany was often criticized for being too dependent on its manufacturing sector and for dragging its heels in becoming a service economy. Germany has indeed traditionally generated a larger share of its GDP with manufacturing than other highly developed countries. The crisis silenced the voices of criticism. Countries such as the UK, France and the US now regret that they focused too much on the service sector and neglected their manufacturing industries, and Japan’s problems with exports are primarily attributed to its weakened manufacturing base.

A strong manufacturing sector is an important pillar of export success. Figure 7 shows that the trade balance depends on how much manufacturing contributes to the gross domestic product (Institut der Deutschen Wirtschaft, 2012). The trade balance is the difference between exports and imports.

The correlation coefficient between the percentage of GDP accounted for by manufacturing and the trade balance is 0.79. Germany may be old-fashioned in this regard, but it is successful. And its manufacturing investments are far larger than those of other countries, especially the investments of small companies. An international study of mid-sized companies conducted by GE Capital found that German small and mid-sized companies (SMEs) invest almost twice as much as comparable SMEs in the UK and France (“Deutsche Unternehmen,” 2012). In the last ten years Germany’s Hidden Champions have increased their workforces both at home and abroad. Most larger companies have also significantly upped the number of employees abroad, but in Germany their workforces have shrunk.

Figure 7: Share of GDP accounted for by manufacturing sector and trade balance of selected countries

Manufacturing has a fundamentally different impact on export performance and employment than the service sector does. This aspect partially explains the export differences between France and the US on the one hand and Germany on the other. Many French and US corporations are service providers that create most of their value added – and therefore new jobs – not in their home market, but wherever in the world their customers happen to be. French companies in this category include the big retailers Carrefour and Auchan, the hotel group Accor, the energy supplier Veolia, the construction companies Bouygues and Vinci, and the media giant Vivendi. The largest corporations in France include numerous banks and insurance companies (Axa, BNP Paribas, Crédit Agricole, Société Générale, Groupe BPCE, CNP Assurances and Groupama, all belong to the Fortune Global 500) that employ the majority of their workforce abroad. The situation is similar in the US, where many corporations create most of their value added outside their home market. In this category we find fast food chains such as McDonald’s, Burger King and Starbucks or hotel chains such as Hilton, Sheraton and Marriott. What distinguishes them from manufacturing companies is where they employ their workforce, namely in their new stores or hotels in Beijing, Mumbai or Sao Paulo. Manufacturers, on the other hand, can generate jobs at home and sell their products worldwide. Building and retaining a strong manufacturing base is therefore important for both developed and emerging countries.

Outstanding innovativeness

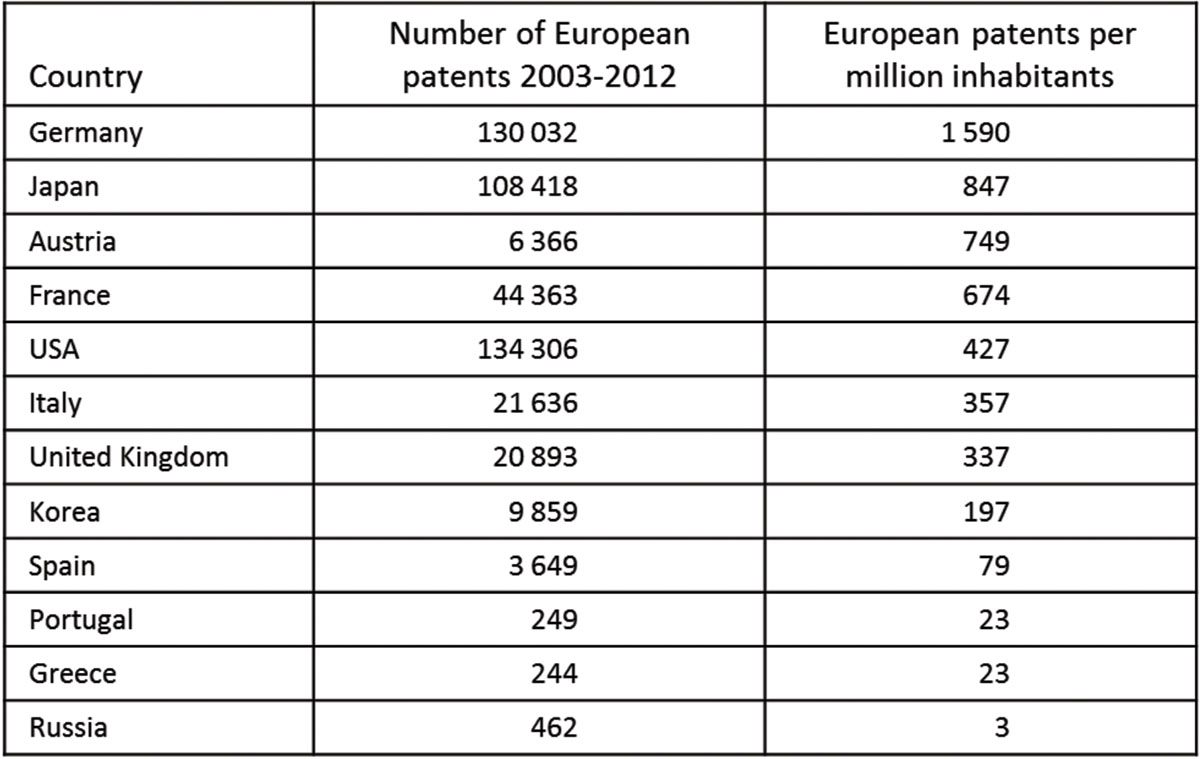

It’s true that few German companies are innovation champions in sectors such as information technology, the Internet or biotechnology. The leaders in these fields are often from the US, occasionally from Japan, and sometimes from China. The Chinese telecommunications equipment maker Huawei, for example, has applied for more patents than any other company in recent years. However, a look at the number of patents granted by the European Patent Office (EPO) casts a different light on Germany’s innovativeness. Of course this indicator does not cover all aspects of innovativeness, but the results are striking.

Figure 8 shows the number of patents granted by the EPO to applicants from selected countries in the ten years from 2003-2012.

Germany is clearly leading. The differences between European countries are huge. Germany has more than twice as many patents per million inhabitants as France, four times as many as Italy, and five times as many as the UK. We also see that the Southern European countries Spain, Portugal and Greece are underperforming in terms of innovation. Russia is the weakest country in this comparison. Although the topic of innovation covers much more than the number of patents, this statistic is nevertheless a strong indicator of the future industrial potential of a country. To excel in Globalia innovation is indispensable.

These are some of the important foundations on which the emergence and prevalence of Hidden Champions in Germany is based. Another factor is the vocational training system which is unique in the world. Germany probably has the best qualified manual workers in the world.

The contribution of the Hidden Champions to the German economy goes far beyond their exports. In the last 20 years they created more than 1.5 million new jobs. Since 1995 they have been growing with annual rates of 10% and are now six times larger than 20 years ago. In terms of revenue about 220 dollar billionaires have emerged from this group. In spite of a much larger global market they increased their global market shares. At the same time they stimulated a massive wave of innovations.

The strategies of the Hidden Champions

The key question is: What can entrepreneurs, companies, academics and politicians learn from the Hidden Champions? What are they doing differently from large corporations? The answer: Almost everything! In what follows I present seven important lessons which can benefit both large and small companies, companies in developed, but especially in emerging countries.

1. Extremely ambitious targets

Hidden Champions set extremely ambitious goals for themselves related to market leadership and growth. The goal of Chemetall is “the worldwide technology and marketing leadership.” Chemetall is a global leader in special metals like cesium and lithium. 3B Scientific, a small company and world leader in anatomical teaching aids, states its goal as follows: “We want to become and stay number 1 in the world.” But leadership goes further, as is expressed in the following statement by Sick, a global leader in sensor technology: “We lead by anticipating our customers’ expectations. Leadership means becoming the benchmark for others. We set the standards on the world market.” Rosen Group, the global leader in pipeline inspection systems, states: “We want to create ultimate value for our customers as the world’s undisputed leading supplier. It is our objective to be the world’s most competitive provider. We go far beyond present market requirements. We envision the market’s future needs.”

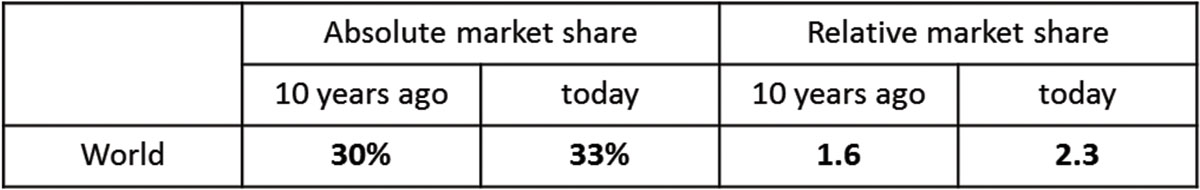

Furthermore, the market shares of the Hidden Champions have increased. In Figure 9 we take a closer look at the market shares of Hidden Champions in terms of absolute and relative share.

Figure 9: Absolute and relative world market shares of the Hidden Champions

Ten years ago their average global market share was 30%, today it is 33%. Even more impressive is the relative market share, an indicator of competitive strength, defined as own market share divided by the market share of the strongest competitor. Only the market leader has a relative market share bigger than 1. Ten years ago the relative market share was 1.56, which means that the Hidden Champions were on average 56% bigger than their strongest competitor. Today it is higher than 2, meaning that they are more than twice as big as their strongest competitor.

Lesson 1: Success always begins with ambitious goals. The Hidden Champions go for growth and market leadership. This is the fuel that drives them forward.

2. Focus and depth

“We always had one customer and will only have one customer in the future: the pharmaceutical industry. We only do one thing, but we do it right”, says Uhlmann, the world leader in packaging systems for the pharmaceutical industry. Flexi states, “We will do only one thing, but we do it better than anyone else.” Flexi makes retractable leashes for dogs and has 70% of the global market. But focus goes deeper. Winterhalter is a manufacturer of commercial dishwashing systems. About ten years ago they analyzed the market and found that there are many sub-markets like hospitals, canteens etc. In each of these segments Winterhalter had a market share of 3 to 5%. They reformulated their strategy, focusing solely on dishwashers for hotels and restaurants. The new focus affected everything they do. They even renamed the company Winterhalter Gastronom (for Gastronomy). Since the quality of water has a strong effect on the ultimate results they deepened their value chain by adding water conditioners. They sell detergents under their own brand name and offer 24/7 service – absolutely essential in this kind of industry. They have special dishwashers for high luster glasses. They recruit sales people with hotel and restaurant background, who speak the language of their customers. They are clearly number 1 today, witnessed by the fact that McDonalds, Burger King, Hilton etc. use Winterhalter. Only focus leads to world class.

Closely connected to focus is a deep value chain. An example is Wanzl, world leader in shopping carts and airport baggage carts: “We produce all parts ourselves, based on the quality standards we define.” The fact that carts at airports all over the world are made by Wanzl shows that airport operators are willing to pay the high prices for superior quality. Even the Japanese in Tokyo Narita or the Koreans in Seoul-Incheon have carts from Wanzl. Since they make everything themselves Wanzl has total quality control, which is the foundation of their outstanding quality.

In order to achieve superiority in the end product, Hidden Champions entrench several steps deeper in the value chain to create unique processes, technologies and components. Uniqueness and superiority can only be created internally. If you buy something on the market, everybody else can buy it too. The Hidden Champions are extremely hesitant with regard to the outsourcing of core competencies.

However, when it comes to non-core competencies Hidden Champions outsource more than larger companies. They usually do not have their own legal or tax function. “That is not our core competency, but the core competency of lawyers, tax people etc. who are better in this non-core field than we can ever be,” they say. In a nutshell: Anti-outsourcing in core competencies, strong outsourcing in non-core competencies.

Lesson 2: Only focus and depth lead to world class. The Hidden Champions focus on narrow markets and are deep rather than broad. They tend to do things themselves and refrain from outsourcing core competencies.

3. Globalization

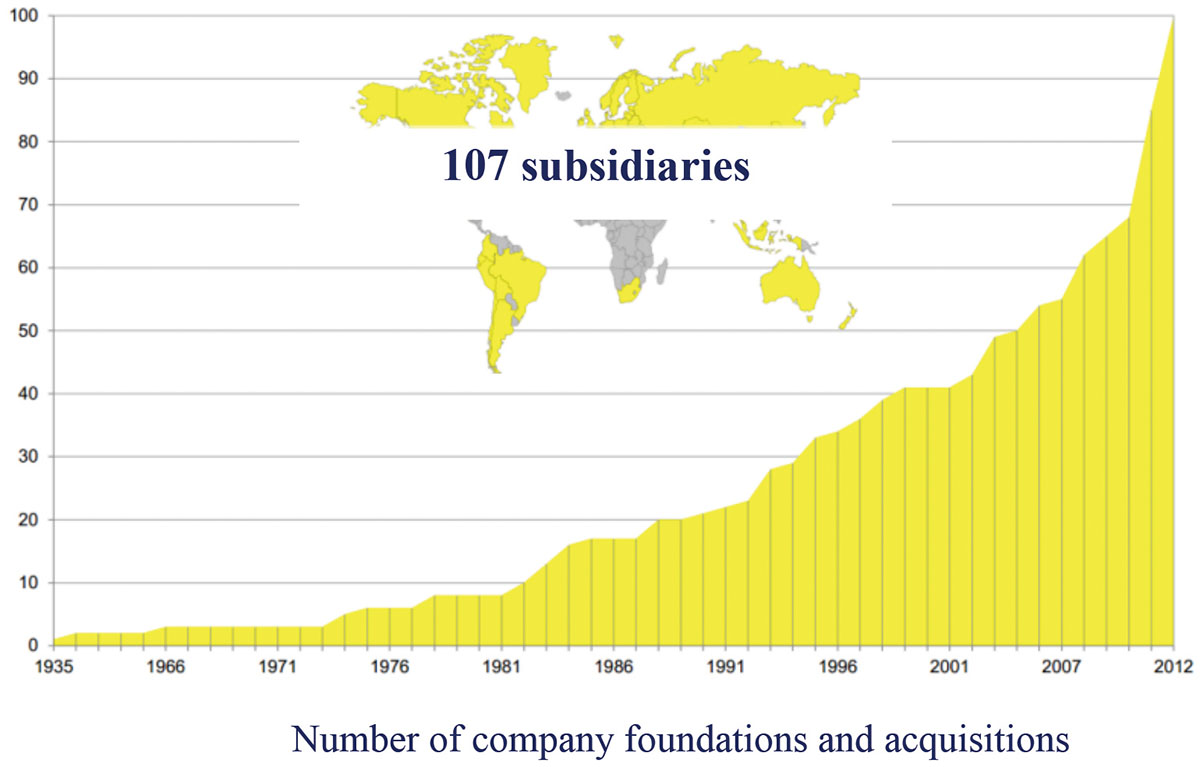

Focus makes a market small. But how do the Hidden Champions manage to make the market big? By globalizing! They combine their specialization in product and know-how with global selling and marketing. As we discussed in the beginning of this article there are hardly growth limits if you go out to Globalia. And go you must! The customers are not coming to you. Kärcher, the global leader in high pressure water cleaners, took its first serious steps towards globalization in the 70s and never stopped, as figure 10 illustrates.

But it’s still a long journey. The CEO of Kärcher told me that he has the ambition to be in all 206 countries of the world, which means that more than 100 markets are still to be entered. Similarly to Kärcher the Hidden Champions globalize by establishing their own subsidiaries in all important markets around the globe. They practice direct customer relationship management instead of delegating their customer relations to intermediaries, agents or importers.

Figure 10: The globalization process of Kärcher

Lesson 3: The Hidden Champions combine specialization in product and know-how with global selling and marketing. Globalization is the growth booster for them. They serve the target markets through their own subsidiaries. They heavily invest into the markets of the future.

4. Innovation

One does not become world market leader by imitation, but by innovation. Innovation starts with spending for research and development. R&D spending of the Hidden Champions is twice as high as in the average industrial company. Even more important is the output. Hidden Champions have five times the number of patents per thousand employees than patent-intensive large corporations (31 patents vs. 6 patents). The annual statistics of the German Federal Office for Patents (Bundespatentamt) show that among the 50 leading patent applicants in Germany one third consistently are Hidden Champions. For instance a company such as Von Ardenne with a little over 500 employees regularly registers more than 100 patents per year. And one Hidden Champion patent costs only one-fifth of the patent of a large corporation. What is the driving force of innovation? Market, technology or both? 65% of the Hidden Champions state that these two forces are well-integrated, whereas only 19% of the large companies say so. And yet this is the core challenge of innovation. With regard to R&D costs, large companies throw big budgets at solving a problem, whereas the Hidden Champions devote very few dedicated people to the problem. That is the reason why their costs per patent are much lower.

Lesson 4: The Hidden Champions are in a phase of massive innovation. The effectiveness of their R&D activities beats that of large companies by a factor of 5. Their innovation processes are fundamentally different. Their innovations are both market- and technology-driven.

5. Closeness-to-customer and competitive advantages

The biggest overall strength of the Hidden Champions is, however, not technology but closeness-to-customer. This is a natural advantage of smaller and mid-sized companies. An average of 38% of their employees have regular customer contacts, as compared to only 8% in large corporations.

Especially pronounced is the closeness to top customers. Grohmann Engineering makes systems for the assembly of micro-electronic products. CEO Klaus Grohmann says, “My market are the top 30 customers in the world.” Asked why he so desperately wants these leading companies as customers, he responds that it’s because they are never satisfied. “They are extremely demanding and, thus, are driving us to ever higher performances.” Using top customers to drive your teams to higher performance is a very interesting view of a company’s customer relationship.

The strategies of the Hidden Champions are value-driven, not price-driven. They usually command a price premium of 10 to 15% over the average market price, which also tells us something about the importance of price versus quality. Value remains the most important factor in most markets. Price comes into the game only if you don’t offer differentiated value (Simon, 2015).

Another outstanding competitive advantage of the Hidden Champions is product quality. Two relatively new advantages with the biggest increase in importance are advice and systems integration. From a competitive point of view they are different from advantages integrated in the product. They cannot be easily re-engineered because these advantages reside in the brains of the employees and in the capacity of the organization to manage complexity. As a consequence the barriers to entry are probably higher today than they were ten years ago.

Lesson 5: Closeness to customer is the greatest strength of the Hidden Champions – even ahead of technology. Their strategies are value-oriented, not price-oriented. The Hidden Champions hold strong competitive positions. Advice and systems integration are new advantages which create higher barriers to entry.

6. Loyalty and highly-qualified employees

Hidden Champions have more work than heads, highly qualified employees and low turnover. They invest 50% more into vocational training than the average German company. The share of university graduates has more than doubled, from 8.5% of the workforce ten years ago to roughly 20% today. And competitiveness in Globalia is more and more about qualification. If you hire, educate and train qualified people and top talent it is very important to retain them. The Hidden Champions have extremely low turnover rates: only 2.7% annually as compared to the average for Germany of 7.3% or for America where almost 20% leave their companies per year. They take with them, of course, their know-how, their experiences and their customer relationships. Low turnover rates are more important than low sickness rates.

Lesson 6: The Hidden Champions have “more work than heads” and high performance cultures. Employee qualification is top. Turnover and sickness rates are extremely low.

7. Strong leadership

The ultimate explanation for the unusual success of the Hidden Champions lies in their leaders. They are characterized, first and foremost, by a very strong identity of person and mission, meaning they totally identify with what they do. Their leadership is ambivalent. There is no discussion regarding the company’s principles and values, but the employees enjoy great latitude and flexibility in the details of carrying out a job. The Hidden Champions have more women in top positions and very high continuity of the CEOs. The average CEO tenure is 20 years. In large companies it is only 6.2 years (Booz and Company, 2013, p. 12).

Lesson 7: The secret of the success of the Hidden Champions lies in their leaders. They are characterized by total identification with their mission. Their leadership is authoritarian in the principles, but flexible in the details. Continuity is very high. Young CEOs and women play a more important role than in large companies.

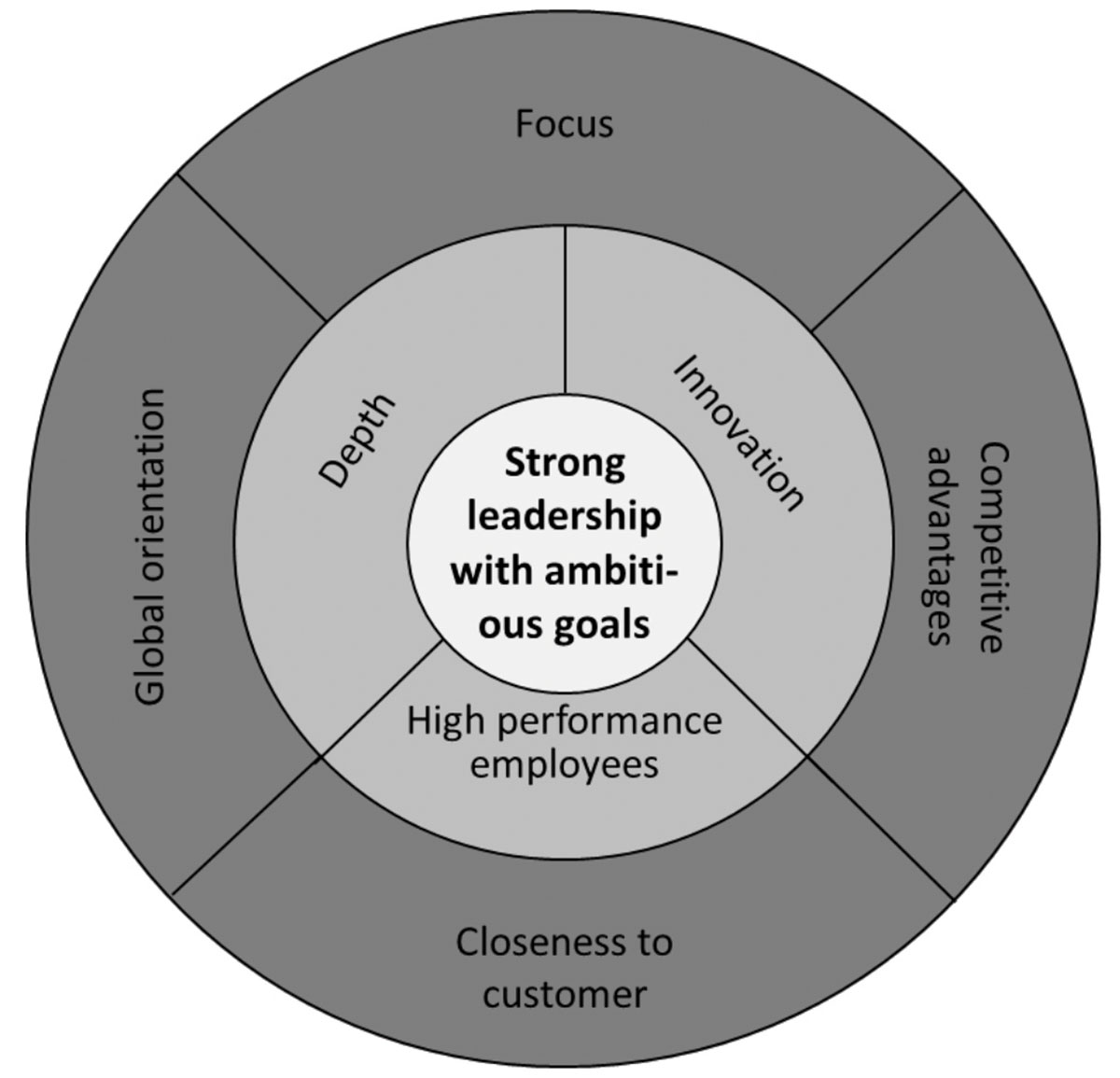

Three circles

The key lessons are summarized in the three circles in figure 11.

Figure 11. The three circles of the Hidden Champions

The core is the strong leadership with ambitious goals. The inner strengths are depth, high performance employees, and continuous innovation. The outer circle comprises focus on a narrow market, closeness-to-customer, clear competitive advantages, and all that with a global orientation. The Hidden Champions go their own ways towards Globalia, more decisively and successfully than ever. They do most things differently from the teachings of management gurus, from modern management fads, from large corporations. They are true role models of strategy and leadership in Globalia.

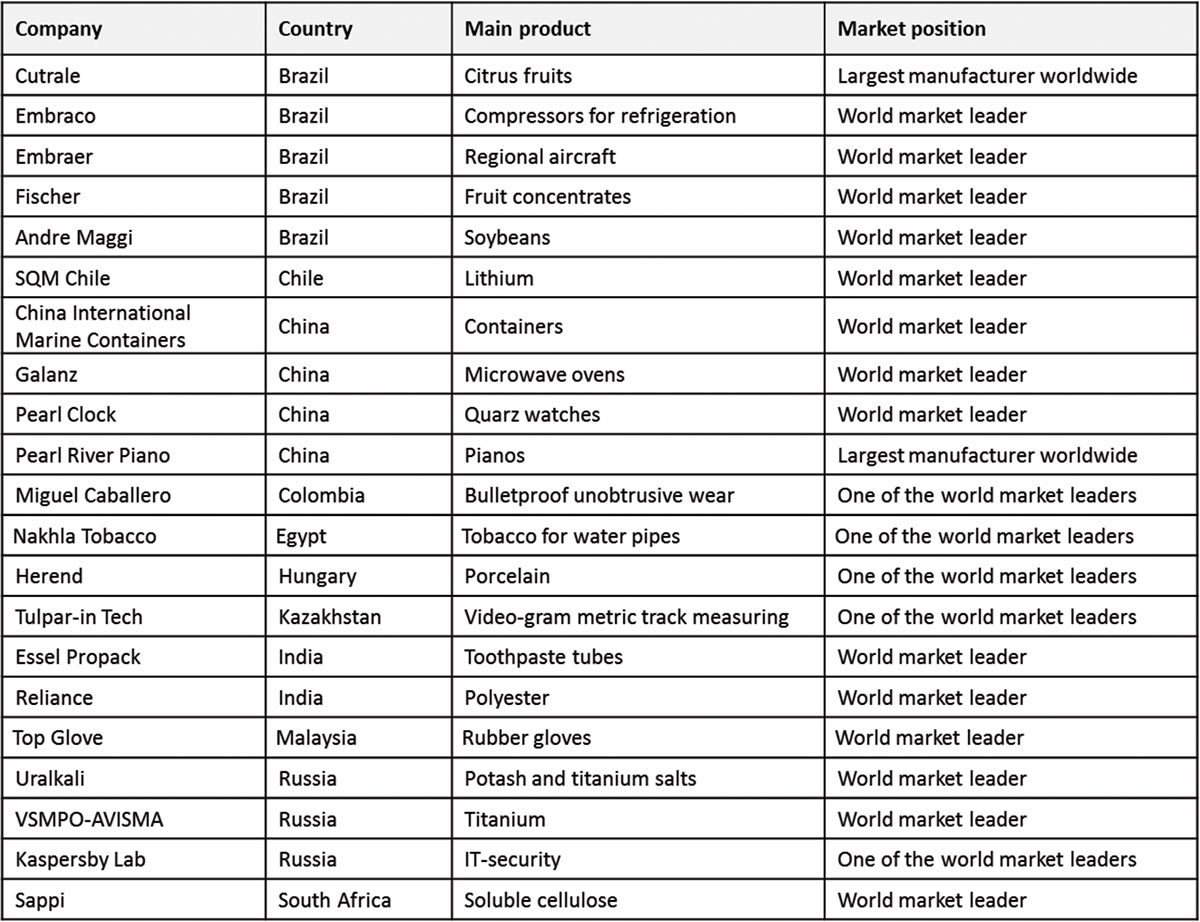

Lessons for emerging countries

Emerging countries would be well advised to pin their hopes on numerous internationally competitive mid-size companies rather than on a few giant corporations. Hidden Champions can be strategic role models for these countries. Indeed we find companies in these countries that already pursue the Hidden Champions’ strategy and are successful in doing so. Figure 12 lists examples of Hidden Champions from emerging countries.

Figure 12: Hidden champions from emerging countries

There are Hidden Champions from emerging countries which have even beaten former market leaders from Germany. The Chinese construction machinery maker Sany is such a case. In 2009, Sany overtook Putzmeister from Germany as the global leader in concrete pumps. In 2012 it acquired Putzmeister. The case shows that companies from emerging countries can rise to leading positions in the world in their respective markets. In what businesses and sectors are the chances of Hidden Champions from emerging countries most promising? There is a clear answer: in sectors where the country has competitive advantages. Often these are natural resources, such as citrus fruits in the case of Brazil, natural rubber in Malaysia, jute in Bangladesh or titanium in Russia. But advantages can also result from specific traditions and skills as the Black Forest case from Germany has shown, where a medical technology industry emerged from a clock-making tradition. Emerging countries and their companies should not limit themselves to producing and exporting primary goods. Rather they should process these goods and sell the semi-finished or finished products at higher prices. Top Glove in Malaysia is an example. In Brazil, Hidden Champions like the Fischer Group, Cutrale, or Sadia prove that this is a path towards success. Middle East countries acquire producers in petrochemical processing to get a larger part of the value chain.

Ultimately the ambitions should reach further with regard to creating world class manufacturing companies. Again Brazil has some astonishing examples. Hidden champions like Embraer, the global leader in regional aircraft, and Embraco, a leader in compressors, show that an emerging country can develop the competencies to compete globally in highly contested and sophisticated markets. Countries such as Taiwan or Korea have gone through this process and achieved spectacular successes. They started very poor not so long ago and have now attained world-class status and leading global positions in numerous markets.

Individual entrepreneurs in emerging countries can learn a lot from the Hidden Champions. One aspect is specialization and focus. Often successful entrepreneurs in emerging countries are tempted to diversify because there are so many growth opportunities in their home markets. This pattern applies right up to the highest size category, so that extremely broad-based conglomerates are typical (such as Koc and Sabanci in Turkey or Samsung and Hyundai in Korea). Instead, SMEs should stay focused and concentrate on conquering a leading market position in their country and region. Remember: only focus leads to world class. A very important point is global presence. Most small and medium-sized companies prefer to sell through distributors and consequently do not hold strong market positions in their target markets. The Hidden Champions, however, establish their own sales subsidiaries, which bring them closer to their customers, help them build customer loyalty and provide them with feedback for innovations. The mental and cultural internationalization of employees is critical. In foreign markets you need people who speak the customers’ language. That is what Globalia is about, as Jakob Fugger, centuries ago one of the world’s most successful traders, said: “The best language is the customer’s language”.

Last but not least: Philip Kotler outlined in his book “Confronting Capitalism”, that income inequality is one of the biggest challenges of mankind (Kotler, 2015). Strong small and mid-sized companies are a very effective way to create a more even income distribution. Therefore, all countries should strive to foster a strong mid-sized sector of Hidden Champions.

Prof. Dr. Hermann Simon

Founder and chairman of Simon-Kucher & Partners

References

Booz & Company (2013, April 16). Frankfurter Allgemeine Zeitung. p. 16.

Deutsche Unternehmen investieren mehr als andere (2012, March 12). Frankfurter Allgemeine Zeitung. p. 18.

Global 500 (2014, July 21). Fortune. pp. F15-F20.

Institut der Deutschen Wirtschaft. (2012, January 12). IW-Dienst Köln.

Kotler, P. (2015): Confronting Capitalism. New York: Amacom

Simon, H. (2009). Hidden champions of the 21st century. New York: Springer.

Simon, H. (2012). Hidden Champions – Aufbruch nach Globalia. Frankfurt: Campus

Simon, H. (2015). Confessions of the pricing man. New York: Springer.

Small fish in a big pond. (2009, September 5). Economist.

@ WCTC LTD --- ISSN 2398-9491 | Established in 2009 | Economics & Working Capital